Iowa Qualifying Subchapter-S Revocable Trust Agreement

Description

How to fill out Qualifying Subchapter-S Revocable Trust Agreement?

If you need to finish, download, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the site’s simple and user-friendly search to find the documents you need.

A variety of templates for business and personal purposes are categorized by type and state, or keywords.

Every legal document template you purchase is yours indefinitely. You have access to every form you have downloaded in your account. Go to the My documents section and select a form to print or download again.

Stay competitive and download and print the Iowa Qualifying Subchapter-S Revocable Trust Agreement with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- Use US Legal Forms to obtain the Iowa Qualifying Subchapter-S Revocable Trust Agreement in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Obtain button to download the Iowa Qualifying Subchapter-S Revocable Trust Agreement.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are a first-time US Legal Forms user, follow the steps outlined below.

- Step 1. Make sure you have chosen the form for the correct city/state.

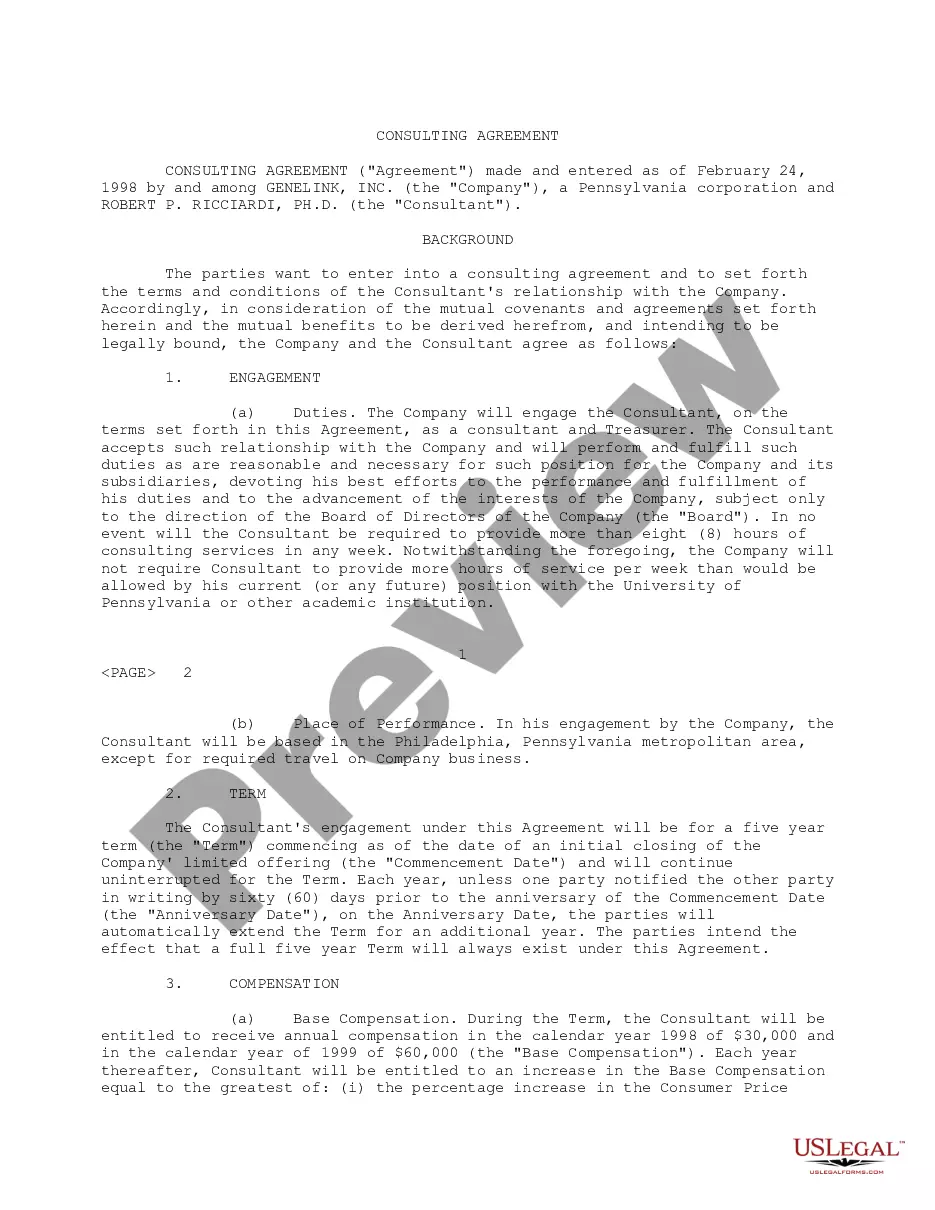

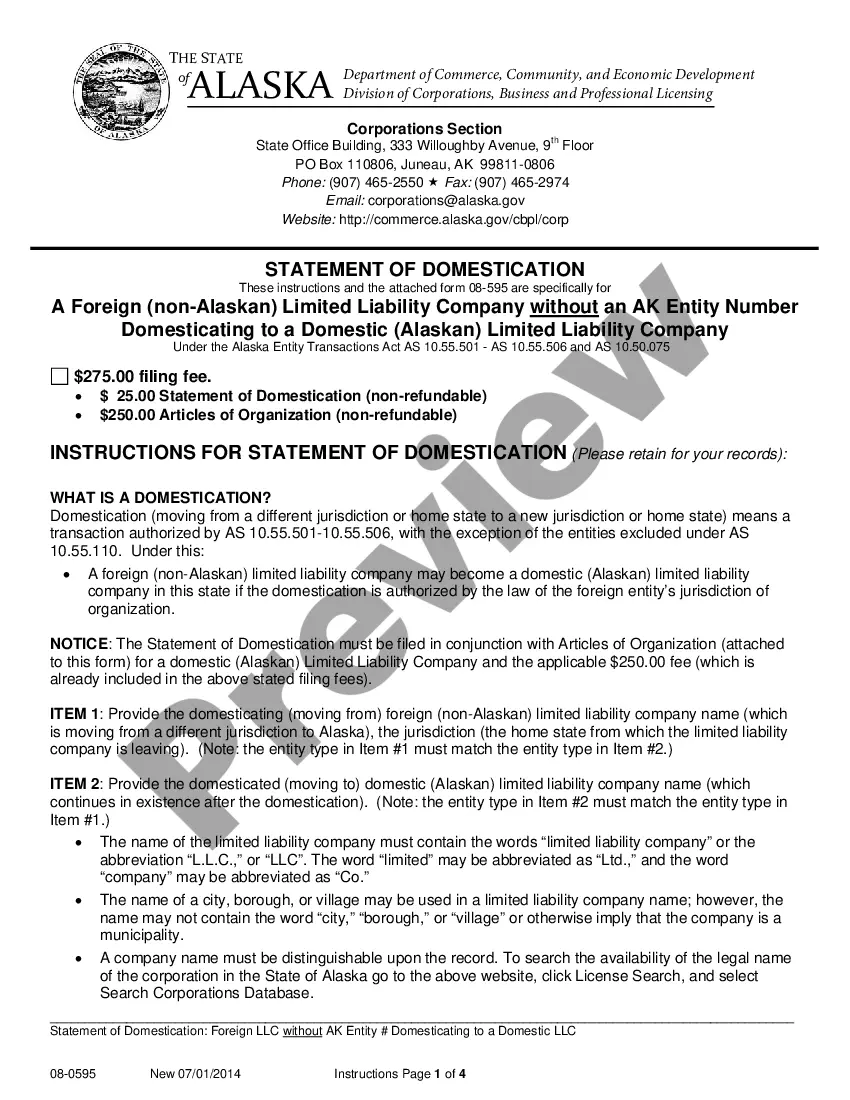

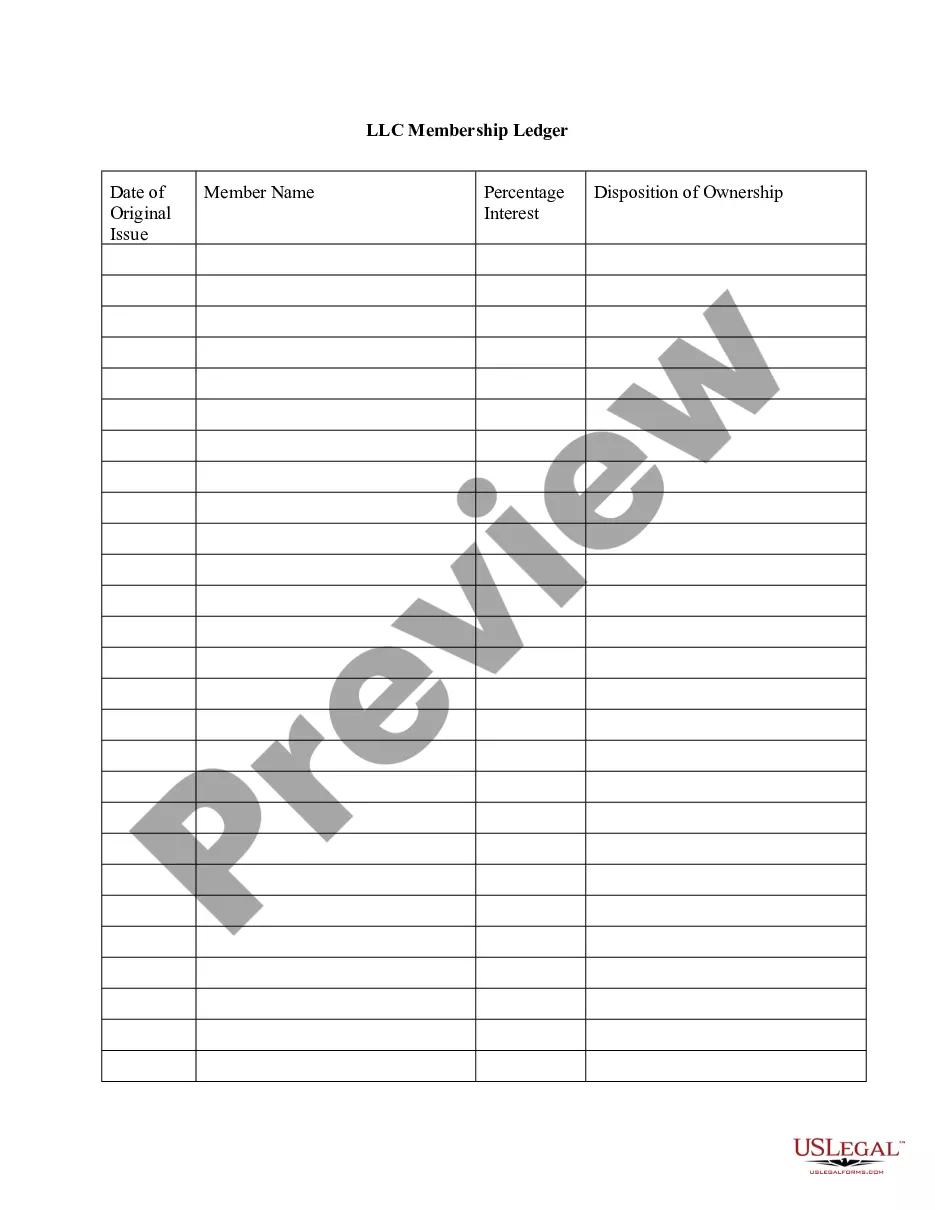

- Step 2. Use the Review option to examine the form's details. Do not forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find alternate versions of the legal form template.

