Hawaii Final Notice of Past Due Account

Description

How to fill out Final Notice Of Past Due Account?

You can dedicate hours online searching for the official document template that complies with the federal and state requirements you need.

US Legal Forms offers numerous official forms that are evaluated by experts.

You can download or print the Hawaii Final Notice of Past Due Account from the service.

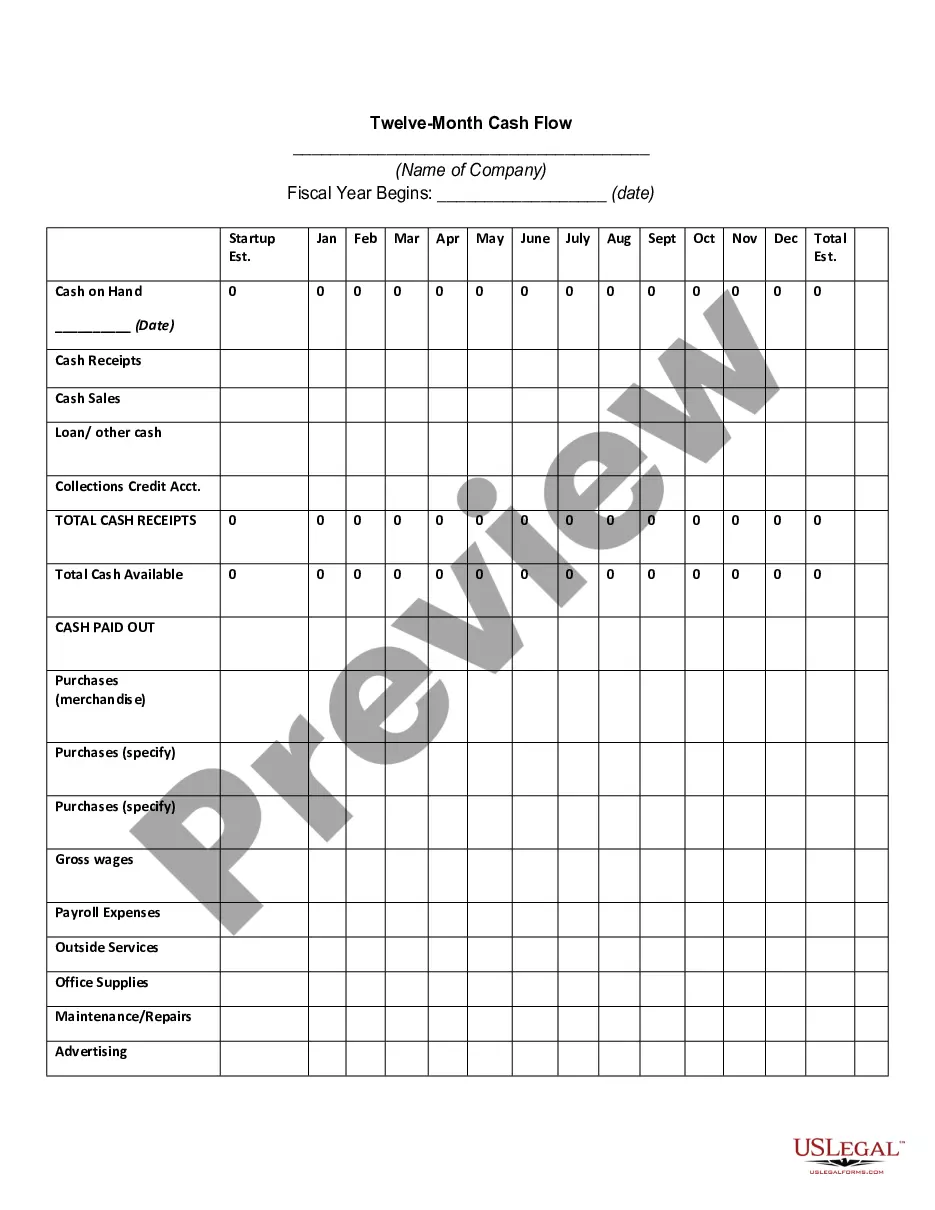

If available, utilize the Preview option to browse through the document template as well.

- If you possess a US Legal Forms account, you may Log In and click on the Obtain button.

- Subsequently, you can complete, modify, print, or sign the Hawaii Final Notice of Past Due Account.

- Every official document template you acquire is yours indefinitely.

- To obtain another copy of the downloaded form, go to the My documents tab and click the relevant option.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure you have chosen the correct document template for the region/city of your choice.

- Review the form description to make certain you have selected the accurate form.

Form popularity

FAQ

In Hawaii, the penalty for late payment of a past due account may vary based on the specific type of debt and terms agreed upon. Typically, you may incur additional fees and interest charges, which can escalate the total amount owed. Ignoring a Hawaii Final Notice of Past Due Account can lead to further financial consequences, including collections or lawsuits. To avoid penalties, act promptly and consult our resources for assistance with your accounts.

To file a Hawaii Final Notice of Past Due Account, you must submit it to the appropriate county office in Hawaii. It is crucial to determine the correct location based on the jurisdiction where the account is registered. Using our US Legal Forms platform can simplify this process by providing you with all the necessary documentation and guidance tailored for Hawaii. Ensure your filing is accurate to avoid further complications.

The effective 11-word phrase to stop debt collectors is, 'I do not acknowledge this debt; please cease all communications.' Using this phrase puts collectors on notice to halt their activities. Always remember, if you receive a Hawaii Final Notice of Past Due Account, understanding how to communicate with creditors can safeguard your rights and peace of mind.

To help us with this commitment, we welcome your feedback to assist our effort to improve our services and make voluntary compliance as easy as possible. Please address your written suggestions to the Department of Taxation, P.O. Box 259, Honolulu, HI, 96809-0259, or email them to Tax.

Forms G-45, G-49, and GEW-TA-RV-6 can be filed and payments made electronically through the State's Internet portal. For more information, go to tax.hawaii.gov/eservices/. The GET is a tax imposed on the gross income you receive from any business activity you have in Hawaii.

According to Hawaii Instructions for Form N-11, every individual doing business in Hawaii during the taxable year must file a return, whether or not the individual derives any taxable income from that business.

11. Individual Income Tax Return (Resident Form)

If I decide to stop operating my business, do I need to cancel my license? Yes. Cancel your license by signing into Hawaii Tax Online or cancel your license(s) by submitting a Form GEW-TA-RV-1.

11, Rev. 2020, Individual Income Tax Return (Resident)

What is the difference between the G-45 and the G-49 Forms? The G-45 is the 'periodic' form which is filed either monthly, quarterly, or semiannually. The G-49 is the annual or so called "reconciliation" form which is filed annually.