Iowa Balance Sheet Deposits

Description

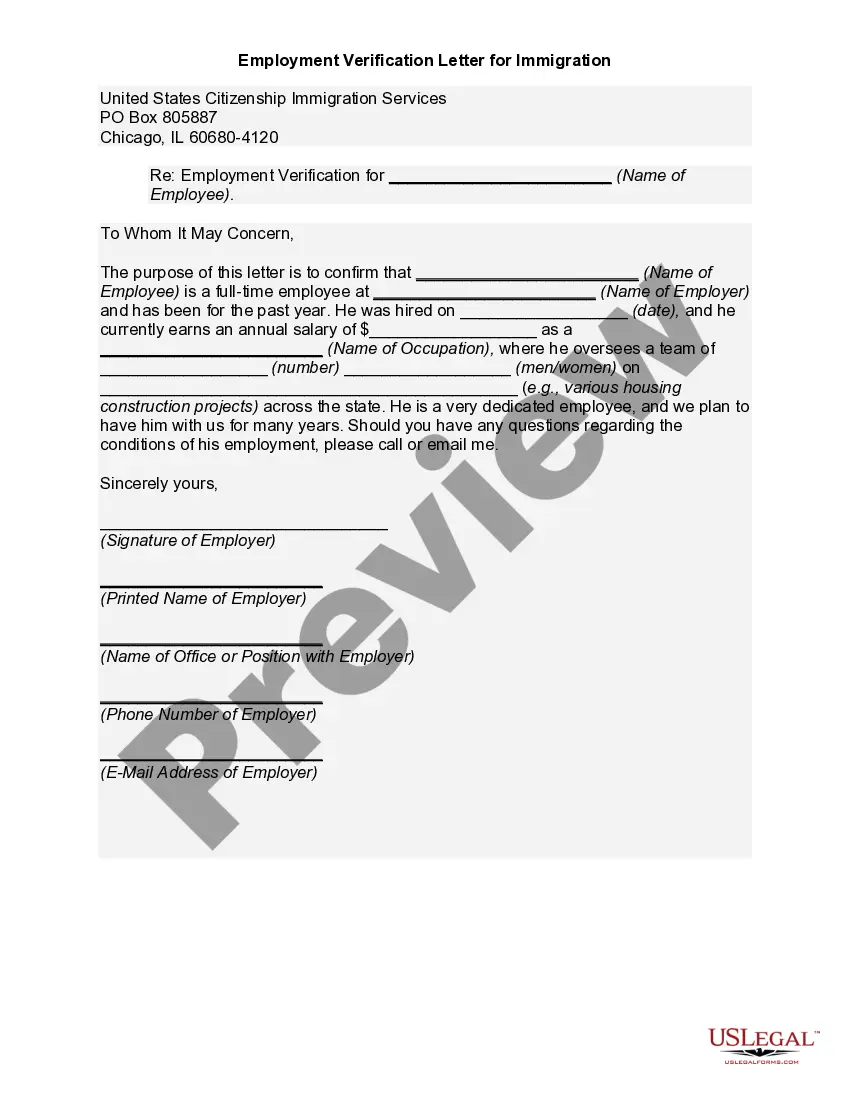

How to fill out Balance Sheet Deposits?

If you wish to acquire, download, or print legal document templates, utilize US Legal Forms, the most extensive array of legal forms available online.

Take advantage of the website's straightforward and user-friendly search to find the paperwork you require.

A multitude of templates for business and personal purposes are categorized by type and state, or keywords.

Step 4. Once you have found the document you need, select the Buy now button. Choose the pricing plan you prefer and enter your information to register for an account.

Step 5. Process the payment. You may use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to obtain the Iowa Balance Sheet Deposits in just a few clicks.

- If you are already a US Legal Forms user, Log Into your account and click the Download button to get the Iowa Balance Sheet Deposits.

- You can also retrieve forms you have previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, adhere to the steps outlined below.

- Step 1. Ensure you have chosen the document for your specific city/state.

- Step 2. Use the Review feature to examine the document's details. Don't forget to read the description.

- Step 3. If you are dissatisfied with the document, make use of the Search box at the top of the page to find alternative legal document formats.

Form popularity

FAQ

Cash and cash equivalents under the current assets section of a balance sheet represent the amount of money the company has in the bank, whether in the form of cash, savings bonds, certificates of deposit, or money invested in money market funds. It tells you how much money is available to the business immediately.

Deposits as Assets When a business places a security deposit that is, it gives someone else money to hold against possible future charges the deposit is listed as an asset on its balance sheet.

The deposit itself is a liability owed by the bank to the depositor. Bank deposits refer to this liability rather than to the actual funds that have been deposited.

A bank's balance sheet is different from that of a typical company. You won't find inventory, accounts receivable, or accounts payable. Instead, under assets, you'll see mostly loans and investments, and on the liabilities side, you'll see deposits and borrowings.

However, for a bank, a deposit is a liability on its balance sheet whereas loans are assets because the bank pays depositors interest, but earns interest income from loans.

Your assets include concrete items such as cash, inventory and property and equipment owned, as well as marketable securities (investments), prepaid expenses and money owed to you (accounts receivable) from payers. Assets also include intangibles of value, like patents or trademarks held.

Deposits is a current liability account in the general ledger, in which is stored the amount of funds paid by customers in advance of a product or service delivery. These funds are essentially down payments.

Off-balance-sheet items are contingent assets or liabilities such as unused commitments, letters of credit, and derivatives. These items may expose institutions to credit risk, liquidity risk, or counterparty risk, which is not reflected on the sector's balance sheet reported on table L.

The volume of business of a bank is included in its balance sheet for both assets (lending) and liabilities (customer deposits or other financial instruments).

In either case, on a bank's T-account, assets will always equal liabilities plus net worth. When bank customers deposit money into a checking account, savings account, or a certificate of deposit, the bank views these deposits as liabilities.