Hawaii Partial Release of Lien on Assigned Overriding Royalty Interest

Description

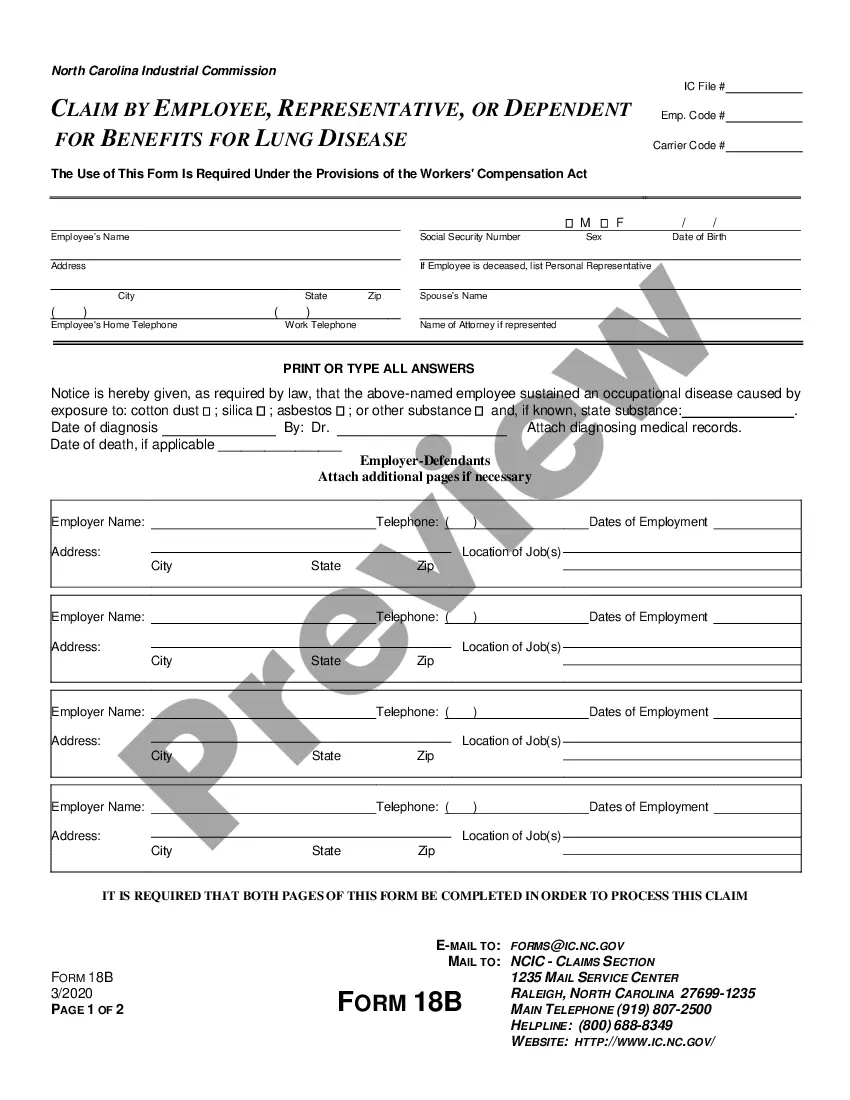

How to fill out Partial Release Of Lien On Assigned Overriding Royalty Interest?

US Legal Forms - among the biggest libraries of lawful varieties in the United States - delivers a wide range of lawful record web templates you are able to acquire or print. Using the internet site, you will get thousands of varieties for business and personal functions, categorized by categories, states, or search phrases.You will discover the most up-to-date variations of varieties much like the Hawaii Partial Release of Lien on Assigned Overriding Royalty Interest in seconds.

If you already possess a membership, log in and acquire Hawaii Partial Release of Lien on Assigned Overriding Royalty Interest through the US Legal Forms local library. The Down load switch will appear on every single kind you view. You gain access to all previously saved varieties in the My Forms tab of your own bank account.

In order to use US Legal Forms for the first time, listed below are basic instructions to get you started out:

- Be sure to have chosen the correct kind for your personal metropolis/area. Click on the Review switch to analyze the form`s content material. Look at the kind outline to ensure that you have chosen the right kind.

- If the kind does not satisfy your requirements, take advantage of the Research discipline at the top of the display to find the the one that does.

- In case you are content with the form, confirm your choice by clicking on the Acquire now switch. Then, opt for the pricing program you prefer and supply your qualifications to register for the bank account.

- Process the financial transaction. Make use of your bank card or PayPal bank account to complete the financial transaction.

- Choose the formatting and acquire the form on your own device.

- Make modifications. Complete, modify and print and indication the saved Hawaii Partial Release of Lien on Assigned Overriding Royalty Interest.

Every single template you included in your money does not have an expiration time and is yours permanently. So, if you would like acquire or print yet another backup, just go to the My Forms area and then click about the kind you want.

Get access to the Hawaii Partial Release of Lien on Assigned Overriding Royalty Interest with US Legal Forms, one of the most considerable local library of lawful record web templates. Use thousands of specialist and state-distinct web templates that meet your business or personal requirements and requirements.

Form popularity

FAQ

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

What Determines the Value of an Overriding Royalty Interest? Mineral interest location. One in a shale basin with high production is worth more. Producing oil and gas wells. Wells currently producing are valued more. ... Production reserves and levels. ... Prices.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

Here is a field-by-field breakdown of this form: Name of Claimant. This is the name the party to be paid, and the party who will be signing the lien waiver document. ... Name of Customer. ... Job Location. ... Owner. ... Maker of the Check. ... Amount of the Check. ... Check Payable To. ... Exceptions.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

Any person claiming a lien shall apply therefor to the circuit court of the circuit where the property is situated. Such "Application For A Lien" shall be accompanied by a written "Notice Of Lien" setting forth the alleged facts by virtue of which the person claims a lien.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.