Hawaii Stock Option Grants and Exercises and Fiscal Year-End Values

Description

How to fill out Stock Option Grants And Exercises And Fiscal Year-End Values?

You may commit several hours on the web attempting to find the lawful papers format that suits the federal and state requirements you will need. US Legal Forms offers thousands of lawful kinds which are reviewed by professionals. You can actually obtain or print the Hawaii Stock Option Grants and Exercises and Fiscal Year-End Values from my services.

If you have a US Legal Forms profile, you are able to log in and click the Acquire key. Next, you are able to total, revise, print, or indication the Hawaii Stock Option Grants and Exercises and Fiscal Year-End Values. Every single lawful papers format you get is yours for a long time. To acquire an additional version for any obtained form, go to the My Forms tab and click the related key.

Should you use the US Legal Forms internet site the first time, adhere to the straightforward recommendations under:

- Initial, be sure that you have chosen the proper papers format for your county/metropolis of your choosing. Browse the form information to make sure you have picked out the proper form. If offered, take advantage of the Preview key to check with the papers format at the same time.

- If you want to get an additional variation of your form, take advantage of the Search field to discover the format that meets your requirements and requirements.

- Upon having found the format you want, simply click Purchase now to carry on.

- Find the prices program you want, key in your references, and register for an account on US Legal Forms.

- Total the transaction. You can utilize your Visa or Mastercard or PayPal profile to fund the lawful form.

- Find the file format of your papers and obtain it to the device.

- Make changes to the papers if necessary. You may total, revise and indication and print Hawaii Stock Option Grants and Exercises and Fiscal Year-End Values.

Acquire and print thousands of papers templates utilizing the US Legal Forms Internet site, which offers the biggest variety of lawful kinds. Use skilled and state-particular templates to deal with your business or personal needs.

Form popularity

FAQ

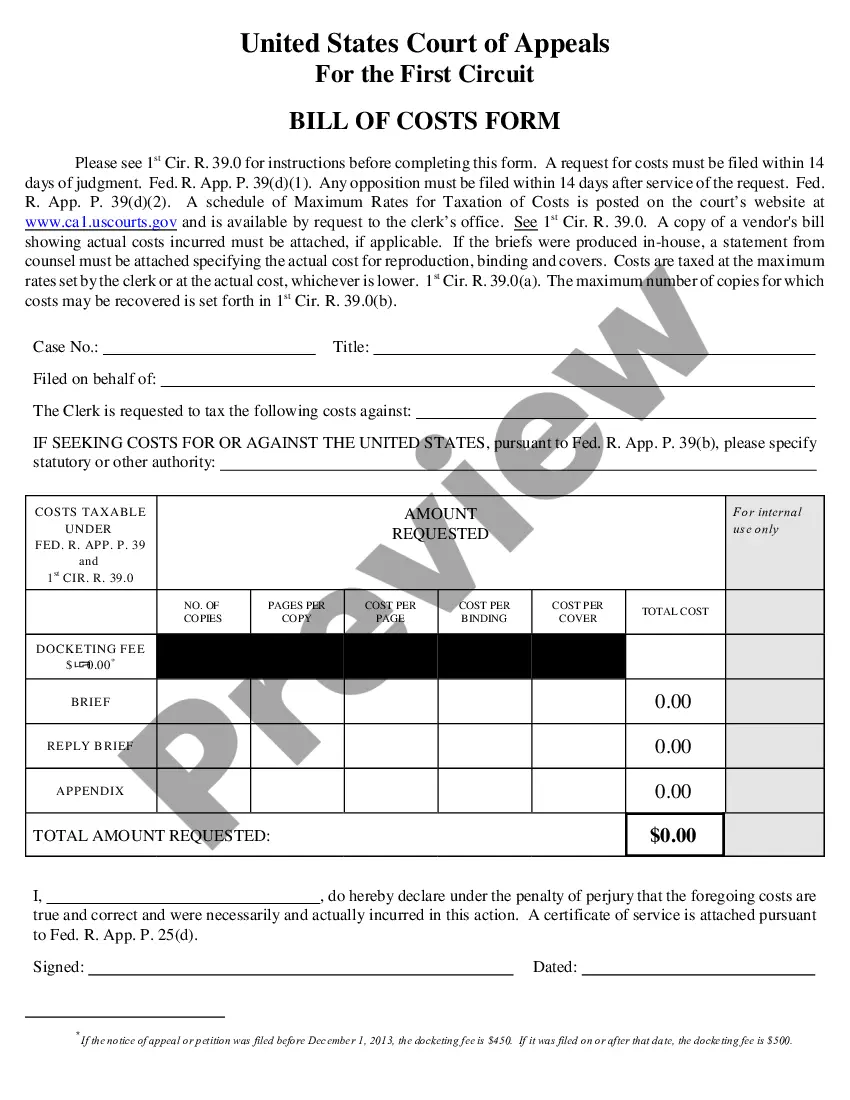

On the income statement, balance sheet, and cash flow statement the loss from the exercise is accounted for by noting the difference between the market price (if one exists) of the shares and the cash received, the exercise price, for issuing those shares through the option.

If the options are exercised then any cash received from the option-holders is debited to cash and credited to equity.

The proceeds you receive from an exercise-and-sell transaction are equal to the fair market value of the stock minus the grant price and required tax withholding and brokerage commission and any fees (your gain).

Every stock option has an exercise price, also called the strike price, which is the price at which a share can be bought. In the US, the exercise price is typically set at the fair market value of the underlying stock as of the date the option is granted, in order to comply with certain requirements under US tax law.

When an employee exercises stock options, you'll credit Common Stock for the number of shares x par value, debit Cash for the number of shares x the exercise price, then debit Additional Paid-In Capital for the difference, representing the increase in value of the shares during the service period.

Since you'll have to exercise your option through your employer, your employer will usually report the amount of your income on line 1 of your Form W-2 as ordinary wages or salary and the income will be included when you file your tax return.

When you exercise nonqualified stock options, your employer will most likely withhold a flat 22% for federal income taxes. However, you might be under-withheld if you're in the 32%, 35%, or 37% tax bracket. Stock options can be advantageous but can also create unexpected tax consequences.

To exercise an option, you simply advise your broker that you wish to exercise the option in your contract. If the holder of a put option exercises the contract, they will sell the underlying security at a stated price within a specific timeframe.