Iowa Qualified Personal Residence Trust One Term Holder

Description

How to fill out Qualified Personal Residence Trust One Term Holder?

If you desire to finalize, obtain, or create legitimate document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Take advantage of the website's straightforward and user-friendly search feature to locate the documents you require.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have located the form you need, click on the Buy now button. Choose the pricing plan you prefer and enter your details to create an account.

Step 5. Complete the payment process. You may use your credit card or PayPal account to finalize the transaction. Step 6. Select the format of the legal document and download it to your device. Step 7. Fill out, modify and print or sign the Iowa Qualified Personal Residence Trust One Term Holder.

- Utilize US Legal Forms to acquire the Iowa Qualified Personal Residence Trust One Term Holder in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and press the Download button to obtain the Iowa Qualified Personal Residence Trust One Term Holder.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your specific city/state.

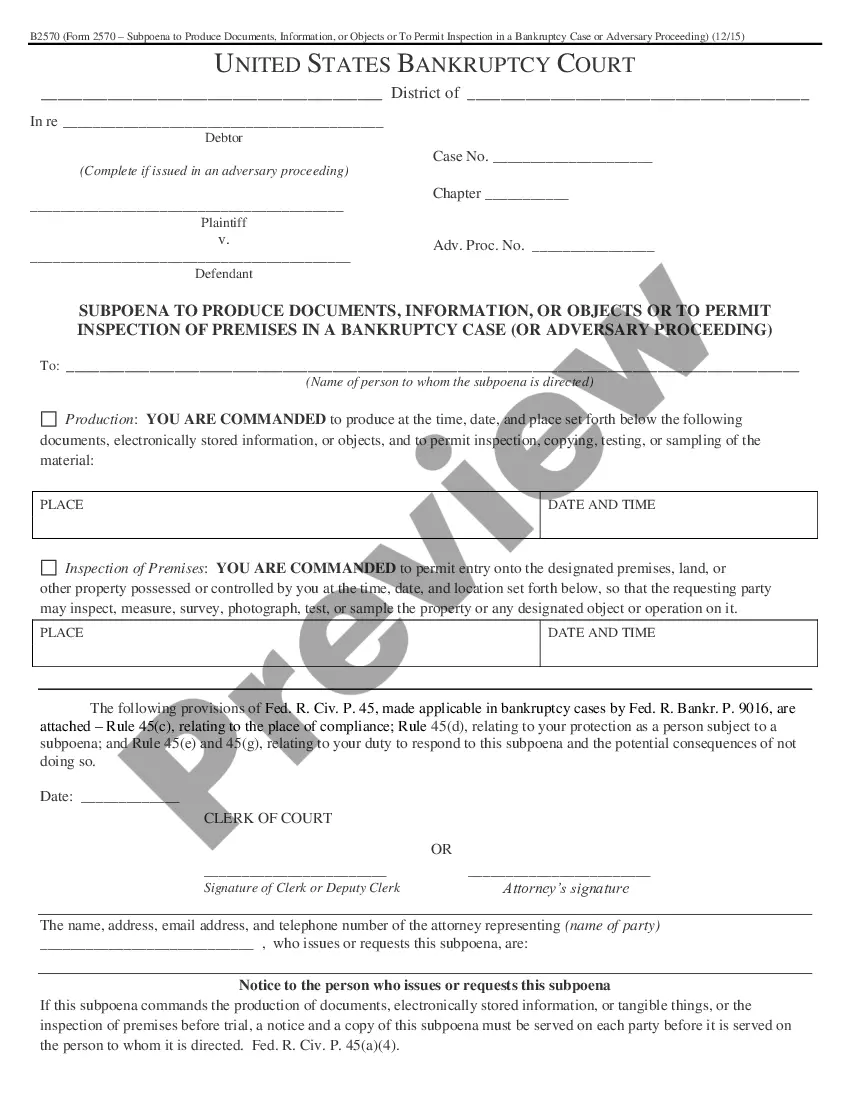

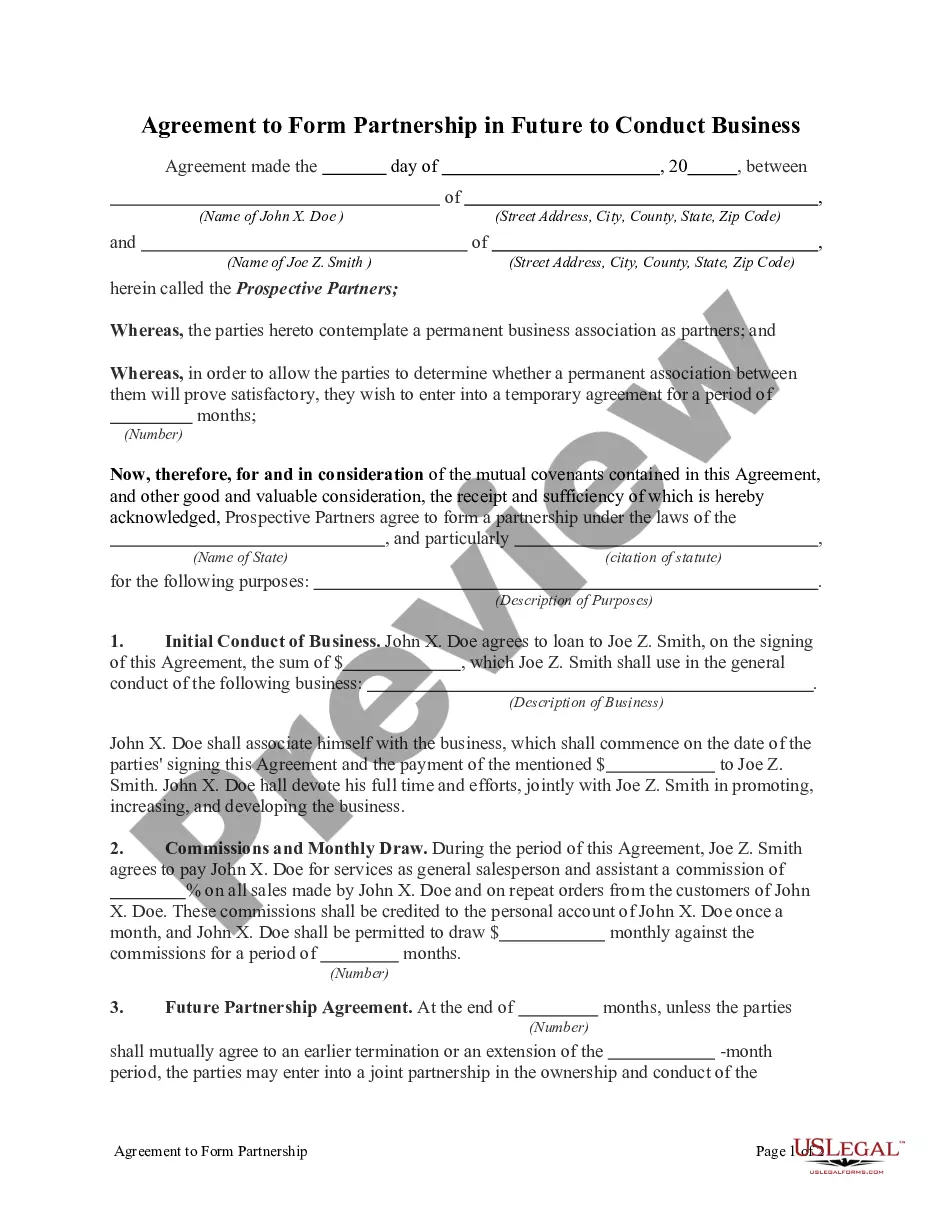

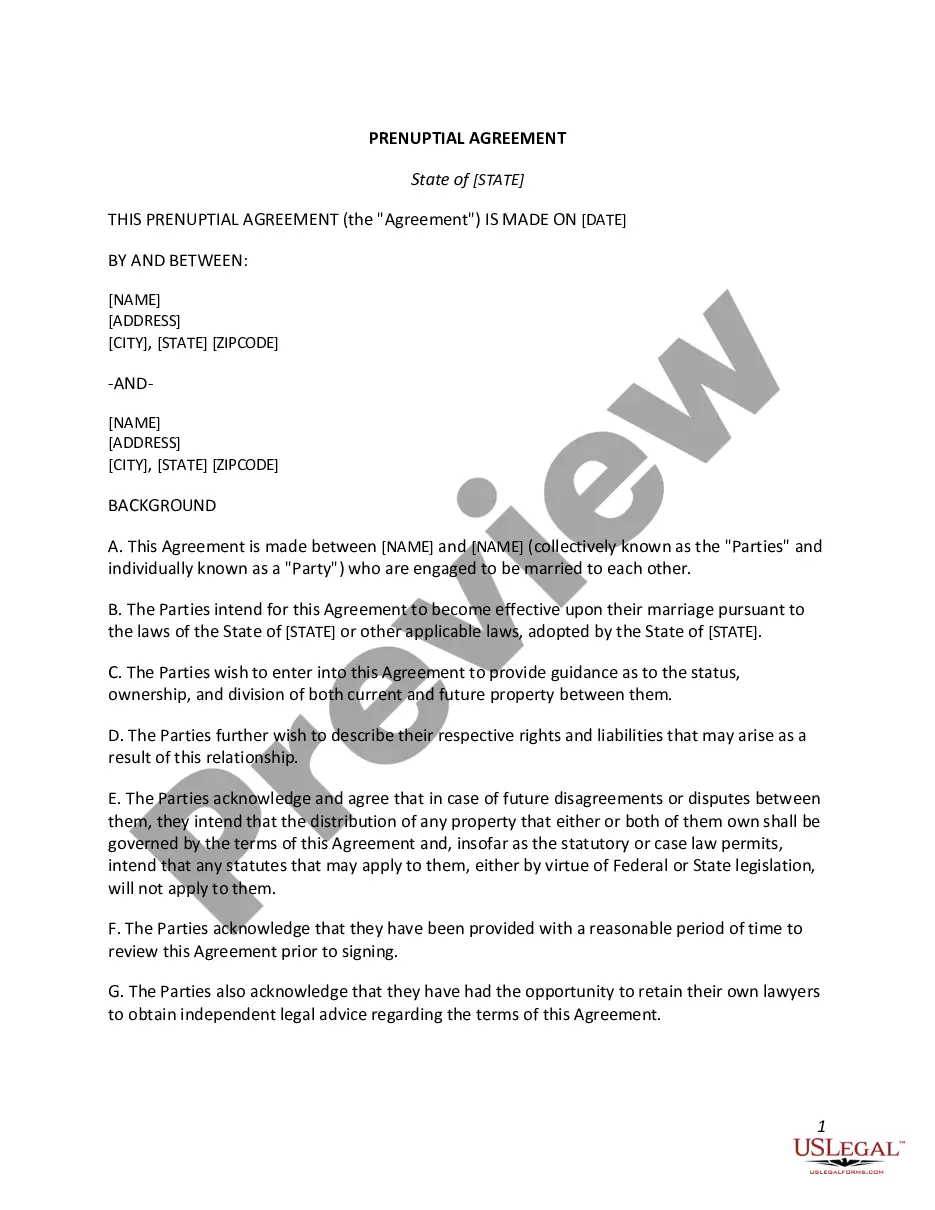

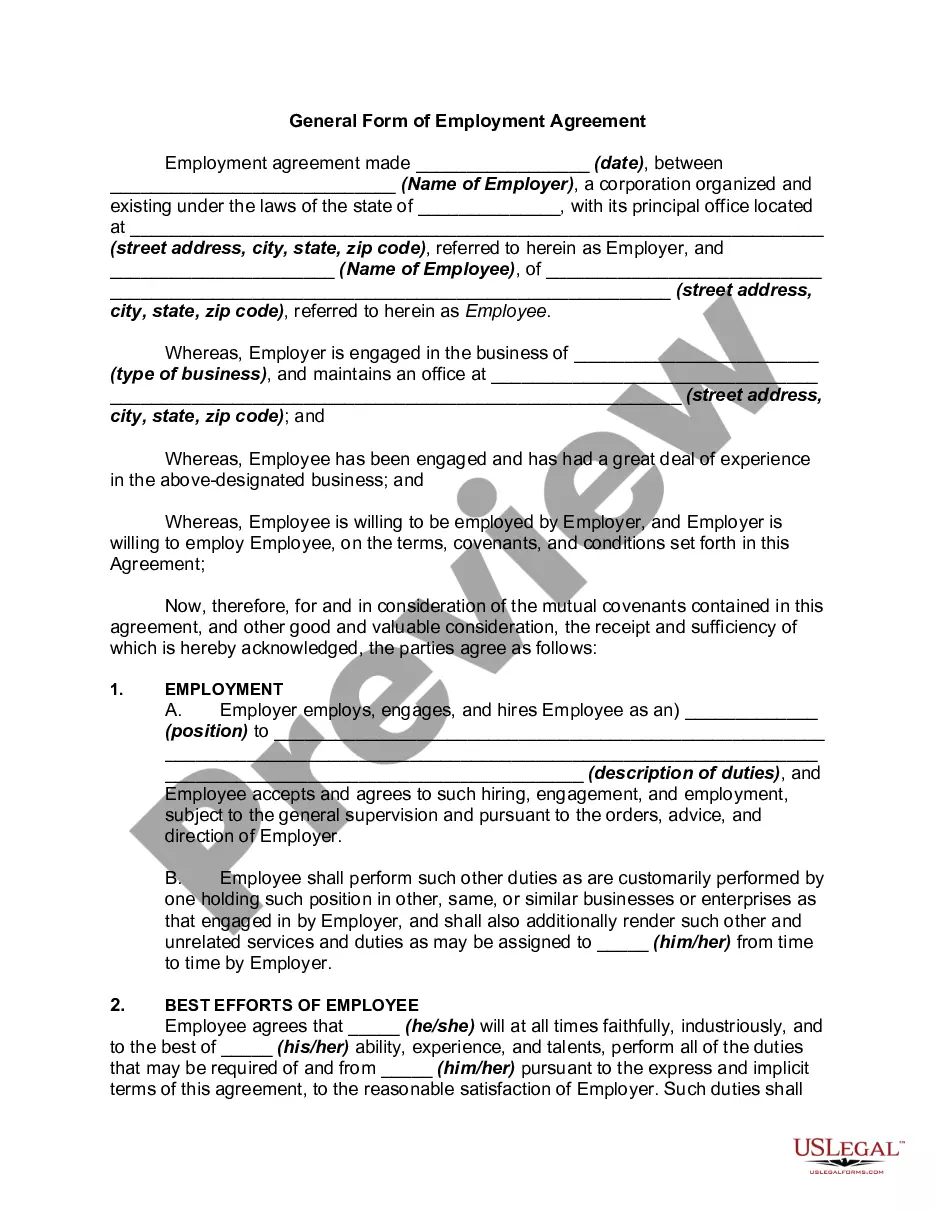

- Step 2. Use the Preview feature to review the contents of the form. Remember to check the summary.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find alternative versions of the legal document template.

Form popularity

FAQ

Setting up a trust in Iowa, like the Iowa Qualified Personal Residence Trust One Term Holder, starts with determining your estate planning goals. Next, you should draft the trust document, outlining beneficiaries, terms, and assets involved. Using a platform like USLegalForms can simplify the process by providing the necessary templates and guidance. Once you have the paperwork ready, you'll need to fund the trust and ensure all legal requirements are met.

