Hawaii Agreement to Sell Real Property Owned by Partnership to One of the Partners

Description

carry on as co-owners of a business for profit.

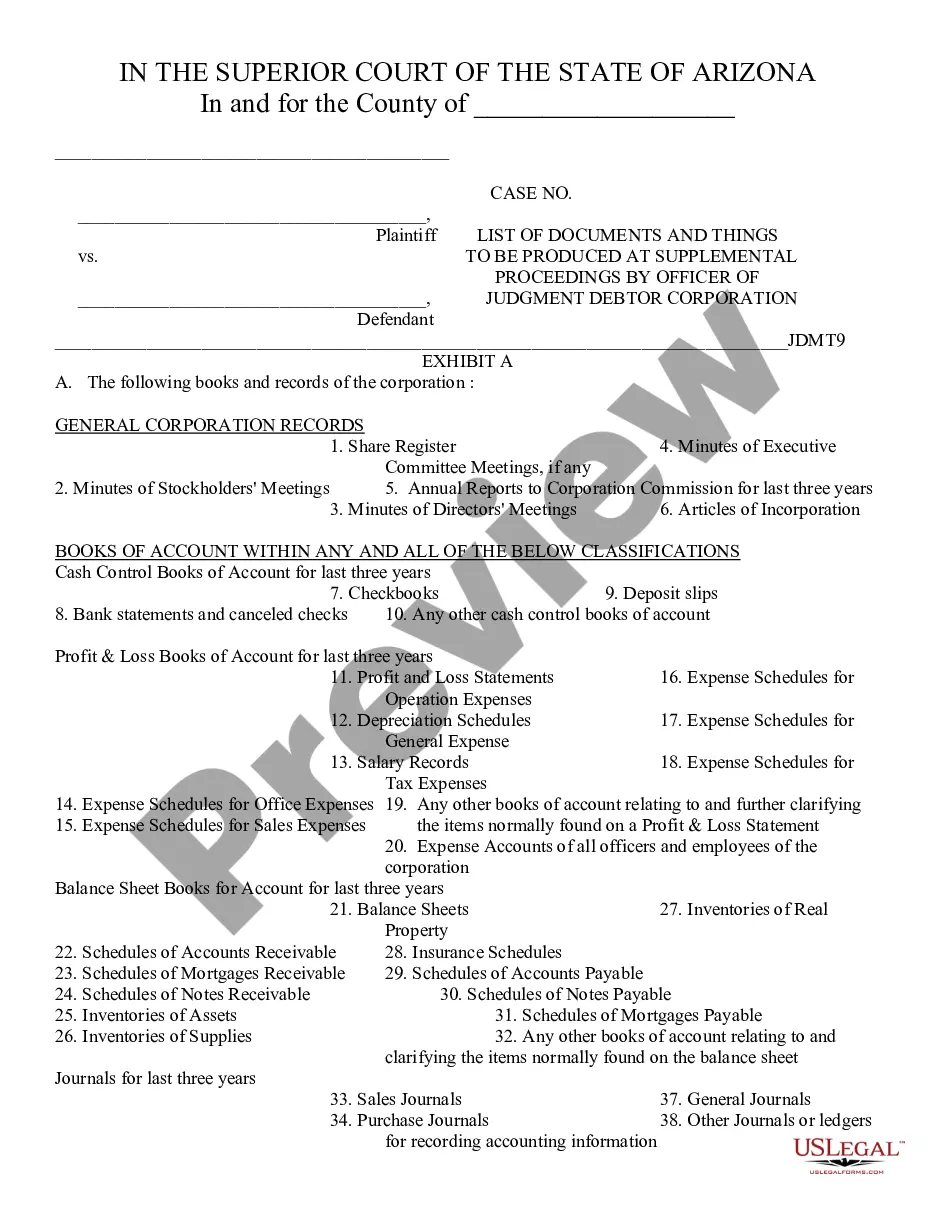

How to fill out Agreement To Sell Real Property Owned By Partnership To One Of The Partners?

Have you ever been in a situation where you require documents for either organizational or personal tasks nearly every day.

There are numerous legal document templates available online, but finding reliable ones is not easy.

US Legal Forms offers thousands of template options, such as the Hawaii Agreement to Sell Real Property Owned by Partnership to One of the Partners, which are designed to meet federal and state regulations.

Once you find the appropriate form, click Get now.

Choose the pricing plan you prefer, provide the required information to create your account, and pay for your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Hawaii Agreement to Sell Real Property Owned by Partnership to One of the Partners template.

- If you don't have an account and want to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it’s suitable for your specific city/state.

- Use the Review button to evaluate the form.

- Read the information to verify that you have chosen the correct form.

- If the form isn’t what you are looking for, utilize the Search field to find the form that meets your needs.

Form popularity

FAQ

File a Form N-288B (with Form N-103 included if applicable) in a timely manner prior to closing to avoid HARPTA withholding altogether if you qualify. Or, maybe you qualify for an N-289 exemption? Alternatively, you may need to file a Form N-288C to get your money back2026 if you don't qualify for an exemption.

