Iowa Notice of Adverse Action - Non-Employment - Due to Credit Report

Description

How to fill out Notice Of Adverse Action - Non-Employment - Due To Credit Report?

You can spend hours online searching for the appropriate legal document format that meets the requirements of both state and federal regulations.

US Legal Forms provides a vast array of legal forms that have been evaluated by experts.

You can download or print the Iowa Notice of Adverse Action - Non-Employment - Due to Credit Report through our services.

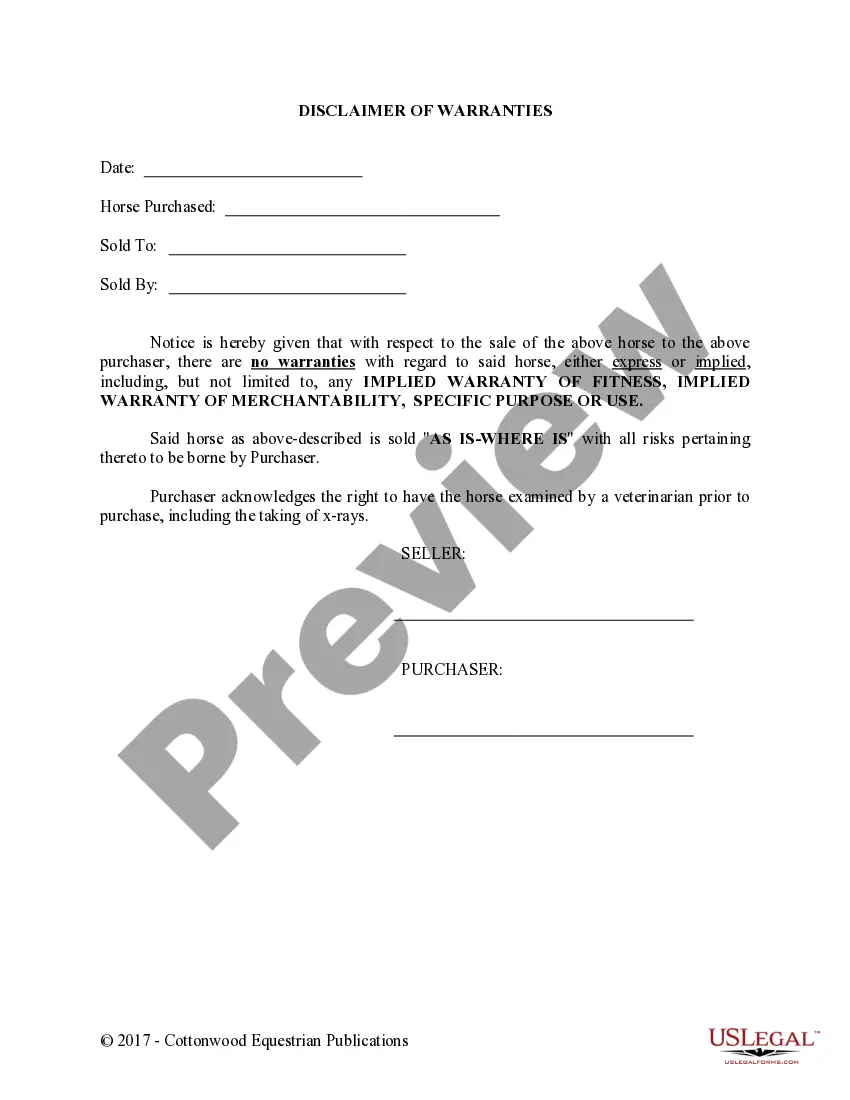

If available, use the Preview button to view the document format as well.

- If you already possess a US Legal Forms account, you can sign in and click the Download button.

- After that, you can fill out, modify, print, or sign the Iowa Notice of Adverse Action - Non-Employment - Due to Credit Report.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of any purchased form, navigate to the My documents section and click the relevant button.

- If you are accessing the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document format for the county/city of your choice.

- Review the form details to confirm you have chosen the right document.

Form popularity

FAQ

In particular: if you deny a consumer credit based on information in a consumer report, you must provide an adverse action notice to the consumer. if you grant credit, but on less favorable terms based on information in a consumer report, you must provide a risk-based pricing notice.

Adverse Action is an action companies take based on the information in a background check report that negatively affects applicant's employment. This could mean denying employment, but can also imply denying a promotion or transfer.

It must include information about the credit bureau used, an explanation of the specific reasons for the adverse action, a notice of the consumer's right to a free credit report and to dispute its accuracy and the consumer's credit score.

An adverse action notice will not hurt your credit score or show up on your credit report. However, if the creditor pulls a hard credit inquiry, this may temporarily lower your scoreand all hard inquiries remain on your credit report for two years.

A creditor must notify the applicant of adverse action within: 30 days after receiving a complete credit application. 30 days after receiving an incomplete credit application. 30 days after taking action on an existing credit account.

An adverse action notice is to inform you that you have been denied credit, employment, insurance, or other benefits based on information in a credit report. The notice should indicate which credit reporting agency was used, and how to contact them.

An adverse action notice is to inform you that you have been denied credit, employment, insurance, or other benefits based on information in a credit report. The notice should indicate which credit reporting agency was used, and how to contact them.

An adverse action notice is to inform you that you have been denied credit, employment, insurance, or other benefits based on information in a credit report. The notice should indicate which credit reporting agency was used, and how to contact them.

There is no requirement that the lender have it signed. It is advantageous to have a point of contact listed, by name or department. But a signature is not required.

A creditor must notify the applicant of adverse action within: 30 days after receiving a complete credit application. 30 days after receiving an incomplete credit application. 30 days after taking action on an existing credit account.