Hawaii Hauling Services Contract - Self-Employed

Description

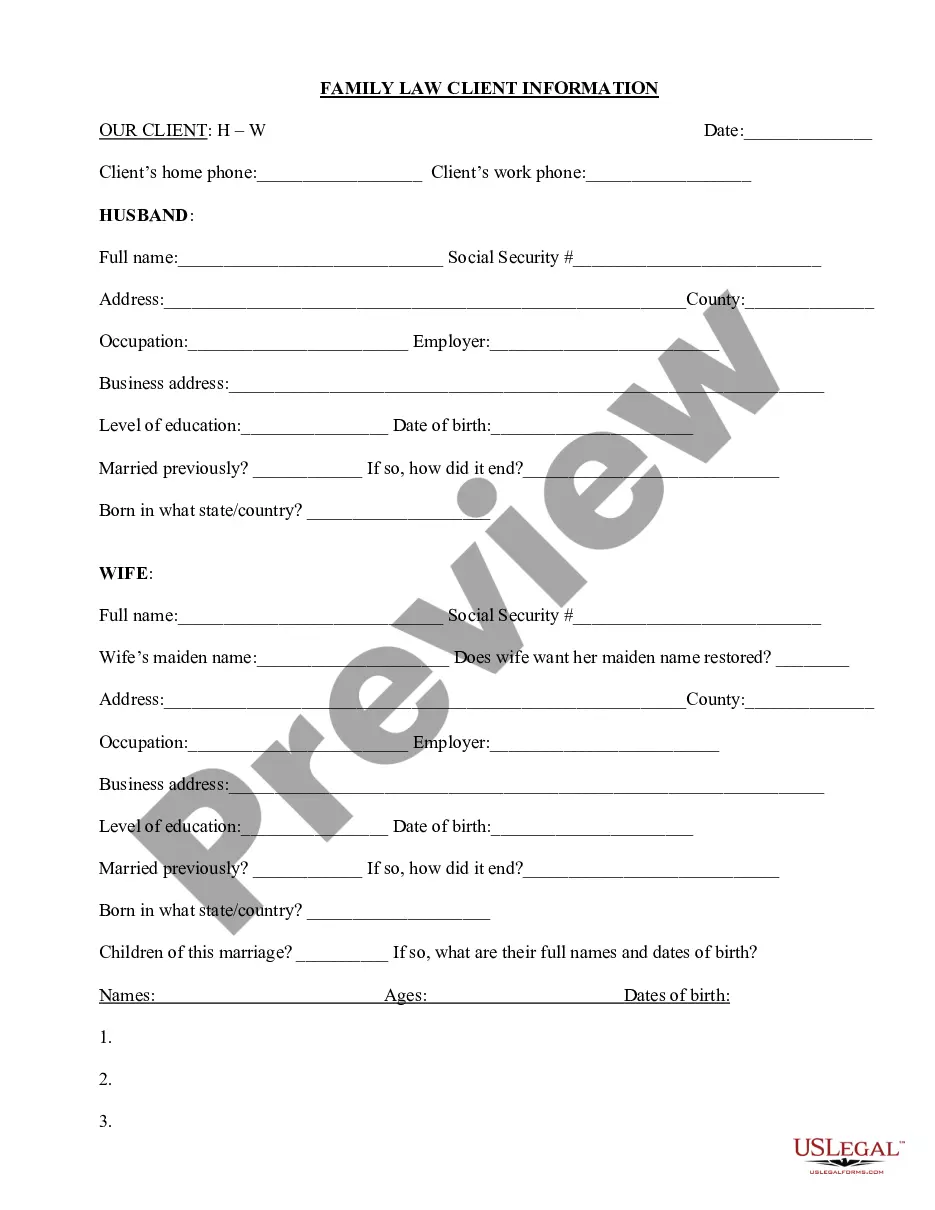

How to fill out Hauling Services Contract - Self-Employed?

If you need to complete, acquire, or create authentic document templates, utilize US Legal Forms, the largest collection of legal forms available online. Take advantage of the site’s simple and user-friendly search to find the documents you require. Numerous templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to obtain the Hawaii Hauling Services Contract - Self-Employed in just a few clicks.

