Iowa Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name

Description

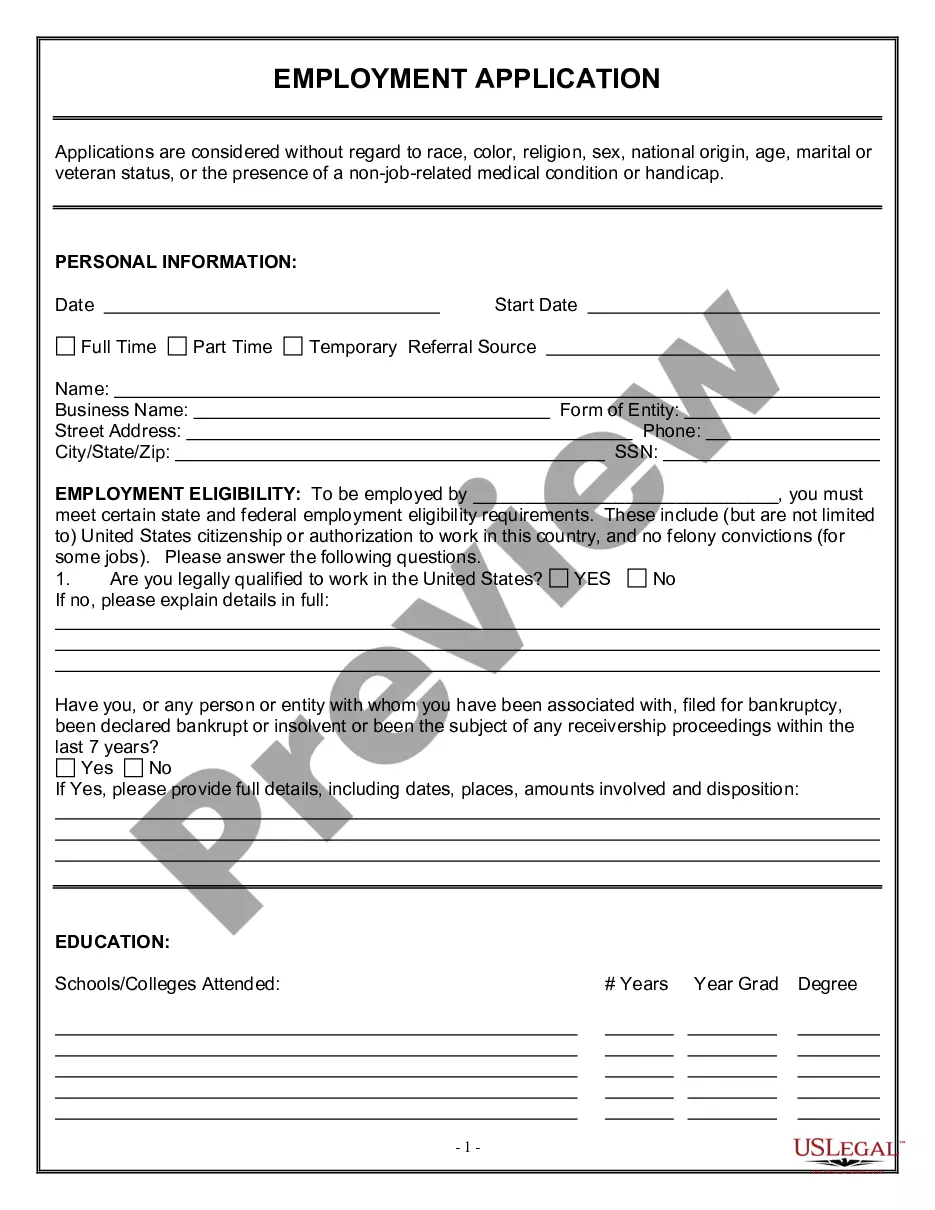

How to fill out Subrogation Agreement Authorizing Insurer To Bring Action In Insured's Name?

