Iowa Shareholders Agreement - Short Form

Description

How to fill out Shareholders Agreement - Short Form?

US Legal Forms - one of the largest collections of authentic documents in the United States - offers a wide range of legal document templates that you can download or print.

Through the website, you will find thousands of documents for both business and personal use, categorized by types, states, or keywords. You can locate the latest versions of documents like the Iowa Shareholders Agreement - Short Form in just moments.

If you possess a subscription, Log In to download the Iowa Shareholders Agreement - Short Form from the US Legal Forms archive. The Download button will be visible on every document you view. You can access all previously saved documents in the My documents section of your account.

After that, process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the document to your device. Edit, complete and print, and sign the saved Iowa Shareholders Agreement - Short Form. Each template you add to your account has no expiration date and is yours permanently. Thus, to download or print another version, just visit the My documents section and click on the document you need.

- Make sure you have selected the correct document for your city/region.

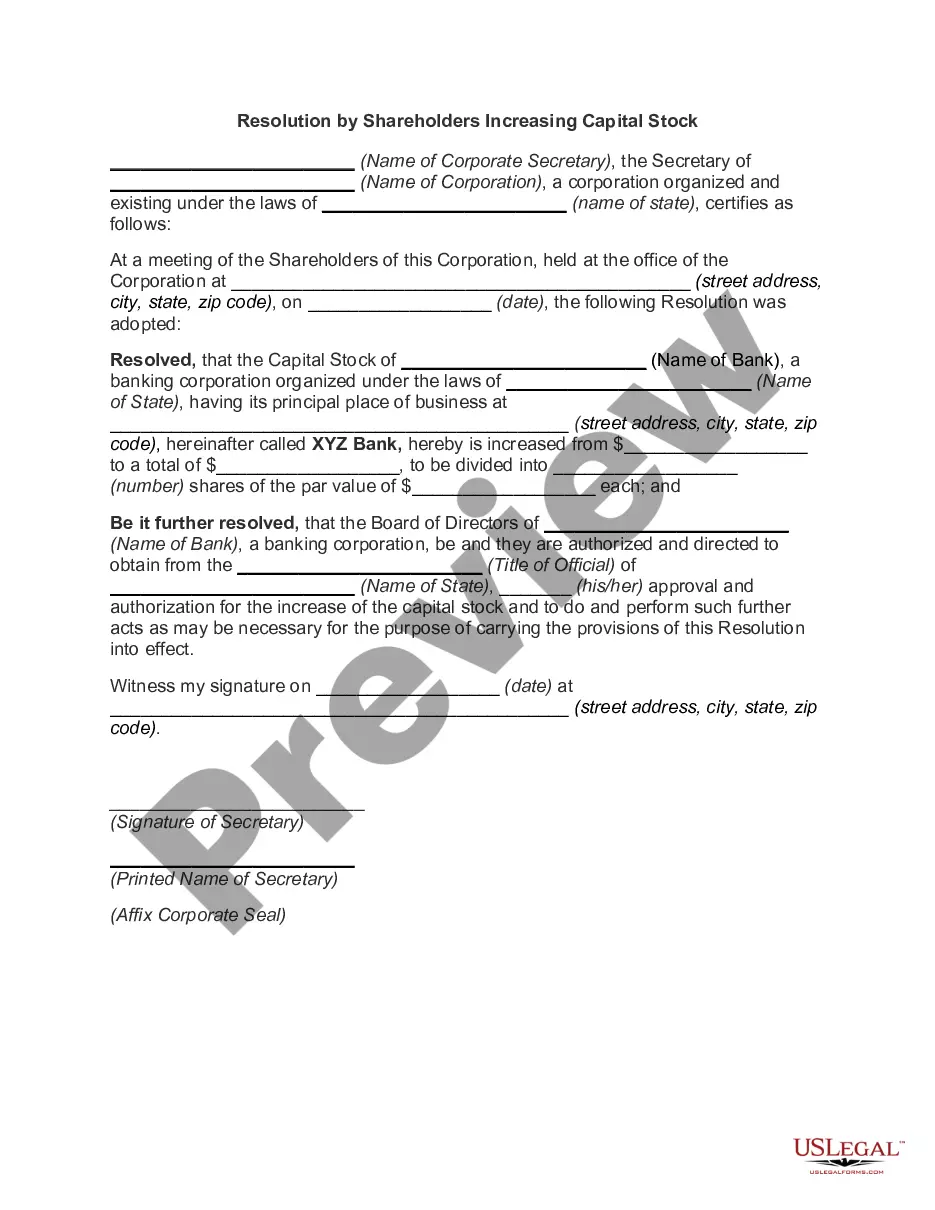

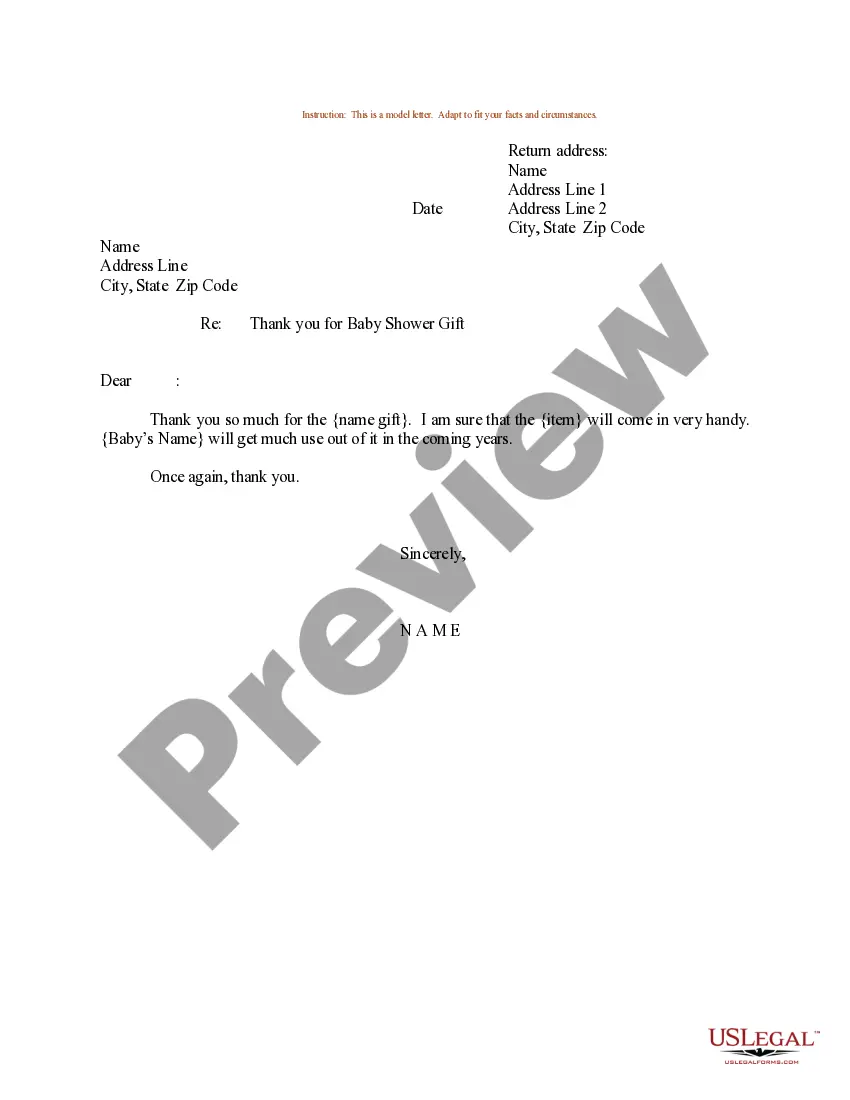

- Click the Preview option to review the content of the document.

- Check the description of the document to ensure you have chosen the right one.

- If the document does not meet your requirements, use the Search field at the top of the screen to find one that does.

- When you are satisfied with the document, confirm your selection by clicking the Get now button.

- Then, choose the pricing plan you wish and provide your details to register for an account.

Form popularity

FAQ

While LLCs do not issue shares like corporations, they often have an operating agreement that serves a similar purpose to a shareholder agreement. This document outlines the management structure and member responsibilities. If you need an Iowa Shareholders Agreement - Short Form for a corporate structure, consider consulting with a legal expert or using a pre-made template.

Creating an Iowa Shareholders Agreement - Short Form involves outlining the roles, responsibilities, and ownership stakes of each shareholder. Start by clearly defining the purpose of the agreement and including essential clauses such as decision-making processes and profit distribution. Consider using a reliable platform like US Legal Forms, which provides templates to simplify the creation of your agreement.

