Hawaii Electronics Assembly Agreement - Self-Employed Independent Contractor

Description

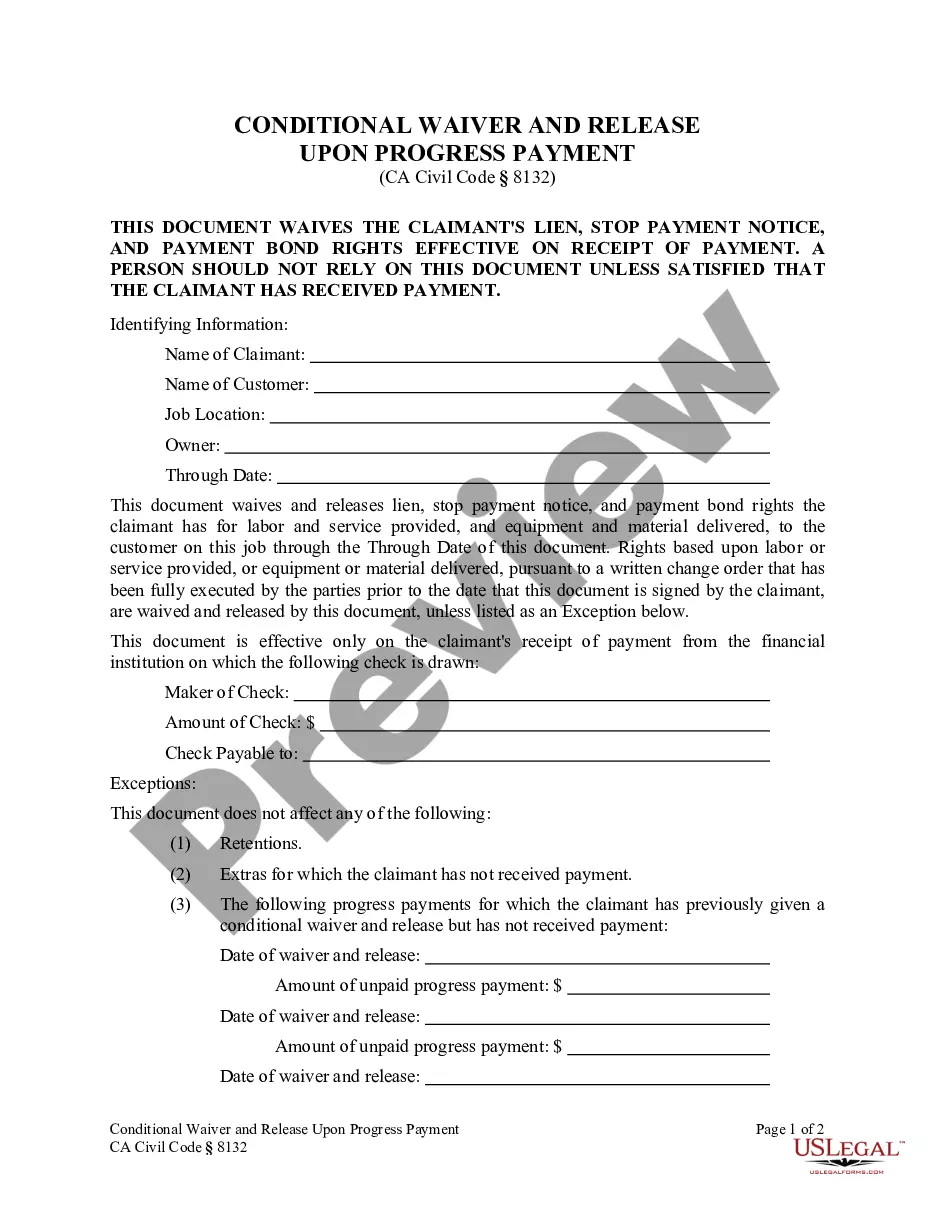

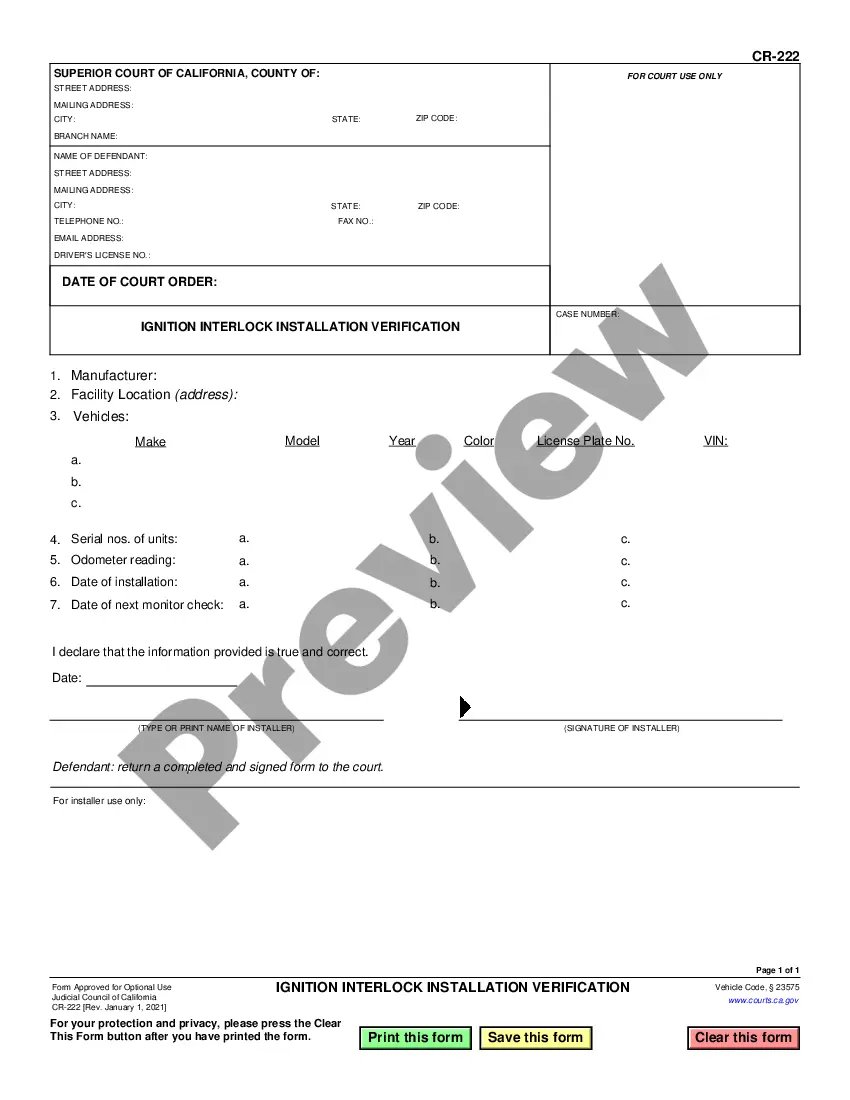

How to fill out Electronics Assembly Agreement - Self-Employed Independent Contractor?

Have you ever been in a location where you require documentation for both business or personal activities almost every day.

There are numerous legal document templates accessible online, but locating ones you can trust is not easy.

US Legal Forms provides thousands of form templates, including the Hawaii Electronics Assembly Agreement - Self-Employed Independent Contractor, designed to comply with federal and state regulations.

Once you find the right form, click on Buy now.

Select the payment plan you desire, complete the required information to create your account, and pay for your order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Hawaii Electronics Assembly Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Search for the form you need and ensure it is appropriate for the correct state/county.

- Use the Preview button to examine the form.

- Read the description to verify that you have selected the correct document.

- If the form is not what you are looking for, utilize the Search box to find the document that meets your needs and requirements.

Form popularity

FAQ

Creating an independent contractor agreement involves several essential steps. First, define the scope of work, including specific tasks and deadlines. Next, outline payment terms and conditions, ensuring both parties understand compensation expectations. By utilizing resources like USLegalForms, you can easily access templates for a Hawaii Electronics Assembly Agreement - Self-Employed Independent Contractor, streamlining the process and ensuring your contract meets legal requirements.

While Hawaii does not mandate an operating agreement for LLCs, it is highly recommended. An operating agreement outlines the management structure and operating procedures of the LLC, ensuring clarity among members. For those entering a Hawaii Electronics Assembly Agreement - Self-Employed Independent Contractor, having this document can protect your interests and lay the groundwork for successful collaboration.

The new federal rule on independent contractors aims to provide clearer guidelines for determining worker status. This regulation focuses on the nature of the working relationship and independence of the contractor. If you are engaging in a Hawaii Electronics Assembly Agreement - Self-Employed Independent Contractor, understanding these rules can help you navigate your rights and responsibilities.

