Hawaii Workers' Compensation Clearance Document

Description

How to fill out Workers' Compensation Clearance Document?

Selecting the correct authorized document template can be a challenge.

Certainly, there are numerous templates available online, but how can you locate the legal form you require.

Utilize the US Legal Forms website. This service offers a multitude of templates, including the Hawaii Workers' Compensation Clearance Document, which can be utilized for both business and personal purposes.

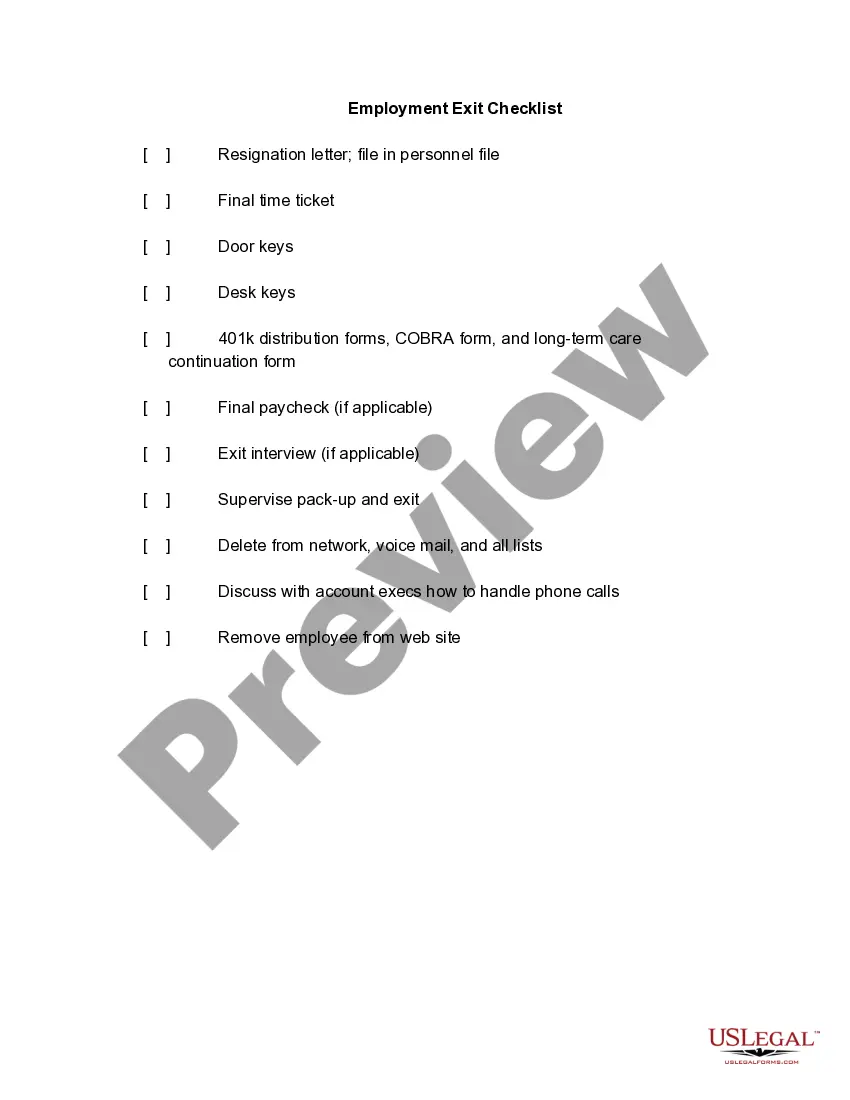

You can browse the form using the Preview option and review the form description to confirm it is the correct one for you.

- All the forms are reviewed by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Download button to access the Hawaii Workers' Compensation Clearance Document.

- Use your account to look through the legal documents you have purchased previously.

- Visit the My documents section of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct form for your jurisdiction.

Form popularity

FAQ

In Hawaii, the amount of a workers' comp death benefit depends on which family members are applying for benefits. The total benefits paid for all family members can't exceed two-thirds of the injured worker's average weekly wages. Death benefits in Hawaii end when a spouse passes away or gets remarried.

UC-B6, Quarterly Wage, Contribution and Employment and Training Assessment Report Hawaii employers are required to fb01le quarterly unemployment insurance tax reports on the new and interactive Employer Website at: .

Like other states, however, Hawaii law sets maximum and minimum weekly rates for TTD benefits, based on a percentage of statewide average wages. For 2020, the maximum is $925, and the minimum is $231. (Like most workers' comp benefits, TTD benefits are not taxed.)

Any weekly WorkCover payments you receive are treated as your income and therefore taxable.

The UI number is assigned only after confirmation of the existence of taxable payroll in Hawaii. To obtain a determination on your unemployment insurance liability and to find out if you will be issued a UI number, go to .

This tax package contains the necessary forms and instructions to file your quarterly Unemployment Insurance Tax Reports. Reports should contain wage data for one quarter only.

Repayment of Workers' Compensation Benefits While you are completing your income tax return, deduct the same amount of your benefit (shown in box 10) on line 25000. This deduction allows your workers' compensation benefits to be deducted from your income. This ensures that you are not taxed on both amounts.

Are unemployment benefits taxable? Yes. You may elect to withhold 10% for federal taxes and 5% for Hawaii state taxes from your regular UI benefits. To request withholdings of Federal and/or State taxes, go to: .

A. Form UC-B6, Employer's Quarterly Wage, Contribution and Employment and Training Assessment Report is mailed to the last known mailing address on file for all active employers, fifteen days prior to the end of EACH calendar quarter.