Iowa Officers Bonus in form of Stock Issuance - Resolution Form

Description

How to fill out Officers Bonus In Form Of Stock Issuance - Resolution Form?

Are you presently in a position where you sometimes require documents for organizational or specific objectives nearly every day? There are many legal document templates available online, but locating ones you can rely on is challenging.

US Legal Forms provides a vast collection of form templates, such as the Iowa Officers Bonus in the form of Stock Issuance - Resolution Form, designed to comply with both federal and state regulations.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. After that, you can download the Iowa Officers Bonus in the form of Stock Issuance - Resolution Form template.

You can view all the document templates you have purchased in the My documents section. You can acquire another copy of the Iowa Officers Bonus in the form of Stock Issuance - Resolution Form whenever needed. Just access the necessary template to download or print the document design.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service supplies professionally crafted legal document templates suitable for a variety of purposes. Create an account on US Legal Forms and start making your life a little simpler.

- Find the template you need and ensure it is for the correct city/region.

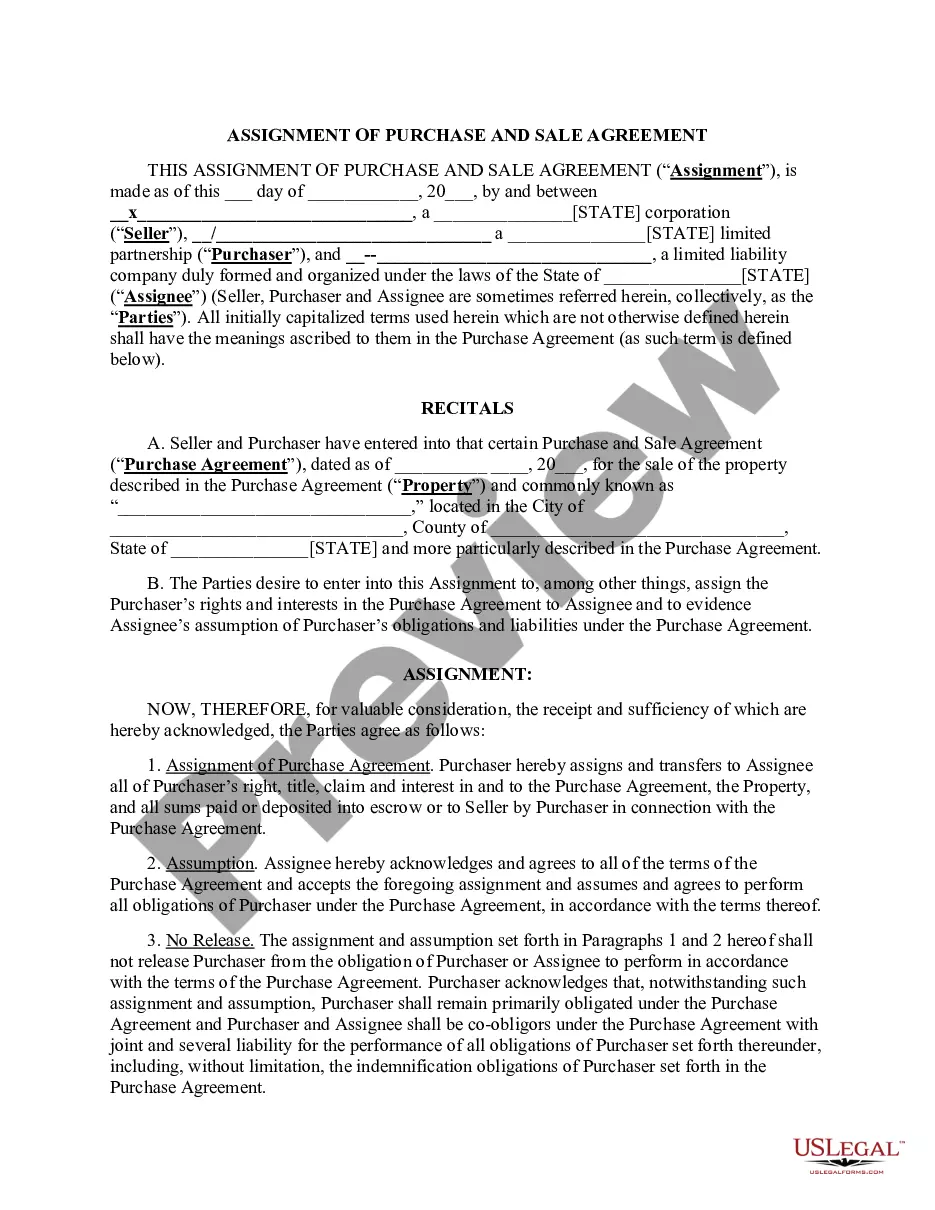

- Utilize the Review button to examine the form.

