Hawaii Ratification and approval of directors and officers insurance indemnity fund with copy of agreement

Description

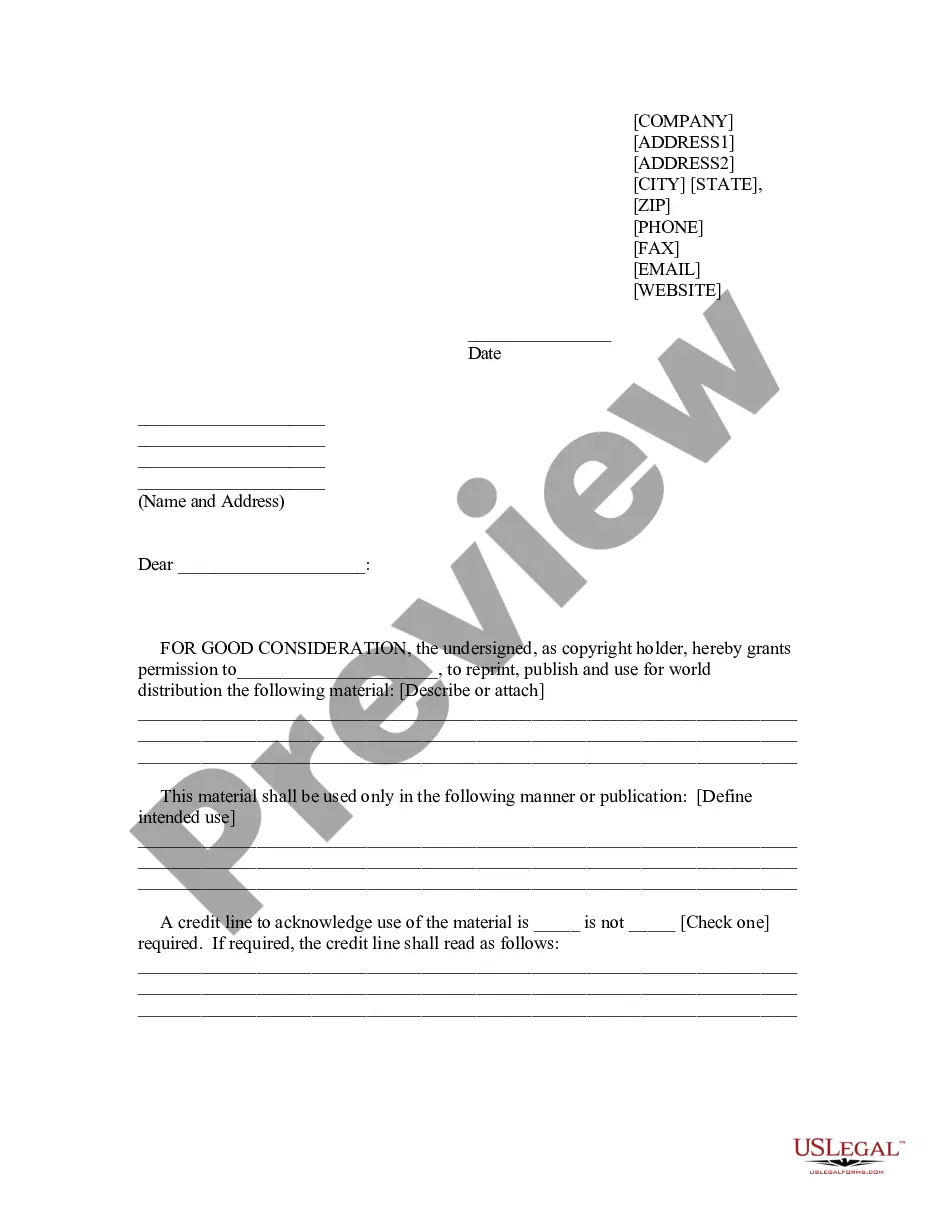

How to fill out Ratification And Approval Of Directors And Officers Insurance Indemnity Fund With Copy Of Agreement?

If you need to full, obtain, or printing lawful document layouts, use US Legal Forms, the biggest assortment of lawful forms, which can be found online. Take advantage of the site`s simple and easy convenient lookup to obtain the documents you want. Different layouts for organization and individual reasons are sorted by categories and states, or search phrases. Use US Legal Forms to obtain the Hawaii Ratification and approval of directors and officers insurance indemnity fund with copy of agreement in a number of clicks.

If you are previously a US Legal Forms customer, log in to the accounts and click the Obtain option to have the Hawaii Ratification and approval of directors and officers insurance indemnity fund with copy of agreement. You can even entry forms you earlier downloaded inside the My Forms tab of the accounts.

If you use US Legal Forms initially, follow the instructions below:

- Step 1. Ensure you have chosen the shape for the proper city/land.

- Step 2. Take advantage of the Review option to check out the form`s information. Do not forget about to read through the information.

- Step 3. If you are not happy with the type, take advantage of the Search area near the top of the monitor to locate other variations in the lawful type template.

- Step 4. When you have identified the shape you want, select the Buy now option. Opt for the costs program you like and add your accreditations to sign up for the accounts.

- Step 5. Procedure the transaction. You may use your charge card or PayPal accounts to complete the transaction.

- Step 6. Pick the formatting in the lawful type and obtain it on your device.

- Step 7. Comprehensive, modify and printing or sign the Hawaii Ratification and approval of directors and officers insurance indemnity fund with copy of agreement.

Every single lawful document template you get is yours forever. You might have acces to every single type you downloaded within your acccount. Click the My Forms portion and select a type to printing or obtain again.

Be competitive and obtain, and printing the Hawaii Ratification and approval of directors and officers insurance indemnity fund with copy of agreement with US Legal Forms. There are thousands of expert and condition-specific forms you can utilize for your personal organization or individual requires.

Form popularity

FAQ

Indemnification refers to the right to have a company reimburse current or former directors or officers for all losses, including legal fees, incurred in connection with litigation arising from actions taken in service to the company or at the company's direction.

Indemnification Agreement to secure against loss or damage; to give security for the reimbursement of a person in case of an anticipated loss falling upon him. Also to make good; to compensate; to make reimbursement to one of a loss already incurred by him.

Insurance ? The indemnification agreement typically will require that the company provide D&O liability insurance that protects the indemnitee to the same extent as the most favorably insured of the company's and its affiliates' current directors and officers.

A company may, however, lend money to a director to fund the director's defence costs. Frequently, an indemnity will include a provision under which the company agrees to lend the director the amounts necessary to fund the director's defence costs.

Indemnification, also referred to as indemnity, is an undertaking by one party (the indemnifying party) to compensate the other party (the indemnified party) for certain costs and expenses, typically stemming from third-party claims.

The typical D&O insurance policy contains three types of insuring agreements. They're commonly referred to as Side A, Side B, and Side C. Side A coverage covers directors and officers for claims where the company refuses to or is financially unable to pay for indemnification.

A letter of indemnity (LOI) is a legal agreement that renders one or both parties to a contract harmless by some third party in the event of a delinquency or breach by the contracted parties. In other words, the party or parties are indemnified against a possible loss by some third party, such as an insurance company.

Both indemnification and insurance transfer risk and guard against financial losses, but they do so differently: Indemnification transfers risk between contracting parties through a non-insurance agreement. Insurance transfers risk from one party to another in exchange for payment.