Typically, a shareholders agreement is drafted by the company's stakeholders, often with legal assistance to ensure it conforms to local laws. If you're looking for a straightforward approach, you can utilize the Iowa Shareholders Agreement - Short Form platform, which allows you to create an agreement efficiently while providing helpful resources and support throughout the process.

Certainly, you can write your own shareholder agreement. However, consider the importance of including all necessary elements to avoid potential disputes later. By utilizing the Iowa Shareholders Agreement - Short Form, you gain access to a straightforward template that ensures you don’t miss critical provisions while expressing your intent clearly.

Setting up a shareholders agreement involves gathering all stakeholders and discussing the terms, roles, and responsibilities outlined in the document. It's essential to ensure everyone agrees on the terms to promote a harmonious business environment. Using the Iowa Shareholders Agreement - Short Form can help you easily organize these discussions into a clear and enforceable document.

To write up a shareholder agreement, start by outlining the key components relevant to your business. These components often include ownership structure, decision-making processes, and steps for resolving disputes. With the Iowa Shareholders Agreement - Short Form, you can simplify this process, ensuring you cover all crucial aspects while adhering to local laws.

The Iowa corporate tax return form is Form 1120, which corporations must file annually to report their income and calculate their tax obligations. Understanding this form is essential for corporations operating under an Iowa Shareholders Agreement - Short Form, as it informs stakeholders of the financial health and tax responsibilities of the entity.

Setting up an S Corp in Iowa involves filing the appropriate documents with the Iowa Secretary of State. You'll need to apply for S Corporation status with the IRS simultaneously, ensuring compliance with both Iowa and federal regulations. Including details about your S Corp within your Iowa Shareholders Agreement - Short Form will help outline the operational structure of your business.

The Schedule 1 form in Iowa is designated for reporting specific additions or subtractions to your taxable income. It provides clarity on financial adjustments necessary for accurate tax reporting. If you are drafting an Iowa Shareholders Agreement - Short Form, being familiar with the implications of Schedule 1 ensures correct financial documentation.

The Iowa Department of Revenue requires non-residents to file Form 126, which serves as the state tax form for them. This form allows non-resident individuals to report Iowa-sourced income. Incorporating this understanding into your Iowa Shareholders Agreement - Short Form can ensure all partners are aware of their tax obligations.