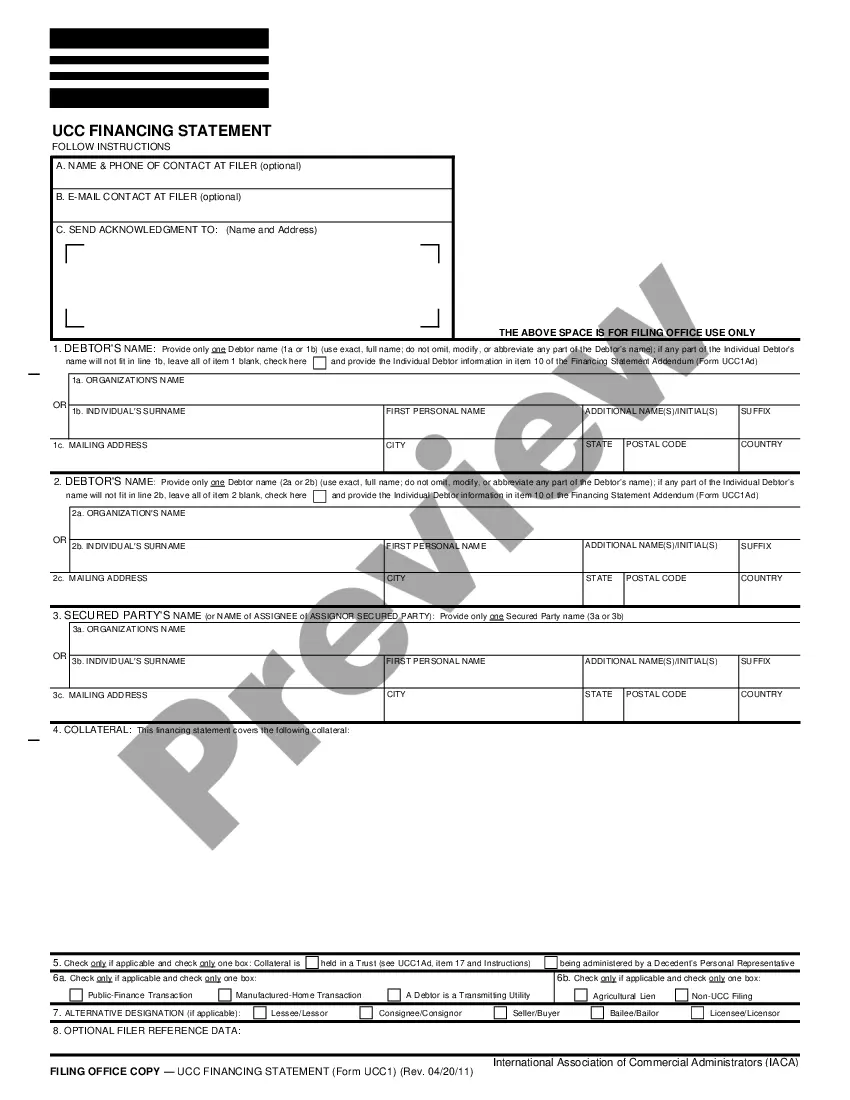

Hawaii UCC1 Financing Statement Addendum

Description

How to fill out Hawaii UCC1 Financing Statement Addendum?

Obtain access to one of the most comprehensive collections of sanctioned forms.

US Legal Forms is truly a platform where you can locate any state-specific document in just a few clicks, including examples of the Hawaii UCC1 Financing Statement Addendum.

No need to squander your time searching for a form that is acceptable in court.

If everything appears correct, click Buy Now. After selecting a pricing plan, create your account. Pay via credit card or PayPal. Download the sample to your computer by clicking on the Download button. That's it! You should complete the Hawaii UCC1 Financing Statement Addendum form and review it. To confirm that everything is accurate, consult your local legal counsel for assistance. Register and effortlessly discover more than 85,000 useful templates.

- To utilize the forms library, choose a subscription and create an account.

- If you have registered, simply Log In and click on the Download button.

- The sample of the Hawaii UCC1 Financing Statement Addendum will automatically save in the My documents tab (a tab for each form you download from US Legal Forms).

- To establish a new account, follow the short guidelines provided below.

- If you plan to use a state-specific example, ensure you indicate the correct state.

- If possible, read the description to grasp all of the details of the form.

- Use the Preview feature if it’s available to view the document's contents.

Form popularity

FAQ

A UCC fixture filing must be made with the state office that handles UCC filings, typically where the debtor is located. In Hawaii, this is also done through the Department of Commerce and Consumer Affairs. It's essential to clarify that your fixture filing is attached to real property. For assistance in filing your UCC fixture filing and ensuring compliance, US Legal Forms provides helpful resources for your Hawaii UCC1 Financing Statement Addendum.

