The Iowa Combined Request for Pollution Control and Recycling Property Tax Exemption and Certification of Pollution Control and Recycling Property is an application provided by the Iowa Department of Revenue to exempt pollution control and recycling property from taxation. This exemption is available to qualifying entities for up to two years. There are two types of Iowa Combined Request for Pollution Control and Recycling Property Tax Exemption and Certification: Type I and Type II. Type I is for the exemption of pollution control and recycling property used in the manufacturing of a product or used in the operation of a pollution control or recycling facility. To qualify for this exemption, the applicant must provide documentation that the property is used solely for the purpose of pollution control or recycling of a product and is not used for any other purpose. Type II is for the exemption of pollution control and recycling property used in the research and development of new products or processes. To qualify for this exemption, the applicant must provide documentation that the property is used solely for the purpose of research and development and is not used for any other purpose. The Iowa Combined Request for Pollution Control and Recycling Property Tax Exemption and Certification must be completed and submitted to the Iowa Department of Revenue for approval. The Department will then review the application and determine if the applicant is eligible for the exemption. If approved, the applicant will be notified in writing and the exemption will be granted.

Iowa Combined Request for Pollution Control and Recycling Property Tax Exemption and Certification of Pollution Control and Recycling Property

Description

How to fill out Iowa Combined Request For Pollution Control And Recycling Property Tax Exemption And Certification Of Pollution Control And Recycling Property?

How much time and resources do you typically allocate for drafting formal documentation.

