An Iowa Security Agreement for Promissory Note is a legal document that outlines the terms and conditions of a loan agreement between a lender and a borrower in the state of Iowa. This agreement serves to provide the lender with security and protection in the event that the borrower defaults on their repayment obligations. Keywords: Iowa, security agreement, promissory note, lender, borrower, loan agreement, repayment obligations, default, protection. There are various types of Iowa Security Agreements for Promissory Notes, including: 1. Real Estate Security Agreement: This type of agreement is used when the loan is secured by real estate property. It highlights the details of the property being used as collateral and establishes the rights and responsibilities of both the lender and borrower in relation to the property. 2. Chattel Security Agreement: This agreement is utilized when the loan is secured by personal property such as vehicles, equipment, or other movable assets. It specifies the details of the collateral and describes the rights and obligations of both parties regarding the pledged assets. 3. Inventory Security Agreement: This type of agreement is employed when the loan is secured by inventory or goods that the borrower possesses. It outlines the specifics of the inventory being used as collateral and establishes the terms and conditions for its protection and handling. 4. Accounts Receivable Security Agreement: This agreement is used when the loan is secured by the borrower's accounts receivable. It outlines the details of the accounts receivable being utilized as collateral and determines the rights and obligations of both parties concerning the accounts. Each type of security agreement for promissory notes in Iowa ensures that the lender has a legal claim to specific collateral in case of default. These agreements protect the lender's interests and provide them with a means of recovering their investment in the event that the borrower fails to fulfill their repayment obligations.

