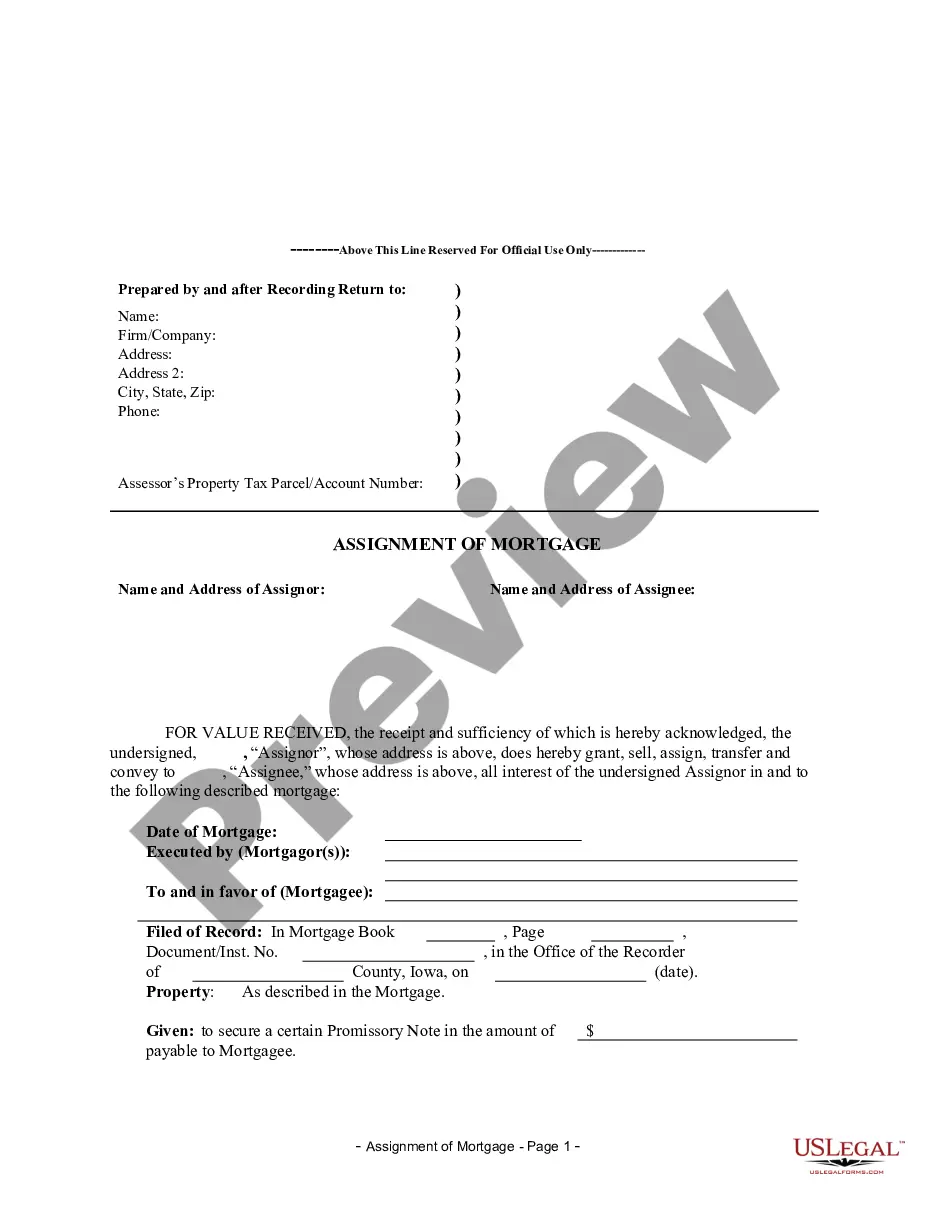

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

Iowa Assignment of Mortgage by Individual Mortgage Holder

Description

How to fill out Iowa Assignment Of Mortgage By Individual Mortgage Holder?

Obtain entry to the most extensive collection of legal forms.

