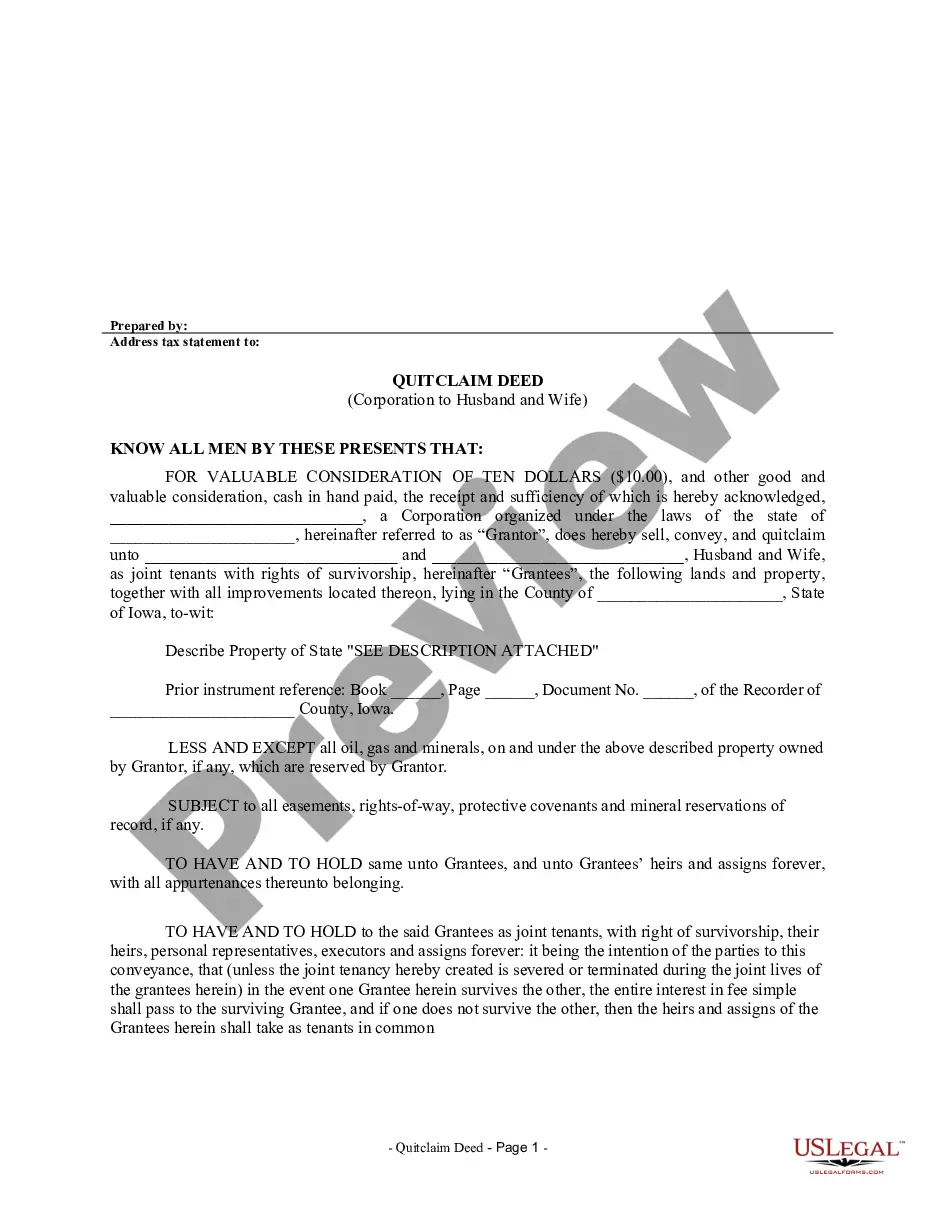

Iowa Quitclaim Deed from Corporation to Husband and Wife

Description

How to fill out Iowa Quitclaim Deed From Corporation To Husband And Wife?

Obtain entry to the most comprehensive collection of sanctioned documents.

