This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Iowa Notice of Non-Responsibility of Wife for Debts or Liabilities

Description

How to fill out Notice Of Non-Responsibility Of Wife For Debts Or Liabilities?

US Legal Forms - one of the most prominent repositories of legal documents in the United States - offers an extensive array of legal template options that you can obtain or print.

Through the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can find the latest versions of documents such as the Iowa Notice of Non-Responsibility of Wife for Debts or Liabilities within minutes.

If you already have an account, Log In and obtain the Iowa Notice of Non-Responsibility of Wife for Debts or Liabilities from the US Legal Forms collection. The Download button will appear on every form you view. You have access to all previously saved forms in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the payment.

Select the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Iowa Notice of Non-Responsibility of Wife for Debts or Liabilities. Each template you added to your account has no expiration date and is yours indefinitely. Therefore, if you want to download or print another copy, just visit the My documents section and click on the form you need. Gain access to the Iowa Notice of Non-Responsibility of Wife for Debts or Liabilities through US Legal Forms, one of the most comprehensive collections of legal document templates. Utilize thousands of expert and state-specific templates that meet your business or personal needs and requirements.

- If you want to use US Legal Forms for the first time, here are easy steps to get you started.

- Ensure that you have selected the appropriate form for your region/county.

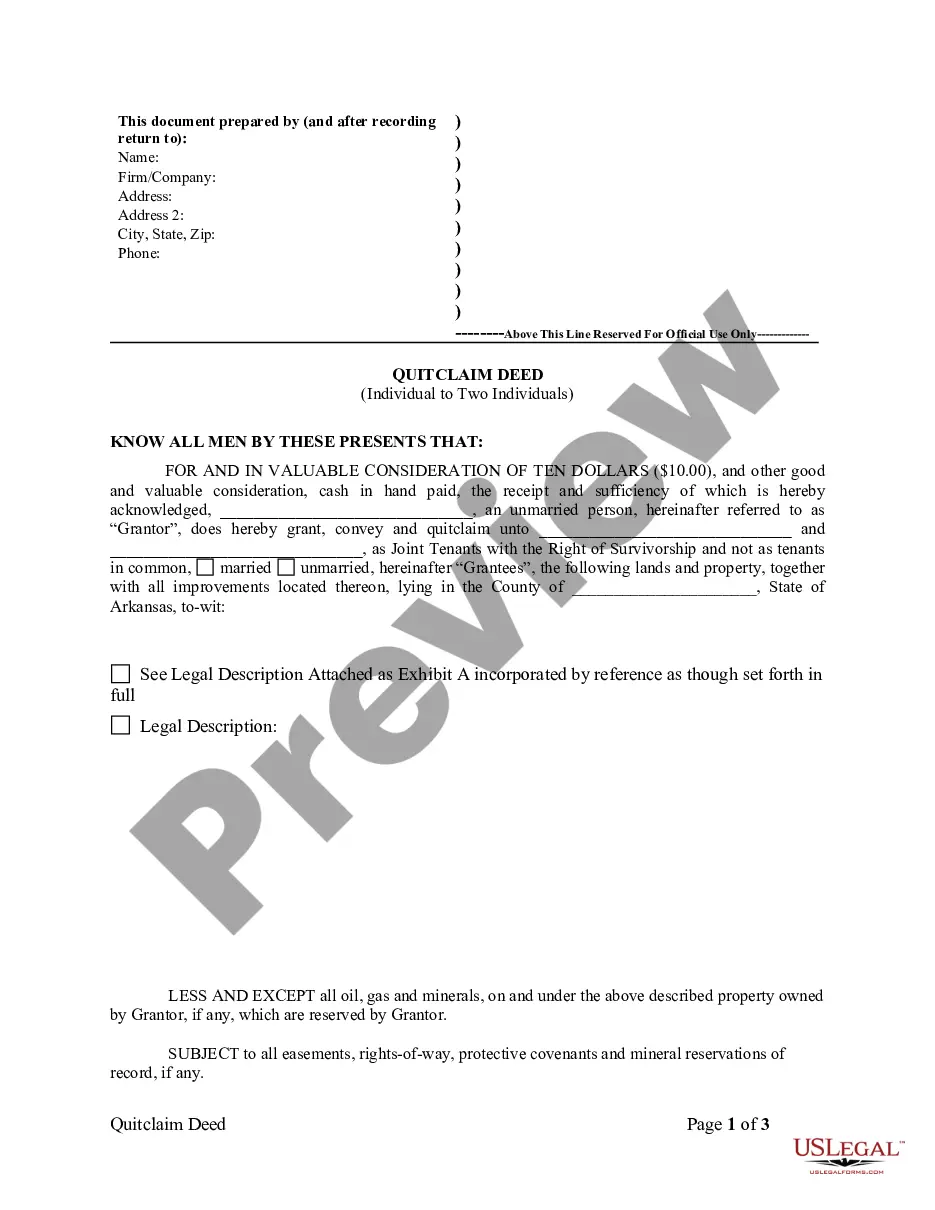

- Click on the Preview button to review the contents of the form.

- Check the form summary to confirm that you have chosen the correct form.

- If the form does not meet your needs, use the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your selection by clicking the Get now button.

- Then, choose the pricing plan you desire and provide your credentials to create an account.

Form popularity

FAQ

Debt collectors can generally attempt to collect debts in Iowa for a period of up to 10 years. During this time, they may contact you through various means to recover the owed amount. It’s important to stay informed about your rights during this period, especially if you're dealing with strategies to mitigate debt. The Iowa Notice of Non-Responsibility of Wife for Debts or Liabilities can provide guidance on how to navigate these challenges.

Legal responsibility for your wife's debt typically depends on the type of debt and whether it was incurred during the marriage. In many cases, if you did not co-sign or are not a joint account holder, you are not liable. However, understanding the nuances of debt obligations is crucial to protecting your finances. The Iowa Notice of Non-Responsibility of Wife for Debts or Liabilities can clarify certain responsibilities in these scenarios.

