Hawaii Withdrawal of Assumed Name for Corporation

Description

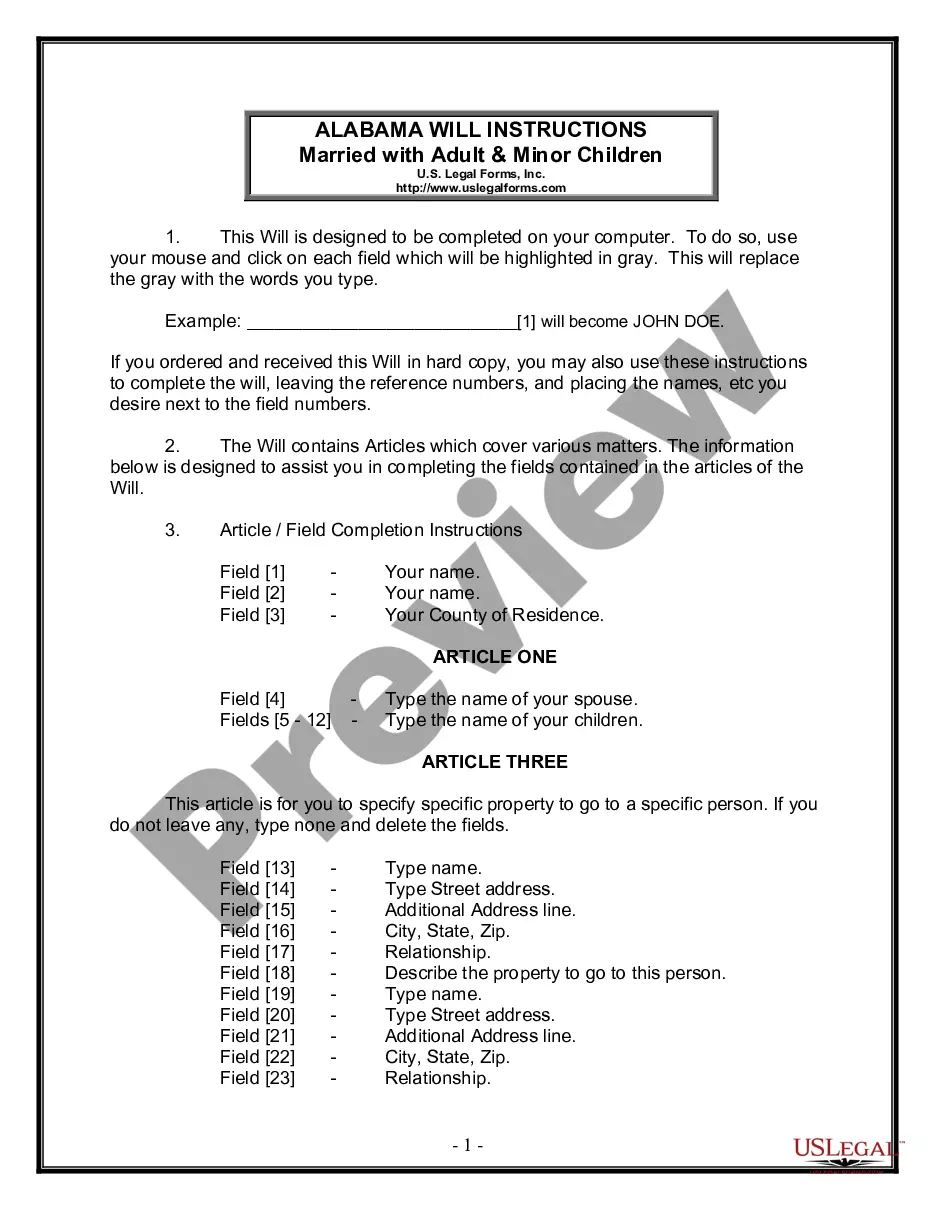

How to fill out Withdrawal Of Assumed Name For Corporation?