If you are already a US Legal Forms user, sign in to your account and click the Download button to get the Hawaii Hauling Services Contract - Self-Employed. You can also access forms you previously downloaded from the My documents section of your account.

If this is your first time using US Legal Forms, follow the instructions below: Step 1. Ensure you have selected the form for the correct region/state. Step 2. Use the Preview option to review the form’s content. Don’t forget to read the details. Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template. Step 4. Once you have identified the form you need, click the Get Now button. Choose your preferred payment method and enter your information to register for an account. Step 5. Process the transaction. You can use your credit card or PayPal account to complete the payment. Step 6. Select the format of your legal form and download it to your device. Step 7. Complete, edit, and print or sign the Hawaii Hauling Services Contract - Self-Employed.

- Every legal document template you purchase is your property indefinitely.

- You have access to every form you downloaded through your account.

- Select the My documents section and choose a form to print or download again.

- Act swiftly and obtain, and print the Hawaii Hauling Services Contract - Self-Employed with US Legal Forms.

- There are millions of professional and state-specific forms available for your business or personal needs.

- Make sure to explore the various options provided.

- Utilize the resources effectively to meet your legal documentation requirements.

Form popularity

FAQ

To engage in work as an independent contractor under a Hawaii Hauling Services Contract - Self-Employed, you must meet specific legal requirements. First, you need to register your business with the Hawaii Department of Commerce and Consumer Affairs. Additionally, ensure that you have the necessary licenses and permits to operate in your area. It is also crucial to understand tax obligations, such as self-employment tax, to comply fully with local laws.

Writing a self-employment contract involves outlining the nature of services, payment details, and responsibilities. Clearly state the terms, including termination conditions and confidentiality obligations. That contract protects both you and your client while ensuring a clear understanding of expectations. For those in the hauling sector, a Hawaii Hauling Services Contract - Self-Employed template can provide a useful starting point.

To demonstrate that you are self-employed, gather documents such as tax returns, invoices, and client contracts that reflect your independent work. Additionally, maintaining a business bank account and keeping business-related expenses can further validate your status. If you're in the hauling services industry, a well-crafted Hawaii Hauling Services Contract - Self-Employed can act as strong documentation of your self-employment.

Yes, you can write your own legally binding contract, provided it includes essential elements like offer, acceptance, consideration, and mutual intent. Make sure each party clearly understands the terms of the agreement. For added assurance, consider using resources or templates specifically designed for contracts in your field, such as a Hawaii Hauling Services Contract - Self-Employed template.

When drafting a contract for a 1099 employee, first define the scope of work and ensure it aligns with IRS guidelines. Include payment terms, deadlines, and any specific requirements for the job. It’s important to clarify the independent nature of the relationship to distinguish it from traditional employment. A Hawaii Hauling Services Contract - Self-Employed template can serve as a tool to create an effective contract.

To write a self-employed contract, start by clearly identifying the parties involved, including their legal names and addresses. Next, outline the specific services you will provide, along with deadlines and payment terms. Finally, ensure both parties understand their obligations by including clauses related to termination, confidentiality, and liability. Utilizing a template designed for a Hawaii Hauling Services Contract - Self-Employed can simplify this process.

Yes, contractors typically need a license to operate legally in Hawaii for most construction-related services. Specific licensing requirements vary depending on the type of work being performed and the contract value. Before entering any Hawaii Hauling Services Contract - Self-Employed, make sure you or your contractor holds the necessary licenses to prevent legal issues.

The new federal rule for independent contractors, implemented to provide clarity on worker classifications, emphasizes the degree of control a business has over its workers. This rule affects how you classify yourself under a Hawaii Hauling Services Contract - Self-Employed. Staying updated on these changes will help you ensure compliance and maintain your independent status.

While an operating agreement is not required by law for an LLC in Hawaii, it is highly recommended. This document outlines the management structure and operational guidelines for your business, providing clarity and structure. Using an operating agreement can be beneficial when forming your Hawaii Hauling Services Contract - Self-Employed to ensure all parties are on the same page.

To qualify as an independent contractor, you must meet specific criteria set by IRS guidelines. Typically, this means demonstrating control over your work, having a distinct business setup, and managing financial risk. Understanding how these qualifications relate to your Hawaii Hauling Services Contract - Self-Employed can make your experience smoother and more professional.