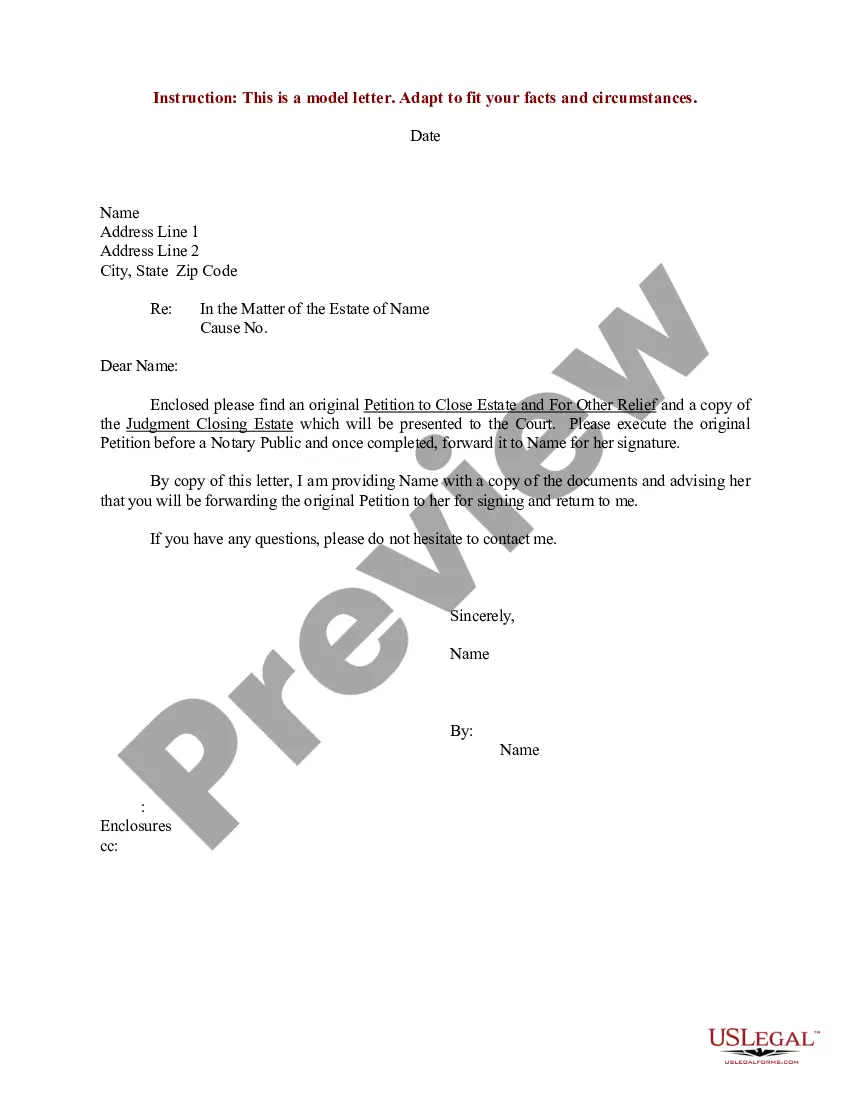

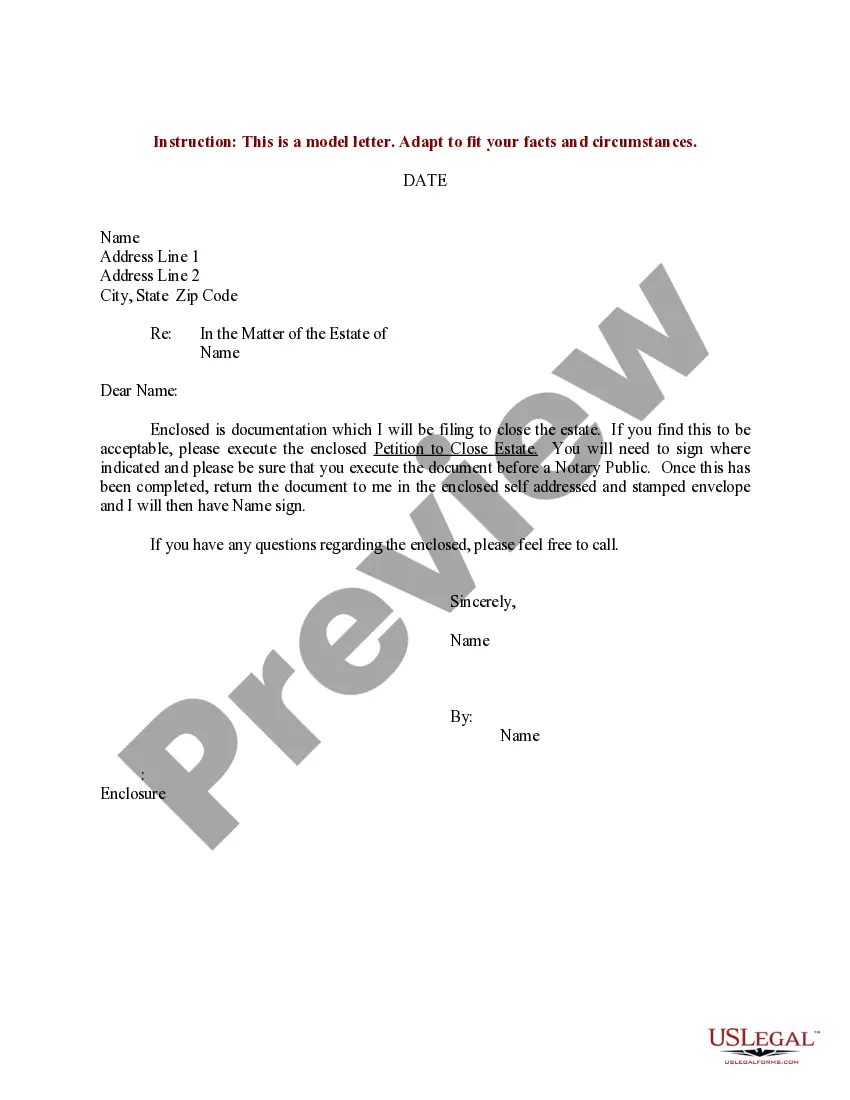

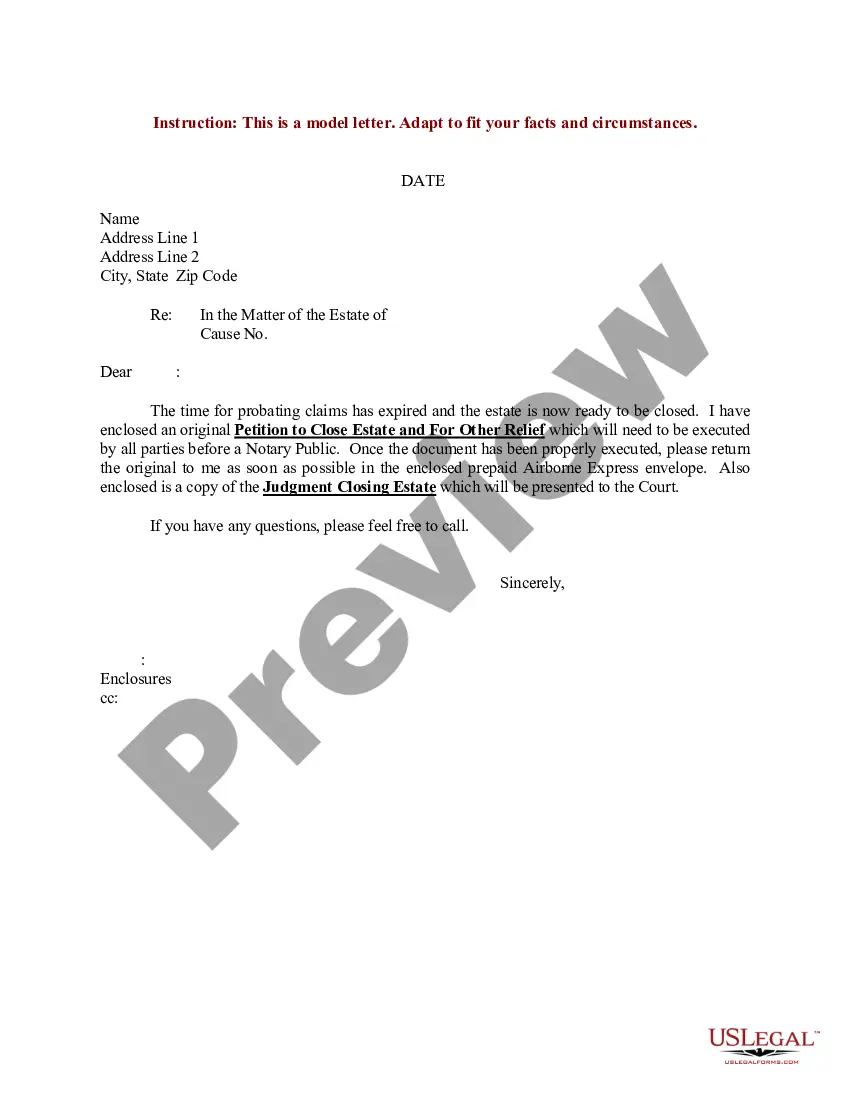

