Iowa Promissory Note with Payments Amortized for a Certain Number of Years

Description

How to fill out Promissory Note With Payments Amortized For A Certain Number Of Years?

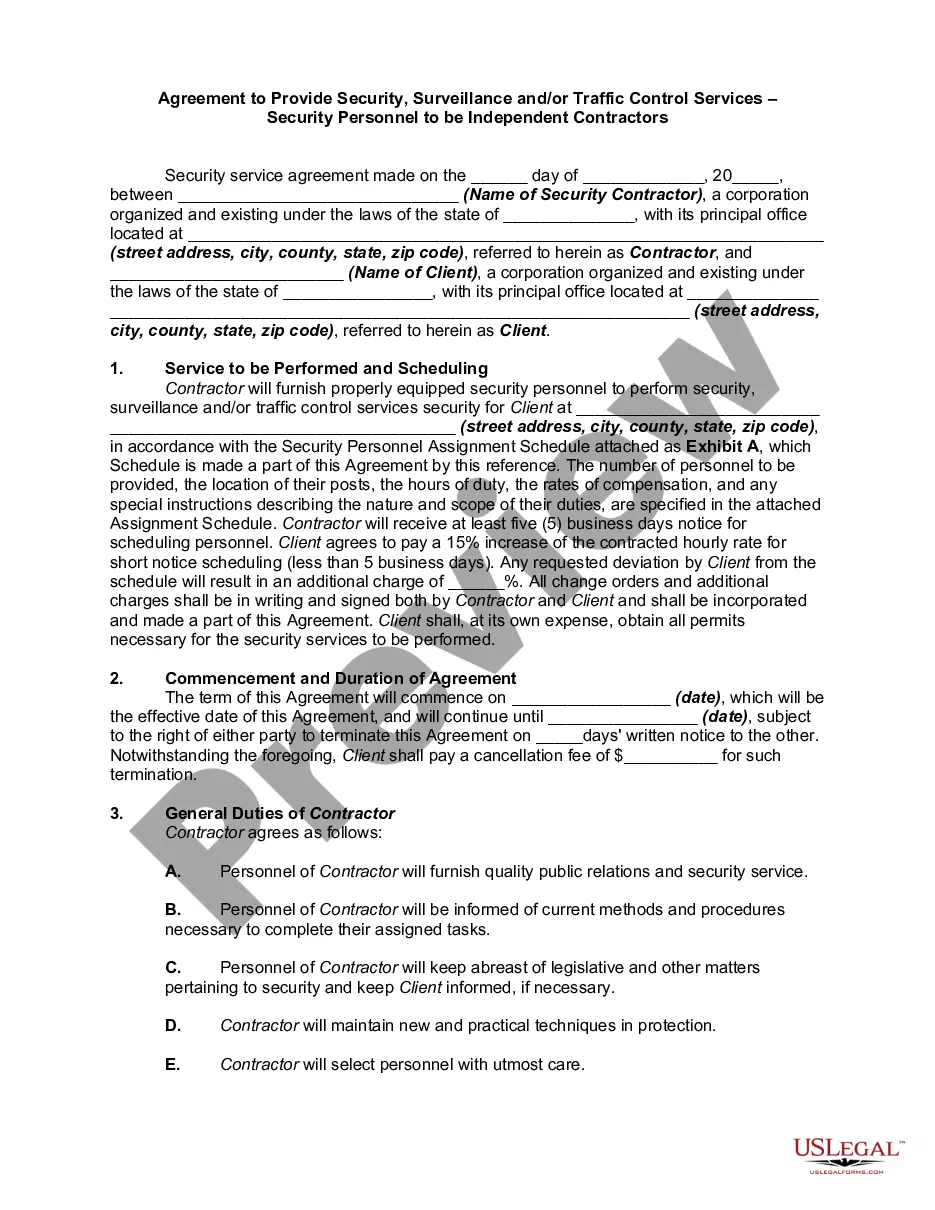

It is feasible to spend numerous hours online looking for the legal document template that meets the federal and state specifications you require.

US Legal Forms offers a vast array of legal forms that are evaluated by experts.

You can download or print the Iowa Promissory Note with Payments Amortized for a Specific Number of Years from our service.

If available, utilize the Preview button to review the document template as well.

- If you possess a US Legal Forms account, you can Log In and click on the Obtain button.

- Then, you can complete, modify, print, or sign the Iowa Promissory Note with Payments Amortized for a Certain Number of Years.

- Every legal document template you obtain belongs to you for many years.

- To get another copy of any acquired form, visit the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document format for your county/town of preference.

- Check the form outline to verify you have chosen the correct form.

Form popularity

FAQ

Amortization refers to the process of gradually paying off a debt over time through regular payments. For instance, when you use an Iowa Promissory Note with Payments Amortized for a Certain Number of Years, your monthly payments include both principal and interest. This method helps borrowers understand their financial commitment clearly, as they see their balance decrease with each payment. Utilizing such a note provides structure and predictability in managing payments, making it easier to budget over the repayment period.

The payment for amortization in an Iowa Promissory Note with Payments Amortized for a Certain Number of Years covers both principal and interest. This means a portion of your payment reduces the amount you owe, while the rest goes towards interest. It's important to understand that these payments remain consistent over the life of the note. To simplify this process, you can use tools available on the US Legal Forms platform.

A notarized promissory note is indeed legally binding in Iowa. Notarization adds a layer of authenticity and helps verify the identities of the involved parties. By using uslegalforms, you can ensure your note meets all legal requirements, providing peace of mind that your promissory note is properly executed.

Yes, in Iowa, a promissory note does have a time limit for enforcement under the statute of limitations. Typically, creditors have a period of five years to bring a lawsuit to collect on a promissory note. Therefore, it's crucial to understand the timeline attached to your note to ensure your rights are protected.

The maximum amount on an Iowa promissory note with payments amortized for a certain number of years varies depending on the lender and the specific terms of the agreement. Generally, lenders may set limits based on factors like the borrower's creditworthiness and repayment capacity. It's important to discuss your needs with a lender who understands Iowa's legal framework.

Promissory note are a valid instrument in the court of law to claim your amount. payable at a certain time after date. So if in your promissory note is it stated that your friend will pay you the amount after a certain date then the instruments date is not very essential.

If you're signing a promissory note, make sure it includes these details:Date. The promissory note should include the date it was created at the top of the page.Amount.Loan terms.Interest rate.Collateral.Lender and borrower information.Signatures.

Generally, as long as the promissory note contains legally acceptable interest rates, the signatures of the two contracted parties, and are within the applicable Statute of Limitations, they can be upheld in a court of law.

While the statute of limitations on an action in an obligation, liability, or contract is four years, Commercial Code Section 3118(a) gives a statute of limitations of six years for an action to be enforced on the party to pay their promissory note. This time period starts from the due date that's listed on the note.

Promissory notes are commonly used in business as a means of short-term financing. For example, when a company has sold many products but has not yet collected payments for them, it may become low on cash and unable to pay creditors.