Oklahoma Merchandise License Agreement

Description

How to fill out Merchandise License Agreement?

If you are looking to finish, download, or create valid document templates, utilize US Legal Forms, the premier selection of legal forms available online.

Take advantage of the site's straightforward and user-friendly search feature to find the documents you need.

Various templates for business and personal purposes are organized by categories and regions, or keywords.

Step 4. Once you have identified the form you need, click the Get now button. Select your preferred pricing plan and enter your details to register for an account.

Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to locate the Oklahoma Merchandise License Agreement in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Oklahoma Merchandise License Agreement.

- You can also access forms you previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Confirm you have selected the form for your specific city/state.

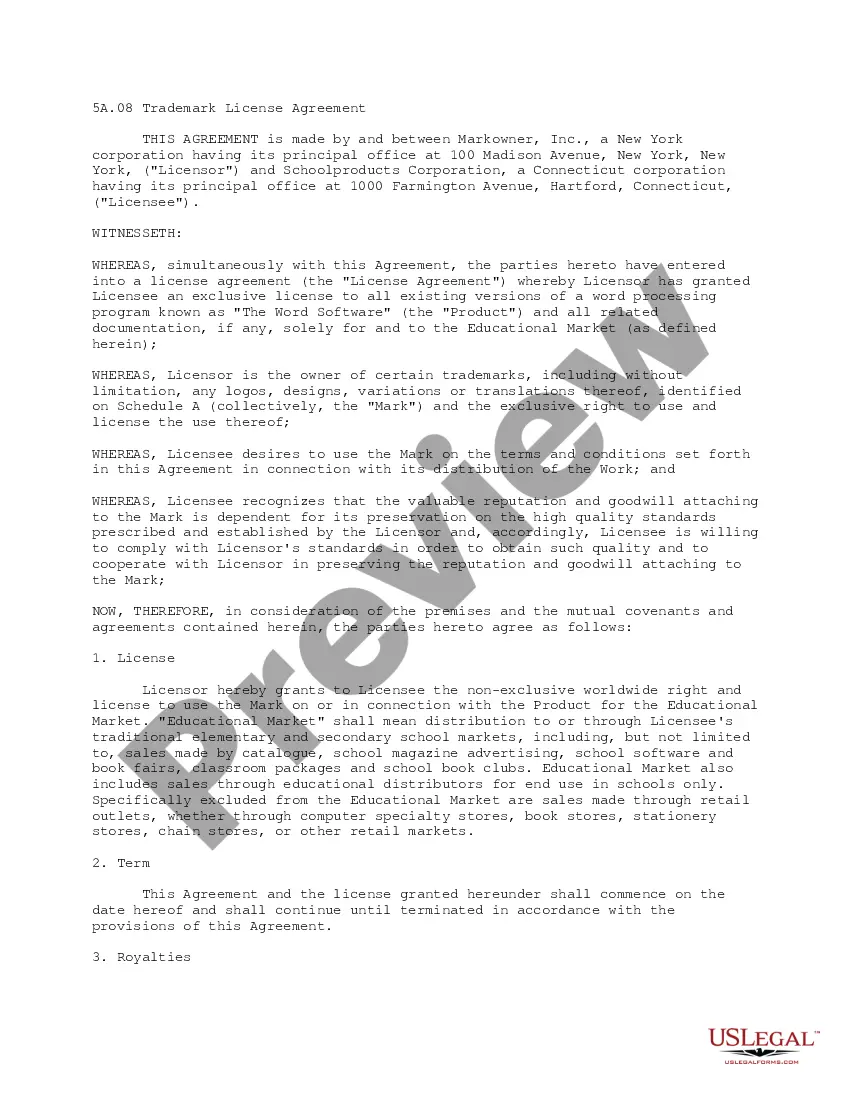

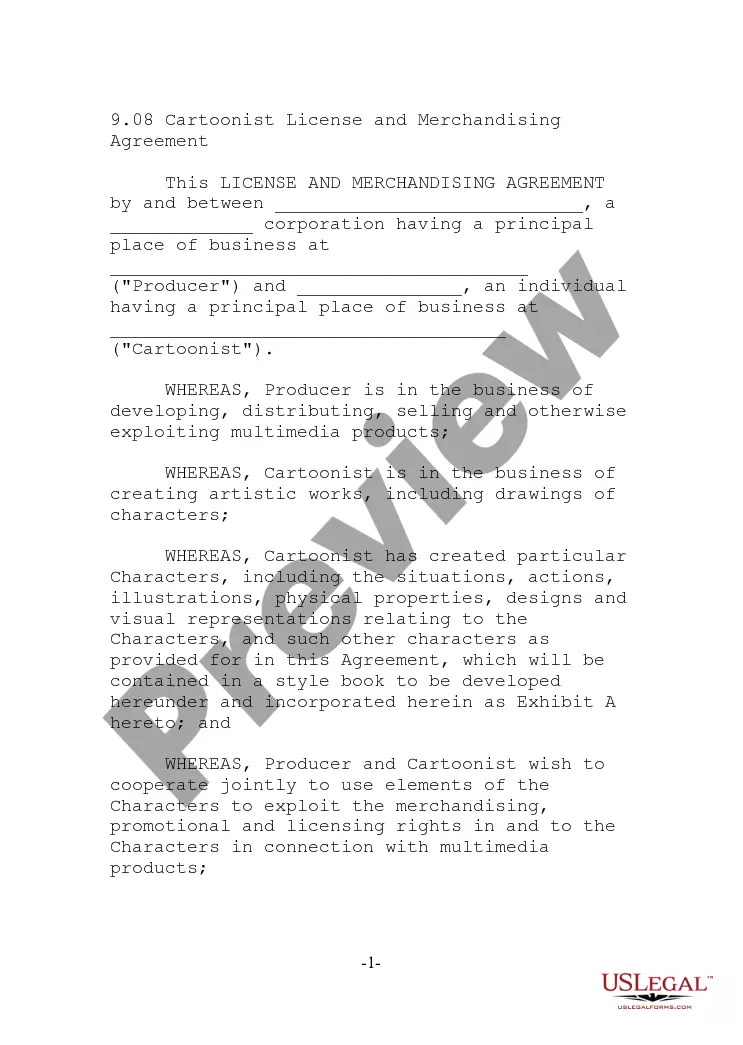

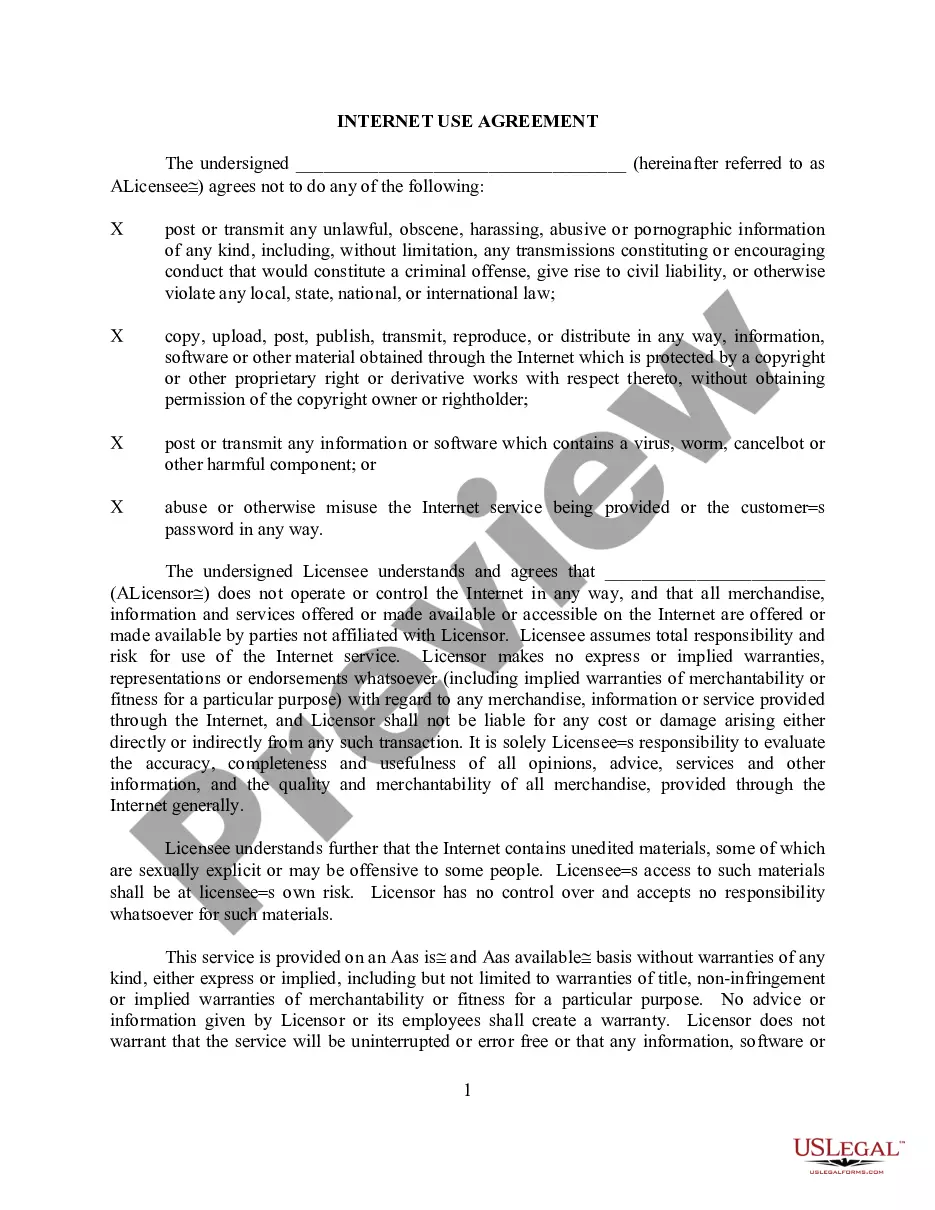

- Step 2. Use the Preview option to review the form's details. Make sure to read the description.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the screen to find other versions of the legal document format.

