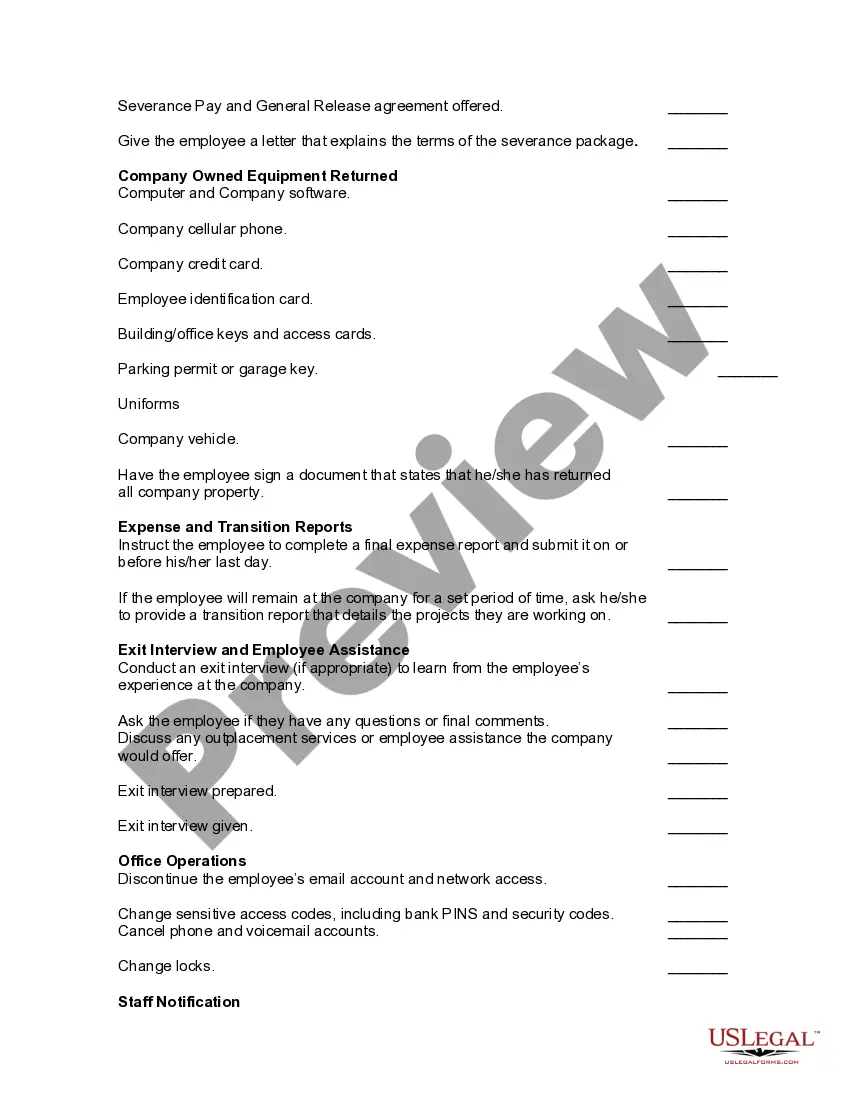

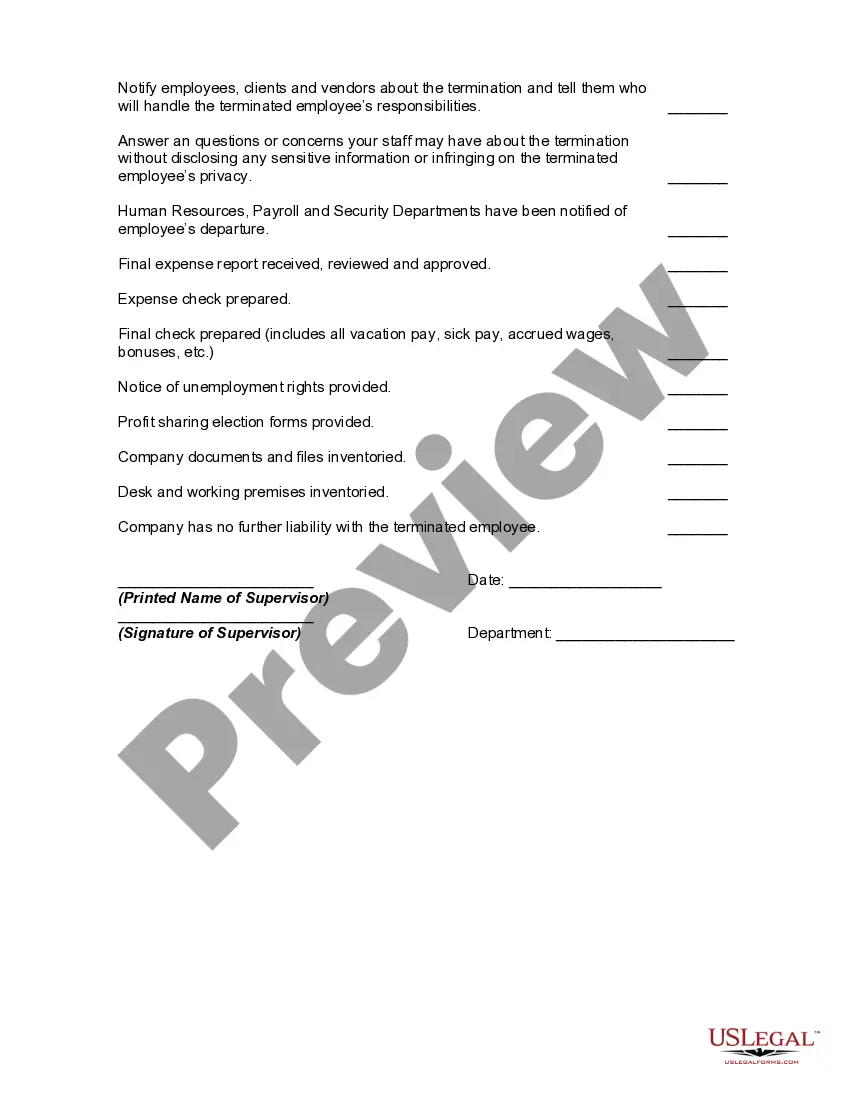

The following items should be checked off prior to an employee's final date of employment. Not all items will apply to all employees or to all circumstances.

Hawaii Worksheet - Termination of Employment

Description

How to fill out Worksheet - Termination Of Employment?

Are you currently in a situation where you require documents for either business or personal purposes almost every day.

There are numerous legal document templates accessible online, but locating trustworthy ones is not straightforward.

US Legal Forms offers a vast array of form templates, such as the Hawaii Worksheet - Termination of Employment, designed to comply with state and federal guidelines.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Hawaii Worksheet - Termination of Employment template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for your correct city/state.

- Use the Preview button to review the form.

- Check the description to ensure you have selected the correct form.

- If the form isn't what you're looking for, use the Search field to find the document that fits your needs and requirements.

- Once you locate the right form, click Buy now.

- Choose your preferred pricing plan, enter the necessary information to create your account, and pay for the order using PayPal or a credit card.

- Select a convenient file format and download your copy.

- Find all the document templates you have purchased in the My documents menu. You can retrieve an additional copy of the Hawaii Worksheet - Termination of Employment at any time, if necessary. Just select the desired form to download or print the document template.

- Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates that can be used for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

Form popularity

FAQ

Generally, Hawaii is an at will State. This means an employer does not need to give you a reason to let you go, lay you off, or fire you unless: You have a contract with the employer that requires you be notified of the reason.