- Check the details to make sure you have selected the right template.

- If the template is not what you are searching for, use the Search feature to find the template that meets your requirements.

- Once you locate the appropriate template, click Buy now.

- Select the pricing plan you want, provide the necessary information to create your account, and complete the purchase using your PayPal or credit card.

- Choose a convenient document format and download your copy.

Form popularity

FAQ

Iowa has introduced new income tax laws aimed at simplifying tax obligations and potentially reducing overall rates. These changes impact how income is taxed, including bonuses and stock options, such as the Iowa Officers Bonus in form of Stock Issuance - Resolution Form. It's advisable to stay informed about these laws, as they can affect your financial planning and tax strategy.

A Schedule 1 form in Iowa is used to report additional income, such as alimony or business earnings not included in the standard return. This form is crucial for individuals who receive unique forms of income, including any Iowa Officers Bonus in form of Stock Issuance - Resolution Form. Completing it accurately ensures that you comply with state laws and avoid potential penalties.

When Iowa is reviewing your tax return, it indicates that the state is examining your submission for accuracy and compliance. This process helps ensure that all reported income, including bonuses such as Iowa Officers Bonus in form of Stock Issuance - Resolution Form, is properly documented. If you receive a notice, respond promptly to avoid delays or issues with your tax account.

Schedule 1 refers to a specific form that taxpayers in Iowa must fill out to report additional income or adjustments. It is essential for accurately calculating your tax liability, especially for earnings that are not reported on the standard tax return. If you are considering an Iowa Officers Bonus in form of Stock Issuance - Resolution Form, it may also affect how you report your income on this schedule.

The oppression remedy provides minority shareholders with potential legal recourse when they experience unfair treatment from majority shareholders or directors. This remedy can include buyouts or modifications to corporate policies to restore fairness in the corporation. Utilizing resources like the Iowa Officers Bonus in form of Stock Issuance - Resolution Form can help create equitable resolutions, fostering an inclusive environment for all shareholders and preventing future conflicts.

Oppression of a majority shareholder occurs when their actions or decisions disproportionately harm minority shareholders, undermining their interests or rights. This can manifest in various ways, such as resignations from key positions or exclusions from important decision-making. Addressing oppression helps maintain harmony within the corporation, and the Iowa Officers Bonus in form of Stock Issuance - Resolution Form can serve as a tool for ensuring fair compensation and recognition of all shareholders.

Iowa Code 490.832 discusses the process of corporate dissolution and the rights of shareholders during this process. Understanding this code is essential when dealing with the Iowa Officers Bonus in form of Stock Issuance - Resolution Form, especially if a corporation faces financial difficulties. This awareness can empower shareholders to protect their investments and ensure proper procedures are followed during dissolution.

Iowa Code 490.640 relates to the procedures and requirements for the issuance of shares, including restrictions and conditions tied to such actions. This code is relevant to the Iowa Officers Bonus in form of Stock Issuance - Resolution Form, as it helps ensure that any bonuses or stock issuance comply with statutory guidelines, thereby safeguarding the corporation’s legal integrity and transparency.

Oppressive conduct occurs when the actions of directors or majority shareholders unfairly disadvantage minority shareholders. This can include actions that limit the rights of minority shareholders, or decisions made without proper consideration of minority interests. In situations involving the Iowa Officers Bonus in form of Stock Issuance - Resolution Form, identifying oppressive conduct is vital for protecting shareholder rights and ensuring fair treatment within the corporation.

Iowa law provides protections against shareholder oppression specifically in closely held corporations. This ensures that minority shareholders are not unfairly treated by majority shareholders. If oppression occurs, affected shareholders may seek legal remedies, ensuring fair treatment within the corporation. Understanding these laws is essential when handling matters like the Iowa Officers Bonus in form of Stock Issuance - Resolution Form, reinforcing democratic governance among shareholders.