Iowa Statement of Reduction of Capital of a Corporation

Description

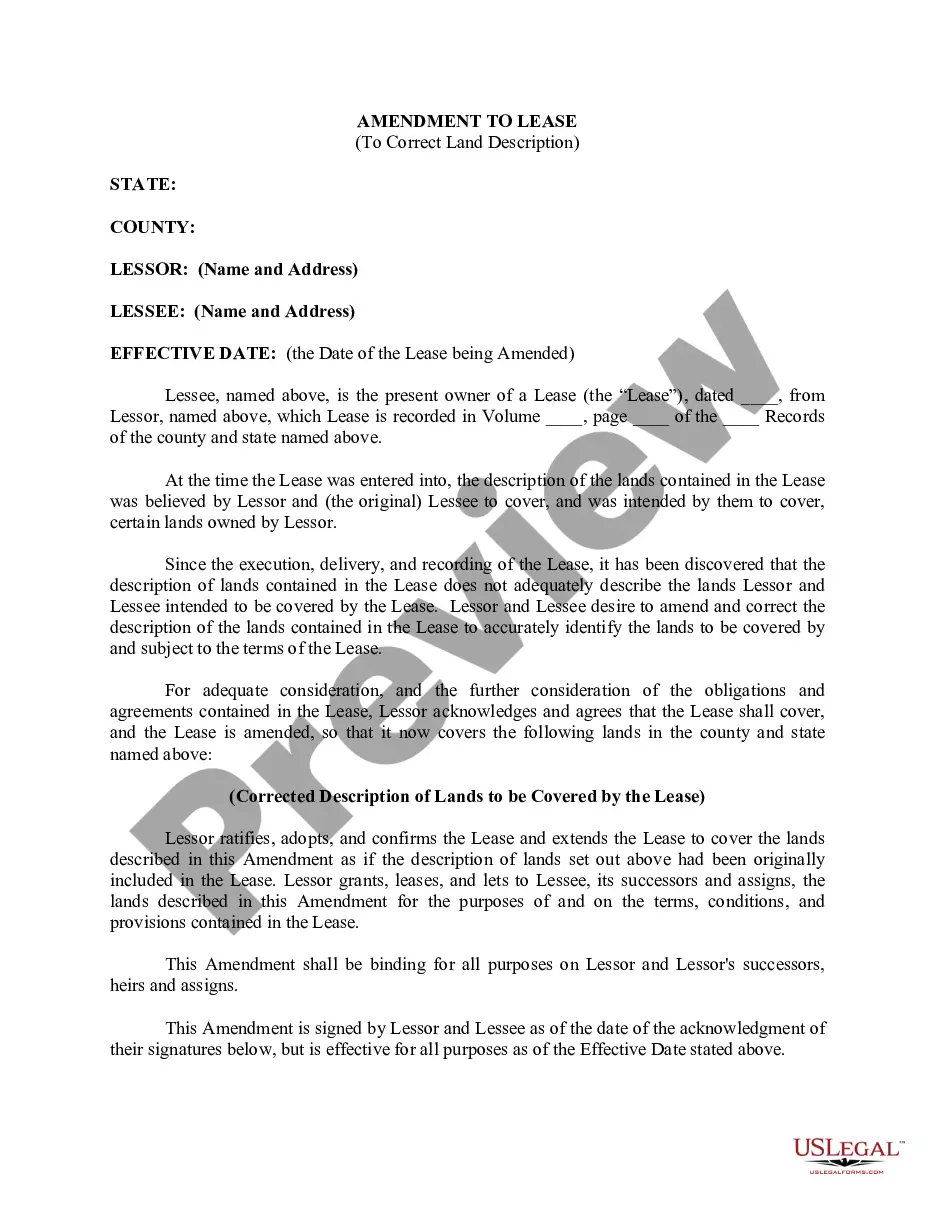

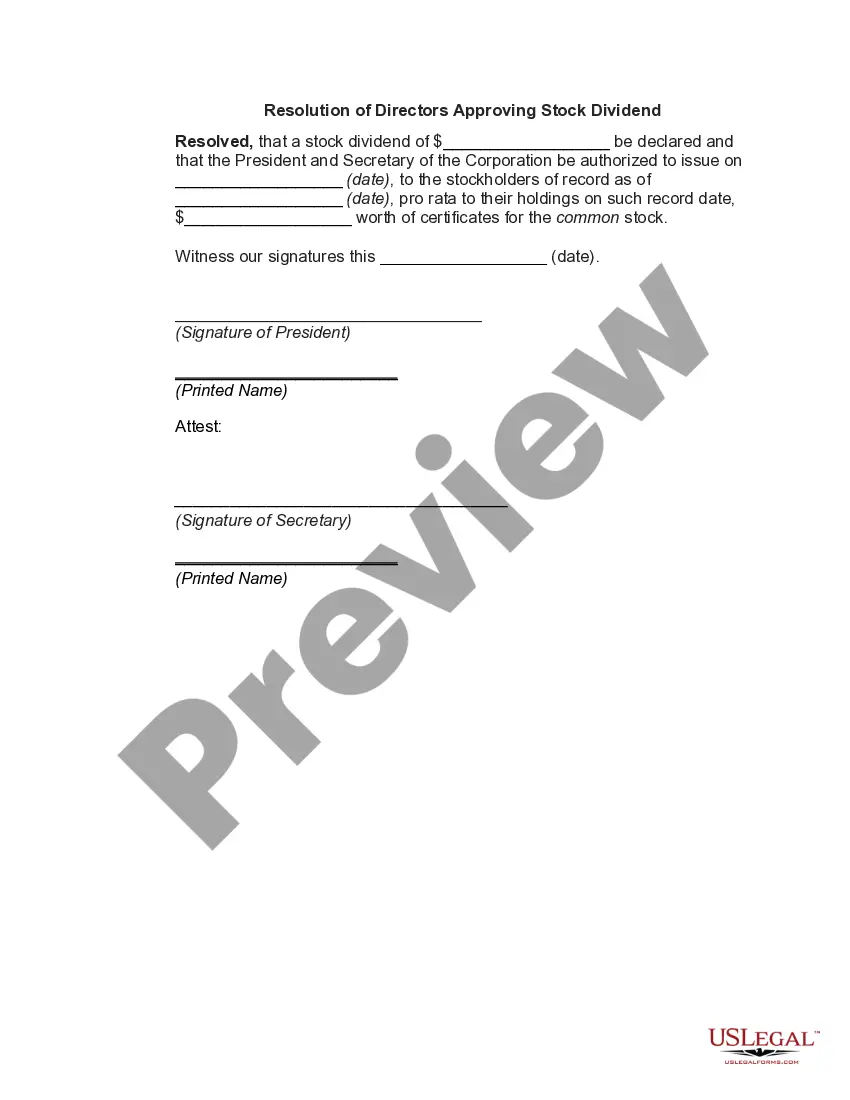

How to fill out Statement Of Reduction Of Capital Of A Corporation?

Choosing the best legal record design could be a battle. Needless to say, there are a variety of layouts available on the Internet, but how do you obtain the legal type you require? Make use of the US Legal Forms web site. The services provides 1000s of layouts, for example the Iowa Statement of Reduction of Capital of a Corporation, which you can use for business and private demands. All of the varieties are checked by professionals and fulfill federal and state demands.

Should you be currently authorized, log in to the profile and then click the Down load switch to obtain the Iowa Statement of Reduction of Capital of a Corporation. Make use of profile to check throughout the legal varieties you may have ordered earlier. Go to the My Forms tab of the profile and have another version in the record you require.

Should you be a whole new end user of US Legal Forms, listed below are basic recommendations that you should stick to:

- Initially, make certain you have selected the proper type to your metropolis/region. You can check out the shape while using Review switch and read the shape explanation to guarantee this is the best for you.

- In the event the type will not fulfill your needs, make use of the Seach discipline to obtain the proper type.

- When you are sure that the shape is proper, select the Get now switch to obtain the type.

- Choose the rates strategy you want and enter in the required information. Make your profile and pay money for your order with your PayPal profile or credit card.

- Choose the document structure and acquire the legal record design to the system.

- Complete, modify and printing and indicator the attained Iowa Statement of Reduction of Capital of a Corporation.

US Legal Forms may be the biggest collection of legal varieties where you can discover various record layouts. Make use of the service to acquire professionally-produced documents that stick to express demands.

Form popularity

FAQ

