Iowa General Guaranty and Indemnification Agreement

Description

How to fill out General Guaranty And Indemnification Agreement?

Have you ever found yourself in a situation where you require documents for either business or personal purposes almost every time.

There is a range of authentic document templates accessible online, yet finding reliable ones can be challenging.

US Legal Forms offers a multitude of form templates, such as the Iowa General Guaranty and Indemnification Agreement, which are crafted to comply with local and federal regulations.

Once you have the correct template, click Purchase now.

Choose the pricing plan you prefer, provide the required information to create your account, and complete the transaction using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After logging in, you can download the Iowa General Guaranty and Indemnification Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these procedures.

- Find the template you need and confirm it is for the correct region/county.

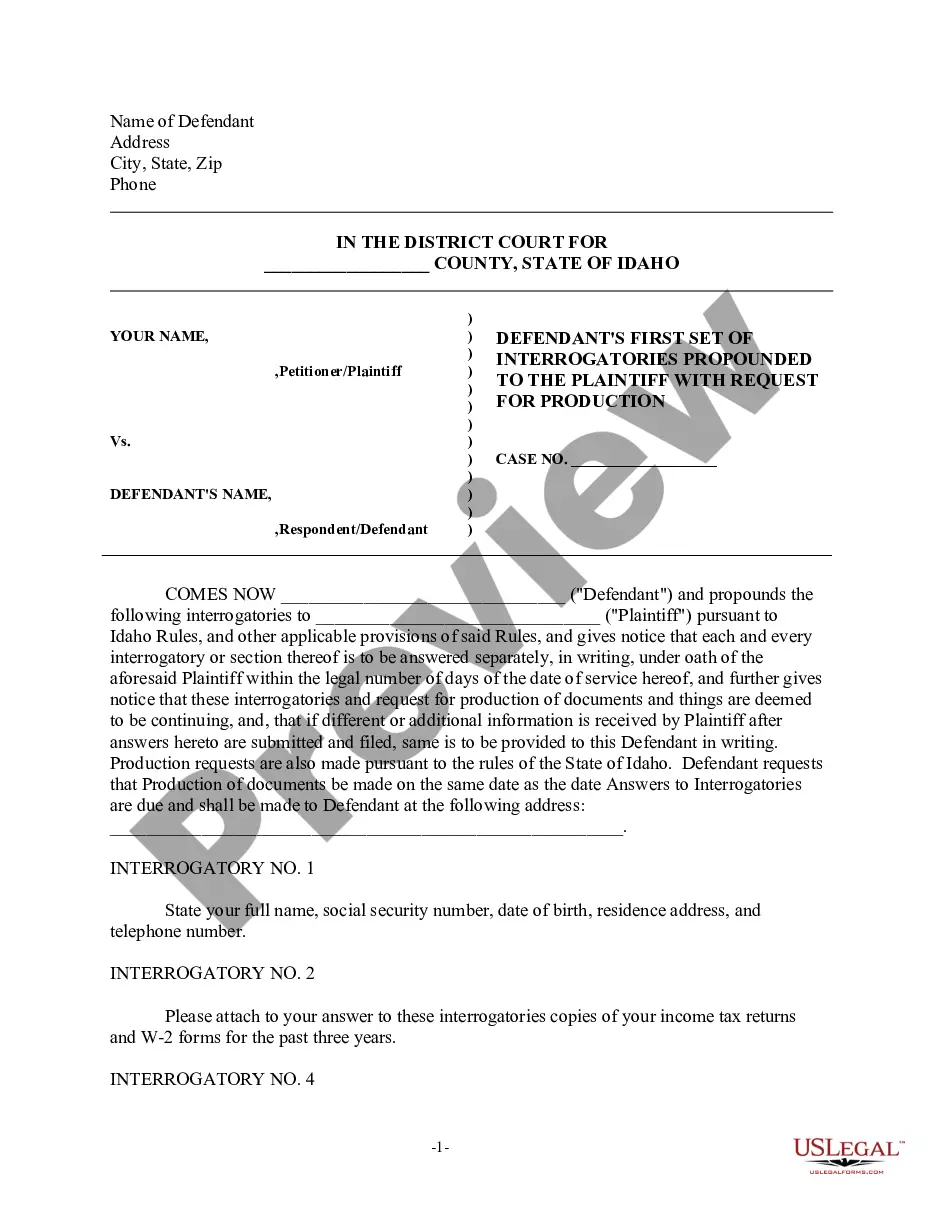

- Utilize the Preview button to review the document.

- Read the description to ensure that you have selected the appropriate template.

- If the document is not what you are looking for, use the Search field to find the form that fits your needs and requirements.

Form popularity

FAQ

Differences between guarantees and indemnitiesa guarantee is a secondary liability, which means that there will be another person who is primarily liable for the obligation; whereas, an indemnity imposes a primary liability.

The mutual assent of two or more parties, competency to contract and valuable consideration. An offer to guarantee must be accepted, either by express or implied acceptance. If a surety's assent to a guarantee has been procured by fraud by the person to whom it is given, there is no binding contract.

A guarantee must be in writing (or evidenced in writing) and signed by the guarantor or a person authorised by the guarantor (section 4, Statute of Frauds 1677). Guarantees and indemnities are often executed as deeds to overcome any argument about whether good consideration has been given.

Described in writing. The guarantee must be in writing and signed by the guarantor or some other person lawfully authorised to sign on the guarantor's behalf. Alternatively, the guarantee can take the form of a note or memorandum of the guarantee agreement which is similarly signed.

Guarantee. 1) v. to pledge or agree to be responsible for another's debt or contractual performance if that other person does not pay or perform.

The main technical requirement for a guarantee to be valid is that it must be in writing and signed by the guarantor or a person authorised on the guarantor's behalf.

His oral agreement is not enforceable against him, as guaranty obligations have to be in a signed writing to be enforceable. Moreover, the written guaranty must properly identify the debtor whose debts are being guarantied.

To be enforceable as a personal guaranty, the signatory must sign the guaranty in his or her personal capacity and not as the president or CEO of the company receiving the loan, which is its own legal entity, separate and apart from the people that run and operate it.