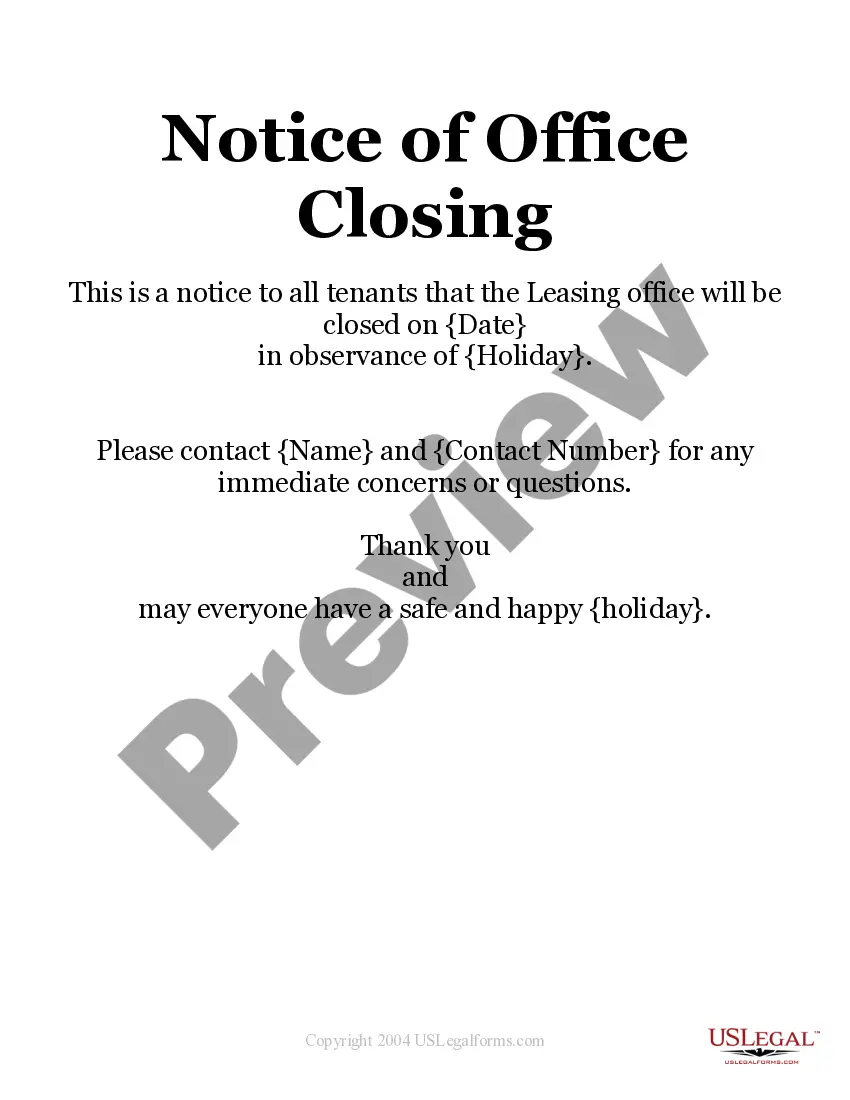

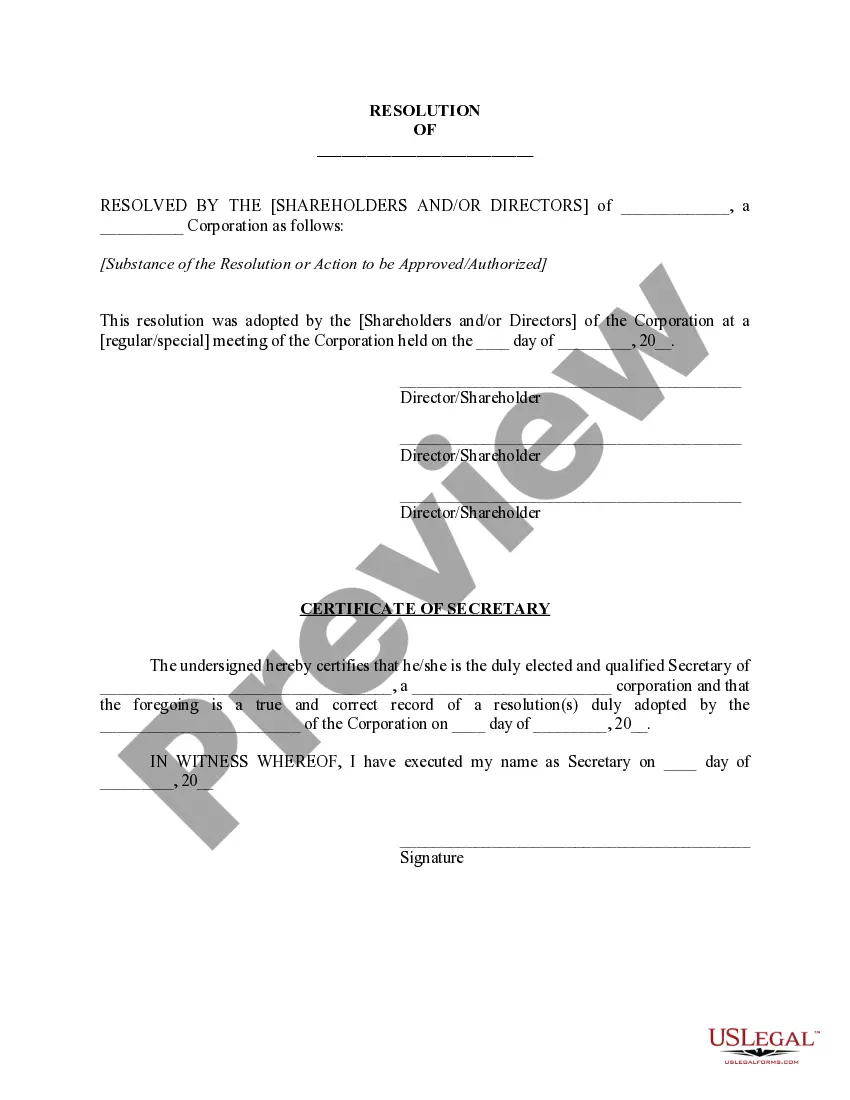

You may devote several hours online trying to find the legitimate document template which fits the federal and state demands you require. US Legal Forms offers a huge number of legitimate forms that are examined by pros. You can easily down load or print the Iowa Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name from your assistance.

If you have a US Legal Forms bank account, you are able to log in and then click the Acquire key. After that, you are able to full, modify, print, or signal the Iowa Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name. Each and every legitimate document template you get is yours permanently. To acquire an additional copy for any obtained kind, check out the My Forms tab and then click the corresponding key.

If you use the US Legal Forms internet site for the first time, keep to the straightforward instructions listed below:

- Initially, make certain you have selected the best document template for the area/town of your liking. Browse the kind outline to make sure you have picked the correct kind. If offered, use the Preview key to search from the document template as well.

- If you wish to get an additional version of the kind, use the Search field to obtain the template that meets your needs and demands.

- Once you have found the template you want, click Buy now to carry on.

- Choose the costs strategy you want, key in your qualifications, and register for a free account on US Legal Forms.

- Complete the purchase. You can use your bank card or PayPal bank account to pay for the legitimate kind.

- Choose the structure of the document and down load it for your device.

- Make adjustments for your document if possible. You may full, modify and signal and print Iowa Subrogation Agreement Authorizing Insurer to Bring Action in Insured's Name.

Acquire and print a huge number of document layouts making use of the US Legal Forms web site, which offers the biggest selection of legitimate forms. Use expert and status-certain layouts to deal with your company or personal requirements.

