Iowa Checklist - Action to Improve Collection of Accounts

Description

How to fill out Checklist - Action To Improve Collection Of Accounts?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a range of legal form templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You will find the most current forms such as the Iowa Checklist - Action to Improve Collection of Accounts in just minutes.

If you already have a subscription, Log In and download the Iowa Checklist - Action to Improve Collection of Accounts from your US Legal Forms library. The Download button will be visible on each form you view. You can access all previously saved forms within the My documents section of your account.

Proceed with the transaction. Use a credit card or PayPal account to complete the payment.

Choose the format and download the form onto your device. Edit the document. Fill out, modify, print, and sign the saved Iowa Checklist - Action to Improve Collection of Accounts. Every form you add to your account does not expire and is yours indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the Iowa Checklist - Action to Improve Collection of Accounts through US Legal Forms, the most extensive library of legal form templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have selected the appropriate form for your city/region.

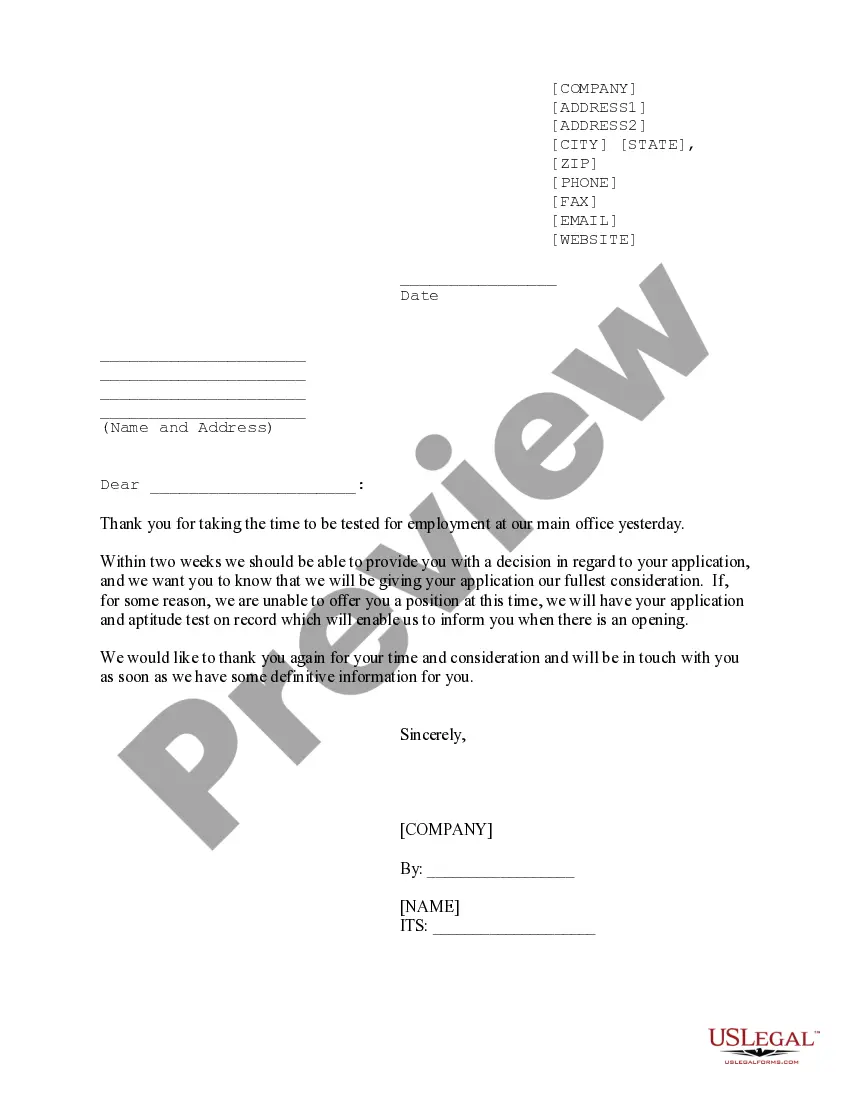

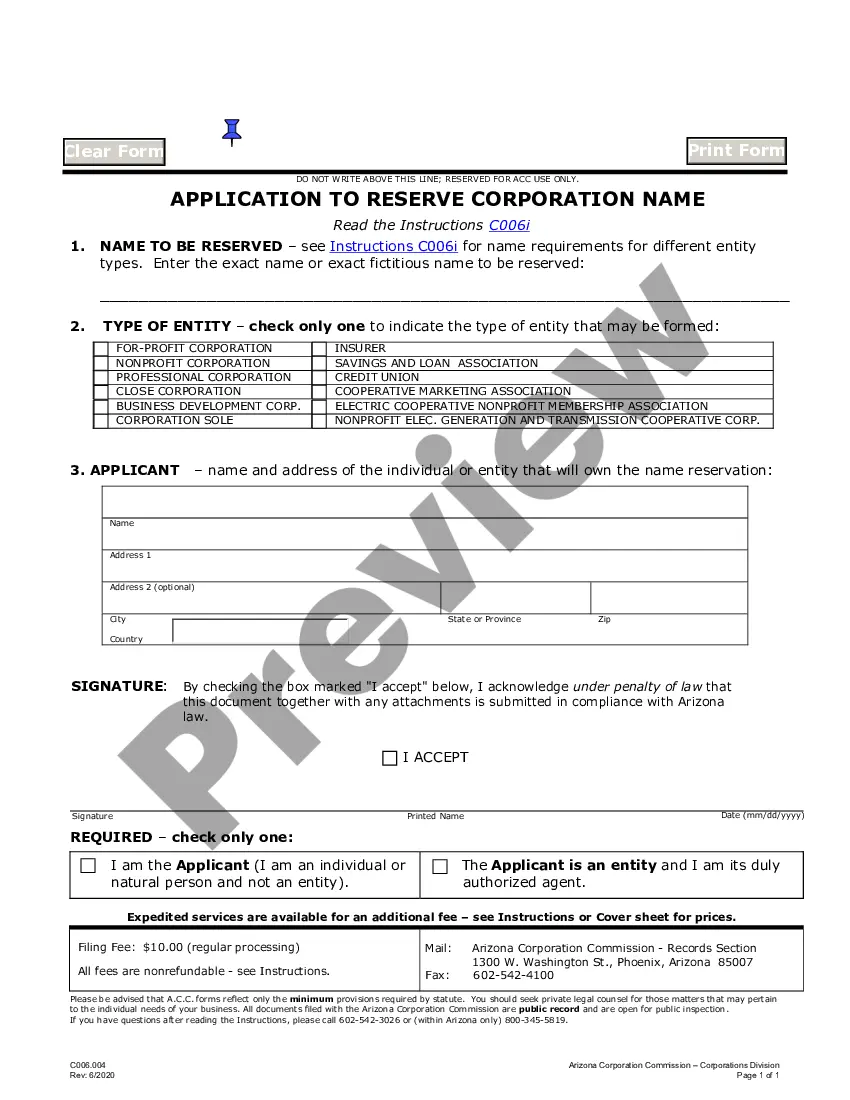

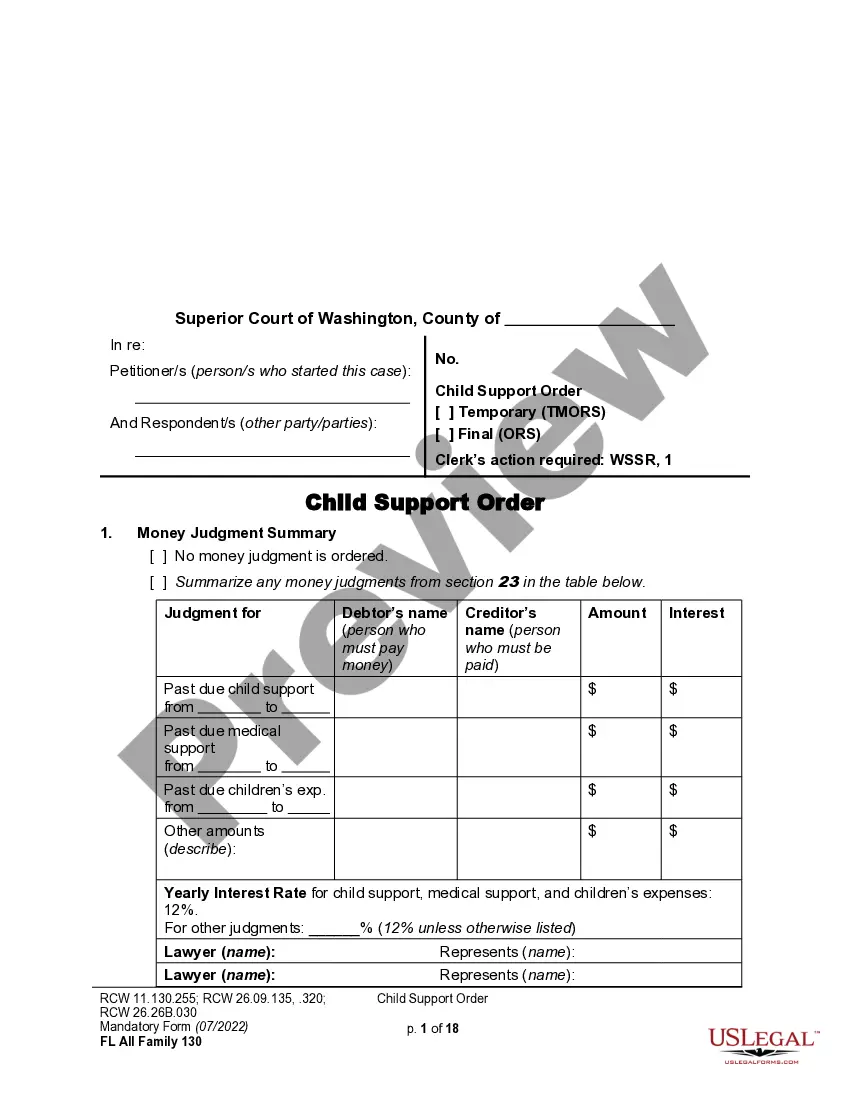

- Click the Preview button to check the form's details.

- Review the form outline to confirm that you have selected the right form.

- If the form does not meet your needs, utilize the Search field at the top of the screen to locate the one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get Now button.

- Then, select the payment plan you prefer and provide your credentials to create an account.

Form popularity

FAQ

