Hawaii UCC1 Financing Statement

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Hawaii UCC1 Financing Statement?

Obtain entry to the most detailed collection of approved formats.

US Legal Forms is essentially a service where you can locate any state-specific document in just a few clicks, such as Hawaii UCC1 Financing Statement examples.

There’s no need to squander multiple hours attempting to locate a court-acceptable form.

After selecting a pricing option, create your account. Pay via credit card or PayPal. Download the template to your computer by clicking Download. That’s all! You should complete the Hawaii UCC1 Financing Statement form and verify it. To ensure that everything is accurate, consult your local legal advisor for assistance. Register and easily browse over 85,000 useful templates.

- To utilize the forms library, choose a subscription and create an account.

- If you have already done this, simply Log In and press the Download button.

- The Hawaii UCC1 Financing Statement document will immediately be saved in the My documents section (a section for every document you save on US Legal Forms).

- To establish a new account, refer to the brief instructions outlined below.

- If you need to use a state-specific template, ensure you select the correct state.

- If possible, review the description to grasp all the details of the document.

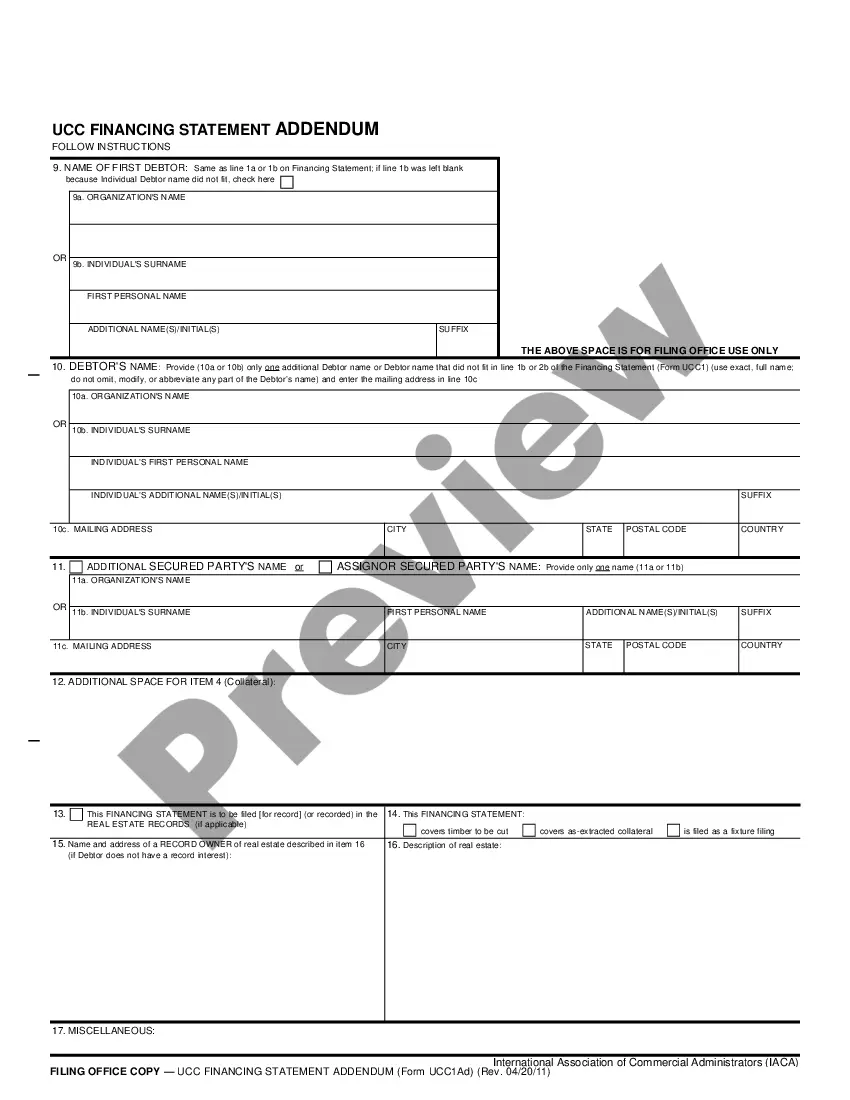

- Utilize the Preview feature if it’s available to examine the document's details.

- If everything seems correct, click on the Buy Now button.

Form popularity

FAQ

To look up a UCC filing, you can access your state's Secretary of State website or a dedicated online database. These resources allow you to search UCC filings by debtor name or filing number. The process is generally straightforward, and platforms like US Legal Forms provide guidance on how to navigate these searches effectively for your Hawaii UCC1 Financing Statement.

