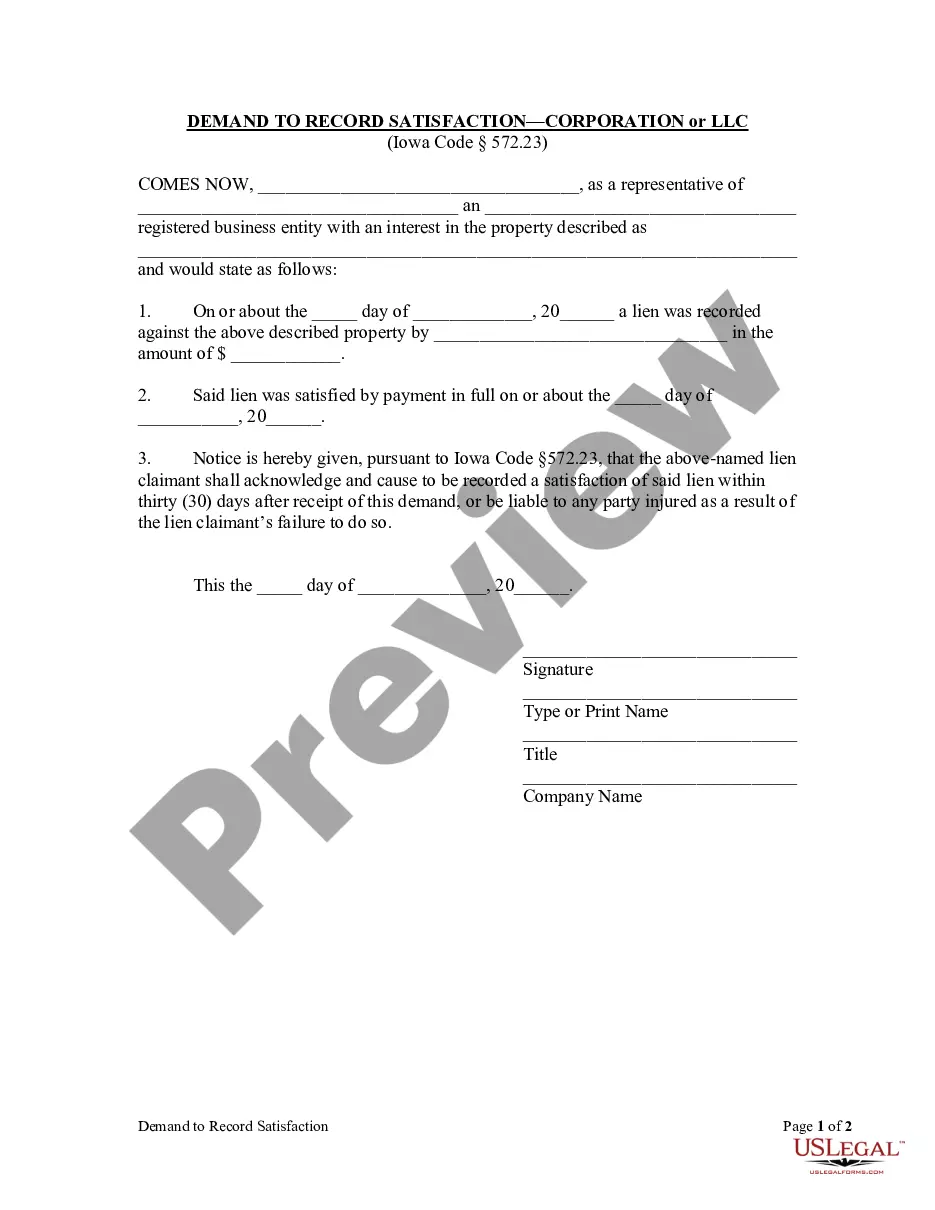

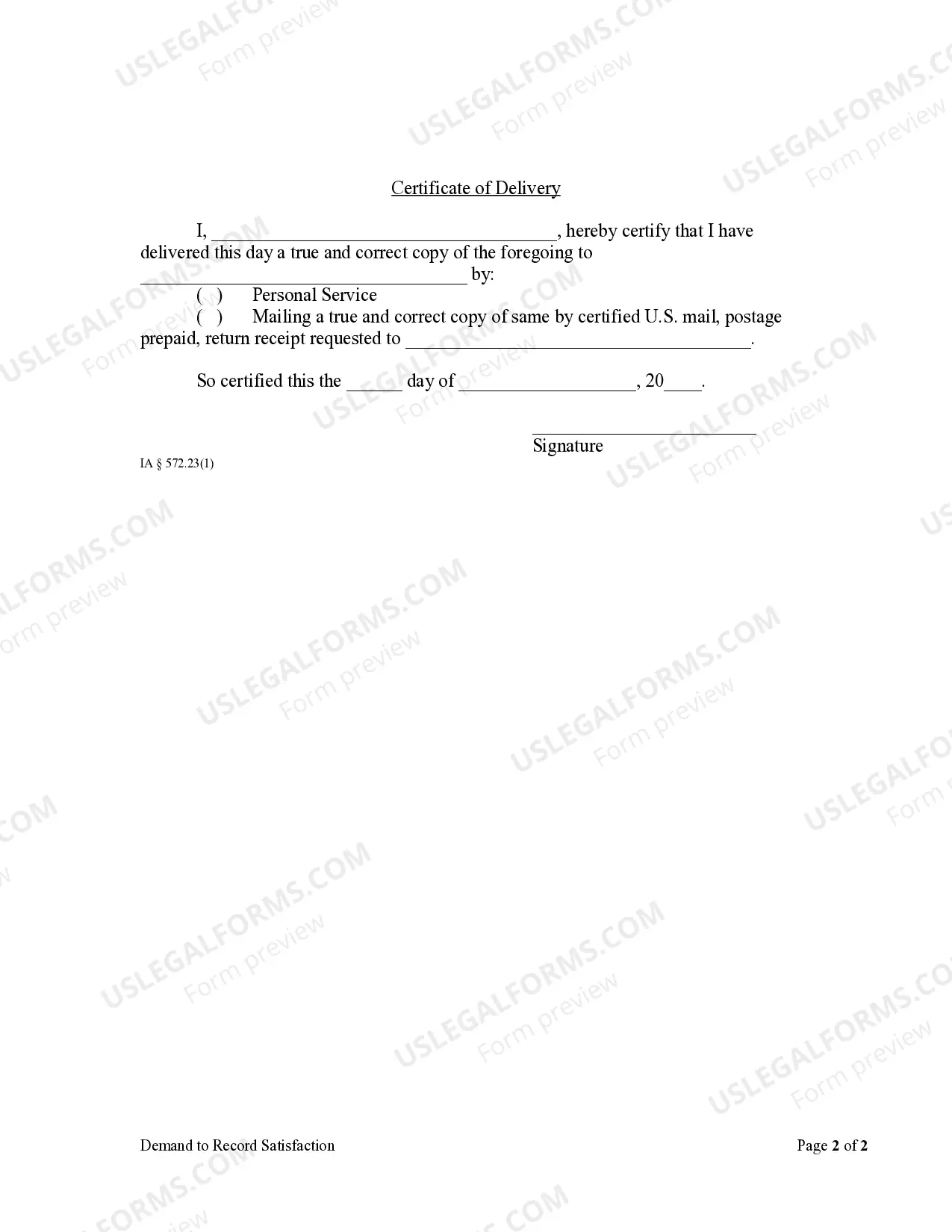

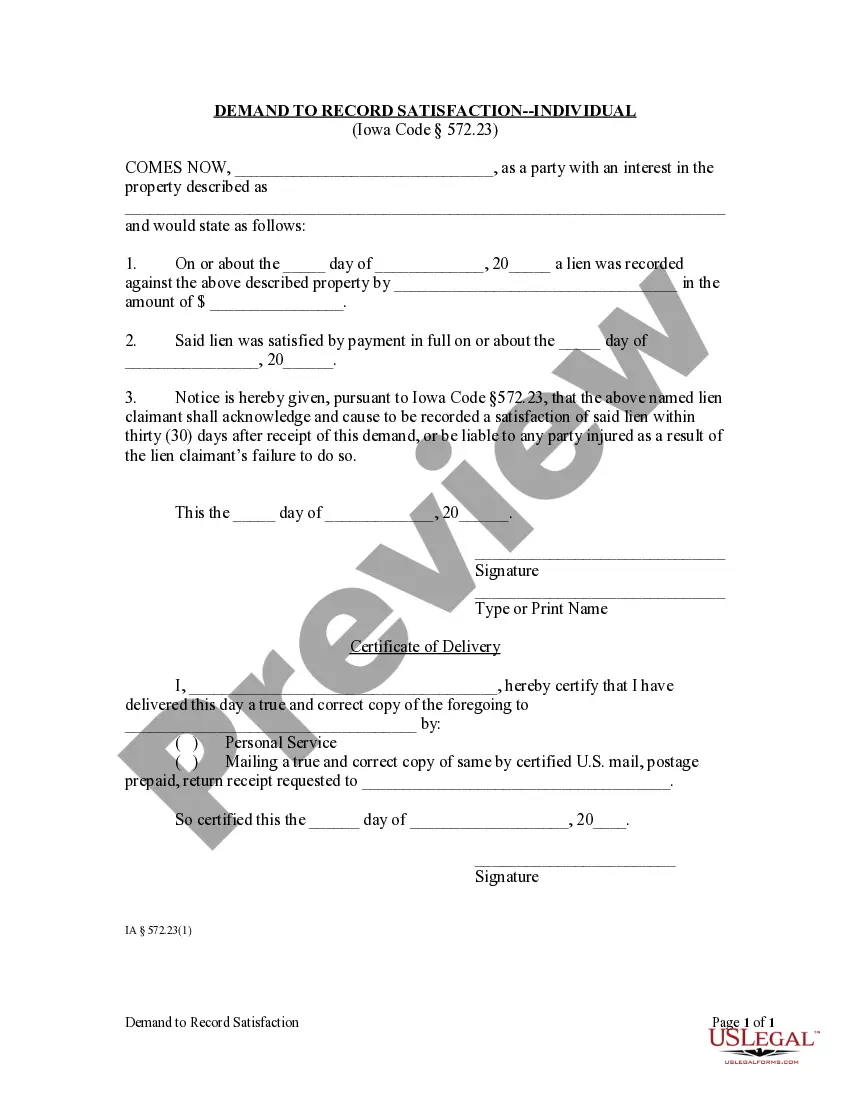

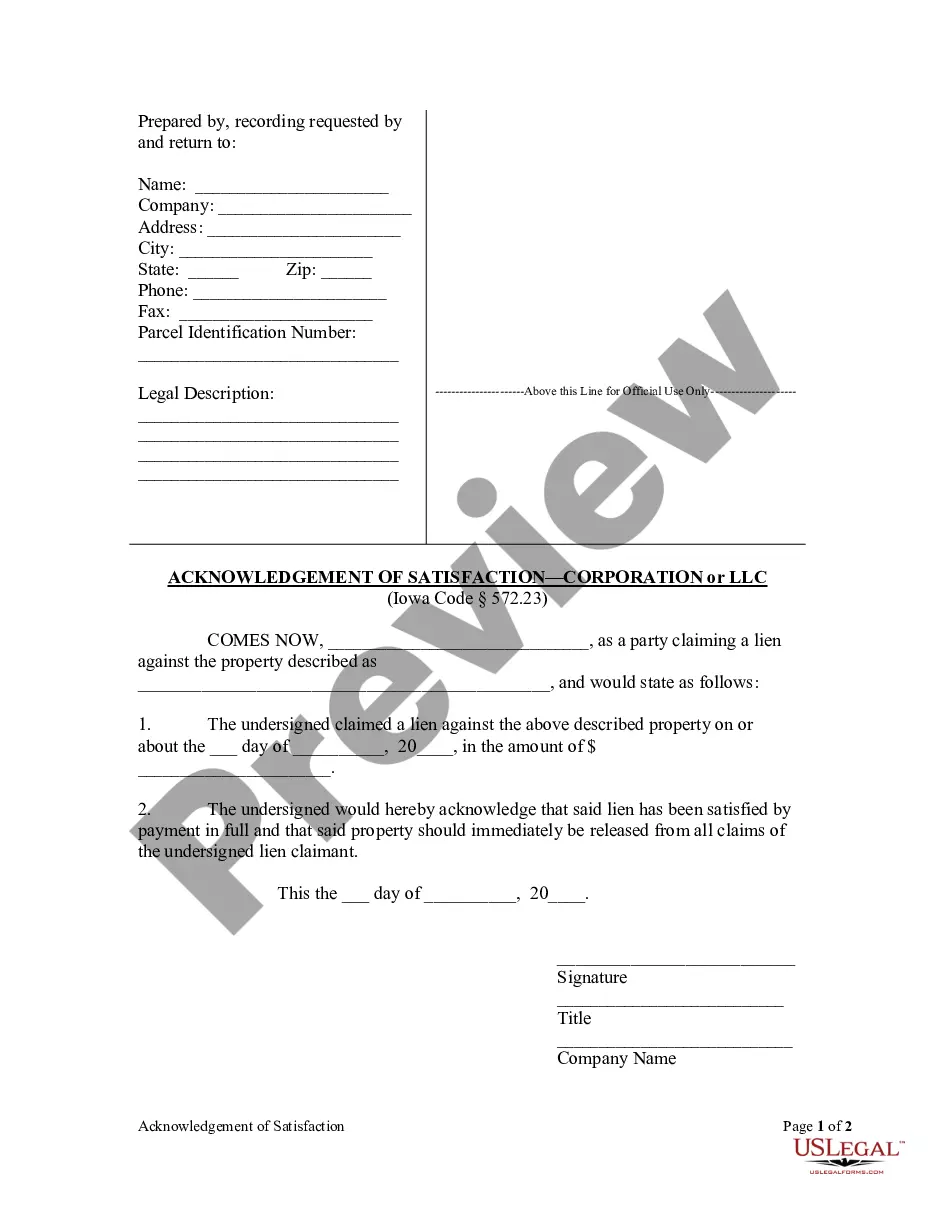

When a lien is satisfied by payment, Iowa law requires the lien holder to acknowledge satisfaction of the lien in the mechanic's lien book or in writing. If necessary, any party with an interest in the property may make a written demand on the lienholder that an acknowledgement of satisfaction be recorded. Failure of the lienholder to acknowledge satisfaction of the lien within thirty (30) days of reciept of the demand will result in the lien holder being held liable for any damages that result from the refusal to comply with the demand.

