Iowa Sample Letter for Petition to Close Estate

Description

How to fill out Sample Letter For Petition To Close Estate?

Are you presently in a position in which you need to have paperwork for both organization or personal reasons almost every day time? There are plenty of legitimate file templates available online, but finding types you can depend on isn`t easy. US Legal Forms delivers 1000s of develop templates, much like the Iowa Sample Letter for Petition to Close Estate, that happen to be published to fulfill federal and state needs.

When you are presently knowledgeable about US Legal Forms web site and have a merchant account, just log in. Following that, it is possible to down load the Iowa Sample Letter for Petition to Close Estate design.

Should you not come with an accounts and would like to begin using US Legal Forms, adopt these measures:

- Obtain the develop you will need and ensure it is to the proper metropolis/region.

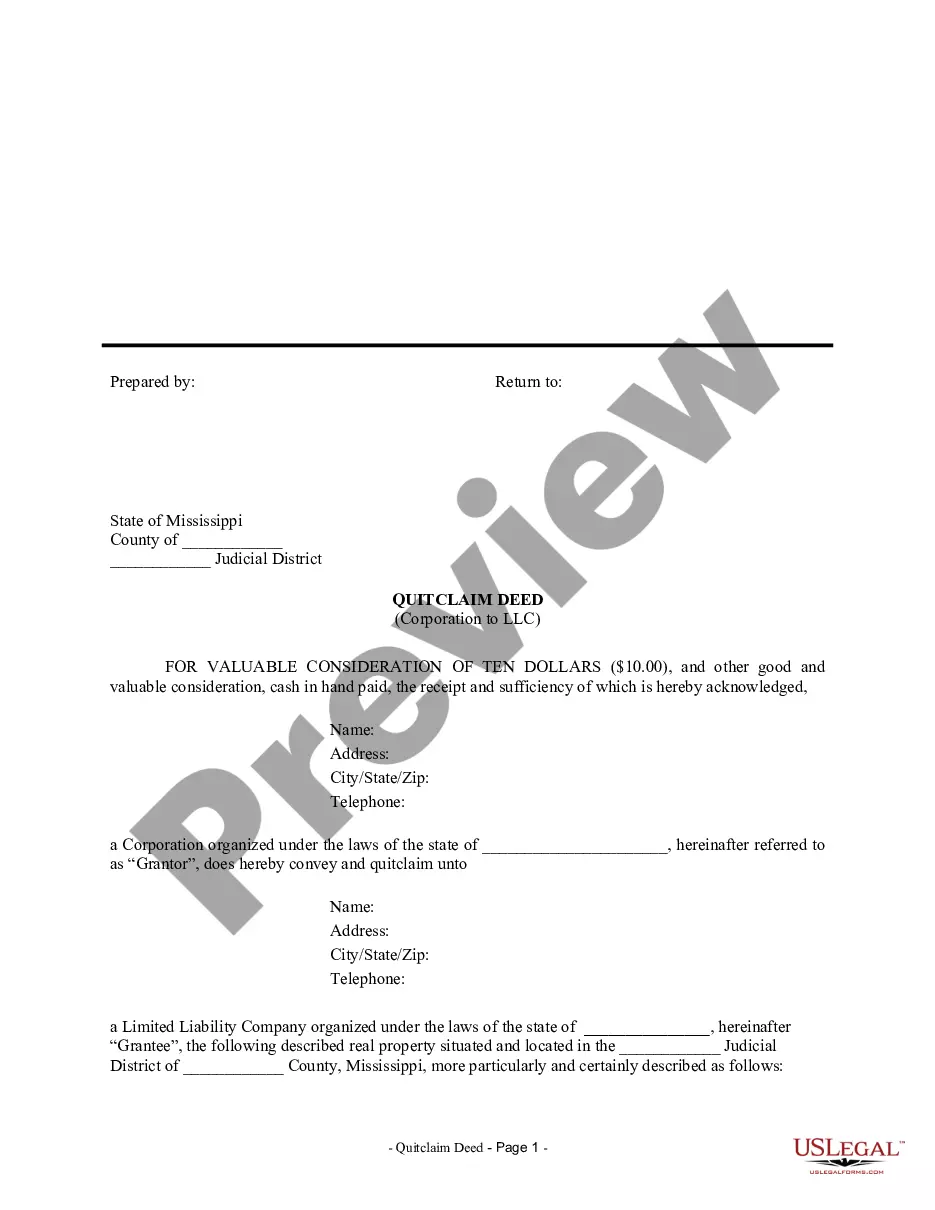

- Utilize the Preview button to review the form.

- Look at the outline to ensure that you have chosen the appropriate develop.

- If the develop isn`t what you are searching for, utilize the Research industry to obtain the develop that meets your needs and needs.

- If you find the proper develop, click on Acquire now.

- Choose the prices prepare you need, submit the necessary info to make your bank account, and pay money for your order utilizing your PayPal or charge card.

- Decide on a hassle-free file structure and down load your version.

Find every one of the file templates you possess bought in the My Forms menu. You may get a additional version of Iowa Sample Letter for Petition to Close Estate anytime, if possible. Just click the needed develop to down load or produce the file design.

Use US Legal Forms, one of the most extensive selection of legitimate forms, to save lots of some time and prevent mistakes. The services delivers expertly manufactured legitimate file templates that can be used for a range of reasons. Create a merchant account on US Legal Forms and start making your daily life a little easier.

Form popularity

FAQ

Iowa probate follows this general flow: contact the court, get appointed as personal representative, submit will if it exists, inventory and submit valuations of all relevant assets, have the court and beneficiaries approve it, and then distribute the assets to beneficiaries.

How to Write (1) Iowa Small Estate Distributee As Declarant. ... (2) Distributee Name. ... (3) Iowa Decedent Name. ... (4) Date Of Iowa Decedent Death. ... (5) County Of Iowa Decedent Death. ... (6) Distributee As Iowa Affiant. ... (7) Address Of Distributee/Iowa Affiant. ... (8) Description Of Iowa Decedent Asset.

Dying Without a Will in Iowa The court then has to follow intestate succession laws to determine who inherits your property, and how much of it. If there isn't a will, the probate court will appoint an executor or a personal representative to wrap up the decedent's estate.

Probate. In Iowa, a small estate is categorized based on the assets owned by the deceased at the time of death. To be considered a small estate, the sum of the assets must equal $200,000 or less.

Most inheritance cases in Iowa will require probate. However, there are a few exceptions, such as having an estate with a value of less than $25,000 that only includes personal property.

A lawyer can design a will and estate plan that will save your heirs time and money later. If your estate does not exceed a certain value (currently $25,000.00) and consists solely of personal property, a probate proceeding may not be required and the estate can be transferred with an affidavit.

Iowa law requires that an estate be closed within 3 years after the second publication of the notice to creditors, unless a court grants an extension. Even while the estate is still in probate, however, beneficiaries may be able to receive part of their inheritance.

Probate can take two years or more depending upon the complexity. Federal and State tax returns need to be filed within nine months after the date of death. Iowa law requires that an estate be closed within three years of publishing the second notice to creditors, unless the court grants an extension.