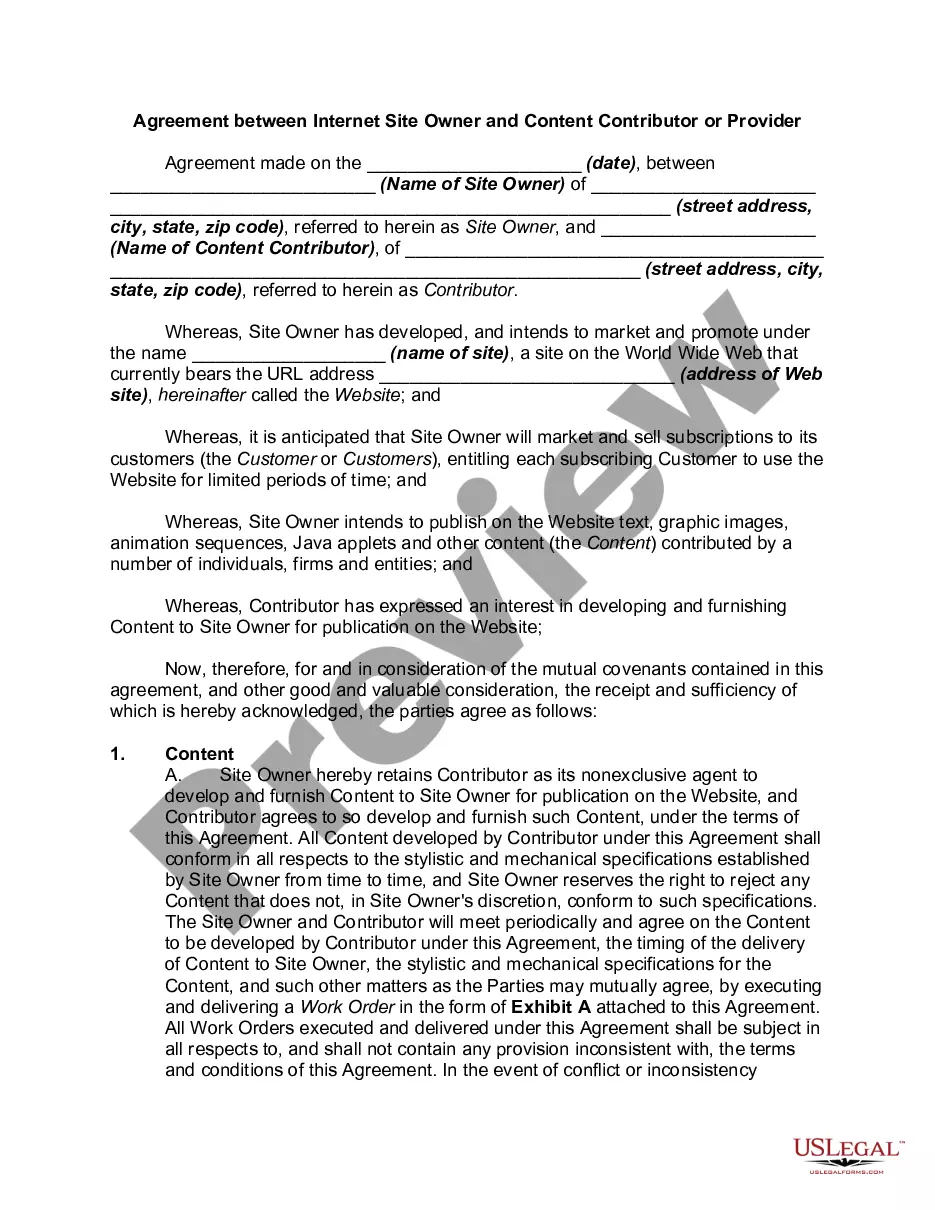

There’s a superior option for obtaining such forms instead of hiring legal professionals or spending hours browsing the internet for an appropriate template. US Legal Forms is the leading online repository that provides expertly crafted and validated state-specific legal documents for various purposes, such as the Iowa Combined Request for Pollution Control and Recycling Property Tax Exemption and Certification of Pollution Control and Recycling Property.

Another benefit of our service is that you can retrieve previously obtained documents that you safely keep in your profile in the My documents tab. Access them at any time and redo your paperwork as often as necessary.

Conserve time and energy organizing formal documentation with US Legal Forms, one of the most reliable online services. Join us today!