US Legal Forms is essentially a platform to locate any state-specific form in just a few clicks, including Iowa Quitclaim Deed from Corporation to Husband and Wife templates.

There's no need to spend countless hours searching for an admissible court form. Our certified professionals ensure that you receive updated samples every time.

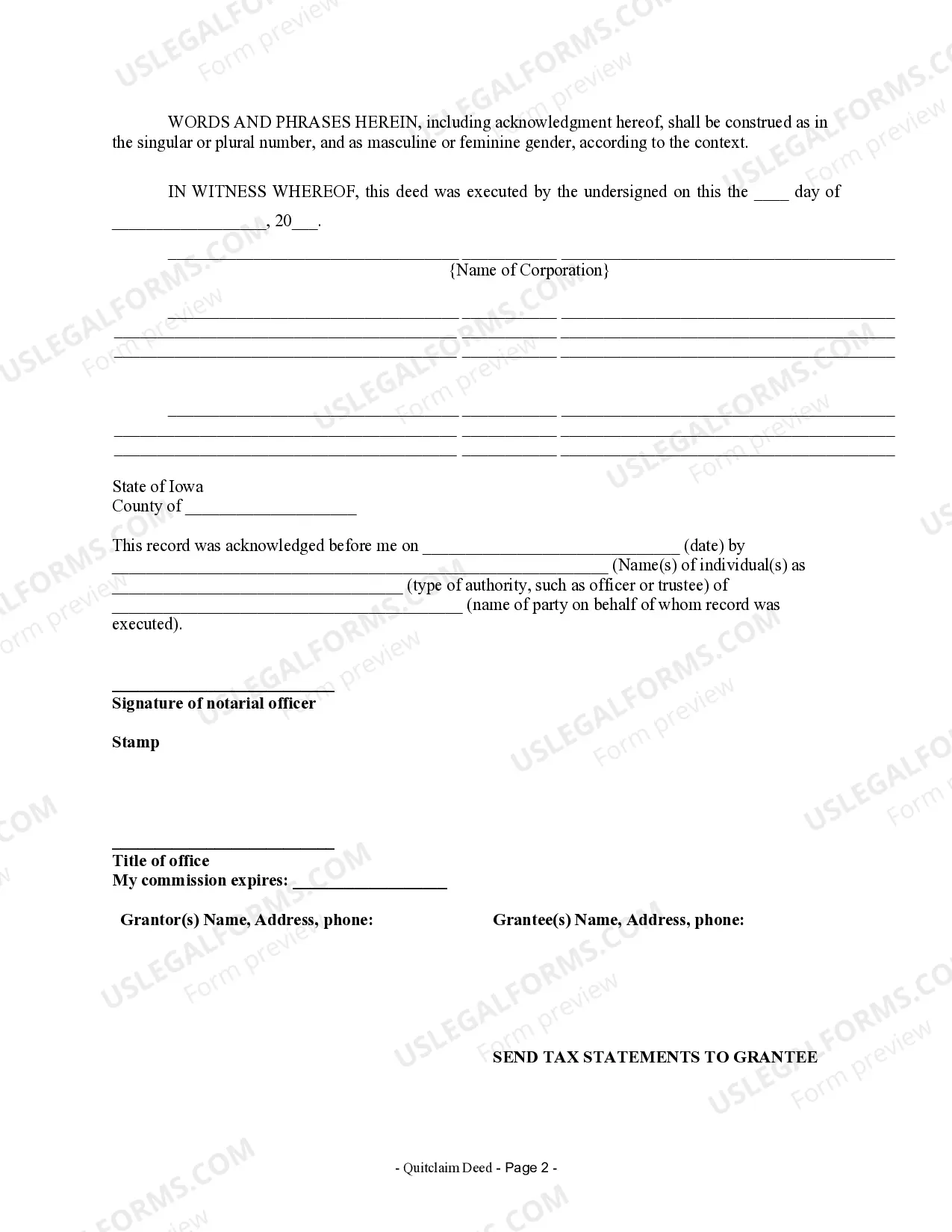

Once everything looks accurate, click the Buy Now button. After selecting a pricing plan, create your account. Make payment via card or PayPal. Download the example to your computer by clicking the Download button. That's all! You should submit the Iowa Quitclaim Deed from Corporation to Husband and Wife template and verify it. To make sure everything is correct, consult your local legal advisor for assistance. Sign up and effortlessly browse more than 85,000 useful samples.