Iowa Demand to Record Satisfaction by Corporation or LLC

Description

How to fill out Iowa Demand To Record Satisfaction By Corporation Or LLC?

Access one of the most comprehensive collections of approved forms.

US Legal Forms is a platform where you can discover any state-specific document in just a few clicks, such as Iowa Demand to Record Satisfaction by Corporation or LLC samples.

There's no need to waste hours searching for a legally acceptable template. Our certified experts ensure that you receive updated documents every time.

After selecting a pricing plan, create your account. Make payment by card or PayPal. Download the sample to your device by clicking Download. That's it! You should fill out the Iowa Demand to Record Satisfaction by Corporation or LLC form and verify it. To ensure everyone is accurate, consult your local legal advisor for assistance. Join us and easily find more than 85,000 useful templates.

- To utilize the document library, select a subscription and create your account.

- If you have registered, simply Log In and then click Download.

- The Iowa Demand to Record Satisfaction by Corporation or LLC file will automatically be saved in the My documents section (a section for all forms you download from US Legal Forms).

- To create a new account, refer to the brief instructions below.

- If you're required to use a state-specific sample, ensure to indicate the appropriate state.

- If possible, review the description to understand all the details of the form.

- Utilize the Preview option if it’s available to examine the content of the document.

- If everything appears correct, click on the Buy Now button.

Form popularity

FAQ

Yes, an LLC can technically operate without an operating agreement in Iowa. However, it is not advisable as it can lead to confusion among members regarding management and financial obligations. Lacking such a document may result in disputes, which can affect the company's operation and decisions. Thus, for effective governance and to facilitate the Iowa Demand to Record Satisfaction by Corporation or LLC, establishing an operating agreement is wise.

Iowa does not require an operating agreement for an LLC, but having one is beneficial. An operating agreement can help define management roles, decision-making processes, and profit-sharing arrangements. This clarity can prevent misunderstandings and disputes among members. Therefore, when addressing an Iowa Demand to Record Satisfaction by Corporation or LLC, an operating agreement serves as a valuable tool.

Iowa code 489.903 deals with the powers and duties of a limited liability company’s members or managers. This code clarifies how members should conduct business and manage the LLC effectively. Understanding these roles is essential for compliance and operation, especially with procedures linked to the Iowa Demand to Record Satisfaction by Corporation or LLC. Seeking legal advice can assist in implementing these guidelines accurately.

An operating agreement is not legally required for LLCs in Iowa, but it is highly recommended. This document outlines the management structure and operational procedures, providing clarity and stability. By drafting one, LLC members can avoid disputes and streamline decision-making. In relation to the Iowa Demand to Record Satisfaction by Corporation or LLC, having an operating agreement can help in maintaining a solid foundation.

Code 489.907 in Iowa pertains to the procedures for making financial distributions to members of the LLC. This code provides guidelines on how and when profits may be distributed, ensuring fair treatment amongst members. Familiarizing yourself with these guidelines is beneficial when considering the Iowa Demand to Record Satisfaction by Corporation or LLC. Always consult legal expertise to navigate these rules effectively.

To form an LLC in Iowa, you need to file Articles of Organization with the Secretary of State. The state also requires a registered agent to accept service of process on behalf of the LLC. Additionally, while an operating agreement is not legally mandated, having one is recommended. These steps ensure compliance with Iowa’s laws, including those related to the Iowa Demand to Record Satisfaction by Corporation or LLC.

Iowa code 489.116 elaborates on the results of a member's dissociation from an LLC. This code stipulates how the remaining members may handle the departing member’s interest. Understanding this code is crucial for any LLC member or manager in Iowa, especially when dealing with the Iowa Demand to Record Satisfaction by Corporation or LLC. It’s advised to consult legal professionals for in-depth insights.

Not all states require an LLC operating agreement, but it is highly recommended in many, including Iowa. An operating agreement lays out the ownership and management structure of the LLC. While some states may not mandate one, having an operating agreement helps clarify roles and responsibilities among members. Thus, for an Iowa Demand to Record Satisfaction by Corporation or LLC, an operating agreement can be beneficial.