Hawaii Assignments of Contracts and Agreements Form B

Description

How to fill out Assignments Of Contracts And Agreements Form B?

Are you currently in a place that you require files for possibly organization or individual purposes virtually every working day? There are tons of legal document themes available online, but locating kinds you can rely on isn`t simple. US Legal Forms delivers 1000s of type themes, like the Hawaii Assignments of Contracts and Agreements Form B, which can be created to fulfill federal and state specifications.

If you are previously informed about US Legal Forms site and possess an account, just log in. Afterward, you may obtain the Hawaii Assignments of Contracts and Agreements Form B format.

Should you not offer an account and want to start using US Legal Forms, abide by these steps:

- Find the type you want and ensure it is for the appropriate metropolis/state.

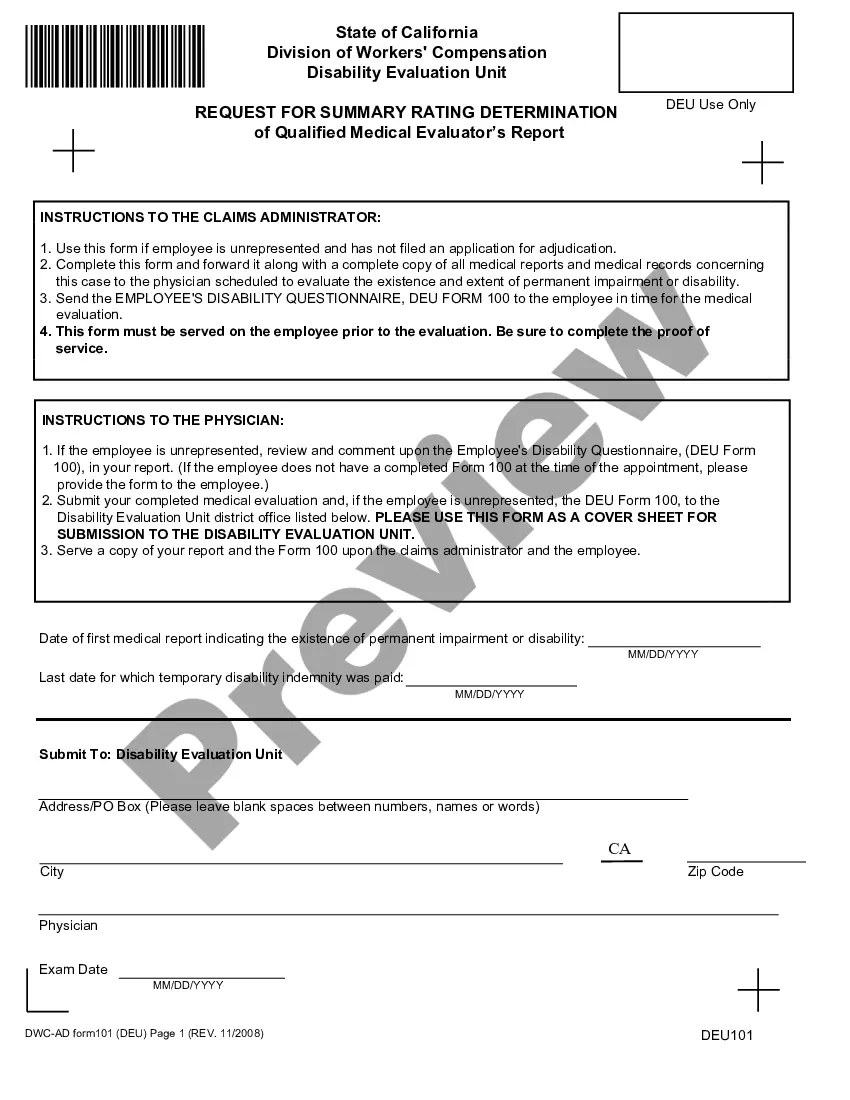

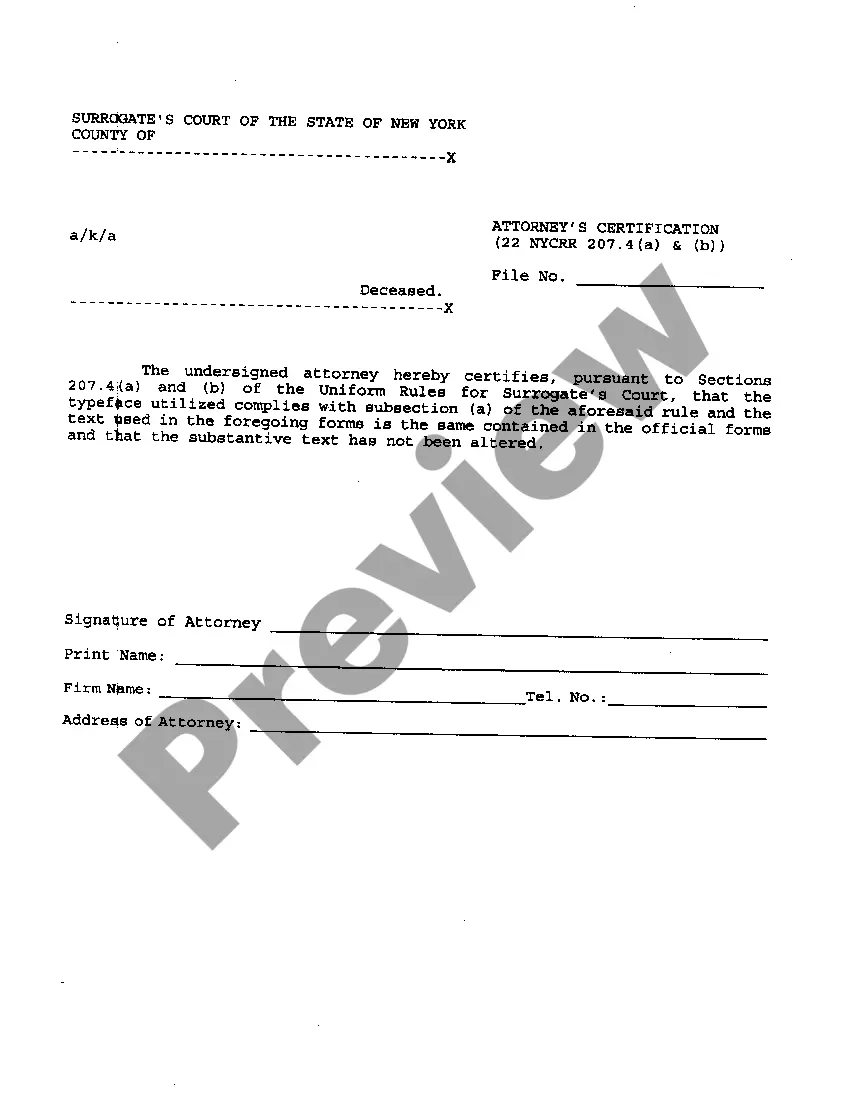

- Use the Preview switch to analyze the shape.

- Browse the outline to actually have selected the correct type.

- If the type isn`t what you`re trying to find, take advantage of the Look for area to obtain the type that meets your requirements and specifications.

- Whenever you obtain the appropriate type, click Get now.

- Select the costs prepare you would like, submit the desired information to produce your money, and pay money for your order with your PayPal or charge card.

- Select a hassle-free document structure and obtain your copy.

Find every one of the document themes you may have bought in the My Forms menu. You can get a additional copy of Hawaii Assignments of Contracts and Agreements Form B whenever, if needed. Just click the required type to obtain or print out the document format.

