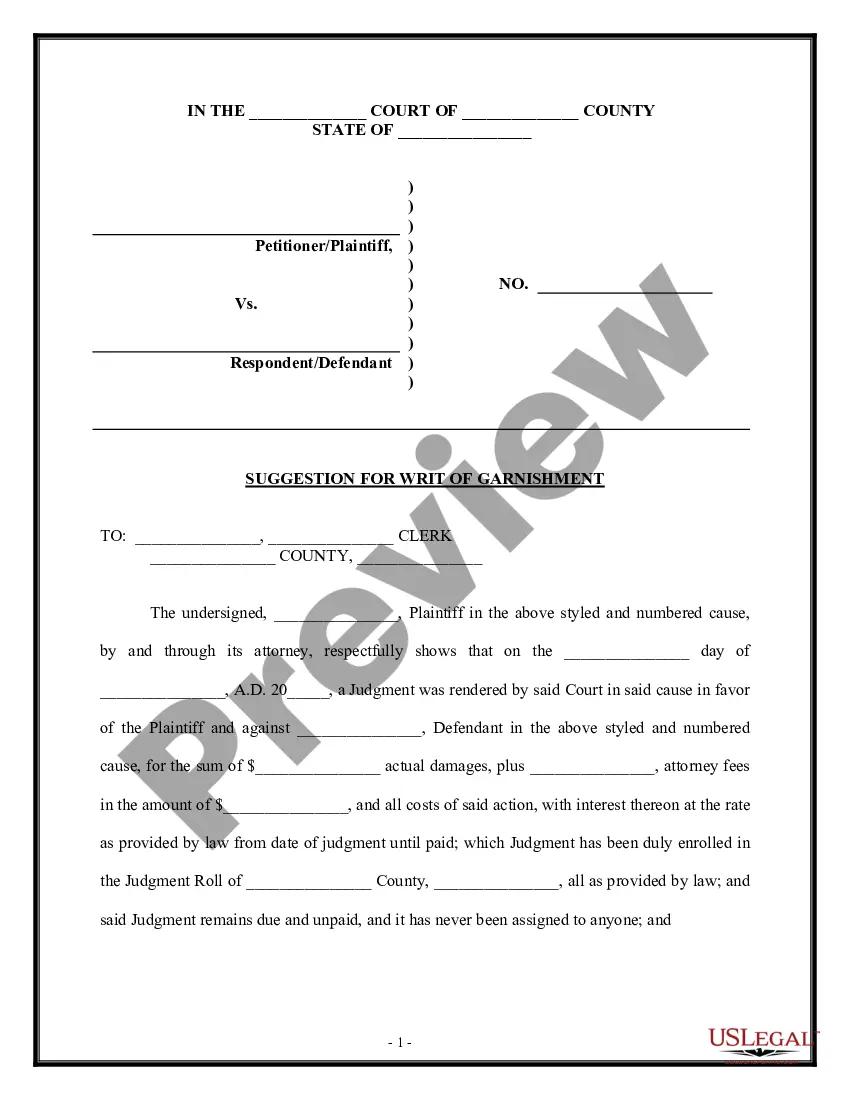

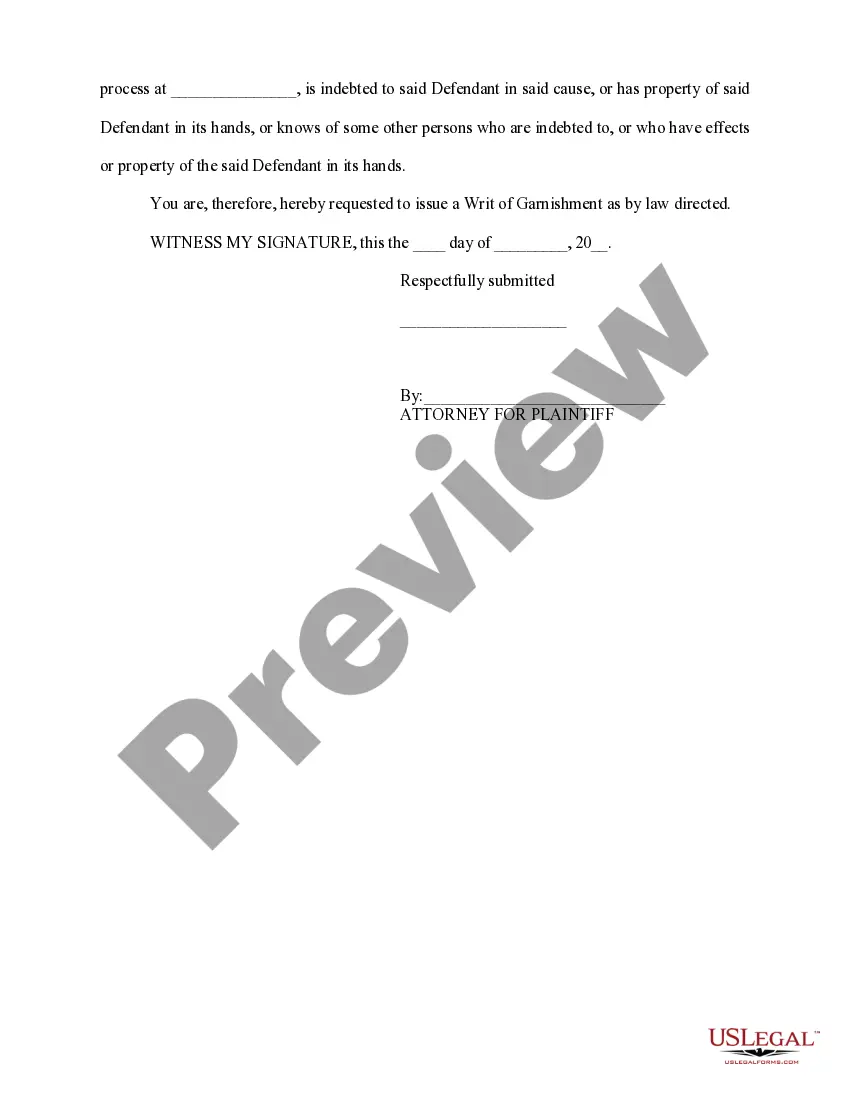

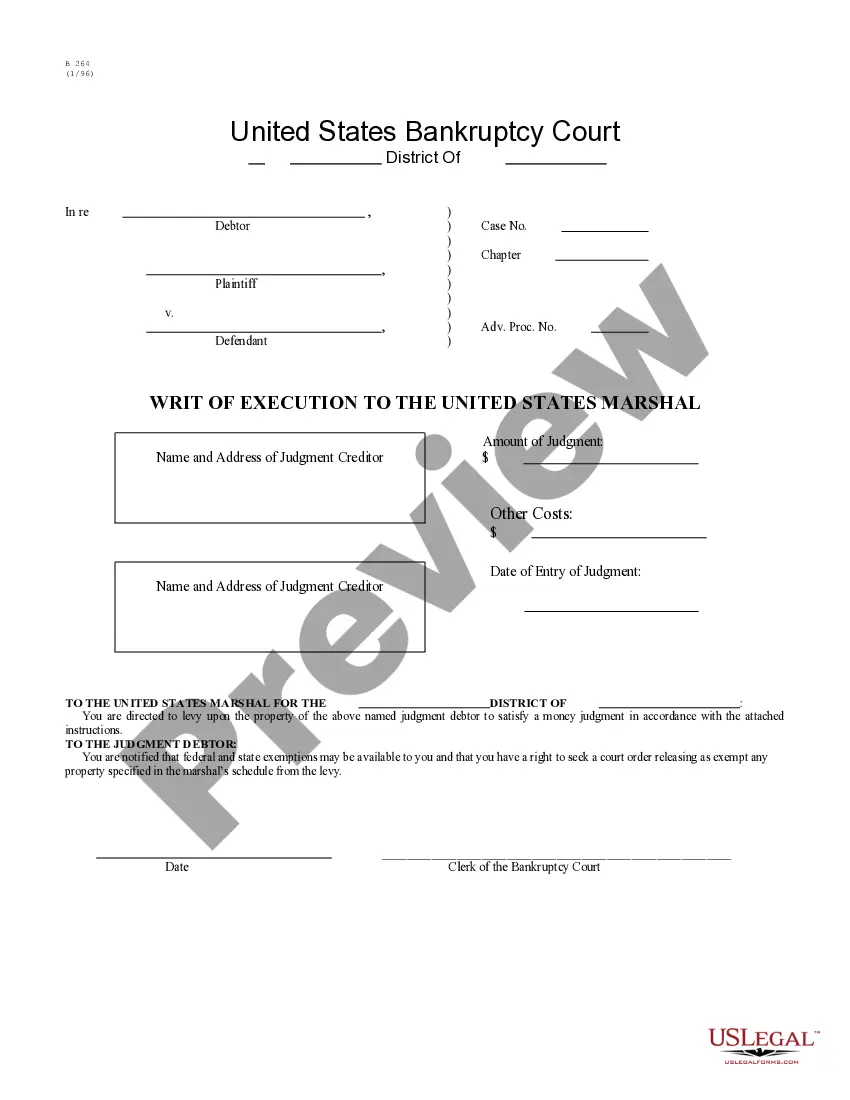

Iowa Suggestion for Writ of Garnishment

Description

Form popularity

FAQ

If a garnishment has been placed on your wages, but you believe the garnishment is incorrect or should be stopped, you may file a ?Motion to Quash Garnishment and Request for Hearing? (Iowa Court Rule form 3.20).