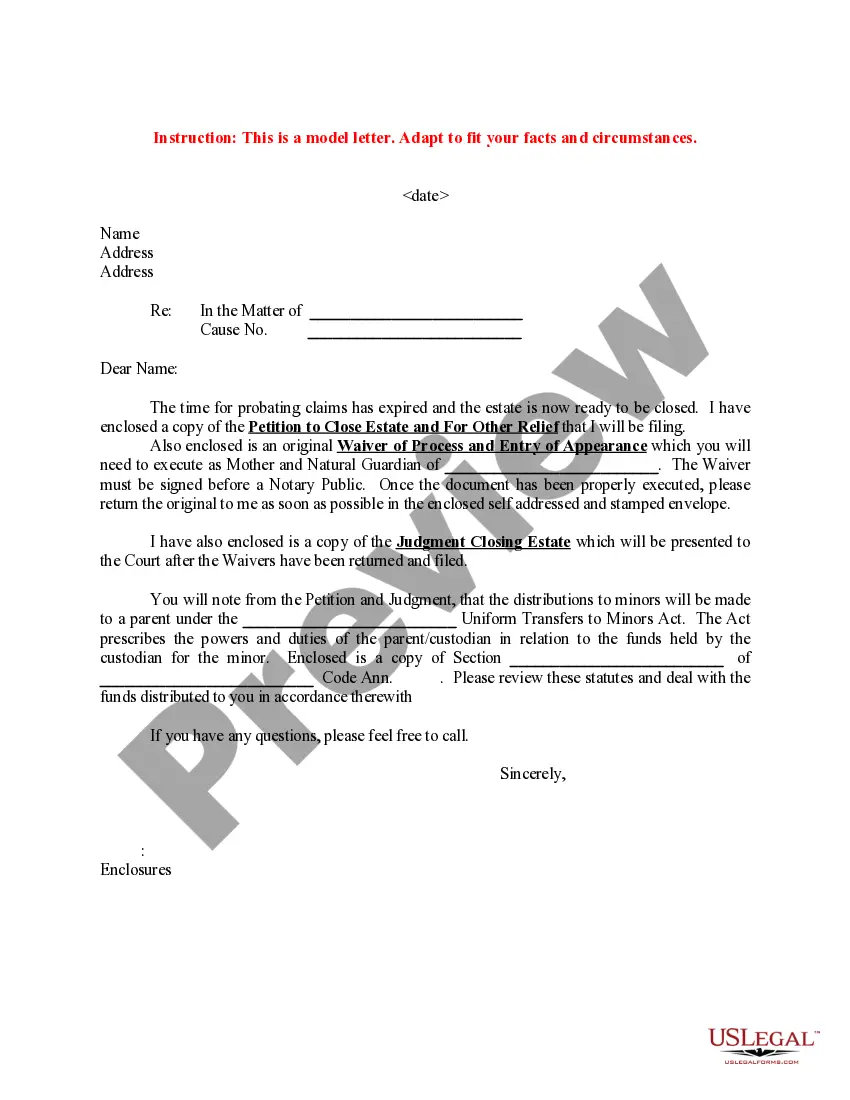

Iowa Sample Letter regarding Revised Petition to Close Estate and For Other Relief

Description

How to fill out Sample Letter Regarding Revised Petition To Close Estate And For Other Relief?