- Step 4. Once you have found the form you need, click the Purchase now button. Select the pricing plan you prefer and provide your information to register for an account.

- Step 5. Process the transaction. You can use your Visa or Mastercard or PayPal account to complete the payment.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Complete, edit, and print or sign the Iowa Qualifying Subchapter-S Revocable Trust Agreement.

Form popularity

FAQ

The step-up in basis tax provision protects the asset in a revocable trust from heavy taxation. Grantors and trustees can take advantage of this provision to reduce or eliminate capital gains taxes. The assets in a revocable trust appreciate and provide the grantor with a consistent stream of income in their lifetime.

Revocable trusts, like assets held outside a trust, do get a step up in basis so that any gains are based on the asset's value when the grantor dies.

A trust may be "qualified" or "non-qualified," according to the IRS. A qualified plan carries certain tax benefits. To be qualified, a trust must be valid under state law and must have identifiable beneficiaries. In addition, the IRA trustee, custodian, or plan administrator must receive a copy of the trust instrument.

Revocable trusts are the simplest of all trust arrangements from an income tax standpoint. Any income generated by a revocable trust is taxable to the trust's creator (who is often also referred to as a settlor, trustor, or grantor) during the trust creator's lifetime.

Qualified trusts are revocable living trusts designed to protect retirement funds while facilitating the distribution of retirement assets held within IRAs, 401(k) accounts, 403(b) accounts, and Self-Employed IRAs (SEPs). Certain retirement accounts, including those listed above, are considered qualified accounts.

For IRA beneficiary purposes, there generally are two types of trusts: one that meets certain IRS requirements is often called a qualified trust, also known as a look-through trust, and one that does not meet the IRS requirements if often called a nonqualified trust.

Upon the death of the grantor, grantor trust status terminates, and all pre-death trust activity must be reported on the grantor's final income tax return. As mentioned earlier, the once-revocable grantor trust will now be considered a separate taxpayer, with its own income tax reporting responsibility.

If you're wondering can a trust own a corporation, the answer is yes, but only specific types of trusts qualify. As a legally separate entity, a trust manages and holds specific assets for a beneficiary's benefit.

A qualified revocable trust (QRT) is any trust (or part of a trust) that was treated as owned by a decedent (on that decedent's date of death) by reason of a power to revoke that was exercisable by the decedent (without regard to whether the power was held by the decedent's spouse).

Revocable Trusts Often called a living trust, these are trusts in which the trustmaker: Transfers the title of a property to a trust. Serves as the initial trustee. Has the ability to remove the property from the trust during his or her lifetime.