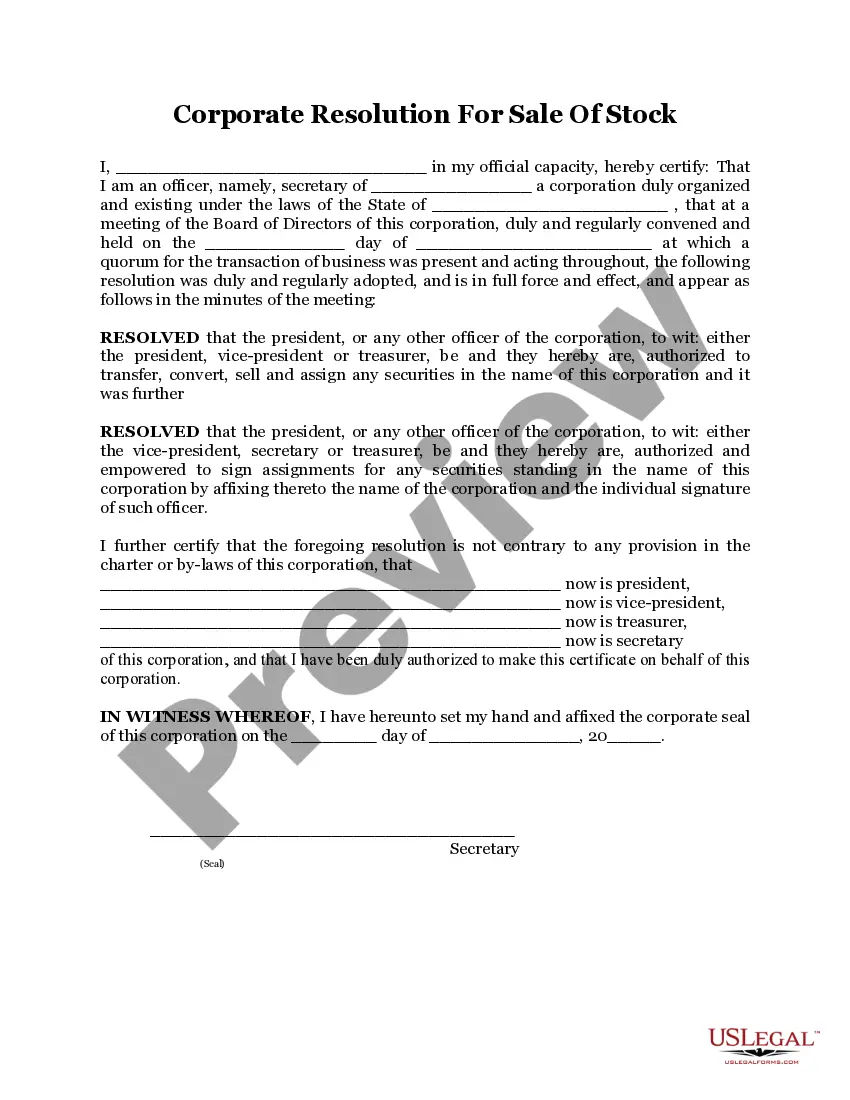

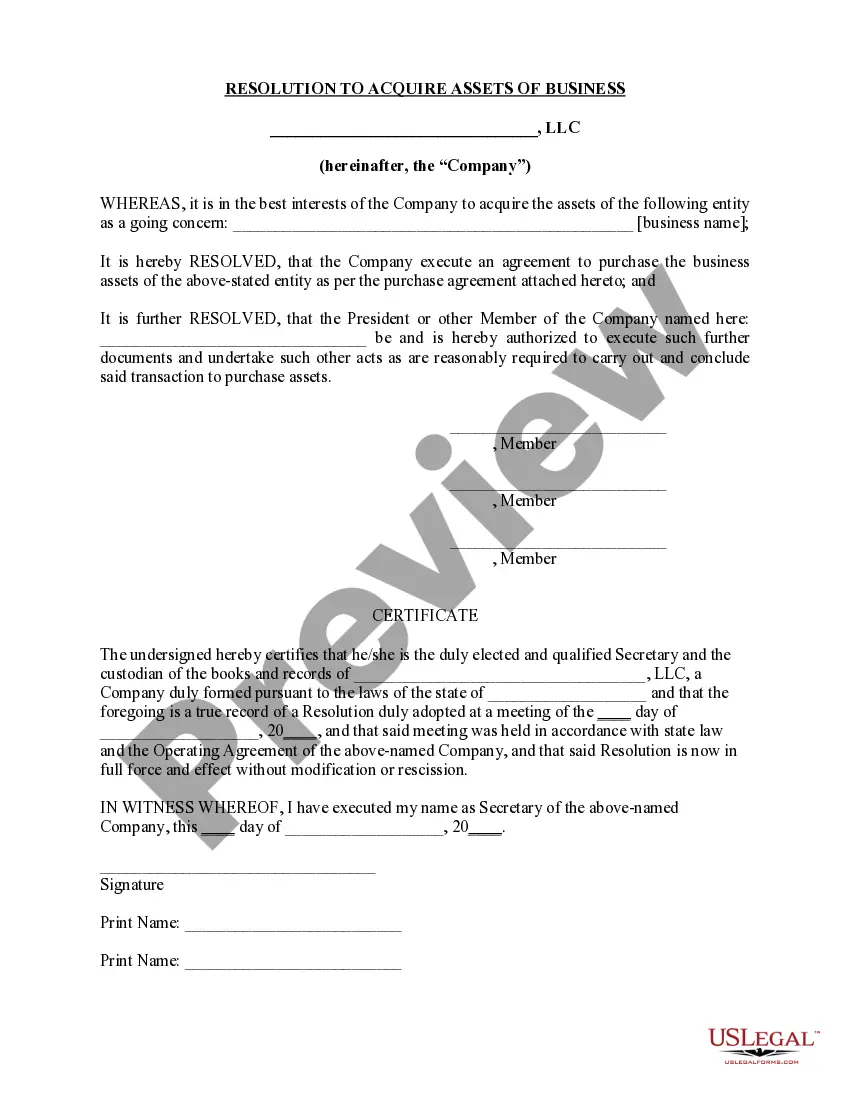

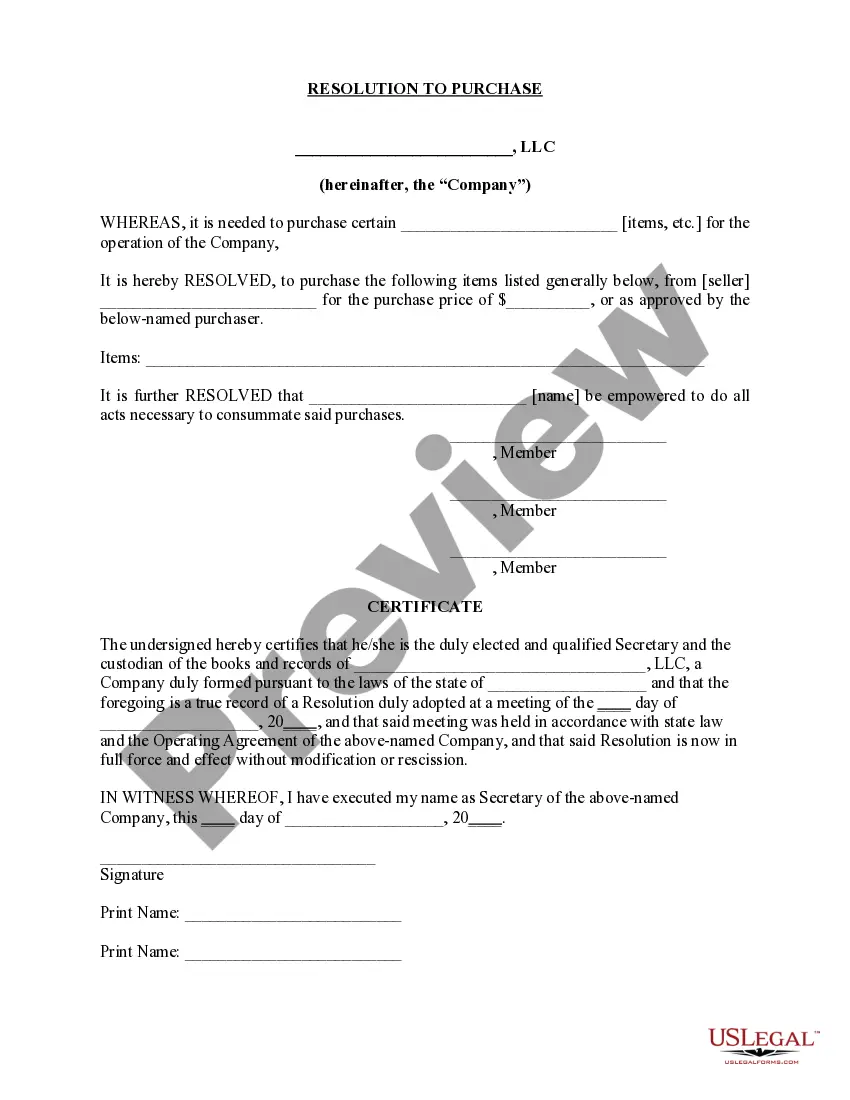

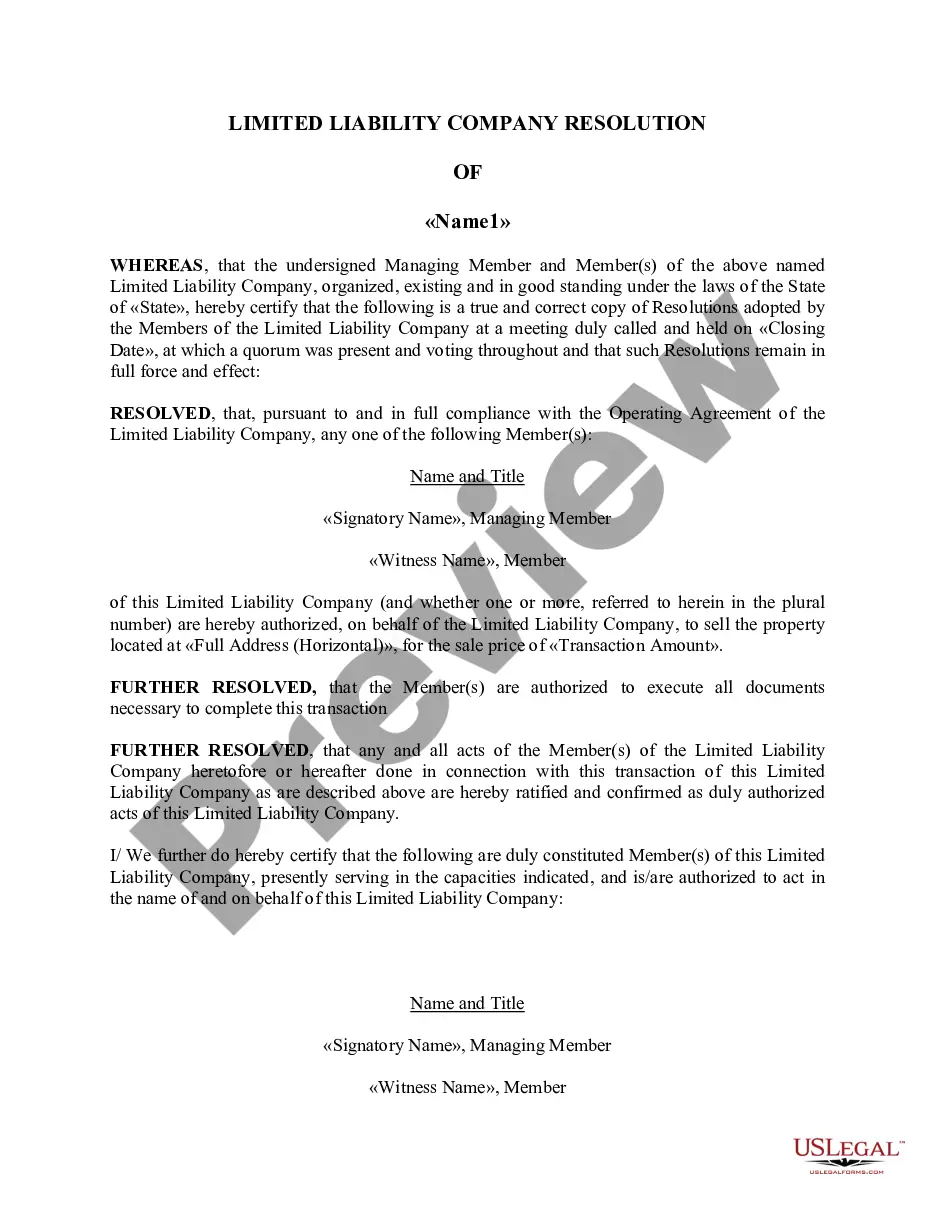

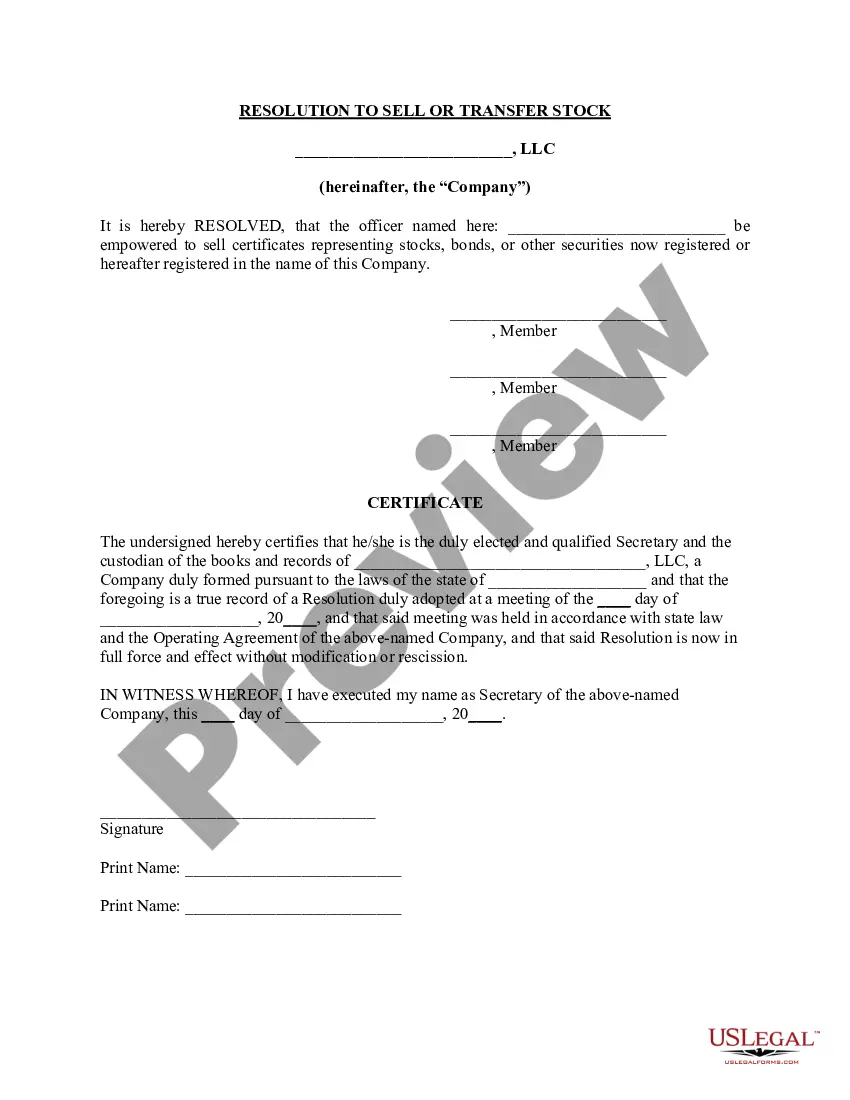

Iowa Resolution of Meeting of LLC Members to Sell or Transfer Stock

Description

How to fill out Resolution Of Meeting Of LLC Members To Sell Or Transfer Stock?

Selecting the correct authentic file format can be challenging.

Certainly, there are numerous templates accessible online, but how do you locate the genuine type you require.

Utilize the US Legal Forms platform. This service offers a vast array of templates, such as the Iowa Resolution of Meeting of LLC Members to Sell or Transfer Stock, suitable for both business and personal needs.

You can review the form using the Preview option and examine the form summary to confirm it meets your needs. If the form does not satisfy your requirements, use the Search field to find the appropriate form. Once you are confident that the form is suitable, click on the Acquire now button to obtain the form. Choose the pricing plan you want and enter the required information. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the legal format to your device. Complete, edit, print, and sign the acquired Iowa Resolution of Meeting of LLC Members to Sell or Transfer Stock. US Legal Forms is the largest repository of legal forms where you can find various document templates. Use the service to obtain professionally-crafted documents that comply with state requirements.

- All forms are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log Into your account and click the Download button to obtain the Iowa Resolution of Meeting of LLC Members to Sell or Transfer Stock.

- Use your account to browse through the legal forms you have previously purchased.

- Navigate to the My documents section of your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions you should follow.

- First, ensure you have selected the correct form for your city/region.