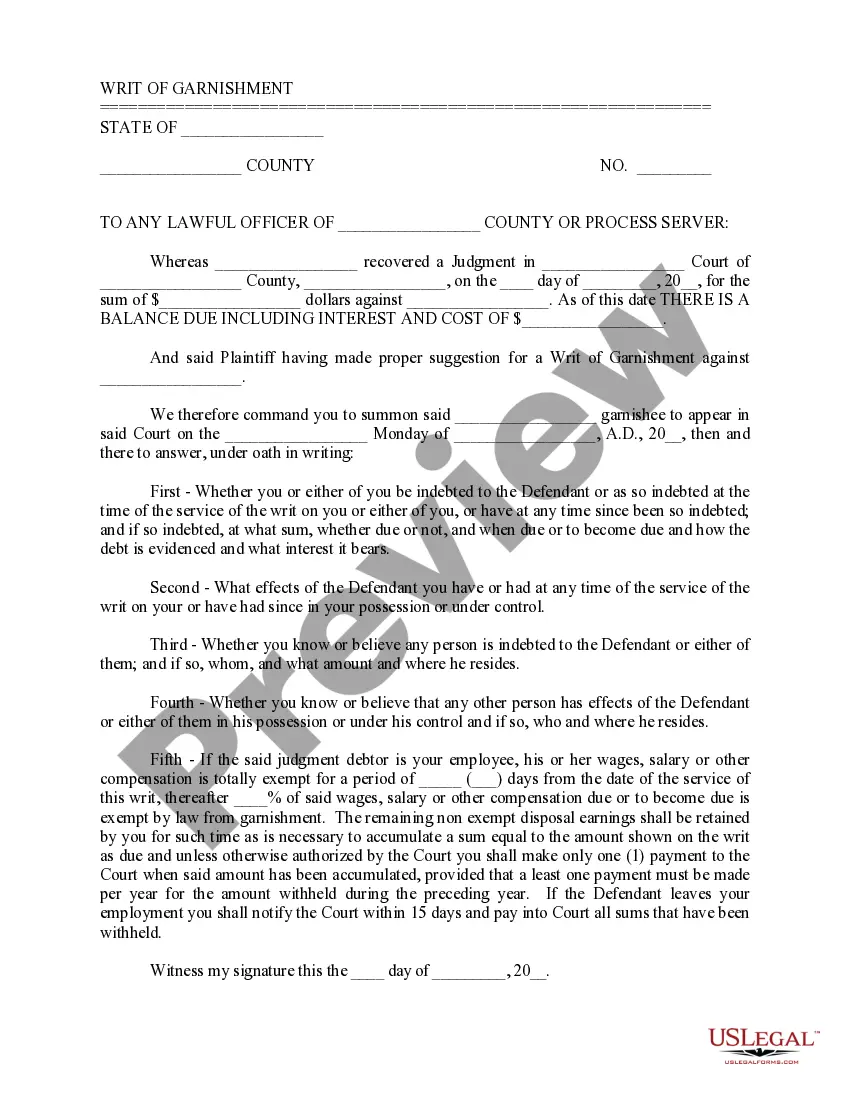

Garnishments expire 120 days from the date it was issued by the Clerk of Court. The Sheriff's Office will require the last known address for the defendant, since for all non-wage garnishment a notice of garnishment is required to be mailed by restricted certified mail, as well as, one copy by first class mail.

Collect evidence showing how detrimental the wage garnishment is to your financial stability or how you qualify for an exemption. In either case, the creditor may agree to a solution that doesn't involve a garnishment, such as an adjustment payment plan or a settlement for a lump sum.

I'm on a limited income, can I be garnished? Iowa and federal law provide exemptions that allow people to protect basic necessities (minimum income and some property) from judgment creditors. Some types of income, like that from Social Security, unemployment benefits, and veterans' benefits, are also protected.

I'm on a limited income, can I be garnished? Iowa and federal law provide exemptions that allow people to protect basic necessities (minimum income and some property) from judgment creditors. Some types of income, like that from Social Security, unemployment benefits, and veterans' benefits, are also protected.

Between $16,000 and $23,999 per year: up to $800 may be garnished. between $24,000 and $34,999 per year: up to $1,500 may be garnished. between $35,000 and $49,999 per year: up to $2,000 may be garnished, or. $50,000 or more per year: no more than 10% of your wages may be garnished.

You can challenge the wage garnishment by filing a motion to quash the execution. You could also file a claim of exemption with the court. However, you need to do so within ten days of receiving the notice from your employer. You can also request a hearing to present your case to the judge.

If the child support amount exceeds 50% of a parent's net income, no more than 50% can be withheld for child support. If the payment is more than is owed to the family and an amount remains owed to the state, the Bureau of Collections applies the remainder to the amount owed to the state.