US Legal Forms is a platform to locate any state-specific document in just a few clicks, such as examples of Iowa Assignment of Mortgage by Individual Mortgage Holder.

No need to waste hours of your time searching for a court-acceptable form.

If everything appears correct, click Buy Now. After choosing a pricing plan, create your account. Make payment using a card or PayPal. Download the sample to your computer by clicking Download. That's it! You need to fill out the Iowa Assignment of Mortgage by Individual Mortgage Holder template and verify it. To ensure that everything is accurate, consult your local legal advisor for assistance. Register and easily browse over 85,000 useful samples.

- To utilize the forms library, choose a subscription and register your account.

- If you've already registered, just Log In and click on the Download button.

- The Iowa Assignment of Mortgage by Individual Mortgage Holder template will instantly be saved in the My documents tab (a tab for each form you download from US Legal Forms).

- To set up a new account, examine the quick instructions provided below.

- If you're planning to use a state-specific template, ensure you select the correct state.

- If possible, review the description to understand all the details of the document.

- Utilize the Preview feature if available to view the content of the document.

Form popularity

FAQ

The two main documents in a mortgage are the promissory note and the mortgage deed. The promissory note is a promise to repay the borrowed amount, while the mortgage deed secures the property as collateral. Understanding these components is vital for anyone engaging in an Iowa Assignment of Mortgage by Individual Mortgage Holder.

Yes, you can assign a mortgage to someone under certain conditions. This process involves transferring the original borrower's rights and responsibilities to the new borrower, typically through a formal Iowa Assignment of Mortgage by Individual Mortgage Holder. It is essential to consult with legal expertise or platforms like uslegalforms to ensure the assignment adheres to regulations.

Code 589.31 in Iowa pertains to the legal framework for the assignment of mortgages. It outlines the necessary steps and requirements for individuals seeking to transfer their mortgage rights. Understanding this code is crucial for anyone involved in an Iowa Assignment of Mortgage by Individual Mortgage Holder for ensuring compliance and proper execution.

When an Iowa Assignment of Mortgage by Individual Mortgage Holder occurs, the purchaser typically receives two important documents. First, they receive an Assignment of Mortgage, which officially transfers the mortgage rights from the seller to the buyer. Second, they acquire a copy of the original mortgage, ensuring they have records of the terms and obligations tied to the mortgage.

Yes, a mortgage can typically be assigned to another individual. This assignment is known as an Iowa Assignment of Mortgage by Individual Mortgage Holder, allowing the existing borrower to transfer their obligations to another party. It is crucial to follow the legal procedures and obtain necessary approvals from the lender to ensure compliance. Platforms like USLegalForms can provide the necessary documents and guidance to facilitate this assignment smoothly.

When a mortgage is assigned, the rights and obligations associated with the mortgage transfer from the original lender to the new holder. This change often means the new holder can receive mortgage payments and enforce terms. It’s essential for the Iowa Assignment of Mortgage by Individual Mortgage Holder to be properly documented, as it alters the relationship between all parties involved.

An example of an assignment of a mortgage is when a homeowner sells their property, and the existing mortgage is assigned to the buyer. In this case, the seller as the mortgage holder signs over the mortgage rights to the buyer. This action provides the buyer with the terms of the original mortgage, securing their new ownership under the Iowa Assignment of Mortgage by Individual Mortgage Holder.

