In this guaranty, the guarantor is guaranteeing both payment and performance of all leases now or later entered into with lessee and all the obligations and liabilities due and to become due to lessor from lessee under any lease, note, or other obligation of lessee to lessor. Such a blanket guaranty would suggest a close business relationship between the lessee and guarantor like that of a parent and subsidiary corporation.

Iowa Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease

Description

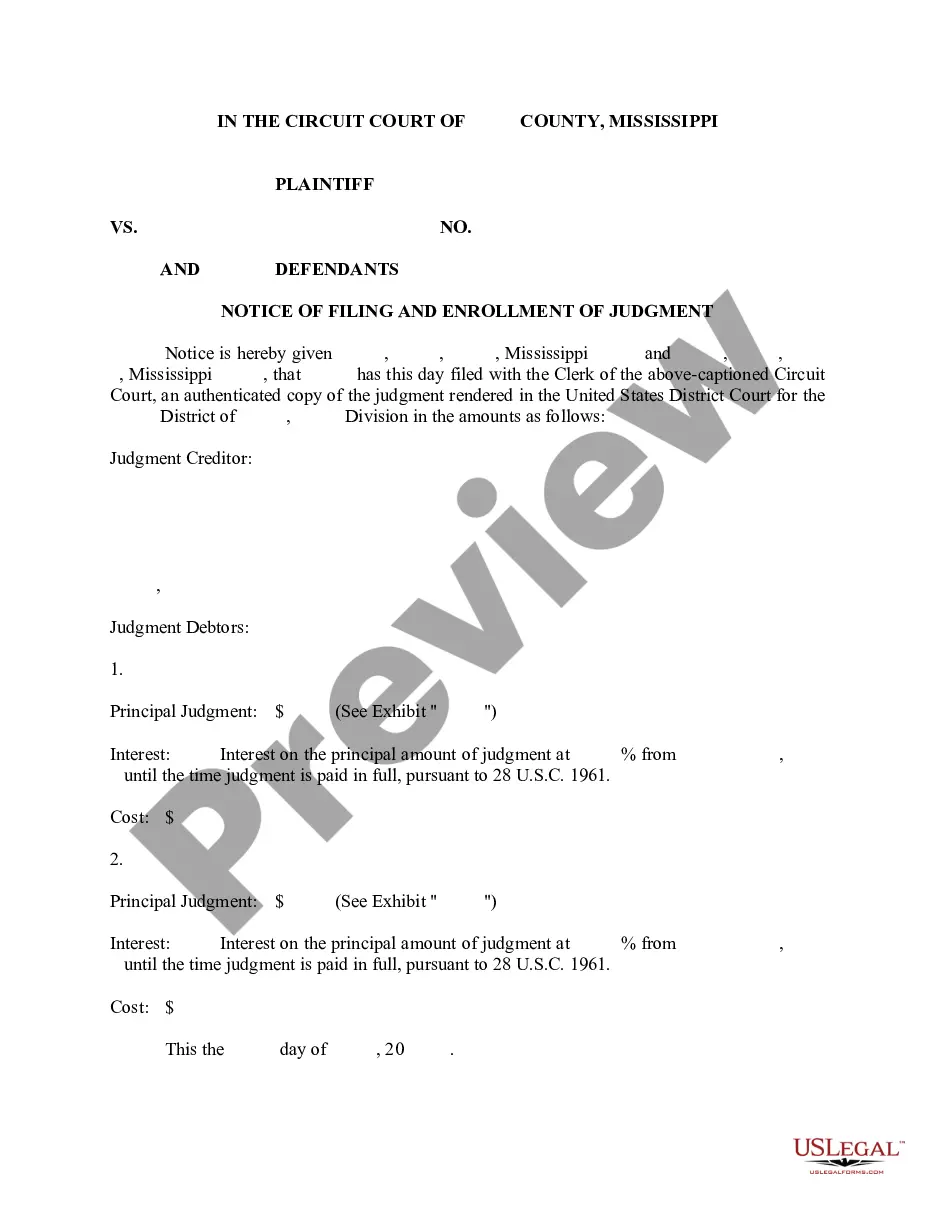

How to fill out Continuing Guaranty Of Payment And Performance Of All Obligations And Liabilities Due To Lessor From Lessee Under Lease?

US Legal Forms - one of the most prominent collections of legal documents in the United States - offers a diverse array of legal form templates that you can download or print out.

By utilizing the website, you can discover thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can quickly find the latest versions of forms such as the Iowa Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease.

If you already have a subscription, Log In and obtain the Iowa Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease from the US Legal Forms catalog. The Download button will appear on every form you view. You can access all your previously downloaded forms from the My documents section of your account.

If you’re satisfied with the form, confirm your choice by clicking on the Acquire now button. Then, select your preferred pricing plan and provide your credentials to register for an account.

Complete the payment process. Use your credit card or PayPal account to finalize the transaction. Choose the format and download the form to your device. Edit the document as needed. Fill it out, modify, print, and sign the downloaded Iowa Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease. Each form you added to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply visit the My documents area and click on the form you want.

Access the Iowa Continuing Guaranty of Payment and Performance of all Obligations and Liabilities Due to Lessor from Lessee under Lease with US Legal Forms, one of the most extensive collections of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are some straightforward tips to get started.

- Ensure you have selected the correct form for your city/county.

- Click the Review button to inspect the form's details.

- Read the form summary to confirm you have selected the right document.

- If the form does not meet your needs, utilize the Search field at the top of the page to find the one that does.

Form popularity

FAQ

Guarantors resemble debtors, then, in that a guarantor, upon default by the primary debtor, owes payment on an obligation secured.

Principal debtor or obligor -The person whose performance to an obligation or undertaking has been secured by a surety or guarantor. The creditor or obligee-The person or institution whom the guarantor promises to fulfill the performance or requirement of the principal debtor in case of default.

In case of non-payment, a guarantor is liable to legal action. If the lender files a recovery case, it will file the case against both the borrower and the guarantor. A court can force a guarantor to liquidate assets to pay off the loan," added Mishra.

A guarantor is a person or business that promises to be responsible for repaying a loan that someone else is taking out. Guarantors share legal liability for the debt, and their financial information is considered when determining loan approval.

A guarantor is an individual that agrees to pay a borrower's debt in the event that the borrower defaults on their obligation. A guarantor is not a primary party to the agreement but is considered as additional comfort for a lender.

Guarantors have several rights that extend beyond that of the debtor. These rights include: Right of Subrogation This right allows the guarantor to recover from the debtor if the guarantor has paid the debtor's debts. For example, the guarantor has creditor rights if the debtor claims bankruptcy.

A continuing guaranty is an agreement by the guarantor to be liable for the obligations of someone else to the lender, even if there are several different obligations that are made, renewed or repaid over time. In contrast, a specific guaranty is limited only to one individual transaction.

Definition of a guarantee made by a guarantor A guarantor is an individual person or firm who approves a three-party-contract to ensure (or guarantee) that the first party (the principal debtor) keeps their promises to the second party and takes on liability if the first party fails to keep these promises.

As per the Contract Act, the guarantor enjoys the right of subrogation wherein the guarantor gets to claim indemnity from the principal debtor in case the guarantor when the principal debtor defaults.

As nouns the difference between debtor and guarantor is that debtor is (economics) a person or firm that owes money; one in debt; one who owes a debt while guarantor is a person, or company, that gives a guarantee.