Form popularity

FAQ

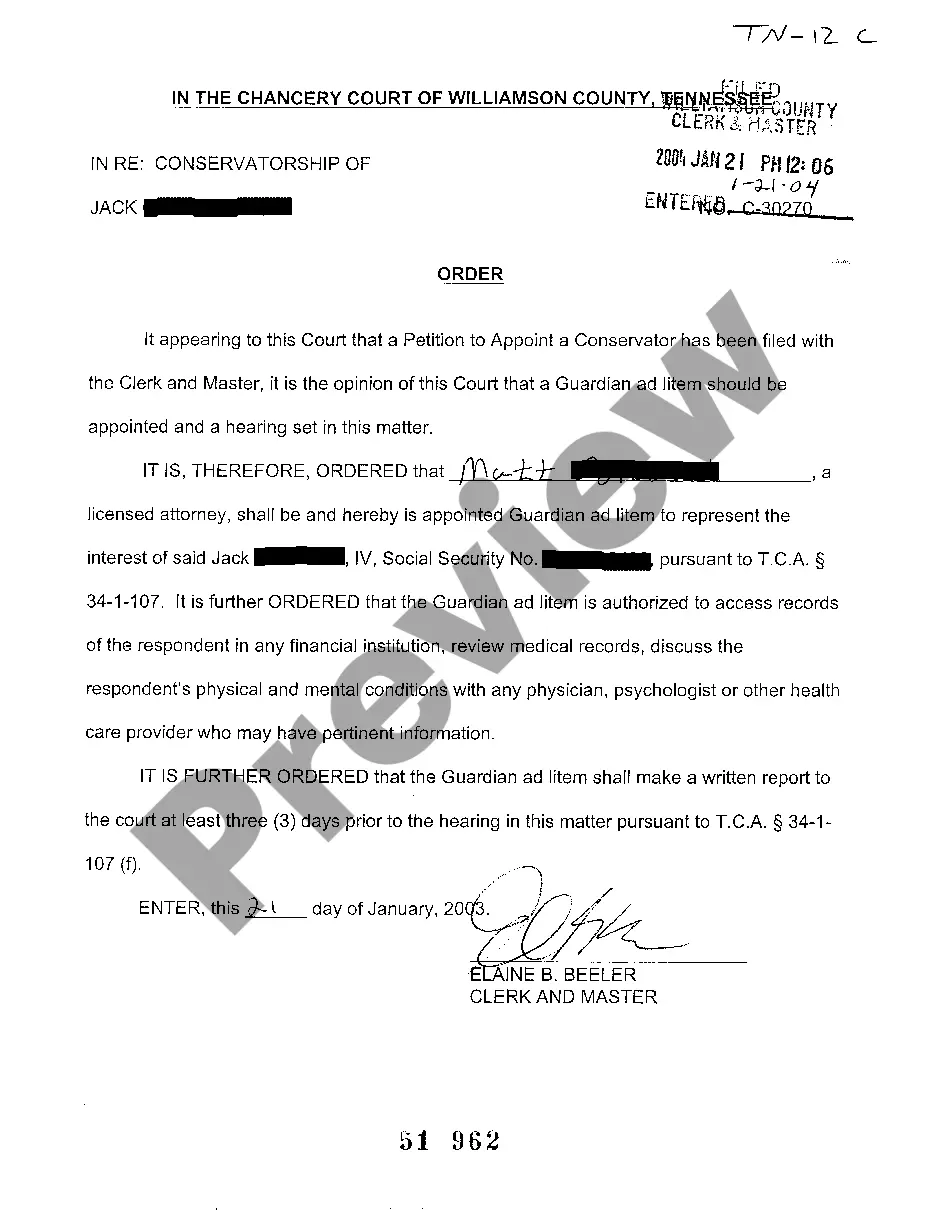

A subrogation receipt transferring the insured's entire causes of action to the insurer allows the insurer to recover in the insured's name for the entire loss, not just to the extent of its payment.

Simply put, subrogation protects you and your insurer from paying for losses that aren't your fault. It's common in auto, health insurance and homeowners policies. It lets your insurer pursue the person at fault to recover the money paid out for a claim that wasn't your fault.

Additional Details letter creation date. insured name. claim number and policy number. date of loss. recipient name. damage amount. claims specialist name and title.

If you've been in an accident and filed a claim with your insurance company, you may have received a subrogation letter. This document allows the insurance company to pursue a claim against a third party that caused damage to their insured, after the insurance company has paid out a claim to the insured.

?Subrogation? refers to the act of one person or party standing in the place of another person or party. It is a legal right held by most insurance carriers to pursue a third party that caused an insurance loss in order to recover the amount the insurance carrier paid the insured to cover the loss.

3 Benefits of Subrogation in Car Insurance Speeds up the claims process for policyholders. Refunds insurers for claims if their customer wasn't at-fault. Keeps premiums low for policyholders who aren't responsible for damage.

Negotiate the claim. If you and your lawyer are unable to stop the subrogation claim altogether, it is possible to negotiate. Most insurance companies are willing to negotiate because they want to settle claims quickly and get their money.