Iowa Job Expense Record

Description

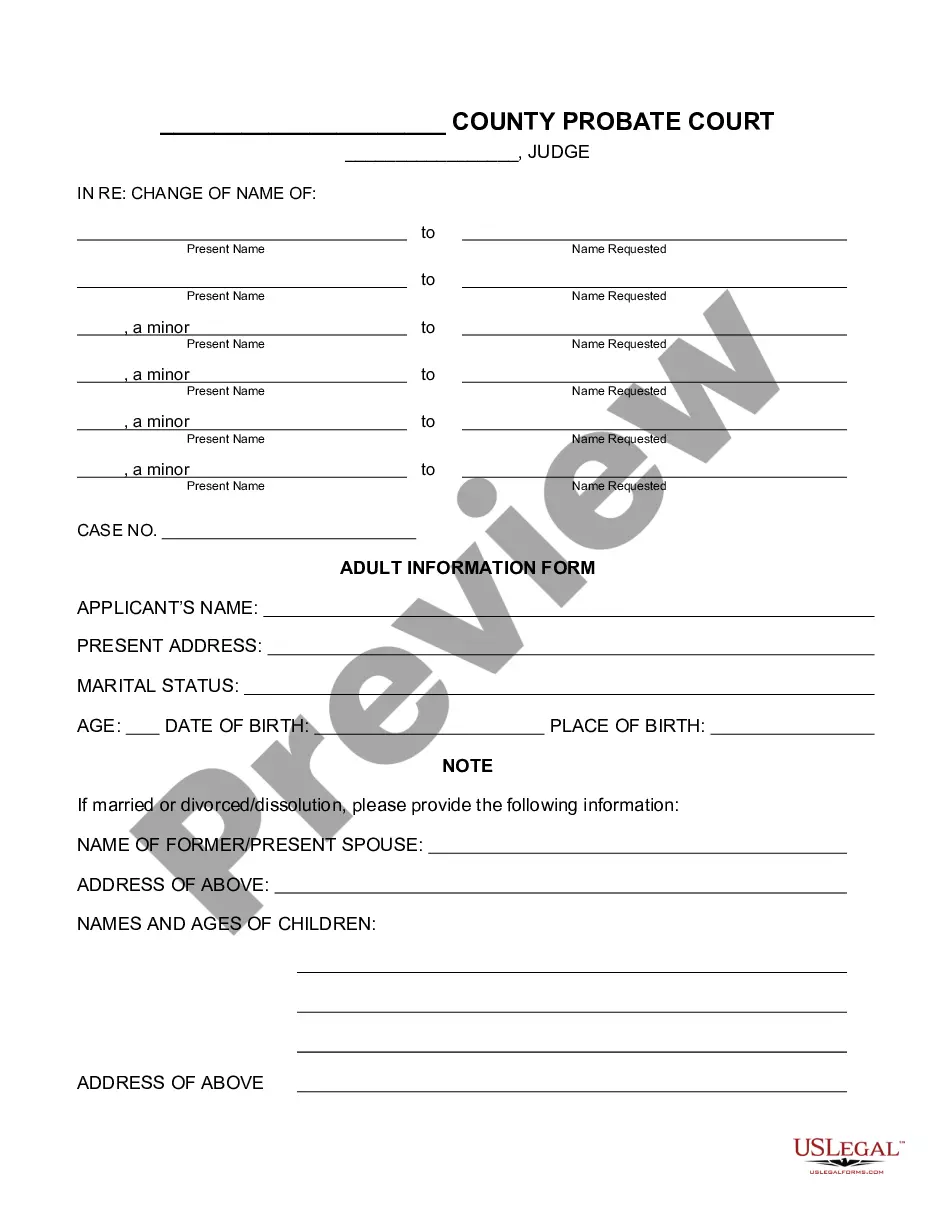

How to fill out Job Expense Record?

Selecting the appropriate legal document template can be a challenge.

Naturally, there are numerous templates accessible online, but how can you locate the legal document you require.

Utilize the US Legal Forms website. The service provides thousands of templates, such as the Iowa Job Expense Record, which can be utilized for both business and personal purposes.

You can preview the form using the Preview button and review the form summary to confirm it is the correct one for you. If the form doesn't meet your needs, use the Search feature to find the appropriate form. Once you are convinced that the form is suitable, click the Get now button to obtain the document. Choose the payment plan you desire and enter the necessary information. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the legal document template onto your device. Complete, modify, print, and sign the downloaded Iowa Job Expense Record. US Legal Forms is the largest repository of legal forms from which you can find numerous document templates. Use the service to download properly crafted documents that comply with state regulations.

- All templates are reviewed by professionals and adhere to federal and state regulations.

- If you are already a member, sign in to your account and then click the Download button to retrieve the Iowa Job Expense Record.

- Leverage your account to search through the legal forms you have previously purchased.

- Navigate to the My documents tab of your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are straightforward instructions you can follow.

- First, ensure you have selected the correct form for your city/county.

Form popularity

FAQ

You can deduct only unreimbursed employee expenses that are paid or incurred during your tax year, for carrying on your trade or business of being an employee, and ordinary and necessary. An expense is ordinary if it is common and accepted in your trade, business, or profession.

Employee Expenses To write off a work expense as an employee, you must itemize deductions on Schedule A of your Form 1040. You list the employee expenses on Form 2106. The expenses must be "ordinary and necessary," and you must pay for them, or incur them, in the year for which you're writing them off.

Alabama, Arkansas, California, Hawaii, Minnesota, New York and Pennsylvania all provide a deduction for unreimbursed employee business expenses on their respective state income tax returns, he said.

Personal Allowances: You can claim the following personal allowances: 2022 1 allowance for yourself or 2 allowances if you are unmarried and eligible to claim head of household status, plus 1 allowance if you are 65 or older, and plus 1 allowance if you are blind.

You can deduct only unreimbursed employee expenses that are paid or incurred during your tax year, for carrying on your trade or business of being an employee, and ordinary and necessary. An expense is ordinary if it is common and accepted in your trade, business, or profession.

But, if you have unreimbursed business expenses as an employee (what used to be known as Employee Business Expenses EBE), then those expenses are generally no longer deductible for the 2019 tax year on your federal tax return. In fact, they were not deductible in 2018, and will not be deductible through 2025.

Employee Expenses To write off a work expense as an employee, you must itemize deductions on Schedule A of your Form 1040. You list the employee expenses on Form 2106. The expenses must be "ordinary and necessary," and you must pay for them, or incur them, in the year for which you're writing them off.

Taxpayers can no longer claim unreimbursed employee expenses as miscellaneous itemized deductions, unless they are a qualified employee or an eligible educator. They must complete Form 2106, Employee Business Expenses, to take the deduction.

Other ExpensesBeginning in tax year 2019, Iowa is conformed to the federal repeal of miscellaneous itemized deductions and unreimbursed employee expenses for most taxpayers. Do not include any deductions on line 19 that were not allowable on your federal Schedule A, line 16.

Are unreimbursed employee expenses deductible in 2020? The vast majority of W-2 workers can't deduct unreimbursed employee expenses in 2020. The Tax Cut and Jobs Act (TCJA) eliminated unreimbursed employee expense deductions for all but a handful of protected groups.