The 597.14 code in Iowa relates to the legal stipulations regarding a spouse's liability for debts and financial obligations incurred by the other spouse. This is crucial in understanding how personal finances are treated, especially in marriage. The Iowa Notice of Non-Responsibility of Wife for Debts or Liabilities is directly tied to this code, as it provides a formal way for a wife to protect herself from her husband's debts. Familiarizing yourself with this code can potentially safeguard your financial future.

In Iowa, most consumer debts become uncollectible after 10 years due to the statute of limitations. After this period, the creditor cannot sue you to recover the debt, although they may still attempt to collect. It is essential to keep accurate records regarding any debts you are owed or owe. As you explore your rights, the Iowa Notice of Non-Responsibility of Wife for Debts or Liabilities should be on your radar.

Yes, a 10-year-old debt can still be collected, but the ability to successfully enforce repayment may vary. While creditors may still attempt to collect on this debt, they cannot take you to court after the statute of limitations expires. Understanding your rights regarding such debts can help you navigate these situations more effectively. The Iowa Notice of Non-Responsibility of Wife for Debts or Liabilities may clarify certain responsibilities in your household.

Debts in Iowa are subject to a statute of limitations, typically extending up to 10 years. This means that after a decade, the creditor can no longer sue for repayment. However, this does not erase the debt; it simply limits the creditor's ability to take legal action. Proper knowledge of the Iowa Notice of Non-Responsibility of Wife for Debts or Liabilities can help clarify individual responsibility.

In Iowa, a debt collector can sue you generally within a period of 10 years from the date of the last payment or the last acknowledgment of the debt. This timeframe is important to consider, especially when dealing with financial obligations. You may wish to seek legal advice or review the applicable statutes to understand your rights better. The Iowa Notice of Non-Responsibility of Wife for Debts or Liabilities can also serve as a tool in certain situations.

In Iowa, you are generally not responsible for your spouse's debts unless you have entered into agreements jointly. Filing an Iowa Notice of Non-Responsibility of Wife for Debts or Liabilities can help affirm your non-liability for your husband's financial obligations. It's wise to keep your finances separate and consult a legal expert for personalized advice.

To avoid responsibility for your spouse's debt, establish clear financial boundaries and maintain separate accounts. You can also file an Iowa Notice of Non-Responsibility of Wife for Debts or Liabilities to formalize your non-involvement in your spouse's debts. Always stay informed about your financial rights and seek professional legal advice for guidance.

A wife generally cannot be held responsible for her husband's debts unless she has agreed to be a co-signer or has otherwise taken on the responsibility. In Iowa, utilizing an Iowa Notice of Non-Responsibility of Wife for Debts or Liabilities serves as a clear declaration of your non-responsibility. It’s important to maintain separate financial accounts to further protect your assets.