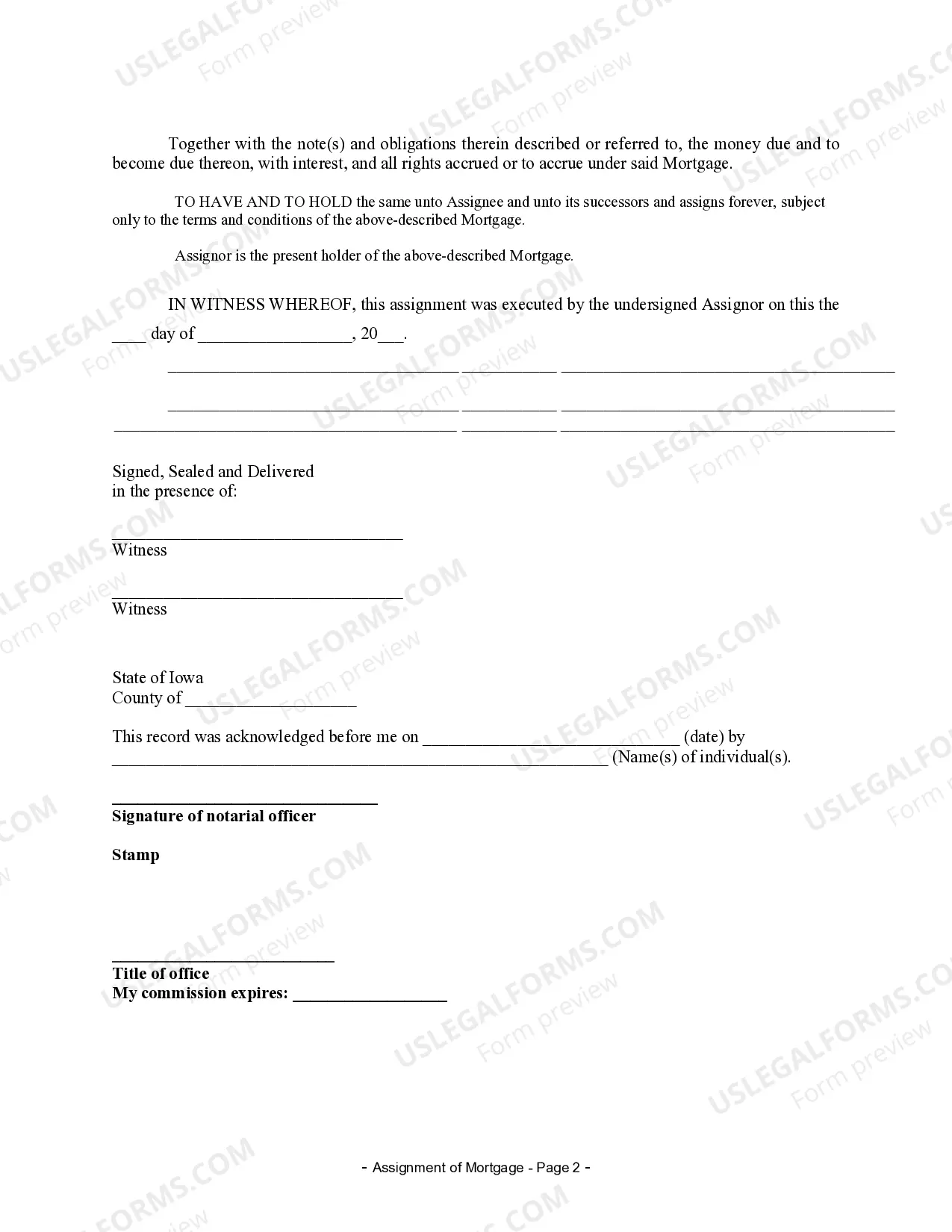

An assignment is generally signed by the individual transferring their rights, known as the assignor, and the individual receiving those rights, known as the assignee. In the context of the Iowa Assignment of Mortgage by Individual Mortgage Holder, it is crucial that both parties clearly understand their responsibilities. Both signatures are vital for the legal validity of the assignment.

To complete an assignment of mortgage, you will first need to obtain the original mortgage document and prepare an assignment form. This form should clearly state the names of both the assignor and assignee, along with details about the mortgage. After both parties sign, ensure you record the assignment with the appropriate county office to reflect the changes publicly, especially when dealing with Iowa Assignment of Mortgage by Individual Mortgage Holder.

An assignment of a mortgage is typically signed by the mortgage holder, which is often the lender or individual who owns the mortgage. In many cases, as part of the Iowa Assignment of Mortgage by Individual Mortgage Holder process, the mortgage holder must provide their signature to legally transfer the mortgage to another entity. It is also essential for the assignee to accept the assignment by signing as well.