Are you in the situation in which you will need documents for possibly enterprise or individual functions nearly every working day? There are a lot of legitimate document web templates available on the net, but finding types you can rely is not simple. US Legal Forms delivers a huge number of form web templates, like the Iowa Sample Letter regarding Revised Petition to Close Estate and For Other Relief, which are published to fulfill state and federal specifications.

When you are presently informed about US Legal Forms website and get a free account, simply log in. Following that, you are able to acquire the Iowa Sample Letter regarding Revised Petition to Close Estate and For Other Relief design.

Should you not have an profile and want to begin to use US Legal Forms, adopt these measures:

- Discover the form you need and make sure it is for your correct metropolis/area.

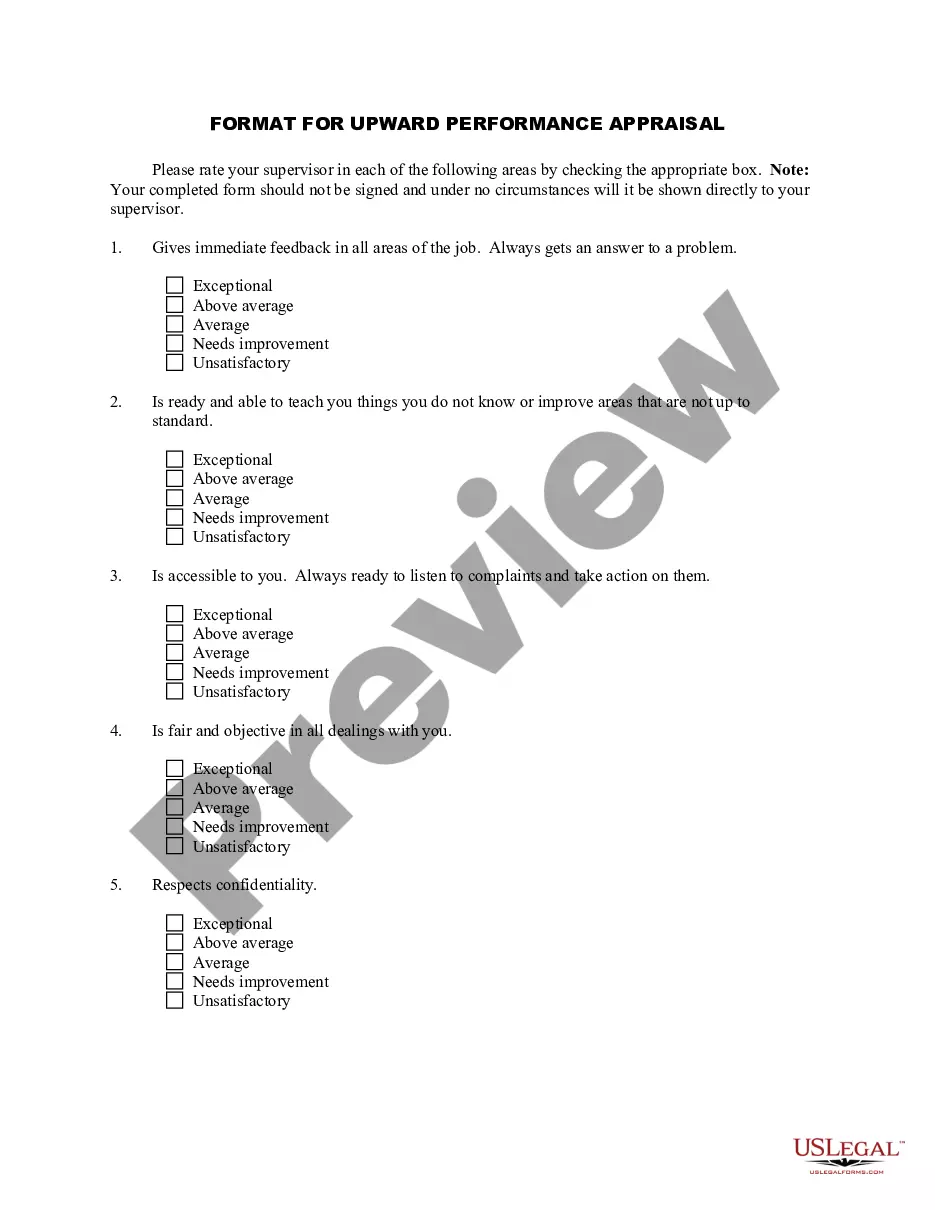

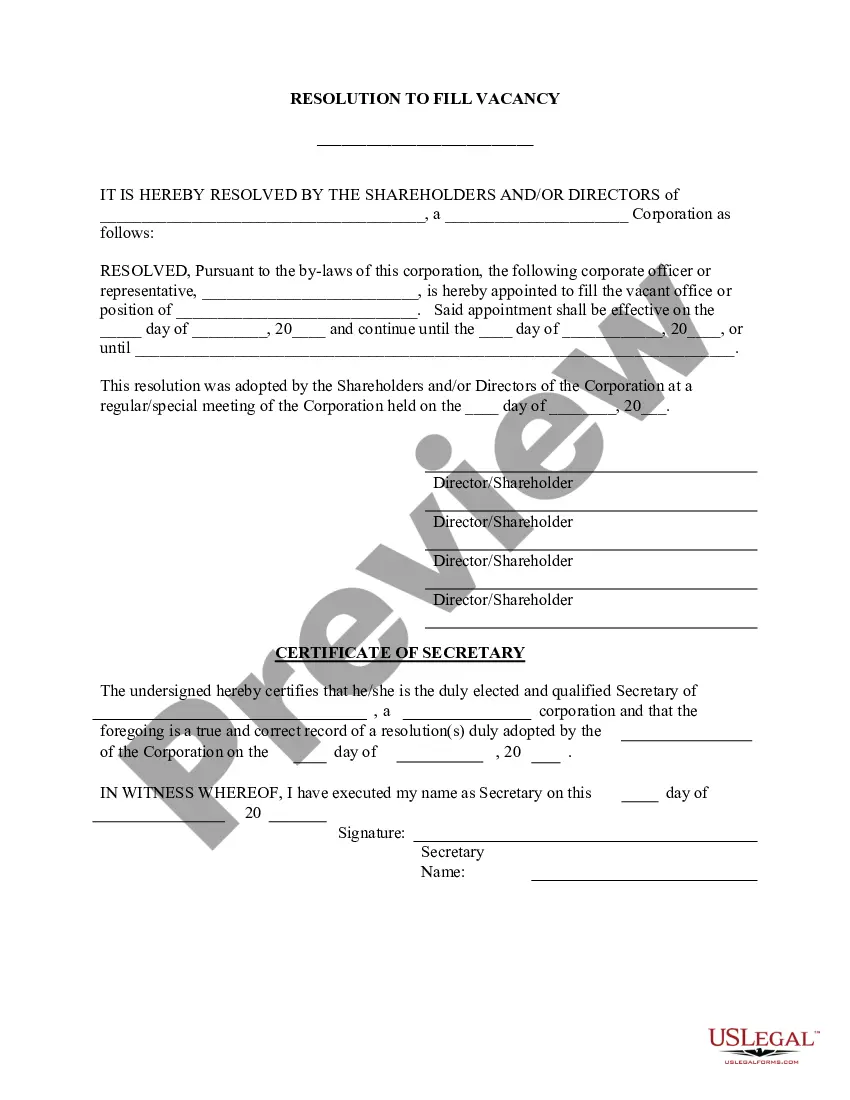

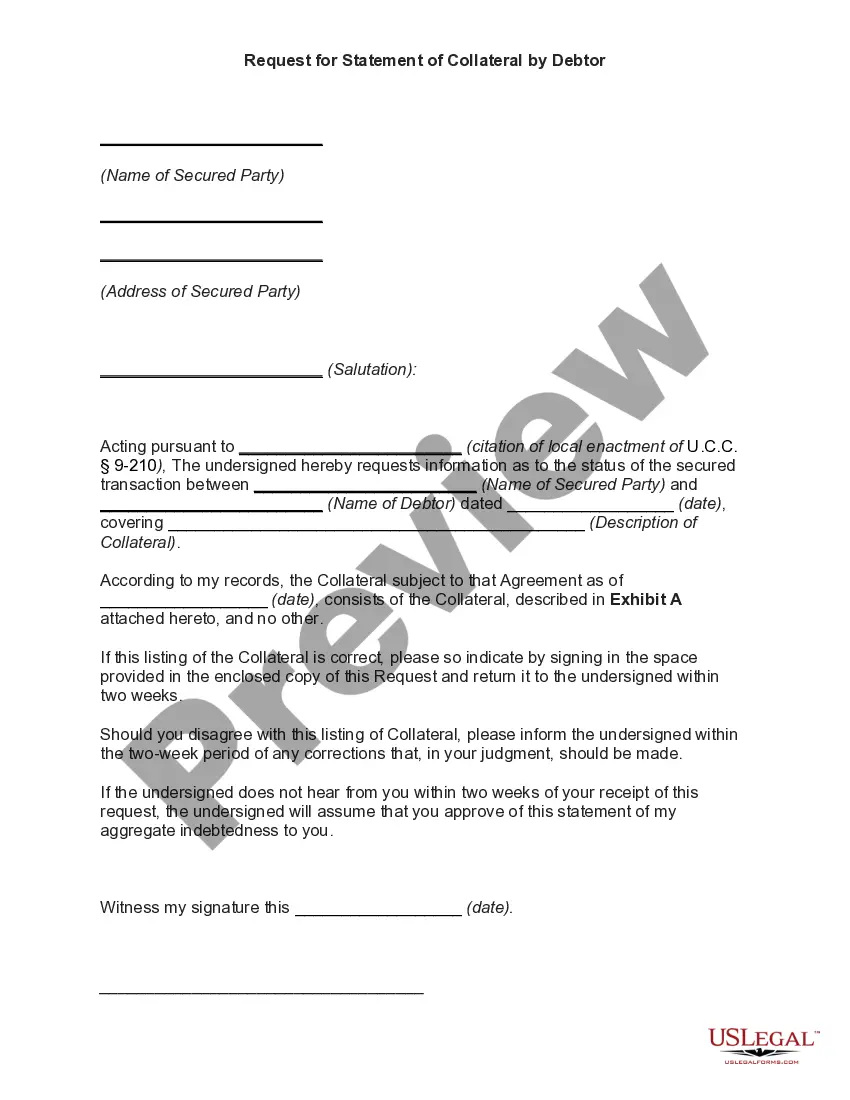

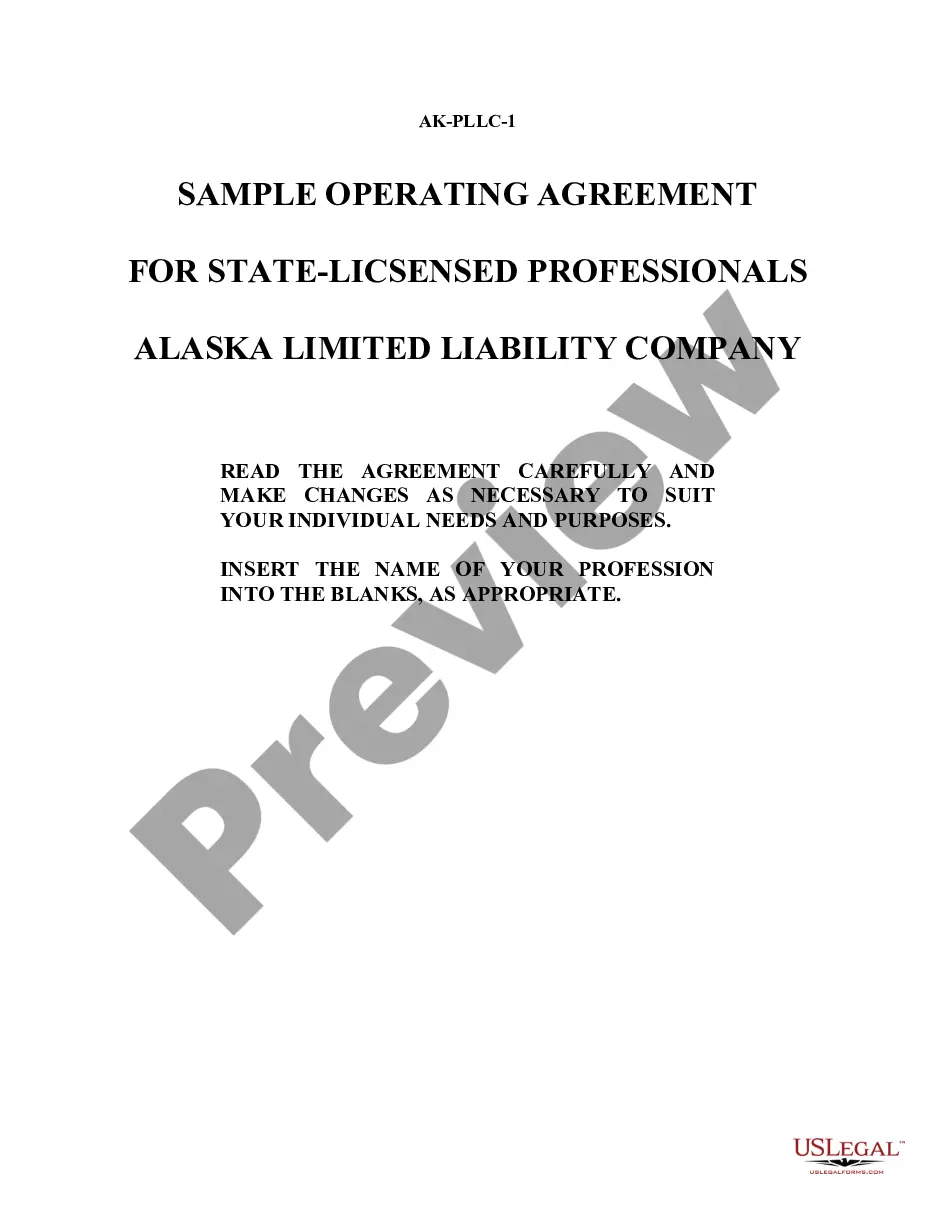

- Utilize the Preview switch to examine the shape.