Form popularity

FAQ

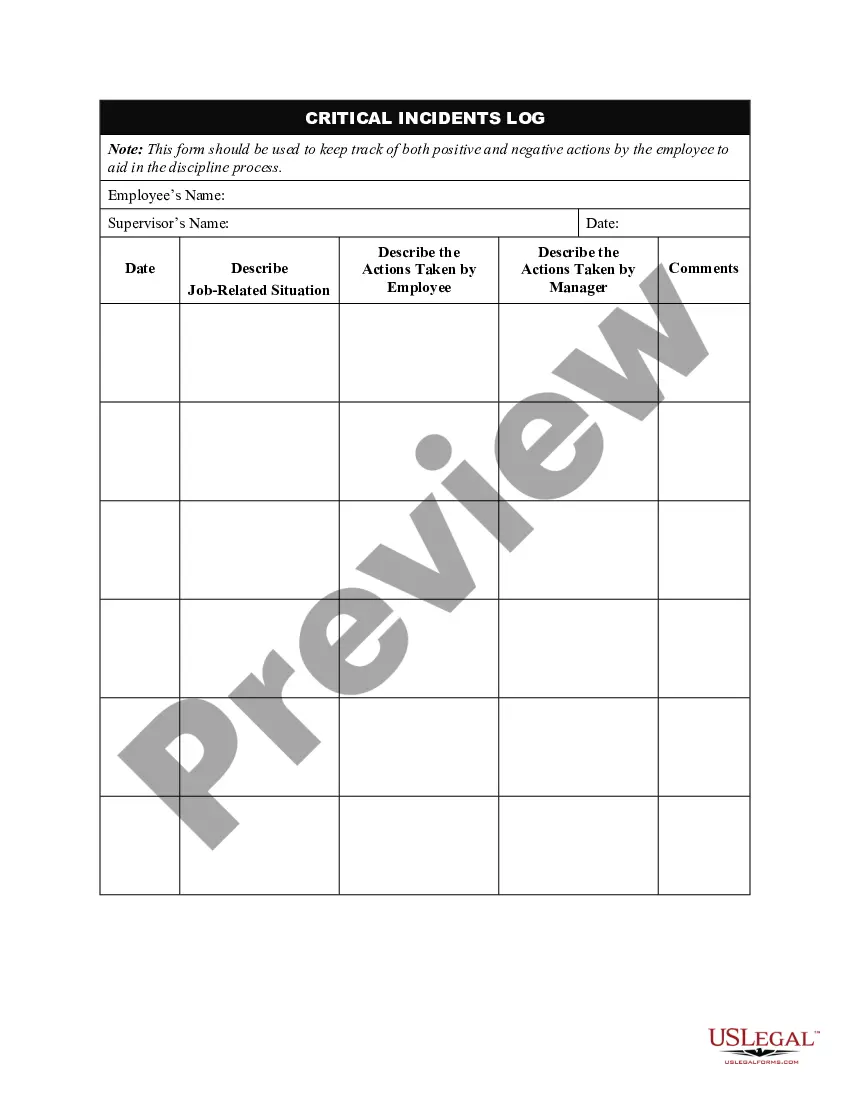

Most LLC Resolutions include the following sections:Date, time, and place of the meeting.Owners or members present.The nature of business or resolution to discuss, including members added or removed, loans made, new contracts written, or changes in business scope or method.More items...

An LLC member resolution is the written record of a member vote authorizing a specific business action. Formal resolutions aren't necessary for small, everyday decisions. However, they're useful for granting authority to members to transact significant business actions, such as taking out a loan on behalf of the LLC.

Is an LLC Operating Agreement required in Iowa? No, Iowa does not legally require you to create an Operating Agreement. You can establish your LLC without one. However, it's still highly advisable to create an Operating Agreement, as it specifies essential details like who owns the LLC and other affairs of the company.

Most LLC operating agreements are short and sweet, and they typically address the following five points:Percent of Ownership/How You'll Distribute Profits.Your LLC's Management Structure/Members' Roles And Responsibilities.How You'll Make Decisions.What Happens If A Member Wants Out.More items...?

What states adopted Rullca? It has been enacted in 19 U.S. jurisdictions: Alabama, Arizona, California, Connecticut, the District of Columbia, Florida, Idaho, Illinois, Iowa, Minnesota, Nebraska, New Jersey, North Dakota, Pennsylvania, South Dakota, Utah, Vermont, Washington, and Wyoming.

An operating agreement is a key business document that shows your business operates like a legit company. Without the operating agreement, your state might not acknowledge you as an LLC, and which means someone could sue to go after you without there being any shield to protect your personal assets.

Get together with your co-owners and a lawyer, if you think you should (it's never a bad idea), and figure out what you want to cover in your agreement. Then, to create an LLC operating agreement yourself, all you need to do is answer a few simple questions and make sure everyone signs it to make it legal.

An Iowa LLC operating agreement is a legal document that provides assistance to the member(s) of any sized company, in outlining the entity's standard operational procedures, organization of the company's internal affairs, and other important aspects of the business, to be agreed upon by the member-management.

You can't simply gift an interest in profits. If the LLC were to distribute its assets, the LLC operating agreement must provide for the donee to receive a share of the assets on dissolution or if the donee withdraws from the LLC. If the donor provides services to the LLC, she must be reasonably compensated.

Limited liability companies (LLCs) do not have stock, nor can they issue it. Despite this fact, LLCs may have advantages over corporations, depending on your particular business needs and goals.