Iowa Miller Trust Forms for Assisted Living

Description

How to fill out Miller Trust Forms For Assisted Living?

Locating the appropriate legal document template can be a challenge.

Naturally, there are numerous templates accessible online, but how can you find the legal form you need? Utilize the US Legal Forms website.

The platform offers thousands of templates, such as the Iowa Miller Trust Forms for Assisted Living, which you can use for both business and personal purposes. All the forms are reviewed by professionals and comply with federal and state regulations.

Utilize this service to acquire professionally crafted documents that comply with state regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Iowa Miller Trust Forms for Assisted Living.

- Use your account to view the legal forms you have purchased previously.

- Visit the My documents section of your account to access an additional copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple steps to follow.

- First, ensure you have selected the correct form for your city/state.

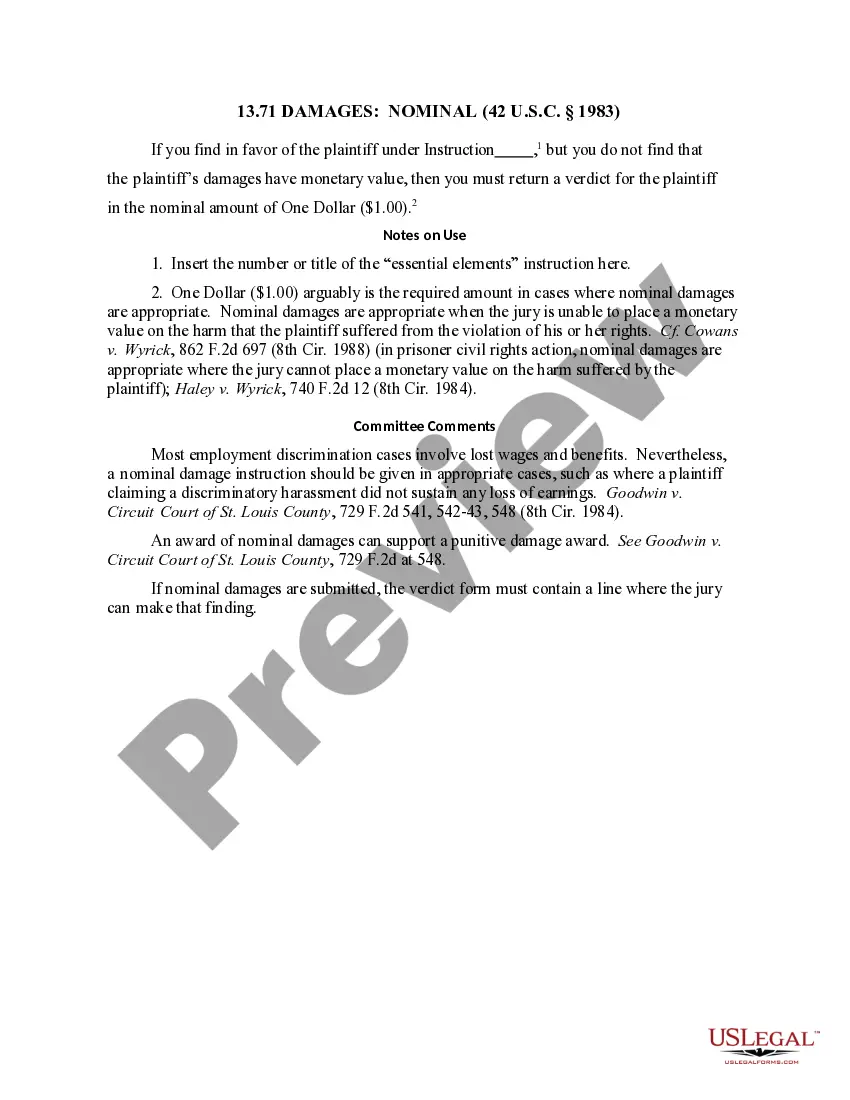

- You can review the form using the Preview button and check the form outline to confirm it meets your needs.

- If the form does not meet your requirements, utilize the Search box to find the right form.

- Once you are confident the form is suitable, click the Purchase now button to obtain the form.

- Select the payment plan you desire and enter the required information.

- Create your account and pay for the order using your PayPal account or credit card.

- Choose the file format and download the legal document template to your device.

- Complete, modify, print, and sign the obtained Iowa Miller Trust Forms for Assisted Living.

- US Legal Forms is the largest collection of legal templates, where you can find various document templates.

Form popularity

FAQ

In Iowa, a Miller trust operates by directing any income above a certain threshold into the trust, which then becomes accessible for specific expenses relating to assisted living. When you establish a Miller trust, you set parameters that enable you to manage the funds while ensuring you remain eligible for Medicaid benefits. Utilizing Iowa Miller Trust Forms for Assisted Living simplifies this process, allowing you to meet legal requirements efficiently. With this approach, you can secure necessary assistance without undermining your financial security.

A Miller's trust, also known as an income trust, is a specialized financial tool used in Iowa to help individuals qualify for assisted living programs while maintaining some control over their income. Essentially, it allows you to set aside monthly income over a specified limit so that you can access necessary services without exceeding Medicaid eligibility requirements. By utilizing Iowa Miller Trust Forms for Assisted Living, you can create a structured agreement that supports your financial and healthcare needs. This trust is essential for many individuals who wish to receive care while preserving their assets.

Creating a trust without a lawyer is possible, but it comes with risks. You can use Iowa Miller Trust Forms for Assisted Living, which offer clear guidance to help you set up the trust correctly. However, be cautious and ensure that everything complies with applicable laws to avoid future complications. Consulting a professional may provide peace of mind as you navigate this process.

Establishing a Miller trust involves several steps, starting with gathering your financial information. You need to complete the Iowa Miller Trust Forms for Assisted Living, specifying how your income will be allocated within the trust. It’s important to ensure that the trust meets the requirements set by your state and that it operates smoothly to protect your assets while qualifying for Medicaid.

A Miller trust in Texas is designed to allow individuals to qualify for Medicaid while still having assets. This trust provides a way to set aside income that exceeds the state's limits, helping you manage medical expenses more effectively. By using Iowa Miller Trust Forms for Assisted Living, you can create a structure that fits within Texas law, making it easier for you to receive the care you need.

To protect your assets from nursing home expenses in Iowa, establishing a Miller trust can be a key strategy. This trust allows you to divert excess income, making you eligible for Medicaid while safeguarding your assets. When using Iowa Miller Trust Forms for Assisted Living, you take a proactive step in asset protection, ensuring that your resources support your needs without sacrificing eligibility for assistance.

While it is not mandatory to hire a lawyer to set up a Miller trust, having legal guidance can simplify the process and ensure compliance with state laws. You can access Iowa Miller Trust Forms for Assisted Living online, which can aid you in creating a trust independently. However, consider consulting with a legal professional to avoid potential pitfalls and ensure your trust meets all regulatory requirements.

Miller trusts, also known as qualified income trusts, are primarily allowed in states like Iowa, as well as several others. These trusts help individuals qualify for Medicaid while maintaining a higher income than typical limits. If you are looking for Iowa Miller Trust Forms for Assisted Living, you can find the necessary documentation through platforms such as UsLegalForms, which simplifies the process.

Iowa Medicaid provides some coverage for assisted living, but it can depend on individual circumstances. To qualify, you often need to meet specific financial and medical criteria. Utilizing Iowa Miller Trust Forms for Assisted Living can help individuals manage their income effectively, ensuring they remain eligible for Iowa Medicaid benefits. By understanding these forms, you can navigate the process confidently.