Iowa Security Agreement for Promissory Note

Description

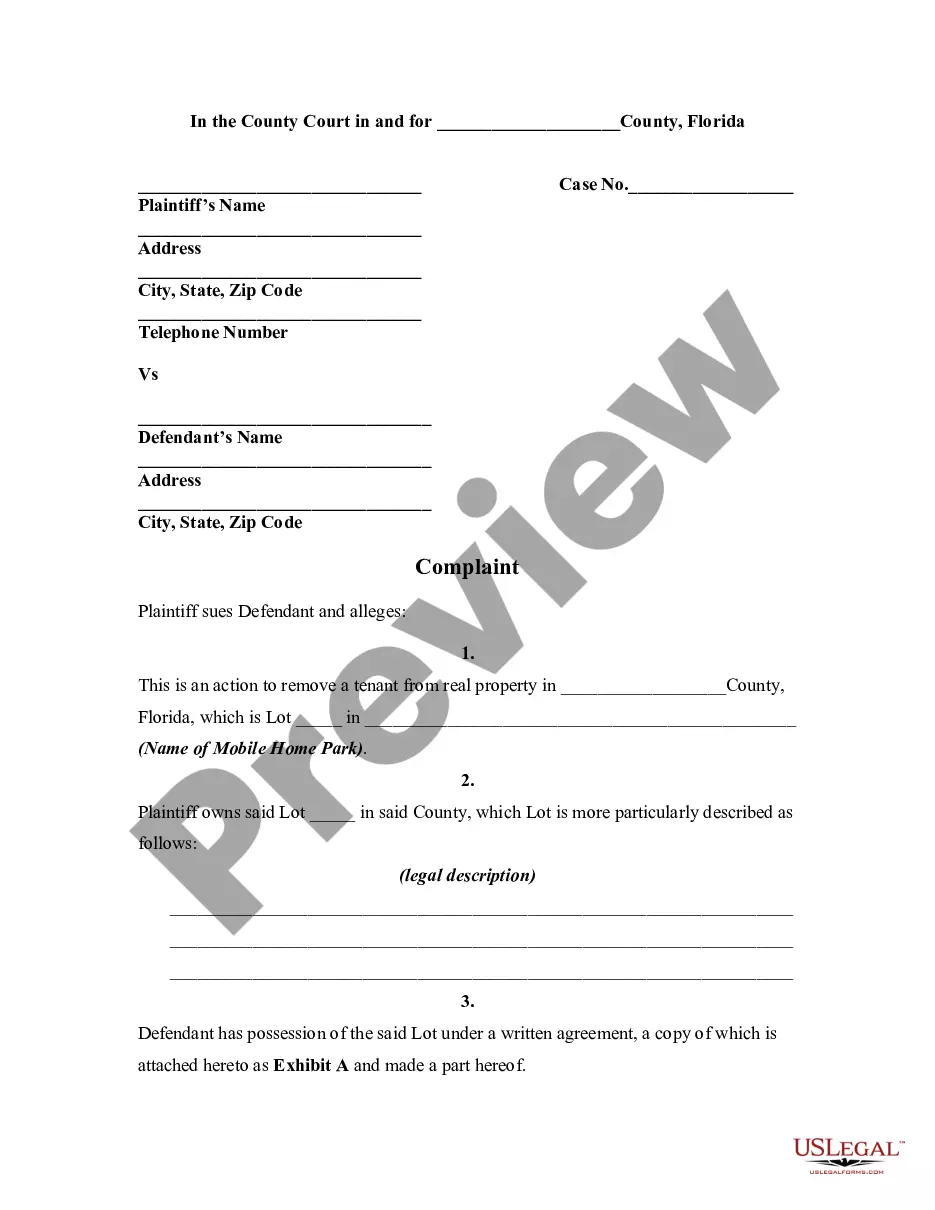

How to fill out Iowa Security Agreement For Promissory Note?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a broad selection of legal templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, categorized by type, state, or keywords. You can find the latest versions of documents such as the Iowa Security Agreement for Promissory Note within moments.

If you have a subscription, Log In to obtain the Iowa Security Agreement for Promissory Note from the US Legal Forms library. The Download button will be available on each form you view. You can retrieve all previously downloaded forms from the My documents section of your account.

Complete the purchase. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded Iowa Security Agreement for Promissory Note. Each template you add to your account has no expiration and is yours for a lifetime. Therefore, if you wish to download or print an additional copy, simply navigate to the My documents section and click on the form you need. Access the Iowa Security Agreement for Promissory Note with US Legal Forms, one of the most extensive collections of legal document templates. Utilize a wide range of professional and state-specific templates that meet your business or personal needs.

- Ensure you have selected the correct form for your area/county.

- Click on the Preview button to review the form's content.

- Check the form summary to confirm you have chosen the appropriate form.

- If the form does not meet your requirements, use the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Download now button.

- Then, select the payment plan you wish and provide your information to create an account.

Form popularity

FAQ

A security agreement is a document that provides a lender a security interest in a specified asset or property that is pledged as collateral. Security agreements often contain covenants that outline provisions for the advancement of funds, a repayment schedule, or insurance requirements.

In general, the promissory note is your written promise to repay the loan and a security agreement is used when collateral is given for the loan.

A Promissory Note may be secured or unsecured. In case of a secured note, the borrower will be required to provide a collateral such as property, goods, services, etc., in the event that they fail to repay the borrowed amount.

A promissory note is a key piece of a home loan application and mortgage agreement, ensuring that a borrower agrees to be indebted to a lender for loan repayment.

General Definition. Promissory notes are defined as securities under the Securities Act. However, notes that have a maturity of nine months or less are not considered securities.

In general, under the federal Securities Acts, promissory notes are defined as securities, but notes with a maturity of 9 months or less are not securities.

A Promissory Note must always be written by hand. It must include all the mandatory elements such as the legal names of the payee and maker's name, amount being loaned / to be repaid, full terms of the agreement and the full amount of liability, beside other elements.

In general, under the federal Securities Acts, promissory notes are defined as securities, but notes with a maturity of 9 months or less are not securities.

A promissory note is a written agreement to pay someone essentially an IOU. But it's not something to be taken lightly. "It is a legally binding written document effectuating a promise to repay money," says Andrea Wheeler, a business attorney and owner of Wheeler Legal PLLC of Florida.

Secured Promissory Notes The property that secures a note is called collateral, which can be either real estate or personal property. A promissory note secured by collateral will need a second document. If the collateral is real property, there will be either a mortgage or a deed of trust.

Interesting Questions

More info

A promissory note will be returned or replaced within the timeframe listed below. If the duration is not listed, it can be extended with an agreement by the borrower and lender. If the duration is not an accepted minimum period of time, the terms may be changed in agreement after approval. If the duration is beyond an accepted minimum period with a change in payment terms as agreed upon, the terms of the promissory note agreement shall continue to be the same until the agreed upon period of time has elapsed. If the interest rate is reduced by the term of the promissory note in addition to the reduction in the period or a change in the term of the promissory note agreement, the interest rate can be further reduced with the agreement of the parties. If the interest rate is increased by the term of the promissory note or a reduction in the term of the promissory note agreement, the maximum interest rate on the promissory note will be increased as specified in the promissory note.