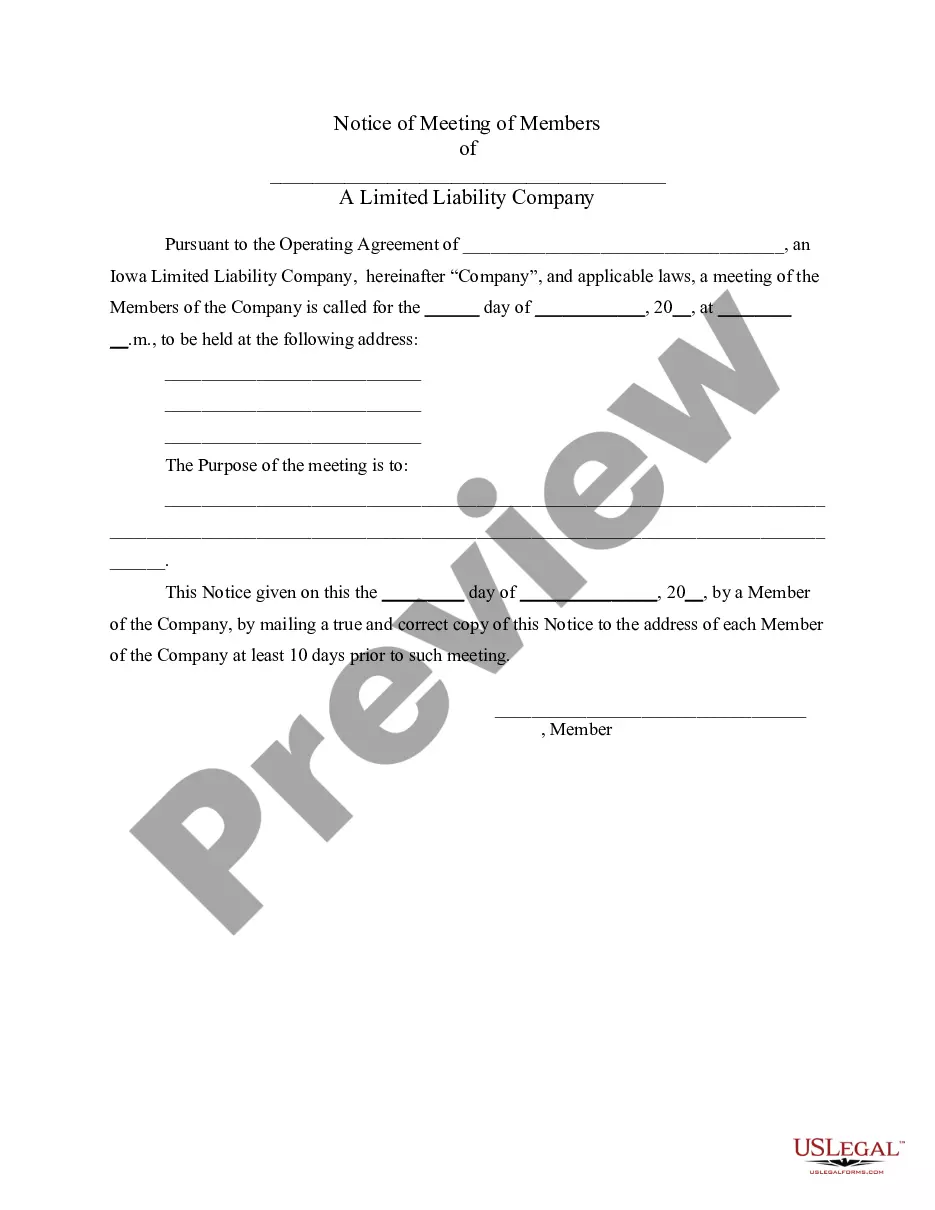

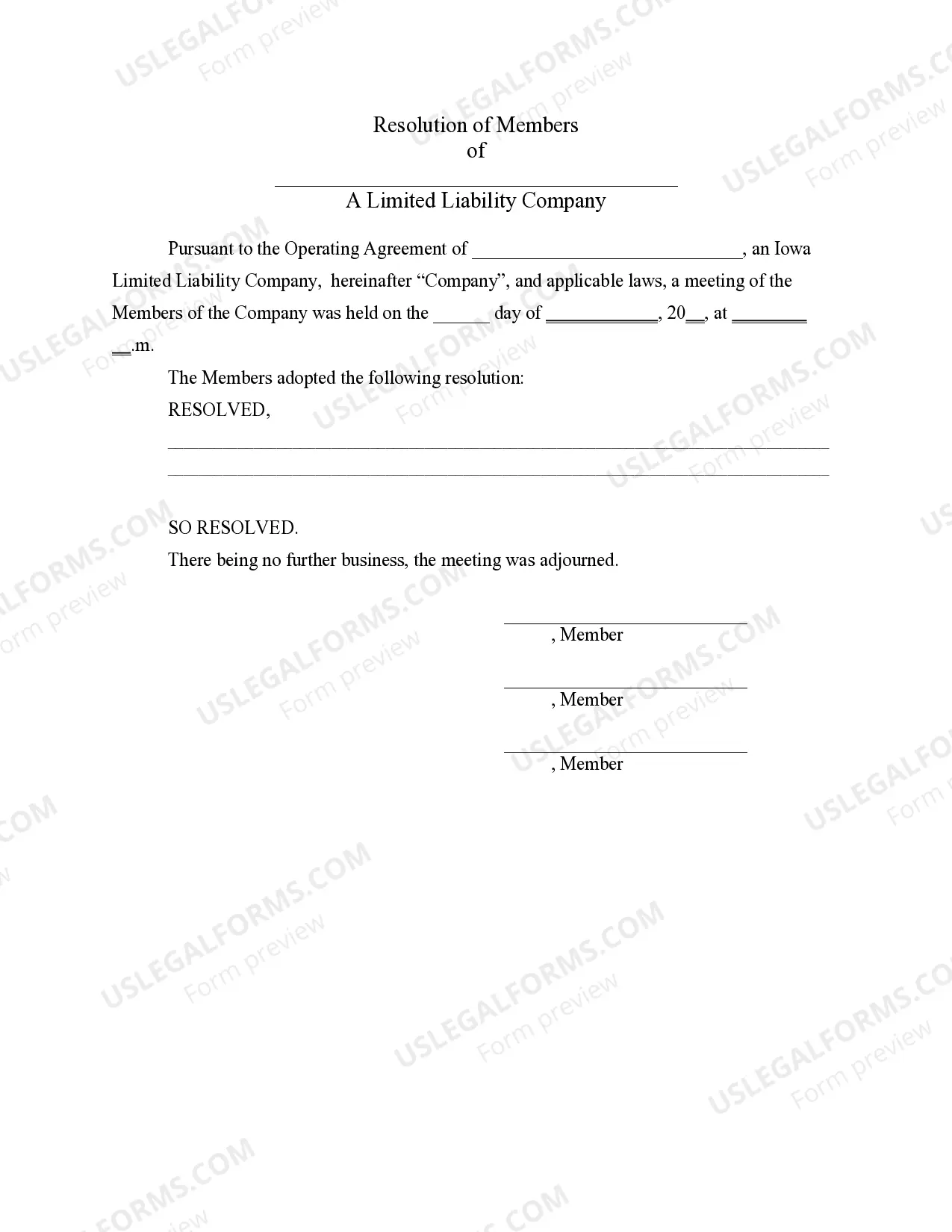

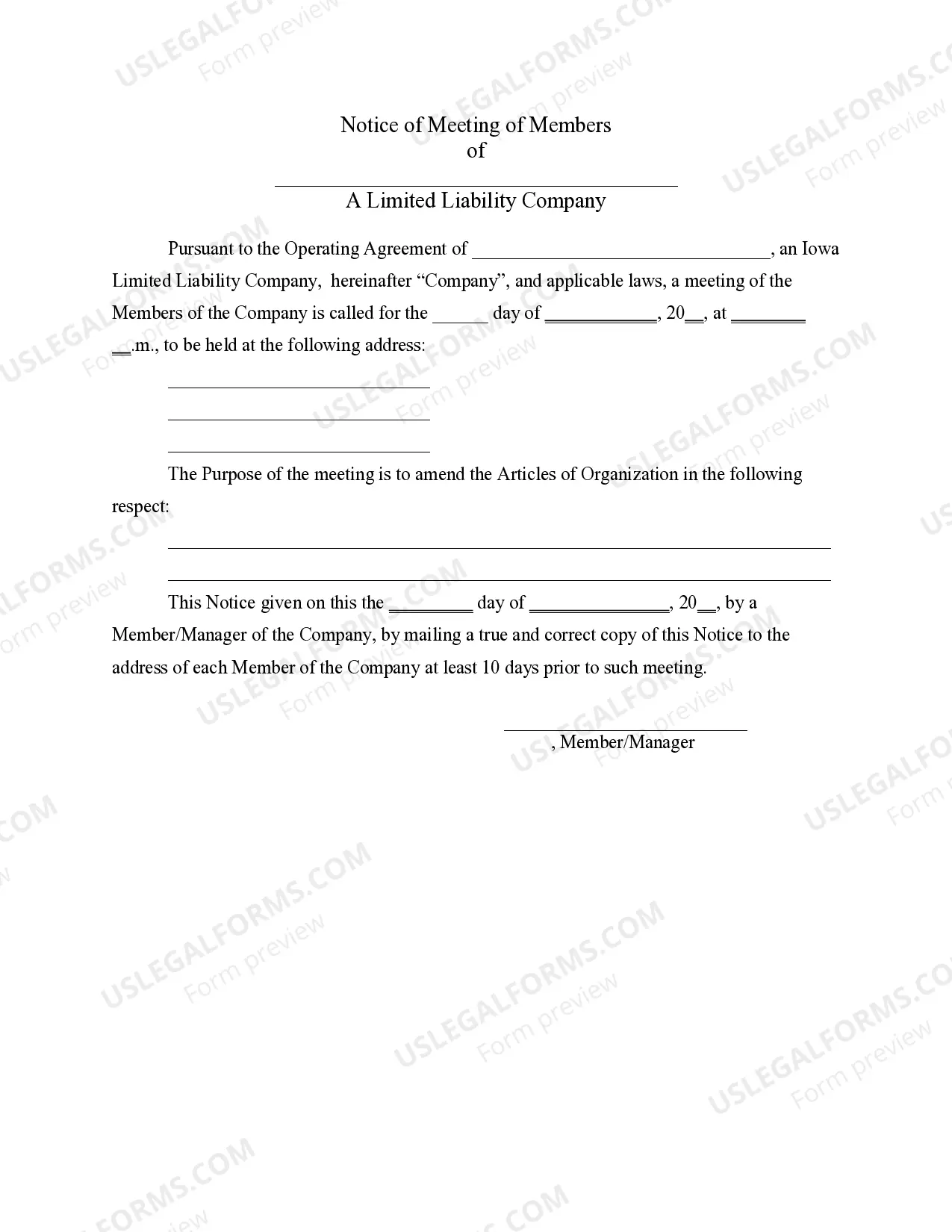

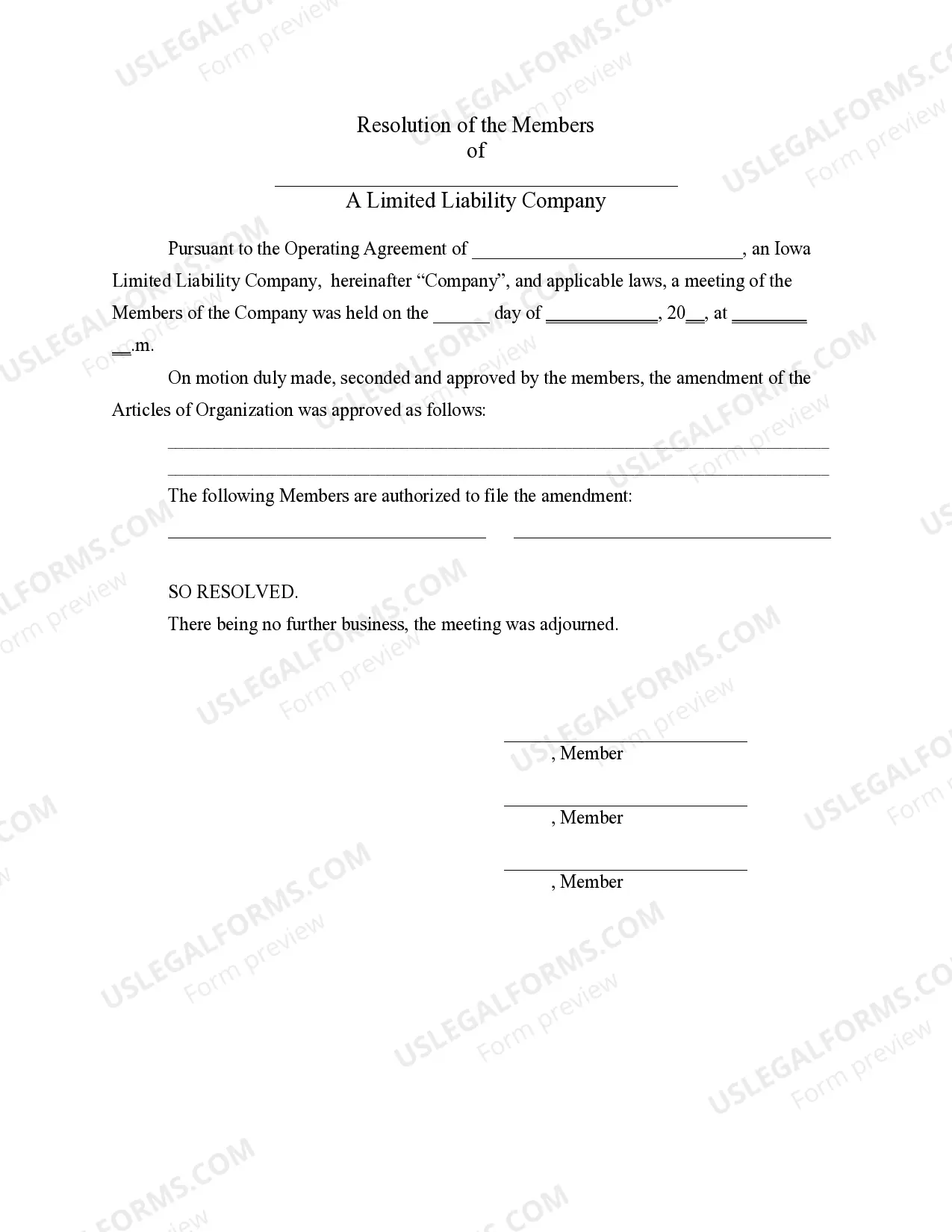

This LLC Notices, Resolutions and other Operations Forms Package contains over 15 forms for use in connection with the operation of a LLC, including the following: (1) Notice of Meeting for General Purpose, (2) Resolution of Meeting for General Purpose, (3) Notice of Meeting to Amend Articles of Organization, (4) Resolution to Amend Articles of Organization, (5) Notice of Meeting to Consider Dissolution, (6) Resolution Regarding Dissolution, (7) Notice to Admit New Members, (8) Resolution Concerning Admitting New Members, (9) Notice of Meeting Concerning Accepting Resignation of Manager, (10) Resolution Accepting Resignation of Manager, (11) Notice of Meeting to Remove Manager, (12) Resolution Concerning Removal of Manager, (13) Notice of Meeting to Consider Disbursements to Members, (14) Resolution Concerning Disbursements, (15) Assignment of Member Interest, (16) Demand for Indemnity by Member/Manager and (17) Application for Tax Identification Number.

Iowa LLC Notices, Resolutions and other Operations Forms Package

Description

How to fill out Iowa LLC Notices, Resolutions And Other Operations Forms Package?

Access one of the most comprehensive collections of sanctioned forms.