- Look at the explanation to ensure that you have selected the correct form.

- In case the form is not what you`re trying to find, use the Lookup area to discover the form that suits you and specifications.

- When you find the correct form, just click Get now.

- Opt for the prices strategy you would like, fill in the specified details to make your account, and pay money for an order with your PayPal or charge card.

- Select a handy data file format and acquire your copy.

Locate all of the document web templates you have purchased in the My Forms food list. You may get a further copy of Iowa Sample Letter regarding Revised Petition to Close Estate and For Other Relief any time, if possible. Just go through the essential form to acquire or printing the document design.

Use US Legal Forms, the most extensive collection of legitimate forms, to conserve efforts and prevent faults. The support delivers expertly made legitimate document web templates which can be used for a selection of functions. Generate a free account on US Legal Forms and start producing your lifestyle easier.

Form popularity

FAQ

Iowa law requires that an estate be closed within 3 years after the second publication of the notice to creditors, unless a court grants an extension. Even while the estate is still in probate, however, beneficiaries may be able to receive part of their inheritance.

Is Probate Required in Iowa? Most inheritance cases in Iowa will require probate. However, there are a few exceptions, such as having an estate with a value of less than $25,000 that only includes personal property. If you name a beneficiary to your assets, you can also avoid probate.

Probate can take two years or more depending upon the complexity. Federal and State tax returns need to be filed within nine months after the date of death. Iowa law requires that an estate be closed within three years of publishing the second notice to creditors, unless the court grants an extension.

Children in Iowa Inheritance Law Intestate Succession: Spouses and ChildrenInheritance SituationWho Inherits Your PropertyChildren but no spouse? Children inherit everythingSpouse but no descendants? Spouse inherits everythingSpouse and descendants from you and that spouse? Spouse inherits everything1 more row ?

When a person dies without a will, Iowa Code provides a surviving spouse with an exclusive right for 20 days to file with the court a petition to initiate administration of the estate. Other heirs in succession, starting with surviving children, if any, have an additional 10 days to file such a petition.

Iowa probate follows this general flow: contact the court, get appointed as personal representative, submit will if it exists, inventory and submit valuations of all relevant assets, have the court and beneficiaries approve it, and then distribute the assets to beneficiaries.

Estates must be closed three years from the date of the second publication of these notices. In some cases, a judge may approve keeping the estate open for a longer period. How much can an attorney charge to probate an estate? Iowa law says that attorneys and Executors can each receive $220 for estates less than $5000.

Opening an estate is not required for every deceased person, but it may be necessary to transfer property, pay debts, and obtain tax clearances. Estate and probate matters can be complicated. You should talk to an attorney.