The sale of the residence without any reinvestment of the proceeds in a new residence will cause the QPRT status to terminate as to all of the assets.

The biggest benefit of a QPRT is that it removes the value of your primary or second home and its appreciation from your taxable estate. Continued use of the property. With your home in a QPRT, you can still live in the property rent-free and enjoy any income tax deductions associated with it.

A life estate with remainder to charity is normally created for one or two lives. However, it may be created for a term of years. Alternatively, it is possible to create a qualified personal residence trust (QPRT) and to create a life estate agreement for a term of years with a remainder to family.

A qualified personal residence trust (QPRT) is a trust to which a person (called the settlor, donor, or grantor) transfers his personal residence. The grantor reserves the right to live in the house for a period of years; this retained interest reduces the current value of the gift for gift tax purposes.

The biggest benefit of a QPRT is that it removes the value of your primary or second home and its appreciation from your taxable estate. Continued use of the property. With your home in a QPRT, you can still live in the property rent-free and enjoy any income tax deductions associated with it. Gift tax benefits.

Unwinding a QPRT All you have to do is enter into a lease agreement that pays fair market rent. After the QPRT expiration term, the grantor must pay rent if they continue to reside in the property.

One of the most important steps for the trustee to follow at the end of the QPRT term is to transfer title and ownership of the residence into the names of the remainder beneficiaries to ensure the correct titling and insuring of the asset.

Because there's no limit on how long the QPRT must run, it's not uncommon to see QPRTs that were created 10 to 15 years ago finally expire today.

A QPRT is typically considered a Grantor Trust for income tax purposes. Most QPRTs do not generate any income and an income tax return is not typically required.