Iowa Agreement and Assignment of Judgment for Collection to Collection Agency

Description

How to fill out Agreement And Assignment Of Judgment For Collection To Collection Agency?

Discovering the right lawful file template could be a have a problem. Needless to say, there are tons of templates available on the net, but how would you discover the lawful develop you want? Utilize the US Legal Forms web site. The service delivers thousands of templates, such as the Iowa Agreement and Assignment of Judgment for Collection to Collection Agency, that you can use for enterprise and personal requires. Every one of the types are checked by specialists and satisfy federal and state requirements.

In case you are presently authorized, log in to the profile and then click the Acquire button to have the Iowa Agreement and Assignment of Judgment for Collection to Collection Agency. Utilize your profile to appear throughout the lawful types you possess acquired earlier. Go to the My Forms tab of the profile and have an additional backup from the file you want.

In case you are a whole new user of US Legal Forms, here are simple recommendations for you to comply with:

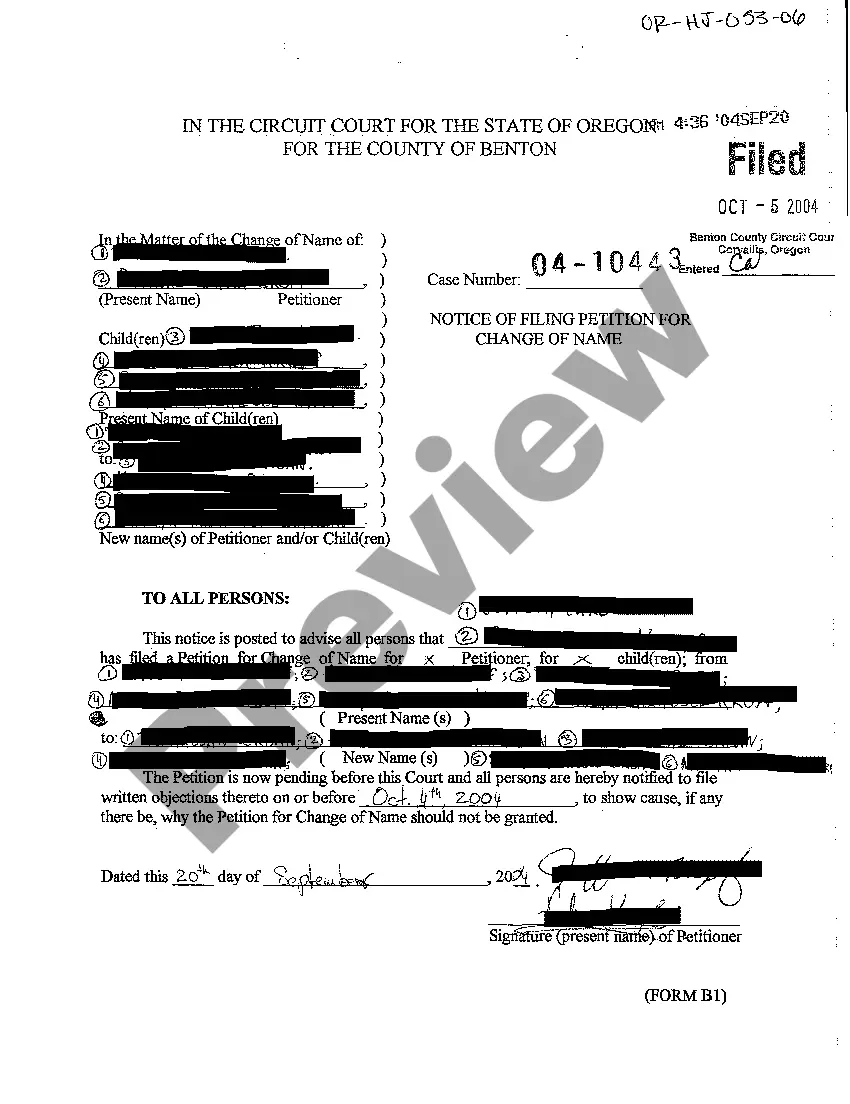

- Very first, make sure you have selected the correct develop to your town/county. You may look through the shape making use of the Review button and study the shape explanation to make certain it is the right one for you.

- In case the develop fails to satisfy your expectations, utilize the Seach area to discover the correct develop.

- Once you are certain the shape is proper, click on the Purchase now button to have the develop.

- Opt for the pricing program you want and enter the needed information and facts. Design your profile and buy your order with your PayPal profile or bank card.

- Select the submit structure and acquire the lawful file template to the gadget.

- Full, revise and printing and indication the obtained Iowa Agreement and Assignment of Judgment for Collection to Collection Agency.

US Legal Forms may be the largest library of lawful types where you can discover a variety of file templates. Utilize the service to acquire skillfully-produced paperwork that comply with state requirements.

Form popularity

FAQ

The statute of limitations for small claims judgments for execution purposes is twenty years, and liens on those judgments exist for ten years. See Iowa Code sections 614.1(6), 624.23(1), 626.2 and 631.12. However, a judgment can be renewed by filing a new action.

If the debt is based on an unwritten contract (like many credit cards), the time limit is five years from the date of the last payment or charge on the card, whichever is more recent. If the debt is based on a written contract, the time limit is ten years from the date you made the last payment or broke the contract.

A judgment is an official result of a lawsuit in court. In debt collection lawsuits, the judge may award the creditor or debt collector a judgment against you.

You must electronically file a request for an order "condemning" the funds held by clerk. The court will then order the clerk to pay you the amounts collected by the sheriff. You must pay the sheriff's fee. The sheriff will continue collection efforts until the judgment is satisfied or for a 120-day period.

What types of property are covered under Iowa law? Generally, a judgment lien can be attached to a debtor's real estate, including a house, condo, land or other property interest.

File a Praecipe and pay the filing fee. A Praecipe is a legal document that tells the clerk of court to begin the legal process of collecting (executing on) a judgment that the defendant is not paying.

If the debt is based on an unwritten contract (like many credit cards), the time limit is five years from the date of the last payment or charge on the card, whichever is more recent. If the debt is based on a written contract, the time limit is ten years from the date you made the last payment or broke the contract.

A judgment lien attaching to the real estate of a city may be discharged at any time by the city filing with the clerk of the district court in which the judgment was entered a bond in the amount for which the judgment was entered, including court costs and accruing interest, with surety or sureties to be approved by ...