Form popularity

FAQ

A licensing agreement allows you to use someone else's intellectual property, such as a brand name, logo, or artwork. It grants you permission to create and sell products under that brand, helping you expand your business offerings. Additionally, it protects both parties' rights, ensuring the original creator receives compensation for their work, while you gain access to established market recognition.

The two types of licensing agreements are exclusive and non-exclusive licenses. In an exclusive license, only one licensee can use the rights granted, while a non-exclusive license allows multiple parties to use the same rights, similar to aspects of the Oklahoma Merchandise License Agreement. Understanding these types can help you choose the best structure for your business needs.

The first step you need to take in order to get a resale certificate, is to apply for an Oklahoma sales tax permit. This permit will furnish a business with a unique Sales Tax Number, otherwise referred to as a Sales Tax ID Number. Once you have that, you are eligible to issue a resale certificate.

The Oklahoma Tax Commission indicates that all tangible goods sold within the state are subject to sales tax. Thus, any actual good sold online (jewelry, clothing, steel) is considered a taxable product.

Owners of businesses located in Oklahoma that make online retail sales to customers in the state are also required to obtain a sales tax permit and set up an account to collect and remit sales taxes.

Currently, there is no charge for a Vendor Use Permit in the state of Oklahoma. There is, however, a $20 charge for applying for the Sales Permit with the state of Oklahoma. The best place to register for a sales tax permit with the state of Oklahoma is on their website at .

Anybody selling tangible personal property to customers in Oklahoma needs to register for a sales tax permit if they have sales tax nexus. Oklahoma considers sales tax nexus to be: An office or place of business in the state.

Some examples of items which the state exempts from tax charges are certain medical prescriptions, some items used in the agricultural industry, cable television services, meals or foodstuff used in furnishing meals for school children, and newsprint paper.

Who needs a business license? Almost every company with an income stream will be required to have some type of business license, permit or registration in order to operate legally, in full compliance with government regulations. Some licenses are required of all businesses operating within a jurisdiction.

In Oklahoma, there is no general license required to start or own a business.