This form set up what is known as present interest trusts, with the intention of meeting the requirements of Section 2503(c) of the Internal Revenue Code.

Iowa Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children

Description

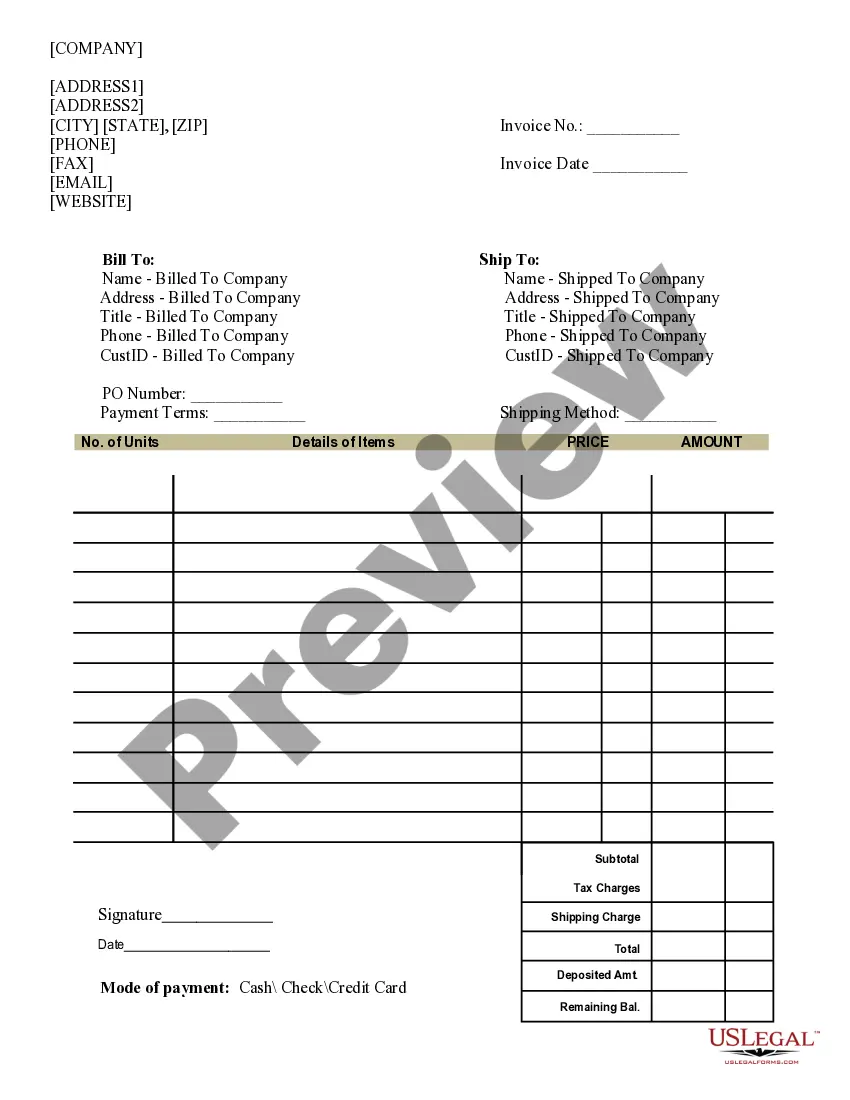

How to fill out Trust Agreement For Minors Qualifying For Annual Gift Tax Exclusion - Multiple Trusts For Children?

If you require thorough, acquire, or print authentic document templates, utilize US Legal Forms, the largest selection of official forms available online.

Make use of the site's simple and user-friendly search to locate the documents you need.

Different templates for business and personal purposes are categorized by type and state, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Choose the payment plan you prefer and enter your details to sign up for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finish the purchase.

- Utilize US Legal Forms to locate the Iowa Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Acquire button to obtain the Iowa Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children.

- You can also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Review option to examine the form's details. Don't forget to read the summary.

- Step 3. If you are unsatisfied with the document, use the Search section at the top of the screen to find other versions of the official form template.

Form popularity

FAQ

When setting up a trust for minors, a revocable living trust can be an excellent choice. It allows you to maintain control over the assets while ensuring they are distributed as per your wishes. An Iowa Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children serves as a precise tool to facilitate tax-exempt gifts for each child, making it both a strategic and beneficial investment in their future. This option also offers flexibility should your circumstances change.

The best trust for minors often depends on your specific goals and circumstances. Generally, an irrevocable trust offers significant benefits, including potential tax advantages and asset protection. With an Iowa Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, you can establish each child's individual trust, ensuring they have access to their assets while also shielding those assets from potential creditors. This arrangement promotes responsible financial management as they grow.

One of the biggest mistakes parents make is failing to properly fund the trust once it is established. A trust without assets does not serve its purpose, and children miss out on potential benefits. Utilizing an Iowa Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children effectively ensures that funds are allocated correctly, and this helps prevent costly errors that could diminish the trust’s value over time.

Gifts to certain types of irrevocable trusts can qualify for the annual exclusion, provided the gifts meet specific criteria. This includes trusts whose beneficiaries have immediate access to the gifted amount. When utilizing an Iowa Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, it is essential to structure the trust properly so that it aligns with IRS rules for annual exclusions.

Gifts that qualify for the generation-skipping transfer (GST) annual exclusion include those to grandchildren or other beneficiaries more than one generation below you. The annual GST exclusion for 2023 is $17,000, similar to the gift tax exclusion. If you use an Iowa Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, you can strategically plan your gifts to minimize tax implications while ensuring your family benefits over generations.

Iowa's trust laws, governed by the Iowa Uniform Trust Code, provide a clear framework for establishing and managing trusts. When creating an Iowa Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, you benefit from these well-defined regulations, ensuring your trusts comply with state requirements. Moreover, understanding local laws helps in maximizing the benefits of your trust while keeping your intentions clear and enforceable.

Gift splitting allows married couples to combine their annual exclusions, effectively doubling the amount they can gift without tax implications. For 2023, this would mean a total exclusion of $34,000 to each recipient, assuming both spouses agree to split gifts. This strategy can be particularly beneficial when setting up an Iowa Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, as it provides a larger pool of resources for minors.

The best type of trust for a minor often includes a revocable trust or a Uniform Transfers to Minors Act (UTMA) account. These trusts provide flexibility and ensure that funds are managed responsibly until the child reaches adulthood. With an Iowa Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, you can create multiple trust accounts tailored to different needs, offering a strategic approach to gifting and managing wealth for your children.

Yes, you must report gifts under the annual exclusion if you exceed the exclusion limit. For 2023, the annual exclusion is $17,000 per recipient. This means that if you gift more than this amount to any individual, including through an Iowa Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, you will need to file a gift tax return. It's always a good practice to keep detailed records of any gifts you make.

Whether a trust is better than a will in Iowa depends on your specific needs. A trust typically avoids the probate process, making it more efficient for transferring assets, especially with an Iowa Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children. Furthermore, trusts can provide more privacy and control over asset distribution than wills. If you aim for a smooth transition of wealth to your children, a trust may be the better choice.