You should file your UCC-1 statement with the appropriate state office, typically the Secretary of State in that jurisdiction. In Hawaii, this is done through the Department of Commerce and Consumer Affairs. Filing in the right location helps protect your secured interest in the collateral. Consider using US Legal Forms for easy access to the necessary forms to file your Hawaii UCC1 Financing Statement Addendum.

Yes, a UCC financing statement can be assigned to another party through an assignment process. This involves transferring your rights to the collateral listed in the UCC filing to the new party. It is necessary to ensure that the assignment is properly documented to maintain the validity of the security interest. If you are considering an assignment, US Legal Forms can help you with the necessary paperwork for your Hawaii UCC1 Financing Statement Addendum.

UCCs should be filed with the Secretary of State's office or a similar designated authority in the state where the debtor operates. In Hawaii, these filings specifically go through the Department of Budget and Finance. Accurate filing is critical for public notice of your secured interest. You can use US Legal Forms to access the necessary forms and streamline the filing process for your Hawaii UCC1 Financing Statement Addendum.

UCC filings need to be made in the state where the debtor is located, not necessarily where the collateral is situated. This means that if the debtor resides or conducts business in Hawaii, you should file your UCC-1 financing statement there. It's important to correctly identify the debtor's location, as this affects the validity of your filing. Consider using US Legal Forms for guidance to ensure you're filing in the correct state with your Hawaii UCC1 Financing Statement Addendum.

You can file your UCC-1 financing statement with the appropriate state authority where the debtor is located. For Hawaii, you can specifically use the Office of Elections and the Bureau of Conveyances. Filing is crucial as it establishes your claim to the collateral described in your statement. Utilizing platforms like US Legal Forms can simplify the filing process and ensure accuracy for your Hawaii UCC1 Financing Statement Addendum.

Several factors can render a UCC financing statement invalid, including incorrect debtor information, failure to provide necessary details, or misfiling in the wrong jurisdiction. Understanding these pitfalls is vital to maintaining the enforceability of your security interest. To help avoid mistakes, you can access templates and resources on US Legal Forms designed to support your filing process.

You must file a UCC-1 financing statement with the appropriate state office, typically the Secretary of State's office. In Hawaii, you can file online or in person, depending on your preference. It is crucial to file in the right location to maintain the validity of your security interest. For assistance with the filing process, consider using US Legal Forms for detailed guidance.