Use US Legal Forms, one of the most considerable selection of legal forms, in order to save time and steer clear of faults. The assistance delivers expertly manufactured legal document themes which can be used for a range of purposes. Produce an account on US Legal Forms and commence creating your life a little easier.

Form popularity

FAQ

Conveyance tax is not imposed on a lease or sublease whose full unexpired term is for a period less than five years. Minimum tax on each transaction is $1.00.

How Is the Conveyance Tax Determined? One dollar and twenty-five cents ($1.25) per $100 of the actual and full consideration for properties with a value of $10,000,000 or greater . The conveyance tax imposed for each transaction shall be not less than one dollar ($1.00).

Form A-6 may be used to get both a state tax clearance and a federal tax clearance. If you need to get a tax clearance from both agencies, you should submit a separate Form A-6 to each agency. (By appointment only. To make an appointment, please call 844-545-5640.)

Form G-49 is a summary of your activity for the entire year. This return must be filed in addition to Periodic General Excise/Use Tax Return (Form G-45). Form G-49 is used by the taxpayer to reconcile their account for the entire year.

Form P-64B is used to request an exemption from the conveyance tax. Depending on the type of transaction, Form P-64B must either be (1) submitted to the Department of Taxation, Technical Section for approval of the exemption, or (2) filed directly with the BOC.

The person responsible for the tax is generally the transferor, grantor, lessor, sublessor, conveyor, or other person conveying the real property interest (HRS §247-3). The ® standard purchase contract directs escrow to charge the conveyance tax to the seller.

In Hawaii, one must complete Form P-64A issued by the Hawaii Department of Taxation to report the amount paid for the sale/transfer of the real estate to pay the Conveyance Tax.