US Legal Forms provides a platform where you can locate any regional document in just a few clicks, including Iowa LLC Notifications, Resolutions, and other Operational Forms Package templates.

No need to waste hours searching for a court-acceptable example.

After choosing a pricing plan, set up your account. Make payment via credit card or PayPal. Download the sample to your computer by clicking on the Download button. That's it! You should complete the Iowa LLC Notifications, Resolutions, and other Operational Forms Package template and review it. To confirm that everything is correct, reach out to your local legal counsel for assistance. Sign up and easily access over 85,000 valuable samples.

- To utilize the forms library, select a subscription and create an account.

- If you have already done this, simply Log In and click on the Download button.

- The Iowa LLC Notifications, Resolutions, and other Operational Forms Package sample will be automatically saved in the My documents tab (a section for all forms you save on US Legal Forms).

- To establish a new account, follow the easy instructions listed below.

- If you plan to use a regional sample, ensure you select the correct state.

- If possible, review the description to understand all the details of the document.

- Utilize the Preview feature if available to examine the document's details.

- If everything looks correct, click Buy Now.

Form popularity

FAQ

To file a biennial report in Iowa, you need to access the Iowa Secretary of State's website. You can complete the report online, ensuring you provide updated information about your LLC. The Iowa LLC Notices, Resolutions and other Operations Forms Package from uslegalforms helps keep you organized, reminding you when reports are due and providing templates for your submissions.

The approval time for an LLC in Iowa can vary, but typically it takes about 2 to 3 weeks if you submit via mail. Filing online may expedite the process, often resulting in quicker approval. Utilizing the Iowa LLC Notices, Resolutions and other Operations Forms Package can help ensure your submission meets all requirements, potentially speeding up the approval process.

To set up an LLC in Iowa, you need to complete the Articles of Organization and submit them to the Secretary of State. Be sure to choose a unique business name and designate a registered agent who will receive legal notices. The Iowa LLC Notices, Resolutions and other Operations Forms Package provides essential forms and invaluable tips to help you establish your LLC efficiently.

Yes, you can set up an LLC for yourself in Iowa. As a sole owner, you will fill out the same Articles of Organization but will list yourself as the sole member. The Iowa LLC Notices, Resolutions and other Operations Forms Package offers resources and templates to help you navigate this process seamlessly.

Filing an LLC in Iowa involves completing your Articles of Organization, which is a straightforward form that requires basic information about your business. After completing the form, you can file it online or via mail with the Iowa Secretary of State. Using the Iowa LLC Notices, Resolutions and other Operations Forms Package can simplify this process by providing formatted documents and step-by-step instructions.

To submit Articles of Incorporation in Iowa, first gather necessary details like your business name, registered agent information, and business purpose. You can file these documents online through the Iowa Secretary of State's website or by mailing a physical copy. The Iowa LLC Notices, Resolutions and other Operations Forms Package from uslegalforms can guide you through the filing process, ensuring you meet all state requirements.

No, an operating agreement is not legally required for an LLC in Iowa; however, it is highly beneficial. This document helps to define management responsibilities and protect members’ interests, creating a smoother operation. Utilizing the Iowa LLC Notices, Resolutions and other Operations Forms Package ensures that you have the tools needed to create a solid operating agreement.

The approval time for an LLC in Iowa can vary, but it typically takes about 2 to 3 weeks for the Secretary of State to process your application. If you choose expedited service, it may take less time. To ensure that your submission is complete, consider using the Iowa LLC Notices, Resolutions and other Operations Forms Package to avoid delays.

An LLC can legally operate without an operating agreement, but it is not advisable. Without this document, you may face confusion and disputes regarding management and profit distribution. By using the Iowa LLC Notices, Resolutions and other Operations Forms Package, you can create an operating agreement that protects your interests and clarifies roles within your LLC.

Yes, you can create your own operating agreement for your LLC, and it's highly recommended to do so. An operating agreement lays out the management structure and operational rules, ensuring everyone is on the same page. The Iowa LLC Notices, Resolutions and other Operations Forms Package offers templates and guidance, making it easier for you to draft a comprehensive agreement that suits your needs.