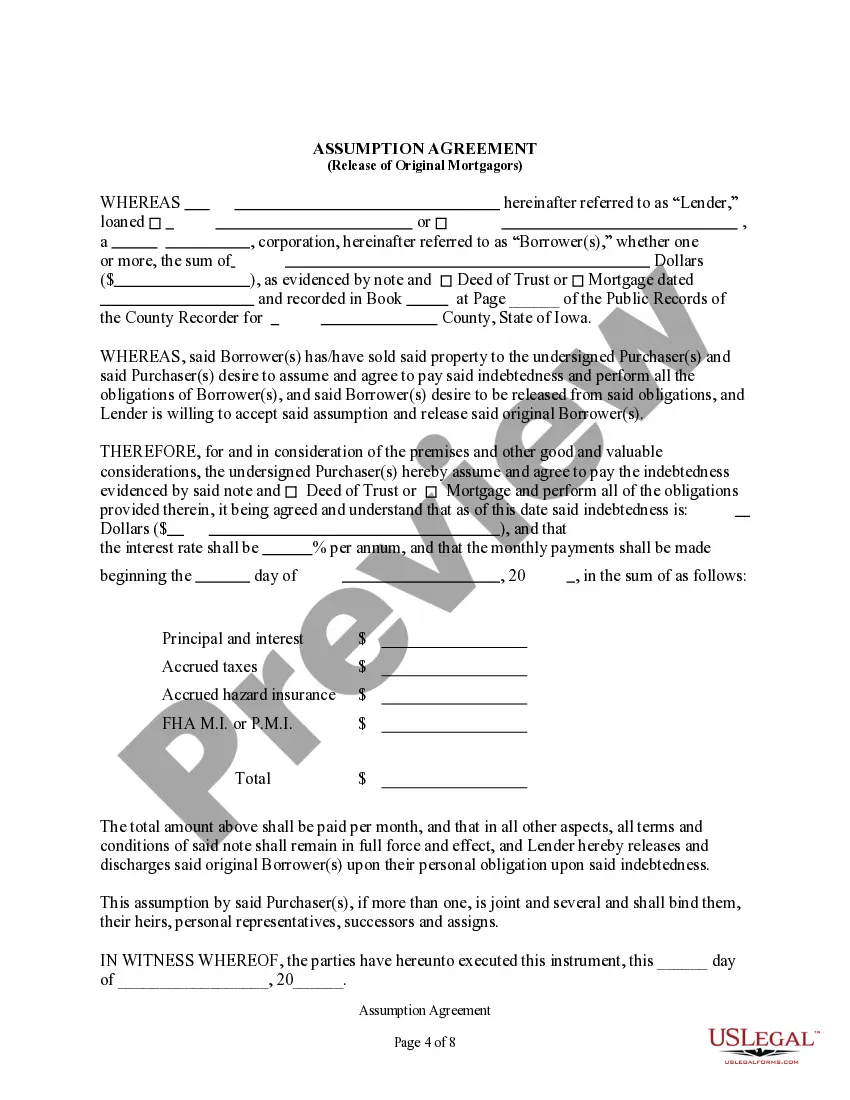

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

Iowa Assumption Agreement of Mortgage and Release of Original Mortgagors

Description

How to fill out Iowa Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

Obtain one of the most extensive collections of sanctioned forms.

US Legal Forms is a platform where you can discover any state-specific document within moments, such as Iowa Assumption Agreement of Mortgage and Release of Original Mortgagors templates.

No need to waste hours searching for an admissible example in court.

Once you select a pricing plan, create an account. Make a payment using a credit card or PayPal. Download the document to your computer by clicking the Download button. That's it! You should complete the Iowa Assumption Agreement of Mortgage and Release of Original Mortgagors form and verify it. To ensure everything is accurate, consult your local legal advisor for assistance. Sign up and simply browse over 85,000 useful samples.

- To utilize the forms library, select a subscription and create your account.

- If you have registered, just Log In and click on the Download button.