Capital Gain Deduction Iowa tax law generally follows the federal guidelines on the exclusion of gain on the sale of a principal residence. A copy of your federal Schedule D and federal form 8949 (if applicable) must be included with this return if required for federal purposes.

Net capital gains from the sale of the assets of a business are excluded from an individual's net income to the extent that the individual had held the business for ten or more years and had materially participated in the business for ten or more years.

Form 1120-S is the return that is dedicated to S corporations. These businesses have fewer than 100 shareholders and pass their income and losses to each shareholder. Companies can file these forms electronically or by mail and must include Schedule K-1 with their returns.

Federal income taxes paid or accrued during the tax year are a permissible deduction for Iowa income tax purposes, adjusted by any federal refunds received or accrued during the tax year. Taxpayers who are not on an accrual basis of accounting shall deduct their federal income taxes in the year paid.

Only six states (Alabama, Iowa, Louisiana, Missouri, Montana, and Oregon) allow this deduction. The chart on this page shows how the deduction works in these six states. Three of these states (Alabama, Iowa and Louisiana) allow a full deduction for all federal income taxes paid.

You can use credits and deductions to help lower your tax bill or increase your refund. Credits can reduce the amount of tax due. Deductions can reduce the amount of taxable income.

The amount of additional federal income tax paid is deductible only if Iowa income tax returns were required to be filed for the year for which the additional federal income tax was paid. Include only the actual federal tax payments made in 2022, but DO NOT include the following: penalties. interest.

You can deduct any estimated taxes paid to state or local governments and any prior year's state or local income tax as long as they were paid during the tax year. Generally, you can take either a deduction or a tax credit for foreign income taxes, but not for taxes paid on income that is excluded from U.S. tax.