- To utilize the forms library, select a subscription and create your account.

- If you have already set it up, simply Log In and click the Download button.

- The Iowa Quitclaim Deed from Corporation to Husband and Wife template will immediately be saved in the My documents section (a section for each form you download on US Legal Forms).

- To create a new account, adhere to the simple instructions below.

- When intending to use a state-specific document, ensure you specify the correct state.

- If possible, review the description to comprehend all the details of the document.

- Utilize the Preview feature if it’s available to examine the document's content.

Form popularity

FAQ

In Iowa, a quitclaim deed transfers ownership without warranties or guarantees about the property. When you file an 'Iowa Quitclaim Deed from Corporation to Husband and Wife,' you simply convey your interest in the property to your spouse. This type of deed is often used in marital situations, seamlessly transitioning property rights. Always consult legal advice to ensure your deed serves your intentions effectively.

Yes, a title company can assist with a quitclaim deed. When executing an 'Iowa Quitclaim Deed from Corporation to Husband and Wife,' a title company can provide guidance and ensure that the document complies with state laws. They can also help facilitate the required title search and any necessary closing procedures, making the process smoother for you.

To fill out a quitclaim deed to add your spouse, start by downloading the appropriate form for your state, ensuring it reflects the 'Iowa Quitclaim Deed from Corporation to Husband and Wife.' Include the names of both spouses and a legal description of the property. After completing the form, sign it in front of a notary public. Finally, file the deed with your local county recorder’s office to finalize the addition.

Despite its simplicity, a quitclaim deed carries some risks. Most notably, it does not guarantee clear title, which means creditors can still pursue claims against the property. Users should also consider that once the deed is executed, there may be limited recourse for reclaiming ownership or addressing disputes. Consulting with a legal expert is advisable when contemplating an Iowa Quitclaim Deed from Corporation to Husband and Wife.

In Iowa, a quitclaim deed must be in writing, signed by the grantor, and typically notarized. Additionally, it should include a description of the property, ensuring clarity in the transfer. Utilizing a reputable platform like US Legal Forms can simplify this process, providing you with the necessary templates and guidance to comply with Iowa's rules.

A quitclaim deed does not override a will; instead, it transfers ownership of a property directly. With the quitclaim deed, the property immediately goes to the new owner, which can be independent of any will provisions. Therefore, if you are considering an Iowa Quitclaim Deed from Corporation to Husband and Wife, it’s important to review both the deed and any existing wills to avoid conflicts.

Quitclaim deeds are most often used to transfer property between family members or close associates. They are commonly employed in divorce settlements or to add a spouse to the title, ensuring a smooth and quick transfer of ownership. An Iowa Quitclaim Deed from Corporation to Husband and Wife can effectively facilitate these transitions without the complexities of traditional sales.

The primary beneficiaries of an Iowa Quitclaim Deed from Corporation to Husband and Wife are the individuals involved in the transfer. Typically, this deed suits couples wishing to simplify their property ownership without engaging in lengthy legal processes. Since it allows for easy transfer of property rights, family members or partners commonly utilize it to strengthen joint ownership.

Legally, you cannot add someone to a deed without their knowledge, as their consent is required to execute an Iowa Quitclaim Deed from Corporation to Husband and Wife. This type of transaction necessitates the agreement of both parties involved in the ownership. Furthermore, any added individual must sign the deed to ensure a valid transfer of interest.

A quitclaim deed cannot be used to transfer property that is subject to a mortgage without the lender's consent. Additionally, it is not appropriate in transfers involving liens or pending disputes regarding property ownership. You should also consider that a quitclaim deed does not guarantee clear title, so it may not be suitable in complex property situations.