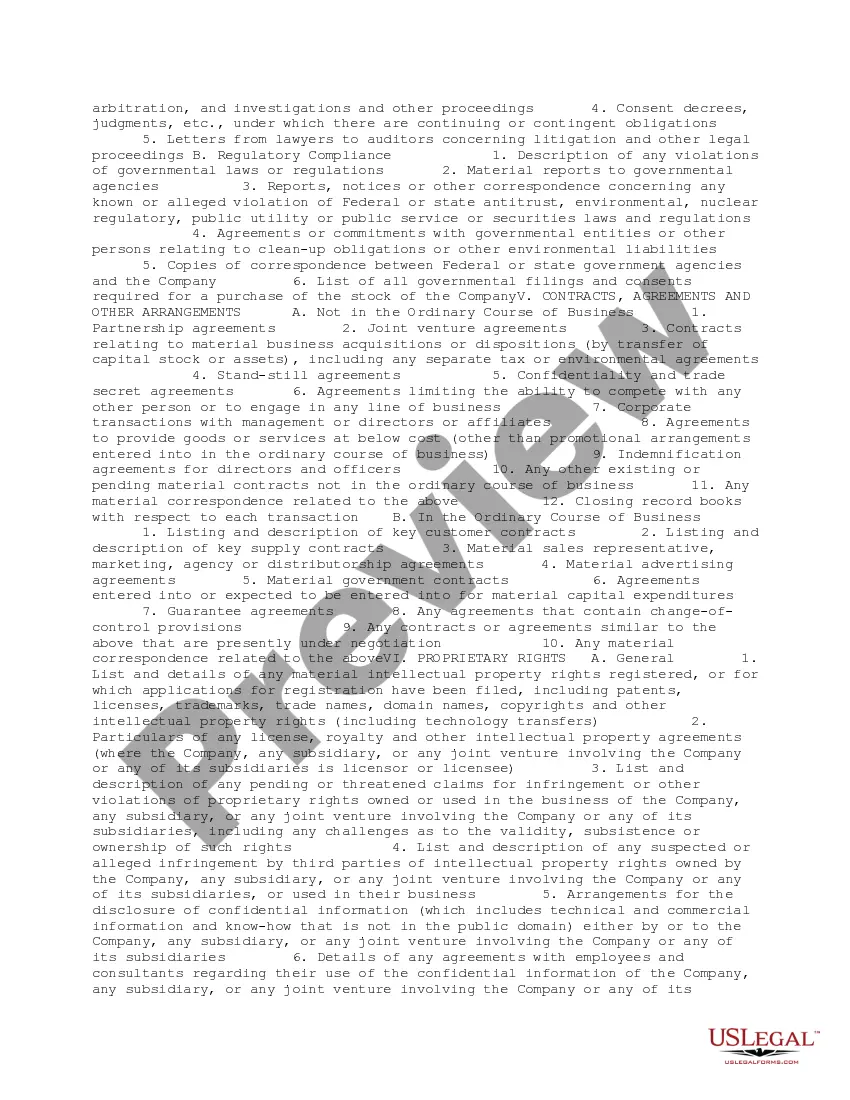

This form is a list of requested due diligence documents from a technology company for the purchase of shares of stock. The list consists of documents and information to be submitted to the due diligence team.

Hawaii Request for Due Diligence Documents from a Technology Company

Description

How to fill out Request For Due Diligence Documents From A Technology Company?

US Legal Forms - among the largest collections of legal documents in the United States - offers an extensive array of legal document templates that you can download or print.

Through the website, you can access thousands of forms for business and personal needs, categorized by type, state, or keywords. You can obtain the most recent version of forms such as the Hawaii Request for Due Diligence Documents from a Technology Company in a matter of minutes.

If you have a monthly subscription, Log In and download the Hawaii Request for Due Diligence Documents from a Technology Company from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms from the My documents section of your account.

Once you are satisfied with the form, confirm your selection by clicking the Buy now button. Then, select the pricing plan you prefer and provide your information to register for an account.

Complete the purchase using a credit card or PayPal account. Choose the format and download the form to your device. Make modifications. Fill out, edit, and print the downloaded Hawaii Request for Due Diligence Documents from a Technology Company. Every document you store in your account has no expiration date and belongs to you indefinitely. Therefore, if you wish to download or print an additional copy, simply visit the My documents section and click on the form you want. Access the Hawaii Request for Due Diligence Documents from a Technology Company through US Legal Forms, the most comprehensive collection of legal document templates, utilizing thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- If this is your first time using US Legal Forms, here are basic instructions to help you get started.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to review the content of the form.

- Check the form details to confirm that you have chosen the right form.

- If the form does not meet your needs, utilize the Search box at the top of the screen to find one that does.

Form popularity

FAQ

To conduct tech due diligence effectively, start by compiling essential documents and data related to the technology. Assess the company's technical capabilities, software development practices, and cybersecurity measures. Additionally, ensure you review any regulatory compliance and intellectual property rights. Utilizing platforms like USLegalForms can help streamline your Hawaii Request for Due Diligence Documents from a Technology Company, offering needed resources and templates.

The three P's of due diligence are People, Processes, and Products. Understanding the people involved helps assess their expertise and experience. Evaluating processes allows you to examine operational efficiency and compliance. Finally, analyzing products reveals the technology offerings and how they align with your needs, especially when preparing a Hawaii Request for Due Diligence Documents from a Technology Company.

Due diligence in technology involves a thorough investigation of a company’s technological assets and practices, ensuring they meet relevant standards and regulations. This process helps identify potential risks or liabilities associated with technology transactions. For your Hawaii Request for Due Diligence Documents from a Technology Company, understanding these aspects is essential for informed decision-making.

To obtain a due diligence report, you should first define your criteria for the review, focusing on areas that matter most to your interests. You can then either consult with a specialized firm or use online resources to facilitate your Hawaii Request for Due Diligence Documents from a Technology Company. Platforms like US Legal can guide you while ensuring that you receive accurate and relevant information.

Various entities can issue a due diligence report, including individual consultants, law firms, and financial institutions. Each of these providers has the expertise to evaluate a technology company's assets and liabilities. It's advisable to choose a reliable source to help with your Hawaii Request for Due Diligence Documents from a Technology Company.

A due diligence report is typically prepared by professionals trained in risk assessment, such as accountants or legal experts. These specialists analyze various aspects of the technology company, including financial records and compliance issues. For an efficient Hawaii Request for Due Diligence Documents from a Technology Company, you can explore the resources available on US Legal.

To apply for due diligence in Hawaii, start by gathering all necessary Information about the technology company you're investigating. Then, visit the US Legal platform, where you'll find a user-friendly guide to facilitate your Hawaii Request for Due Diligence Documents from a Technology Company. Lastly, complete the required forms and submit your request for processing.

The four P's of due diligence are Product, People, Process, and Patents. Each component plays a crucial role in evaluating the potential of a company. When you request documents from a technology company in Hawaii, you will analyze these aspects to make well-informed decisions that align with your business strategy.

Filing for due diligence involves preparing and submitting necessary documents to the relevant parties. Begin by gathering required information and organizing it in a comprehensive manner. Through US Legal Forms, you can efficiently manage your Hawaii request for due diligence documents from a technology company, saving time and ensuring you don’t overlook critical details.

Essential information for due diligence typically includes financial records, operational insights, intellectual property details, and legal documents. Additionally, you need to evaluate technology assessments and team qualifications. By collecting these documents in your Hawaii request for due diligence from a technology company, you gain a clearer picture of the company's viability and compatibility with your objectives.