An organized list of all accounts in an accounting system is called a Chart of Accounts. This structure serves as the backbone of financial reporting, allowing businesses to categorize expenses, revenues, assets, and liabilities clearly. For improved management and reporting, utilize the Iowa Checklist - Action to Improve Collection of Accounts to ensure your Chart of Accounts is comprehensive and functional.

In accounting, a list of accounts is commonly referred to as an account ledger. This ledger plays a vital role in maintaining an organized view of all financial transactions. To maximize efficiency, consider using the Iowa Checklist - Action to Improve Collection of Accounts as a resource for structuring your account ledger effectively.

The financial organizational tool that lists every account in your accounting system is known as the Chart of Accounts. This structure helps you categorize and manage your accounts effectively, making it easier to generate reports. The Iowa Checklist - Action to Improve Collection of Accounts guides you in optimizing your Chart of Accounts to enhance financial performance.

COA stands for Chart of Accounts. It is a crucial component in accounting that categorizes all the accounts used in the financial reporting system. By having a well-structured COA, businesses can effectively track their financial transactions. Utilizing tools like the Iowa Checklist - Action to Improve Collection of Accounts helps ensure your COA is optimized for better oversight.

Documents needed for debt collection typically include account statements, agreements, payment histories, and any written communications. These documents play a vital role in substantiating the debt and ensuring you meet legal requirements. Following the Iowa Checklist - Action to Improve Collection of Accounts can facilitate the organization of these documents, leading to a more effective collection process.