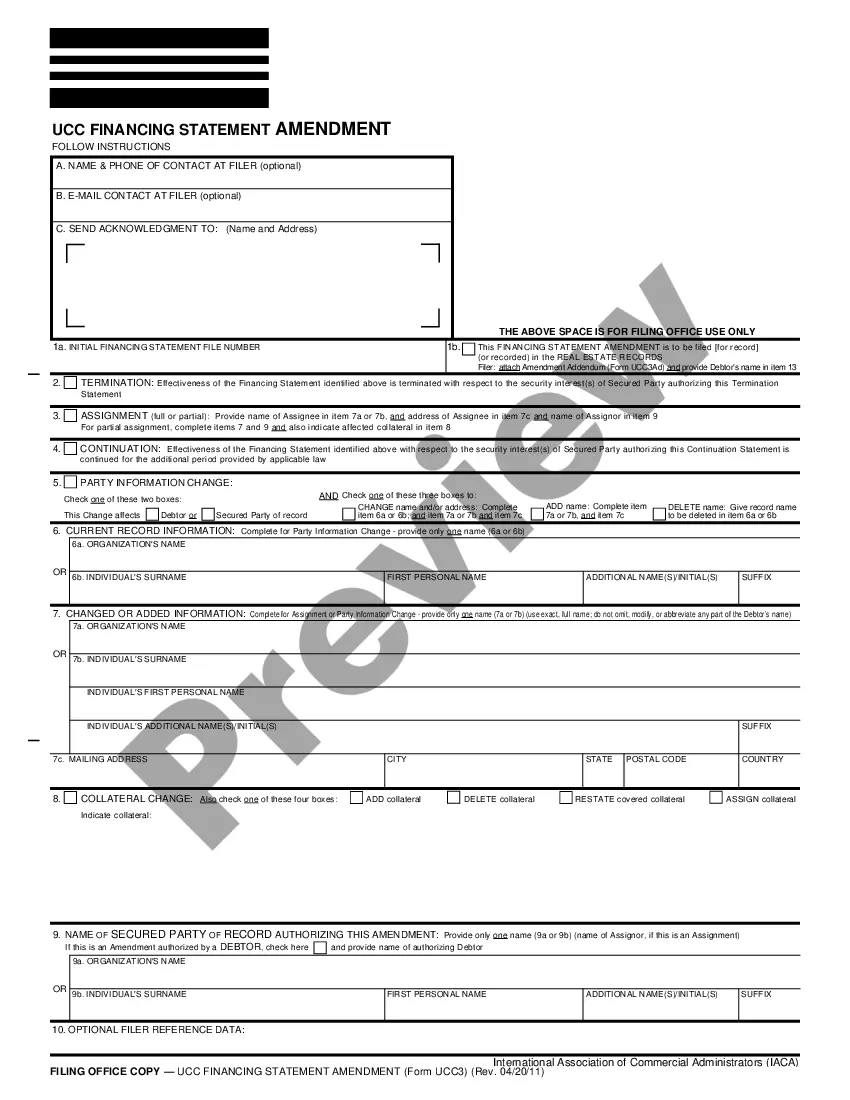

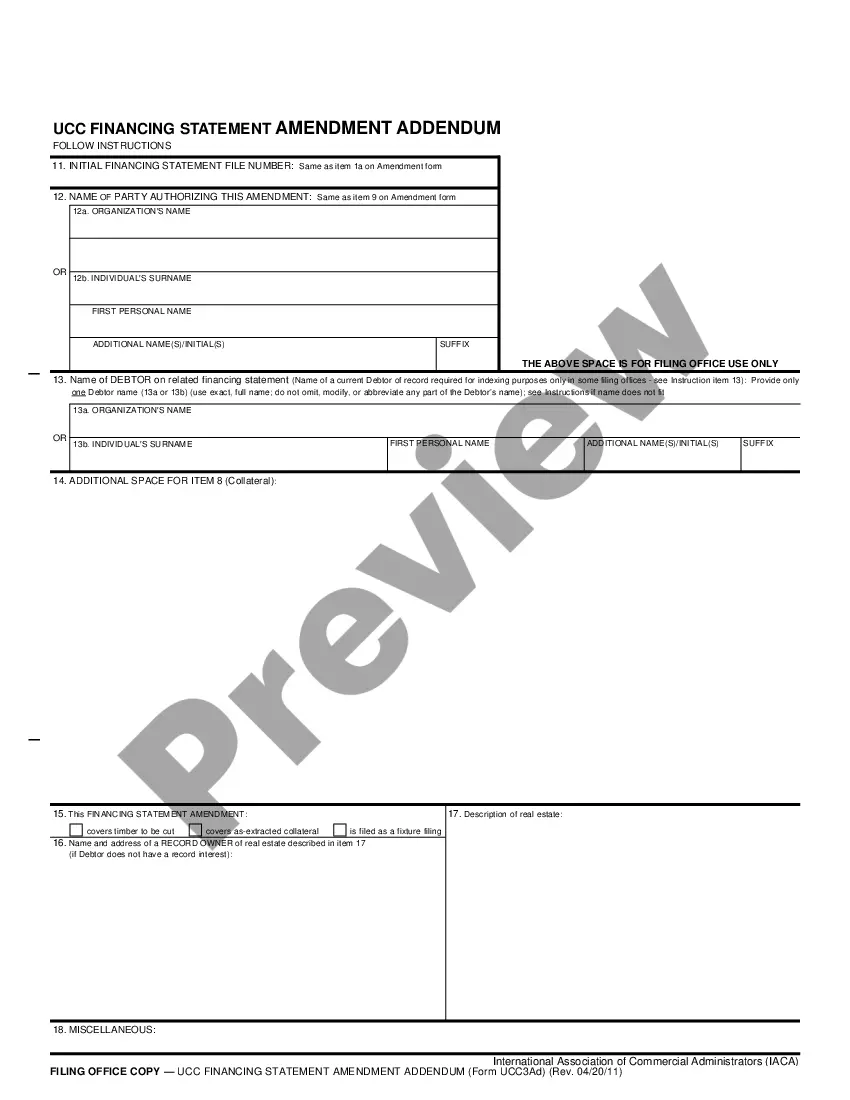

A UCC financing statement amendment refers to a document filed to change or correct information in the original financing statement. Updates might include changes in the debtor's name or the addition of new collateral. Submitting an amendment ensures your records remain accurate and up-to-date. To learn more about filing amendments, you can rely on the tools offered by US Legal Forms.

The grantee on a UCC financing statement is the individual or entity that holds a security interest in the assets of the debtor. This person or organization benefits from the financing statement as it provides notice of their claim. Understanding the role of the grantee is crucial for maintaining accurate records. For more information on this topic, check out the resources on US Legal Forms.