Hawaii Vehicle Policy

Description

How to fill out Vehicle Policy?

If you require to finalize, obtain, or create sanctioned document templates, utilize US Legal Forms, the most significant repository of legal forms available online.

Leverage the site’s straightforward and convenient search function to locate the documents you need.

Various templates for corporate and personal purposes are categorized by types and regions, or keywords.

Step 4. Once you have located the form you need, click on the Get now button. Choose your preferred pricing plan and enter your information to register for an account.

Step 5. Complete the purchase. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to find the Hawaii Vehicle Policy with just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and select the Download option to access the Hawaii Vehicle Policy.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions provided below.

- Step 1. Ensure you have selected the form for the correct city/state.

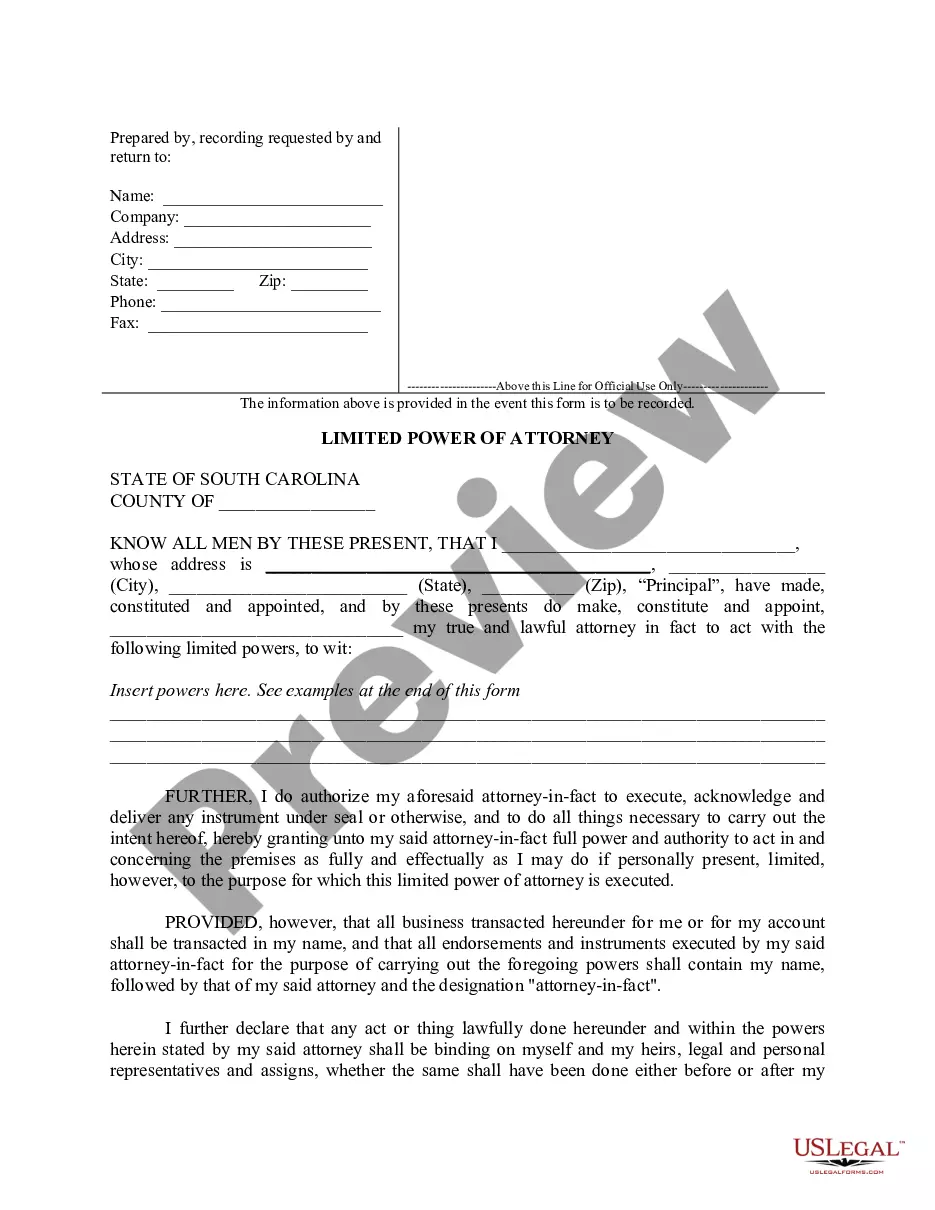

- Step 2. Utilize the Review feature to examine the content of the form. Don’t forget to review the summary.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the page to find alternative models of the legal form format.

Form popularity

FAQ

Personal Injury Protection (PIP) is required in Hawaii, and the minimum coverage you can get is $10,000 per covered person per accident, regardless of fault.

Here are the minimum Hawaii auto insurance coverage requirements for the legal operation of an automobile in the state: Bodily injury liability coverage: $20,000 per person and $40,000 per accident. Basic personal injury protection: $10,000. Property damage liability coverage: $10,000.

According to Nolo, drivers in Hawaii must also carry at least a 20/40/10 policy, which means a minimum of: $20000 per person for injury coverage. $40000 per accident for injury coverage. $10000 per accident for property damage.

Fines. Hawaii law provides for a fine of $500 for a first infraction of driving without auto insurance. Things get more serious from there. Subsequent infractions that occur within five years of a previous violation can cost a minimum of $5,000.

The Short All plans cover emergency services at any hospital in the United States, regardless of what state plan was purchased from, with the exception of Hawaii.

Hawaii is a considered a no-fault state, which means your motor vehicle insurance company will pay the bills for your injuries and your passengers' injuries up to the personal injury protection benefits (PIP) limit. And you cannot sue or be sued unless there are serious injuries.

Car insurance usually follows the car in Hawaii. The types of car insurance that follow the car in Hawaii are collision, comprehensive, and property damage liability. You're required to carry property damage liability and personal injury protection in Hawaii. PIP follows the driver, unlike liability coverage.

Driving without car insurance in Hawaii is illegal. Throughout the registration period, the driver must show evidence of continuous insurance.

What does it mean to be a no-fault state? Car insurance laws can be defined as no-fault, choice no-fault, add-on or tort liability. In states with no-fault laws, each driver files a claim with their own insurance company following an accident, regardless of who is at fault.