Are you inside a situation in which you will need documents for possibly company or specific reasons almost every time? There are a variety of legitimate papers templates accessible on the Internet, but getting types you can rely on isn`t simple. US Legal Forms gives a large number of develop templates, just like the Hawaii Withdrawal of Assumed Name for Corporation, that are written to meet federal and state specifications.

If you are already knowledgeable about US Legal Forms web site and also have a merchant account, simply log in. Next, you are able to download the Hawaii Withdrawal of Assumed Name for Corporation web template.

Should you not have an bank account and need to start using US Legal Forms, follow these steps:

- Obtain the develop you require and ensure it is to the proper town/area.

- Make use of the Review key to review the shape.

- Look at the information to actually have selected the proper develop.

- In the event the develop isn`t what you are trying to find, take advantage of the Look for discipline to obtain the develop that meets your needs and specifications.

- Whenever you find the proper develop, click on Buy now.

- Choose the costs strategy you would like, complete the required information to generate your money, and pay money for your order making use of your PayPal or credit card.

- Choose a hassle-free file formatting and download your backup.

Locate each of the papers templates you have bought in the My Forms food list. You can obtain a more backup of Hawaii Withdrawal of Assumed Name for Corporation anytime, if possible. Just click on the necessary develop to download or printing the papers web template.

Use US Legal Forms, by far the most extensive selection of legitimate kinds, to conserve time as well as stay away from faults. The service gives skillfully created legitimate papers templates which can be used for a range of reasons. Produce a merchant account on US Legal Forms and begin generating your daily life easier.

Form popularity

FAQ

In Hawaii, there is no requirement that a business register a DBA in order to use an alternative name in commerce. However, despite the fact that a DBA is not mandatory, it can be helpful in many regards. Some advantages are: A registered DBA prevents others from legally using the name. File a DBA in Hawaii | .com ? articles ? file-a-dba-in-haw... .com ? articles ? file-a-dba-in-haw...

When a company is dissolved, its directors are released from their duties and responsibilities related to that specific company. As long as the individual has not been disqualified from acting as a director or found guilty of unfit conduct, they are free to take up directorship positions in other companies.

After dissolution, the company ceases to legally exist. The dissolving of a company is often a voluntary process; however Companies House can dissolve companies that have not kept up with their accounting responsibilities such as filing accounts and tax returns.

To dissolve your Hawaii Corporation, file Form DC-13, Hawaii Articles of Dissolution with the Hawaii Department of Commerce and Consumer Affairs, Business Registration Division (BREG) by mail, fax, or in person. The articles of dissolution cannot be filed online. Free guide to dissolve a Hawaii Corporation northwestregisteredagent.com ? corporation northwestregisteredagent.com ? corporation

After dissolution, a corporation is generally expected to pay all its existing debts and then liquidate its remaining assets to its shareholders. This sometimes becomes difficult, however, where there are unknown claims that may exist against the corporation. Dissolution of a North Carolina Corporation jahlaw.com ? dissolution-of-a-north-carolina... jahlaw.com ? dissolution-of-a-north-carolina...

After a company is dissolved, it must liquidate its assets. Liquidation refers to the process of sale or auction of the company's non-cash assets. Note that only those assets your company owns can be liquidated. Thus, you can't liquidate assets that are used as collateral for loans.

(a) A corporation which is dissolved nevertheless continues to exist for the purpose of winding up its affairs, prosecuting and defending actions by or against it, and enabling it to collect and discharge obligations, dispose of and convey its property and collect, and divide its assets, but not for the purpose of ...

If I decide to stop operating my business, do I need to cancel my license? Yes. Cancel your license by signing into Hawaii Tax Online or cancel your license(s) by submitting a Form GEW-TA-RV-1. Licensing Information - Hawaii Department of Taxation hawaii.gov ? geninfo ? licensing hawaii.gov ? geninfo ? licensing