Hawaii General Agreement

Description

How to fill out General Agreement?

Finding the right legal papers web template might be a struggle. Obviously, there are a variety of themes accessible on the Internet, but how do you obtain the legal form you want? Use the US Legal Forms web site. The support provides thousands of themes, such as the Hawaii General Agreement, that you can use for enterprise and private needs. Each of the varieties are inspected by pros and fulfill state and federal specifications.

When you are currently registered, log in to the accounts and then click the Download switch to obtain the Hawaii General Agreement. Make use of your accounts to check through the legal varieties you might have bought previously. Go to the My Forms tab of your own accounts and get an additional backup of the papers you want.

When you are a fresh end user of US Legal Forms, allow me to share easy directions for you to follow:

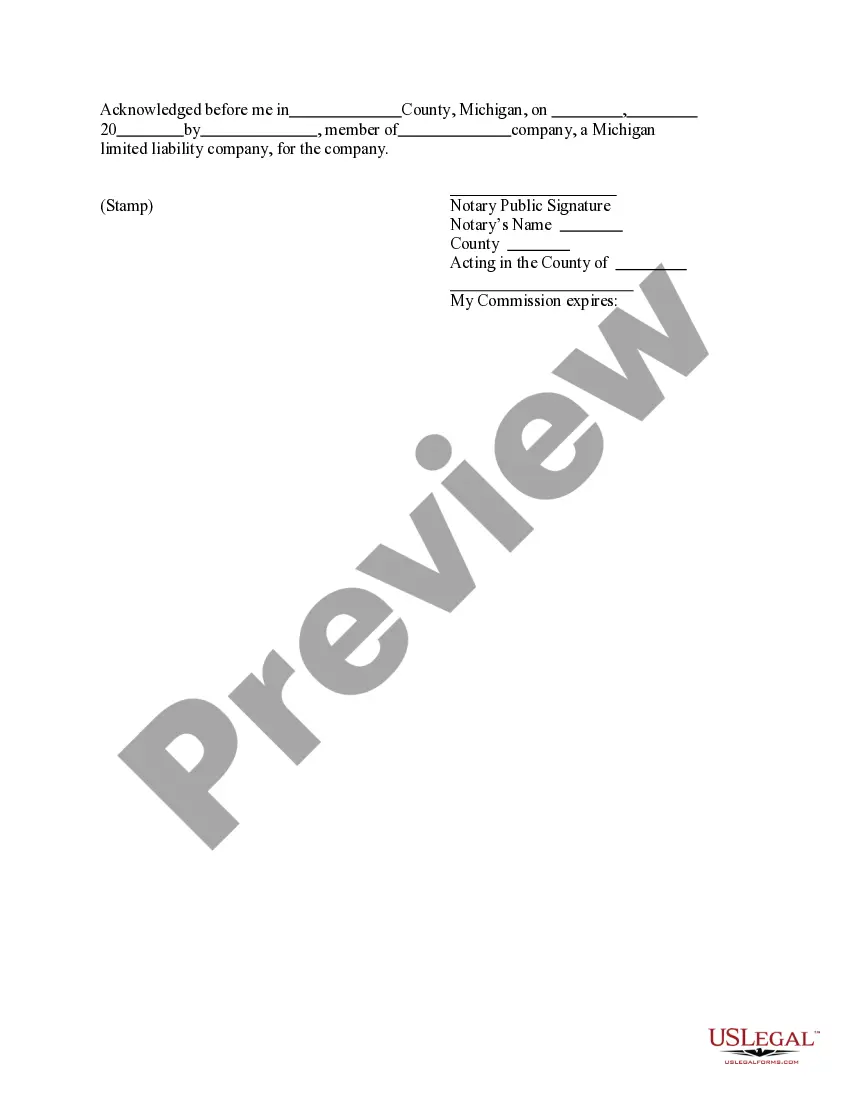

- Initial, be sure you have chosen the right form for your personal metropolis/county. It is possible to look through the form utilizing the Preview switch and study the form description to guarantee this is basically the best for you.

- In case the form does not fulfill your expectations, make use of the Seach area to obtain the appropriate form.

- Once you are sure that the form is acceptable, click the Acquire now switch to obtain the form.

- Choose the costs prepare you desire and type in the essential information. Make your accounts and purchase an order using your PayPal accounts or charge card.

- Select the document format and acquire the legal papers web template to the gadget.

- Comprehensive, change and print and signal the attained Hawaii General Agreement.

US Legal Forms is definitely the most significant local library of legal varieties where you can see numerous papers themes. Use the service to acquire professionally-made documents that follow condition specifications.

Form popularity

FAQ

Generally, a Hawaii individual income tax return must be filed with the Department of Taxation for each year in which an individual has gross income that exceeds the amount of his or her personal exemptions and standard deduction.

The GET is a privilege tax imposed on business activity in the State of Hawaii. The tax is imposed on the gross income received by the person en- gaging in the business activity. The GET applies to nearly every form of business activity.

Forms G-45, G-49, and GEW-TA-RV-6 can be filed and payments made electronically through the State's Internet portal. For more information, go to tax.hawaii.gov/eservices/. NOTE: The Department requires taxpayers whose general excise tax liability exceeds $4,000 for the taxable year, to file returns electronically.

The G-45 is the 'periodic' form which is filed either monthly, quarterly, or semiannually. The G-49 is the annual or so called "reconciliation" form which is filed annually.

Form G-49 - All filers must file an annual return and reconciliation (Form G-49) after the close of the taxable year. Form G-49 is a summary of your activity for the entire year. This return must be filed in addition to Form G-45.

Yes. Most widely used return forms are available for e-filing on Hawaii Tax Online. E-filed returns are easier to complete, more accurate, and processed more quickly than paper returns.

You must file monthly if you will pay more than $4,000 in GET per year. You may file quarterly if you will pay $4,000 or less in GET per year. You may file semiannually if you will pay $2,000 or less in GET per year.

The general excise tax is a tax imposed on business activity in Hawaii. This tax is often called a ?gross income tax? because the tax is computed on the business' total gross income derived from doing business in Hawaii and not on the business' net profit.