Hawaii Stop Annuity Request

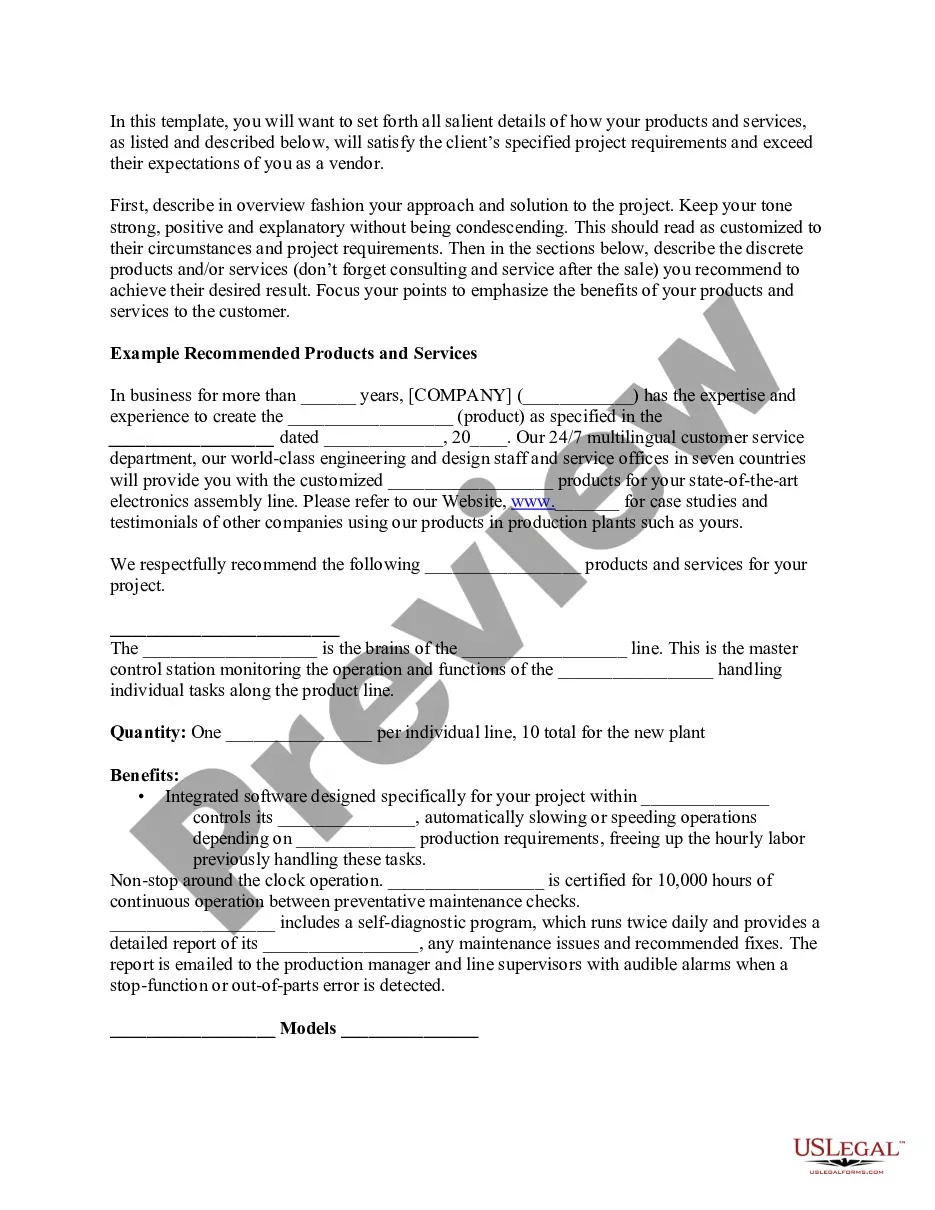

Description

How to fill out Stop Annuity Request?

Have you found yourself in a circumstance where you require documentation for various business or particular purposes almost every workday.

There are numerous legal document templates accessible online, but finding trustworthy versions is not straightforward.

US Legal Forms provides a wide array of form templates, including the Hawaii Stop Annuity Request, designed to fulfill federal and state requirements.

Once you find the correct form, click Get now.

Select the pricing plan you prefer, fill in the required information to process your payment, and complete the order using your PayPal or Visa/Mastercard.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Afterward, you can download the Hawaii Stop Annuity Request template.

- If you do not have an account and wish to start using US Legal Forms, follow these guidelines.

- Locate the form you need and ensure it corresponds to the correct city/state.

- Use the Review button to look over the document.

- Read the description to confirm you have selected the appropriate form.

- If the form isn’t what you’re looking for, utilize the Search field to find the document that fits your needs.

Form popularity

FAQ

The N-11 form is a Hawaii state tax form used for resident individual income tax filings. This form is essential for residents to report their income accurately. If you need to file a Hawaii Stop Annuity Request, ensuring you complete the N-11 form can streamline your tax process and keep you compliant with state requirements.

Non-residents filing taxes in Hawaii need to use the appropriate state form, which is typically the N-15 form. This form is designed to capture income earned in Hawaii by non-residents. If you are looking to submit a Hawaii Stop Annuity Request, using the N-15 will ensure that you provide the necessary information while adhering to state regulations.

Mailing your form N-196 in Hawaii is straightforward. You'll want to send it to the address specified on the form itself, which is typically the Department of Taxation. In case your inquiry relates to a Hawaii Stop Annuity Request, ensure you include any relevant documents that support your submission. This will help avoid processing delays.

Non-residents in Hawaii typically use Form N-15 for filing their state income taxes. This form accounts for income earned within Hawaii while excluding out-of-state earnings. If you find yourself submitting a Hawaii Stop Annuity Request, be mindful of how your income may be categorized under state law.

According to Hawaii Instructions for Form N-11, every individual doing business in Hawaii during the taxable year must file a return, whether or not the individual derives any taxable income from that business.

Hawaii state tax forms and reproduction specifications are available on the Federation of Tax Administrators (FTA) Secure Exchange System (SES) website. The SES website is a secure way to provide files to those that reproduce our forms.

11. Individual Income Tax Return (Resident Form)

Forms G-45, G-49, and GEW-TA-RV-6 can be filed and payments made electronically through the State's Internet portal. For more information, go to tax.hawaii.gov/eservices/. The GET is a tax imposed on the gross income you receive from any business activity you have in Hawaii.

To help us with this commitment, we welcome your feedback to assist our effort to improve our services and make voluntary compliance as easy as possible. Please address your written suggestions to the Department of Taxation, P.O. Box 259, Honolulu, HI, 96809-0259, or email them to Tax.

VP1, the putative RNA-dependent RNA polymerase of infectious bursal disease virus, forms complexes with the capsid protein VP3, leading to efficient encapsidation into virus-like particles. J Virol.