This tax package contains the necessary forms and instructions to file your quarterly Unemployment Insurance Tax Reports. Reports should contain wage data for one quarter only.

You can earn up to $150 a week and still receive your full unemployment check. If you are still employed and working and earning less than your weekly benefit amount, you may qualify for the difference between your earnings over $150 and your weekly benefit amount.

UC-B6, Quarterly Wage, Contribution and Employment and Training Assessment Report Hawaii employers are required to fb01le quarterly unemployment insurance tax reports on the new and interactive Employer Website at: .

Severance Pay, Dismissal or Separation Pay. Severance pay is not wages for unemployment insurance purposes. There is no specific code section in the California Unemployment Insurance Code which declares that severance pay is not wages. We cite Section 1265 when we state that severance pay is not wages.

Are unemployment benefits taxable? Yes. You may elect to withhold 10% for federal taxes and 5% for Hawaii state taxes from your regular UI benefits. To request withholdings of Federal and/or State taxes, go to: .

The UI number is assigned only after confirmation of the existence of taxable payroll in Hawaii. To obtain a determination on your unemployment insurance liability and to find out if you will be issued a UI number, go to .

The form includes the amount of benefits paid and other information to meet Federal, State, and personal income tax needs for the tax year. The 1099-G information will be available for viewing on or about January 19, 2021 at: .

Yes, employees receiving severance may still apply for unemployment insurance. Employees may need to provide the severance information when they apply for benefits.

A. Form UC-B6, Employer's Quarterly Wage, Contribution and Employment and Training Assessment Report is mailed to the last known mailing address on file for all active employers, fifteen days prior to the end of EACH calendar quarter.