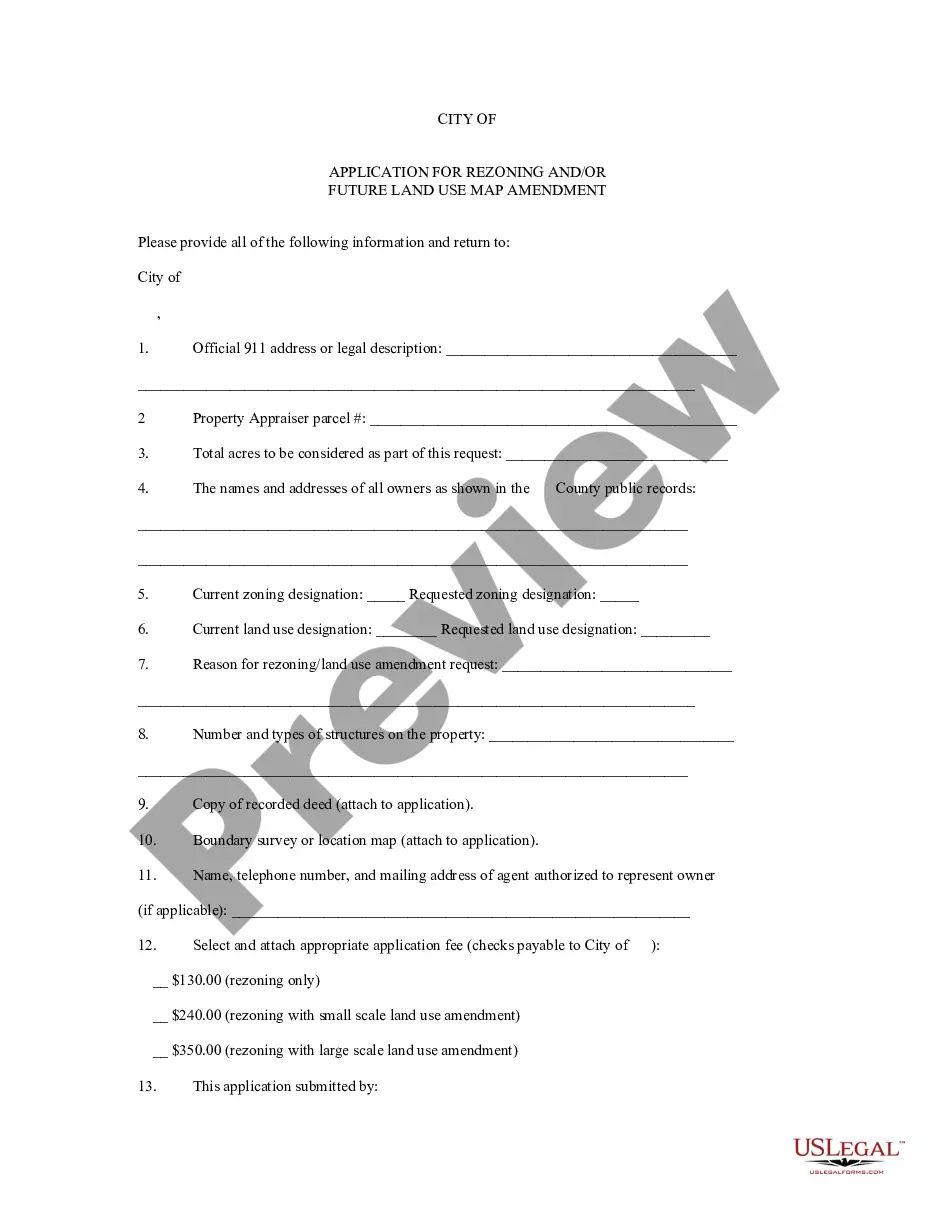

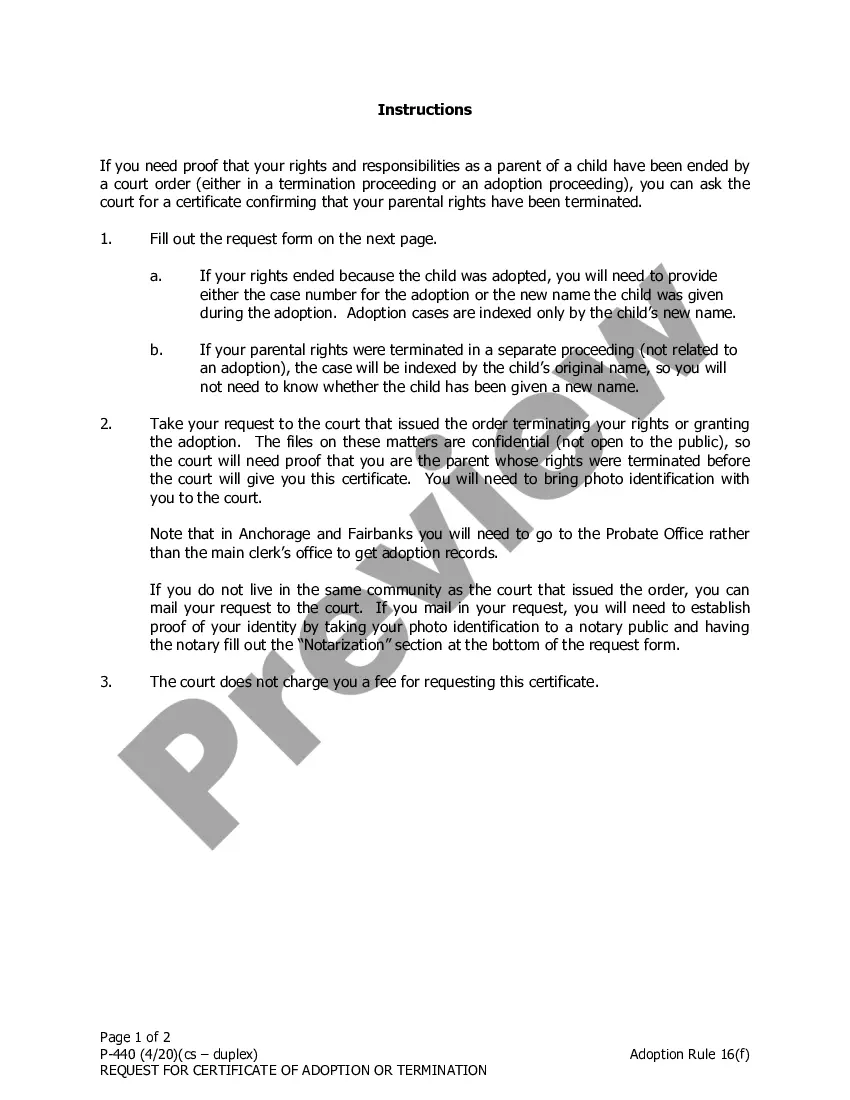

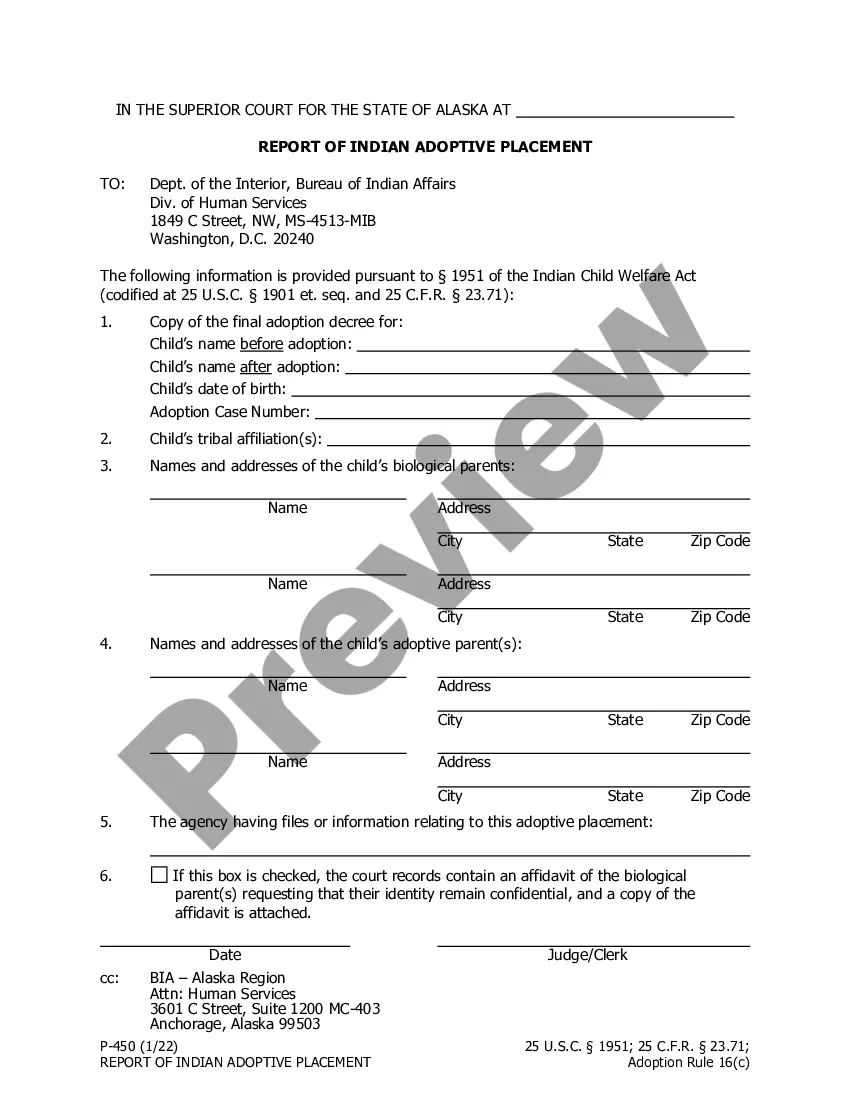

- Review the form details to confirm it satisfies your state conditions. To do this, examine the form description or utilize the Preview option.

- If your legal template does not fulfill your requirements, find an alternative using the search bar at the top of the page.

- If you already possess an account with us, Log In and download the Iowa Combined Request for Pollution Control and Recycling Property Tax Exemption and Certification of Pollution Control and Recycling Property. Otherwise, move to the subsequent steps.

- Click Buy now after finding the appropriate template. Choose the subscription plan that best fits your needs to access the complete range of our library's offerings.

- Register for an account and make your subscription payment. You can transact using your credit card or via PayPal - our service is entirely secure for this.

- Download your Iowa Combined Request for Pollution Control and Recycling Property Tax Exemption and Certification of Pollution Control and Recycling Property onto your device and fill it out on a printed copy or electronically.

Form popularity

FAQ

To become farm tax exempt in Iowa, you must first meet the state’s criteria for qualifying as a farm. This includes operational and income requirements, along with filling out the Iowa Combined Request for Pollution Control and Recycling Property Tax Exemption and Certification of Pollution Control and Recycling. Engaging with local agricultural authorities can also help streamline the process.