- The Iowa Assumption Agreement of Mortgage and Release of Original Mortgagors template will be promptly saved in the My documents section (a section for all forms you save on US Legal Forms).

- To establish a new profile, review the brief instructions listed below.

- If you are going to use a state-specific sample, ensure you specify the relevant state.

- If possible, review the description to understand all the details of the form.

- Utilize the Preview feature if available to review the document's content.

- If everything appears correct, click Buy Now.

Form popularity

FAQ

An assumption agreement is a legal document that allows one party to take over another's mortgage, effectively transferring the financial responsibility. In the case of the Iowa Assumption Agreement of Mortgage and Release of Original Mortgagors, this agreement outlines the obligations and terms agreed upon by the buyer, seller, and lender. Utilizing platforms like USLegalForms can help generate these documents efficiently and accurately.

An assumption and release agreement allows the seller to transfer their mortgage obligations to the buyer while releasing themselves from liability. In the context of the Iowa Assumption Agreement of Mortgage and Release of Original Mortgagors, this document is vital for protecting the seller's credit after the transaction. This agreement clarifies all parties' rights and duties, creating a transparent process.

To assume a mortgage, you must meet the lender's requirements, which often include credit checks and financial assessments. Additionally, providing sufficient documentation, such as proof of income and employment, is essential. Successfully navigating these requirements is crucial for executing an Iowa Assumption Agreement of Mortgage and ensuring that the transition is smooth.

While there are benefits to the Iowa Assumption Agreement of Mortgage and Release of Original Mortgagors, some downsides exist. For example, if the underlying mortgage has a high interest rate, you might be stuck with less favorable terms compared to current market rates. Additionally, if the original mortgage owes more than the home’s current value, this may complicate the financial situation. It’s wise to evaluate these factors thoroughly before proceeding.

The assumption agreement for a mortgage allows a buyer to take over the seller's existing mortgage under the Iowa Assumption Agreement of Mortgage and Release of Original Mortgagors. This process involves transferring the debt obligation from the seller to the buyer, which can simplify the home buying experience. By assuming the mortgage, you may benefit from the seller's existing interest rate and repayment terms. It is crucial to ensure that the lender approves this arrangement to avoid any complications.

When considering an Iowa Assumption Agreement of Mortgage and Release of Original Mortgagors, you may wonder if there are any hidden issues. Typically, if the current mortgage holder agrees to the assumption, you can take over the payments without significant complications. However, it is essential to check the original mortgage terms, as some lenders may include restrictions or fees. Understanding these elements will help you make an informed decision.

To remove someone from a mortgage without refinancing, you can use an Iowa Assumption Agreement of Mortgage and Release of Original Mortgagors. This legal process allows another party to assume the mortgage, thus releasing the original borrower from liability. Ensure that the lender agrees to this arrangement, as their approval is essential. US Legal Forms offers easy-to-use templates that help you navigate this process effectively.

In an Iowa Assumption Agreement of Mortgage and Release of Original Mortgagors, the new borrower assumes the mortgage and signs the agreement alongside the lender. The original mortgagors may also need to provide consent for the transfer. This step ensures that all parties are aware of their obligations under the mortgage terms. For a seamless process, consider using US Legal Forms to obtain the necessary documents.

To let someone take over your mortgage, you must initiate a mortgage assumption with your lender. This process typically involves the new borrower applying for approval and meeting specific financial criteria set by the lender. Once approved, you will need to execute the necessary paperwork to formalize the transfer. Utilizing the Iowa Assumption Agreement of Mortgage and Release of Original Mortgagors helps clarify responsibilities for all parties involved.

The process of assuming a mortgage requires the new borrower to apply with the lender for approval. The lender will assess their creditworthiness and ability to fulfill the mortgage obligations. Once approved, the original mortgage may need modifications to transfer responsibility fully. Following the Iowa Assumption Agreement of Mortgage and Release of Original Mortgagors ensures that all legal aspects are managed effectively.