The new 1099 law, which affects many independent contractors, requires that businesses report payments made to contractors if they exceed a certain amount. This change seeks to enhance transparency and compliance for both contractors and the IRS. Those operating under a Hawaii Electronics Assembly Agreement - Self-Employed Independent Contractor should be aware of how this affects income reporting.

Yes, the IRS is increasing its scrutiny of 1099 employees to ensure proper tax compliance. They are focusing on independent contractor misclassification, so it's crucial to keep detailed records of income and expenses. If you are working under a Hawaii Electronics Assembly Agreement - Self-Employed Independent Contractor, be prepared to meet tax obligations accurately.

In Hawaii, you can undertake specific contracting work without a license as long as it falls below a monetary threshold. However, any construction projects exceeding $1,000 require a valid contractor license. Engaging in a Hawaii Electronics Assembly Agreement - Self-Employed Independent Contractor may allow you to work without a license in certain contexts, so it is essential to stay informed about local regulations.

The new federal rule for independent contractors clarifies the criteria used to determine worker classification. It emphasizes the importance of control over work and dependencies between the contractor and the client. This rule impacts those working under a Hawaii Electronics Assembly Agreement - Self-Employed Independent Contractor, ensuring that businesses accurately classify their workers.

Yes, having a contract as an independent contractor is crucial for both parties involved. A well-drafted contract clarifies expectations, outlines project details, and protects against potential disputes. Make sure to formalize your working relationship with a Hawaii Electronics Assembly Agreement - Self-Employed Independent Contractor, which can be easily created through the helpful tools available on uslegalforms.

Writing an independent contractor agreement requires careful attention to detail. Begin with a title that specifies it as an independent contractor agreement, followed by a section detailing the parties involved. Include key sections such as scope of work, payment terms, confidentiality, and termination clauses to ensure both parties understand their responsibilities. Using uslegalforms can provide valuable templates to create a solid Hawaii Electronics Assembly Agreement - Self-Employed Independent Contractor.

Filling out an independent contractor agreement can seem daunting, but it becomes easier with a clear understanding of the necessary components. Start by including the names and contact details of both parties, the description of the services to be provided, and the payment terms. This can be effectively managed using the resources available through uslegalforms, allowing you to confidently create a comprehensive Hawaii Electronics Assembly Agreement - Self-Employed Independent Contractor.