1 financing statement is filed with the appropriate state agency, typically the Secretary of State's office, in the state where the debtor is located. This filing provides notice to other potential creditors about the secured interests in the debtor's property. Ensure that you confirm the correct filing location for your Hawaii UCC1 Financing Statement to maintain compliance.

Several factors can contribute to the invalidity of a UCC. Common issues include improper completion of the UCC form, missing signatures, or failures in meeting state-specific filing requirements. It is important to ensure that your Hawaii UCC1 Financing Statement adheres to all legal standards. Using US Legal Forms can help you avoid these pitfalls.

A UCC filing is indeed public information. This means anyone can access details about UCC filings, including the secured parties and the collateral involved. Public access helps maintain transparency in financial transactions, which can benefit creditors and debtors alike. You can easily look up these filings through the US Legal Forms platform.

Yes, a UCC financing statement must be signed by the debtor or a representative on their behalf. This signature indicates consent and acknowledgment of the financing arrangement. To ensure compliance with legal requirements, consider using a reliable platform like US Legal Forms when preparing your Hawaii UCC1 Financing Statement.

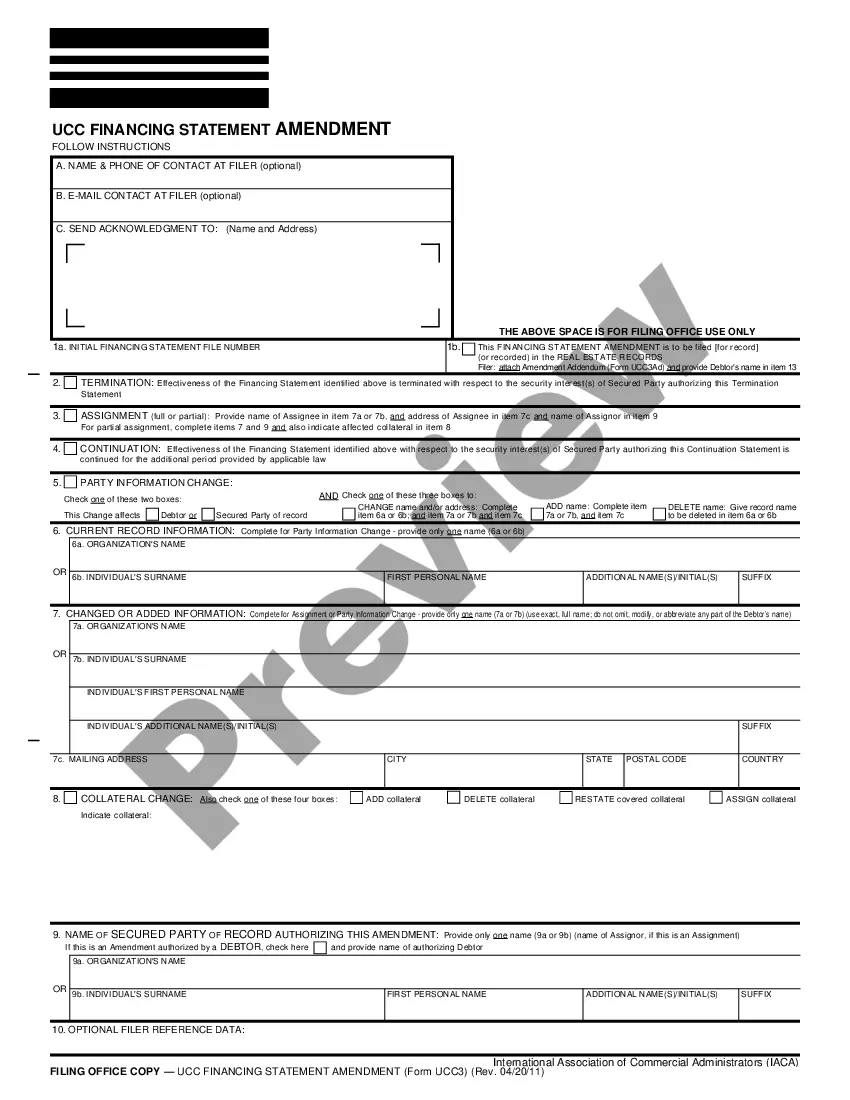

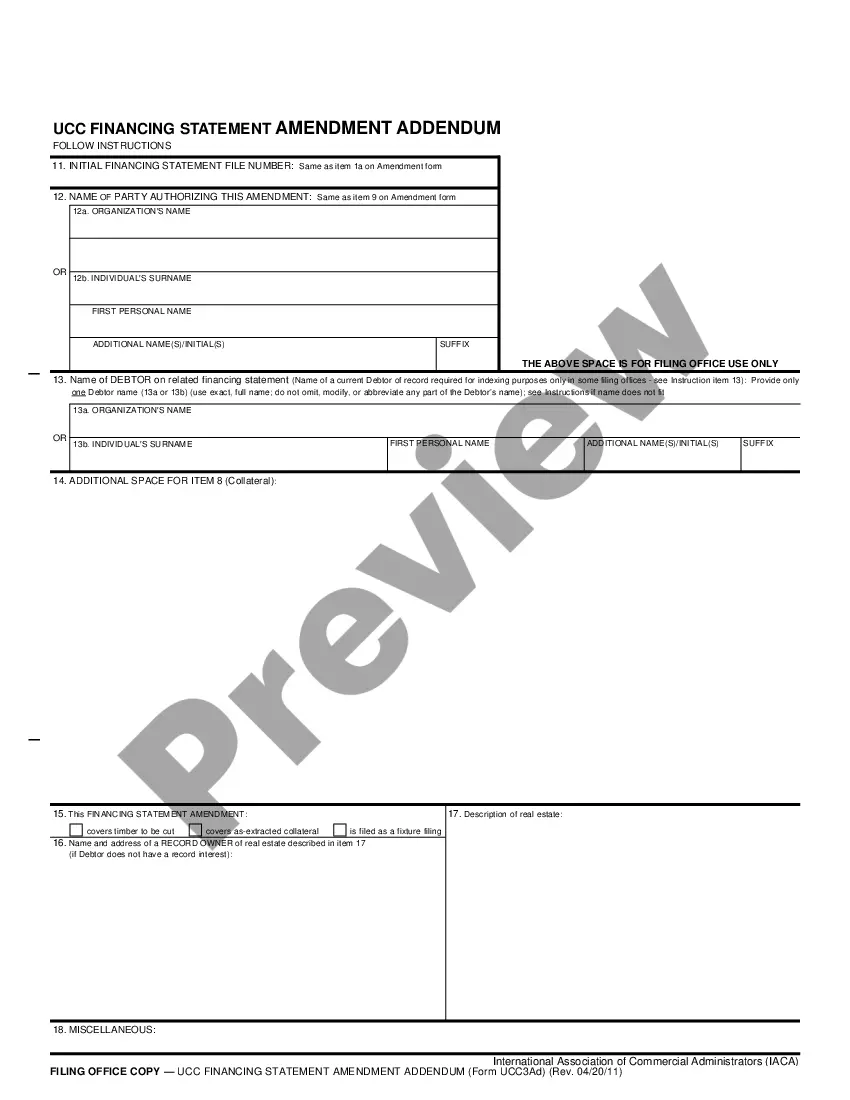

A UCC financing statement can be assigned to another party as part of the secured transaction. The necessary steps should be followed to ensure the assignment is valid and legally recognized. It is crucial to complete the proper paperwork to avoid any confusion in the future. The US Legal Forms platform can guide you through the assignment of your Hawaii UCC1 Financing Statement.

Yes, a UCC can be assigned. When an original secured party wants to transfer their rights, they can assign the UCC to another party. This assignment must be documented properly for it to be legally binding. Consider using the US Legal Forms platform to simplify the process of assigning your Hawaii UCC1 Financing Statement.

Filling out a Hawaii UCC1 Financing Statement involves several important steps. Start by providing the full legal names and addresses of both the debtor and the secured party. Next, describe the collateral in detail to specify what is secured. Finally, review the document for accuracy and file it with the appropriate state office, making use of USLegalForms’ platform can streamline this process and offer helpful templates.

In a Hawaii UCC1 Financing Statement, the grantee is the individual or entity receiving a security interest in the collateral. This can include lenders or creditors who have extended credit in exchange for the right to claim specific assets if the borrower defaults. It is essential to accurately identify the grantee to ensure proper recording and enforceability of the security interest. For the best guidance on completing a UCC1 financing statement, consider using resources from USLegalForms.

To properly file a UCC-1 financing statement, you must include the debtor's name, the secured party's name, and a description of the collateral involved. Each detail must be clearly stated to avoid confusion or misinterpretation. By accurately completing these elements in your Hawaii UCC1 financing statement, you enhance your chances of securing your rights effectively.