Iowa Direct Deposit Form for Payroll

Description

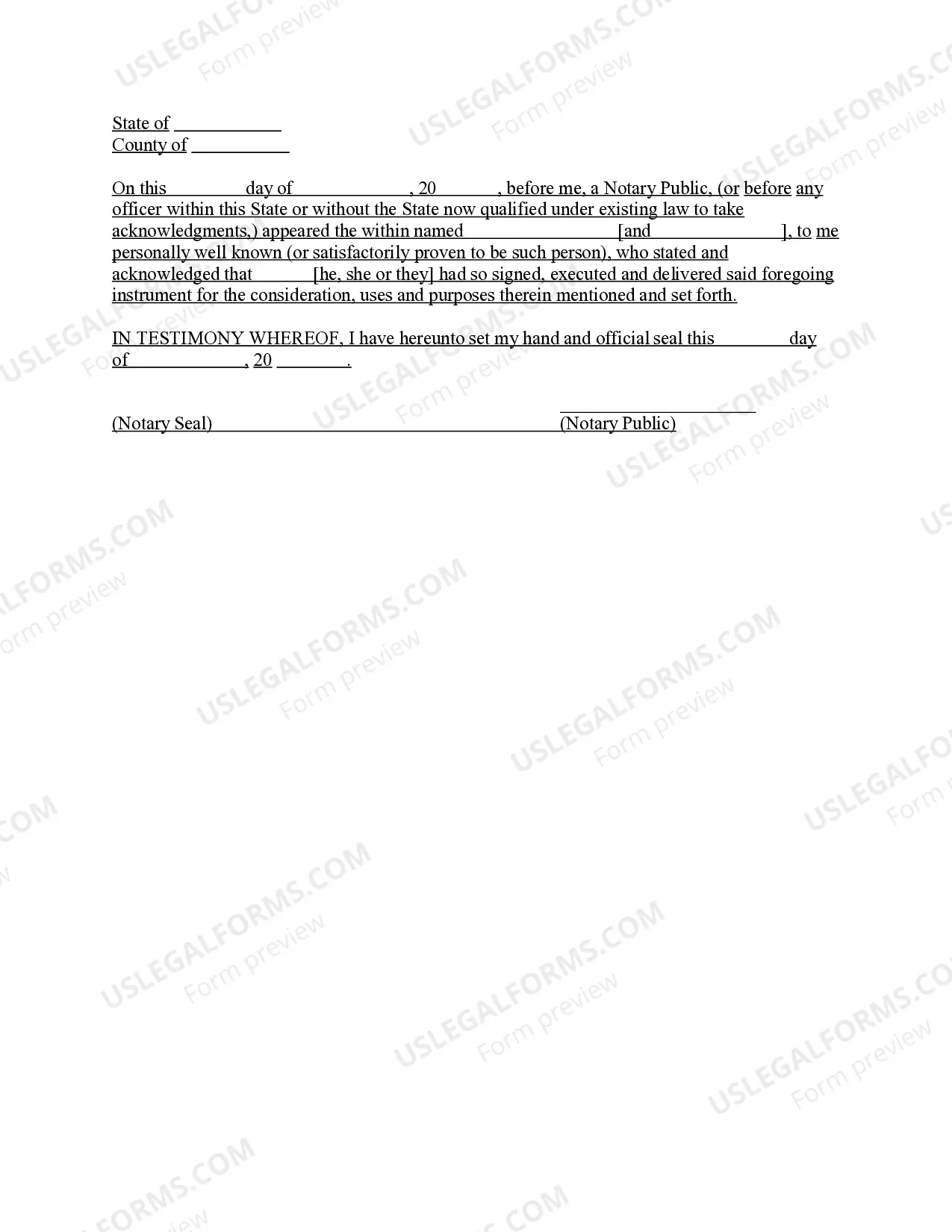

How to fill out Direct Deposit Form For Payroll?

Are you presently in the position where you need to obtain documents for potential business or personal requirements almost daily.

There are numerous legal document templates accessible online, but finding ones you can trust isn’t straightforward.

US Legal Forms offers thousands of form templates, such as the Iowa Direct Deposit Form for Payroll, which are designed to comply with federal and state regulations.

Once you have located the correct form, simply click Buy now.

Choose the pricing plan you prefer, complete the required information to create your account, and pay for your order using your PayPal or Visa or MasterCard.

- If you are already familiar with the US Legal Forms website and have an account, simply sign in.

- Then, you can download the Iowa Direct Deposit Form for Payroll template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is in the correct area/state.

- Use the Review button to assess the form.

- Review the details to confirm that you have selected the appropriate form.

- If the form isn’t what you are looking for, utilize the Search section to find the form that fulfills your needs and requirements.

Form popularity

FAQ

To fill out the payroll direct deposit form correctly, start by providing your full name, address, and Social Security number. Then, add your bank's account number and routing number. Be sure to check that all of your entries are correct to prevent errors when processing your Iowa Direct Deposit Form for Payroll, and consult UsLegalForms for additional templates and guidance.

In a direct deposit form, the term 'branch' refers to the specific location of your bank where your account is held. This information helps your employer identify the correct routing for your funds. It's important to ensure that you provide this detail accurately on your Iowa Direct Deposit Form for Payroll to avoid potential delays in receiving your earnings.

Filling out an ACH direct deposit form involves entering your personal identification details, such as your name and Social Security number. Next, provide the required banking details, including your routing number and account number. After completing your Iowa Direct Deposit Form for Payroll, make sure to review it and submit it according to your employer’s directives.

Your direct deposit form should include several key pieces of information: your name, address, and phone number, along with your bank's account and routing numbers. Be sure to also indicate the type of account, such as checking or savings, to ensure your Iowa Direct Deposit Form for Payroll is processed correctly. Providing accurate information helps streamline the payroll deposit process.

When filling out a direct debit form, first specify the amount and frequency of the payment you wish to authorize. Next, include your bank account details, such as the account number and routing number. Remember to double-check the information to ensure complete accuracy for transactions related to your Iowa Direct Deposit Form for Payroll.

To effectively fill out the Iowa Direct Deposit Form for Payroll, begin by entering your personal information such as your name, address, and Social Security number. Next, provide your bank's details, including the account number and routing number. Finally, review the information for accuracy and submit the form according to your employer's instructions.

Yes, you can set up direct deposit without visiting the bank. You simply need to complete the Iowa Direct Deposit Form for Payroll, which organizes your bank information digitally. Many employers allow online submissions of this form, eliminating the need for a bank visit. This convenient option simplifies your payroll setup, making it easy to get started.

A small business can set up direct deposit for employees by first choosing a payroll service that offers this feature. After selecting a service, obtain the Iowa Direct Deposit Form for Payroll to collect each employee's banking details. Submit the completed forms to the payroll service to ensure that employees receive their payments directly into their accounts. This method simplifies payroll management and enhances employee satisfaction.

To set up direct deposit for payroll, you need to fill out the Iowa Direct Deposit Form for Payroll. Ensure that you have your banking information ready, including your account number and routing number. Once completed, submit the form as directed by your employer. This process allows for seamless direct deposit of your earnings into your bank account.

To submit a direct deposit form, complete the Iowa Direct Deposit Form for Payroll by providing accurate banking details. Make sure to check for any specific submission guidelines provided by your employer. In most cases, you can submit the form via email, through an online portal, or in person at your payroll department. This submission ensures your payroll is directly deposited into your account.