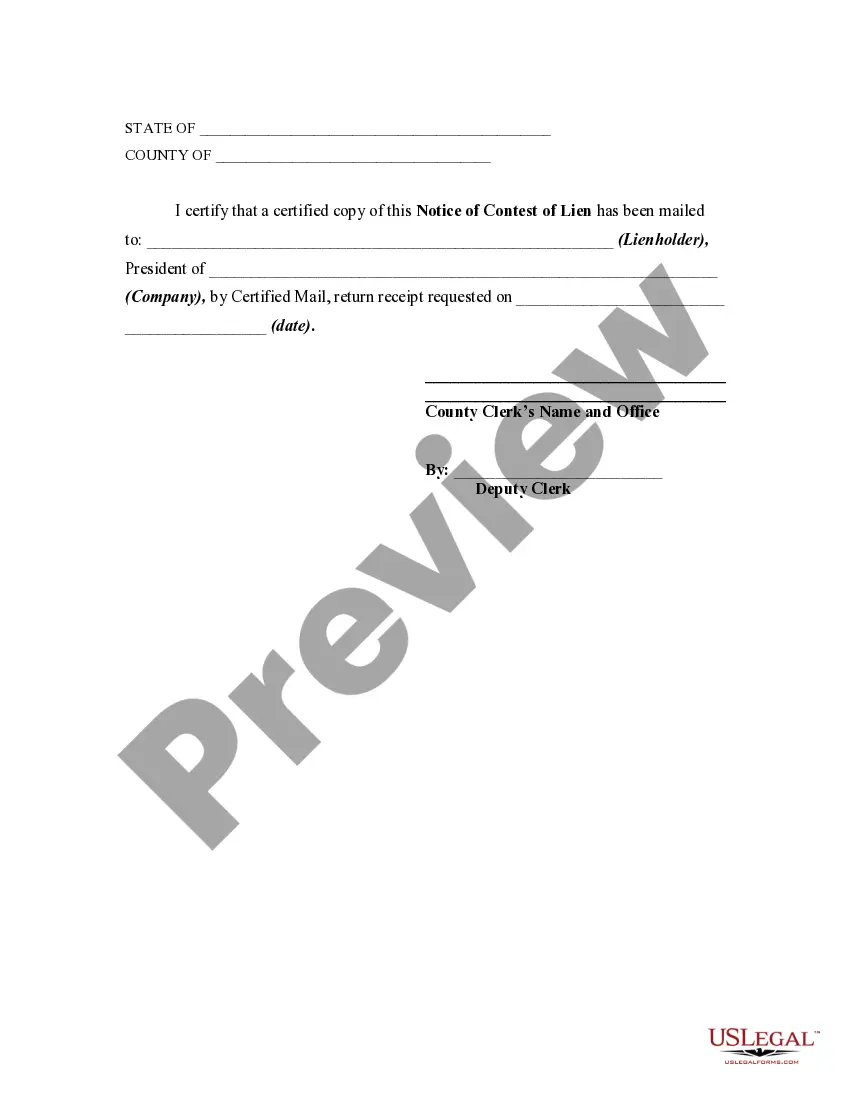

This form is a sample of a notice contesting a lien that has been recorded in the office of the appropriate county official.This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Iowa Notice of Contest of Lien

Description

How to fill out Notice Of Contest Of Lien?

You can commit time online searching for the authorized record design that fits the federal and state specifications you will need. US Legal Forms supplies a large number of authorized kinds which are reviewed by specialists. You can easily download or printing the Iowa Notice of Contest of Lien from our service.

If you currently have a US Legal Forms profile, you can log in and then click the Acquire key. Next, you can total, revise, printing, or sign the Iowa Notice of Contest of Lien. Each authorized record design you get is your own eternally. To have another version of any purchased develop, proceed to the My Forms tab and then click the corresponding key.

If you use the US Legal Forms web site the first time, adhere to the simple recommendations listed below:

- Initial, make sure that you have chosen the proper record design for the county/city that you pick. Read the develop outline to ensure you have chosen the correct develop. If available, utilize the Preview key to look through the record design as well.

- If you would like discover another version in the develop, utilize the Look for discipline to find the design that meets your requirements and specifications.

- After you have located the design you want, simply click Get now to move forward.

- Pick the costs prepare you want, type in your references, and sign up for an account on US Legal Forms.

- Full the financial transaction. You can use your credit card or PayPal profile to purchase the authorized develop.

- Pick the format in the record and download it in your system.

- Make adjustments in your record if needed. You can total, revise and sign and printing Iowa Notice of Contest of Lien.

Acquire and printing a large number of record themes while using US Legal Forms site, that provides the largest collection of authorized kinds. Use specialist and condition-certain themes to take on your company or person demands.

Form popularity

FAQ

About Iowa Notice of Intent to Lien Form No one wants to be forced to file a mechanics lien, and this document gives all of the parties involved one final chance to take care of the payment issues on a project. This form advises the party that a lien will be filed if payment is not received within 10 days.

The lien lasts for two years and 90 days. Any action to enforce a mechanic's lien shall be brought within two years from the expiration of ninety days after the date on which the last of the material was furnished, or the last of the labor was performed.

If you challenge the lien, you can also bring a claim for money against the contractor, if you believe the contractor owes you any money damages. Another way to get the lien off of the property is to make a "demand for bringing suit." This is a demand that the contractor enforce the lien.

The property owner will need to have the judgment lien removed so the title can be cleared and the property sold. A knowledgeable California debt settlement attorney can have the lien taken off, possibly without payment to the creditor or debt collector.

To get a lien on property removed, a Release of Lien or a Satisfaction of Judgment must be filed with the Clerk of the District Court in the county where the support order is filed. Contact Iowa Child Support for assistance if part or all of the support is owed to the State of Iowa.

The statute of limitations for small claims judgments for execution purposes is twenty years, and liens on those judgments exist for ten years. See Iowa Code sections 614.1(6), 624.23(1), 626.2 and 631.12.

You should pay your tax debt in full. If a Notice of Tax lien was filed, we release the lien at the county recorder's office approximately 60 days after your tax debt was paid in full. You can pay your tax debt in full at PayDebt.Iowa.gov.

You can search court records on the Iowa Judicial Branch website at: , or you can contact your County Recorder's Office, a title company, or an attorney to search for you.