Military Property Tax Exemption This benefit reduces a veteran's assessed home value for property tax purposes by $1,852. In order to qualify, a service member must have served on active duty during a period of war or for a minimum of 18 months during peacetime.

State homestead laws do place a limit on the value or acreage of property that can be designated as a homestead. The Hawkeye State allows citizens to set aside 40 acres of rural property or a half-acre of urban property under its homestead protections, and caps the value of protected personal property at $500.

Eligibility: Must be 65 or older or totally disabled, and meet annual household low income requirements. Filing Requirements: A property owner must file a claim with the county treasurer by June 1 preceding the fiscal year in which the property taxes are due.

IDR Announces: Homestead Tax Exemption for Claimants 65 Years of Age or Older. Iowa Department Of Revenue.

If you are using filing status 1 (single), you are exempt from Iowa tax if you meet either of the following conditions: Your net income from all sources, line 26, is $9,000 or less and you are not claimed as a dependent on another person's Iowa return ($24,000 if you are 65 or older on 12/31/22).

News Across the U.S. Access the digital replica of USA TODAY and more than 200 local newspapers with your subscription. Iowans age 65 or older are eligible for a property tax exemption worth $3,250 for the assessment year beginning Jan. 1, 2023. In subsequent years, the exemption doubles to $6,500.

Iowa Family Farm Tax Credit Eligibility: All land used for agricultural or horticultural purposes in tracts of 10 acres or more and land of less than 10 acres if contiguous to qualifying land of more than 10 acres. The owner or designated person must be actively engaged in farming the land.