Collecting on a ten-year-old debt can be challenging due to statutes of limitations. However, if the debt is still within the applicable time frame, collectors may still pursue it. Utilizing the Iowa Checklist - Action to Improve Collection of Accounts could provide clarity on these timelines and assist you in deciding the best course of action for older debts.

In Iowa, the statute of limitations on most debts is typically five to ten years, depending on the type of debt. Once this period passes, the debt may be considered too old to enforce legally. To effectively manage your collections, you should stay informed on the Iowa Checklist - Action to Improve Collection of Accounts to help navigate these time limits expertly.

Debt collectors generally need to prove the existence of the debt, the identity of the debtor, and that the debt collector has the right to collect on the debt. Each of these elements plays a critical role in the legal collection process. The Iowa Checklist - Action to Improve Collection of Accounts can be your guide in ensuring that all necessary proof is collected and that your collection efforts stand on solid ground.

The checklist for debt collectors typically includes verifying the debt, understanding consumer rights, and documenting every communication. It serves as a roadmap to ensure all necessary steps are completed in a timely manner. By leveraging the Iowa Checklist - Action to Improve Collection of Accounts, you can standardize your processes, ensuring that you do not miss essential actions that can aid in successful collections.

A debt collector needs clear evidence that shows the debt is valid, which may include signed contracts, statements, and records of payments. These documents should be organized and readily accessible for the collection process. Using the Iowa Checklist - Action to Improve Collection of Accounts can help in identifying the necessary evidence and maintaining compliance throughout the collection process.