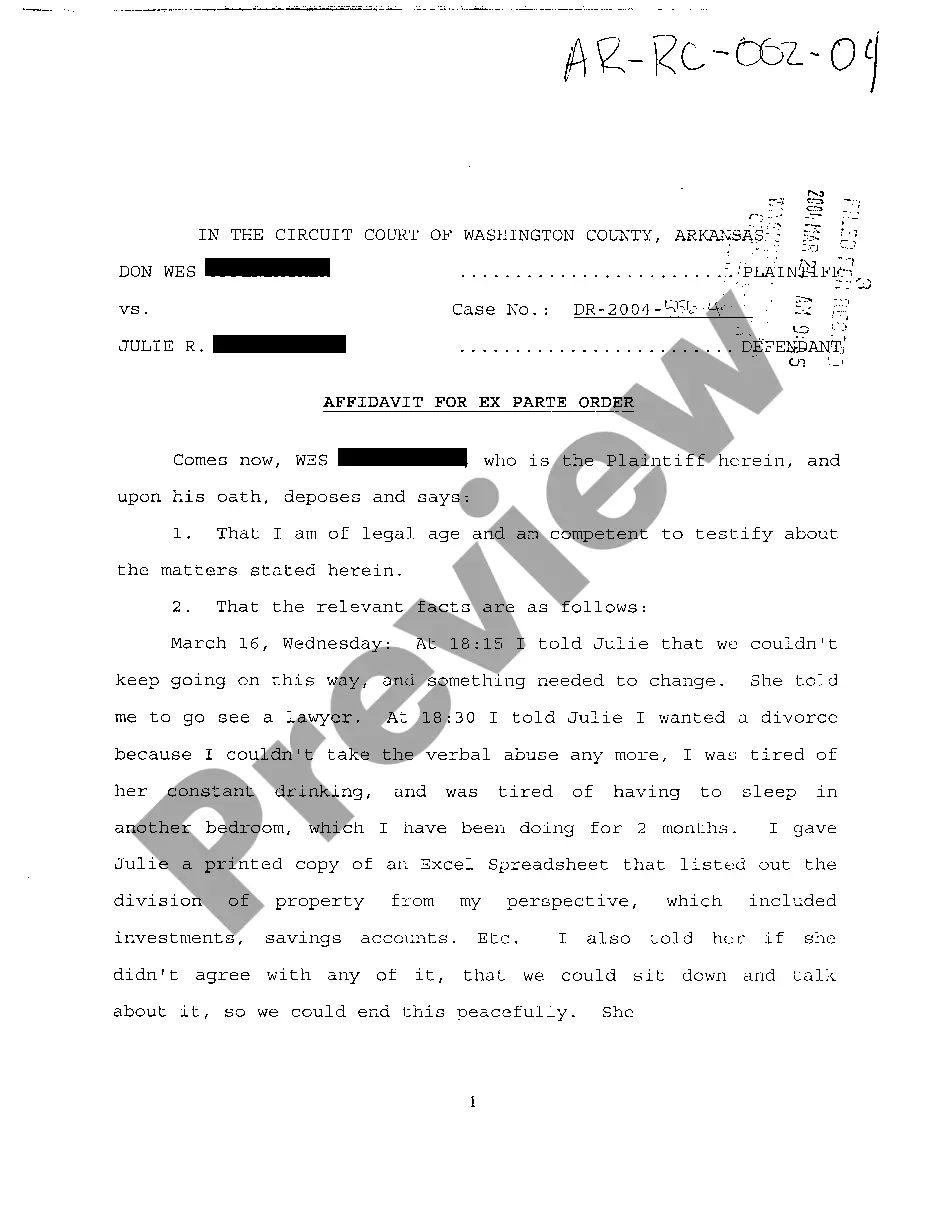

A Hawaii Agreement of Sale is a purchase contract and, if properly recorded, a security device between a Seller and Buyer of real property in which the Seller provides financing to buy the property for an agreed-upon purchase price and the Buyer repays the loan in installments.

The conveyance tax is imposed on all transfers of ownership or interest in real property through deeds, leases, subleases, assignments of lease, agreements of sale, assignments of agreements of sale, instruments, writ- ings, or other documents, unless the transfer is specifically exempted.

Use Form N-289 to inform the transferee/buyer that the withholding of tax is not required upon the disposition of Hawaii real property if (1) the transferor/seller is a resident person, (2) by reason of a nonrecognition provision of the Internal Revenue Code as operative under chapter 235, HRS, or the provisions of any

Other Exceptions to the HARPTA Withholding Requirement:If the seller does not realize a gain or loss with the sale, e.g. 1031 exchange. Or, If the property was used as the seller's principal residence for the year before the sale and the sales price is $300K or less.

Form P-64B, Rev 2019, Exemption from Conveyance Tax.

How Is the Conveyance Tax Determined? One dollar and twenty-five cents ($1.25) per $100 of the actual and full consideration for properties with a value of $10,000,000 or greater . The conveyance tax imposed for each transaction shall be not less than one dollar ($1.00).

Unless an exemption applies, the State of Hawai'i imposes a tax on the conveyances or transfers of real property and interests in real property by deed, lease, sublease, an assignment of lease, or other document (HRS §247-1).

The person responsible for the tax is generally the transferor, grantor, lessor, sublessor, conveyor, or other person conveying the real property interest (HRS §247-3). The Hawaii Association of REALTORSA® standard purchase contract directs escrow to charge the conveyance tax to the seller.