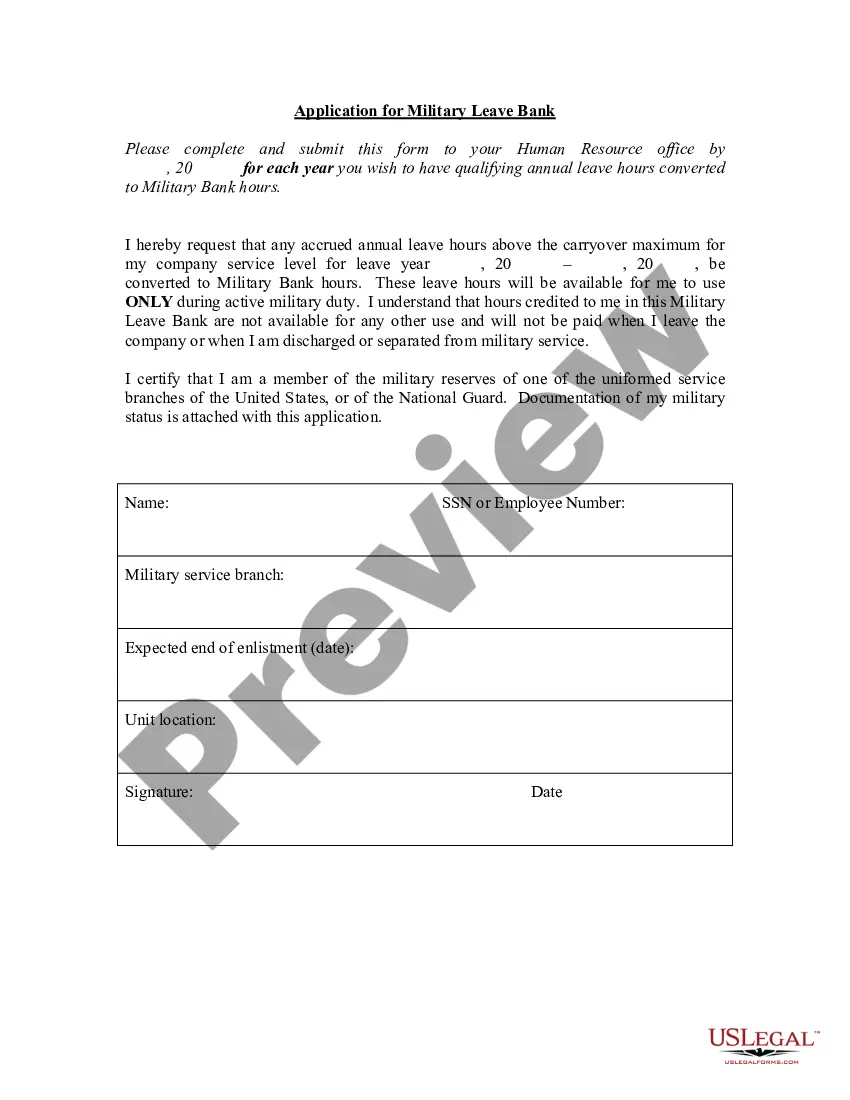

Hawaii Application for Military Leave Bank

Description

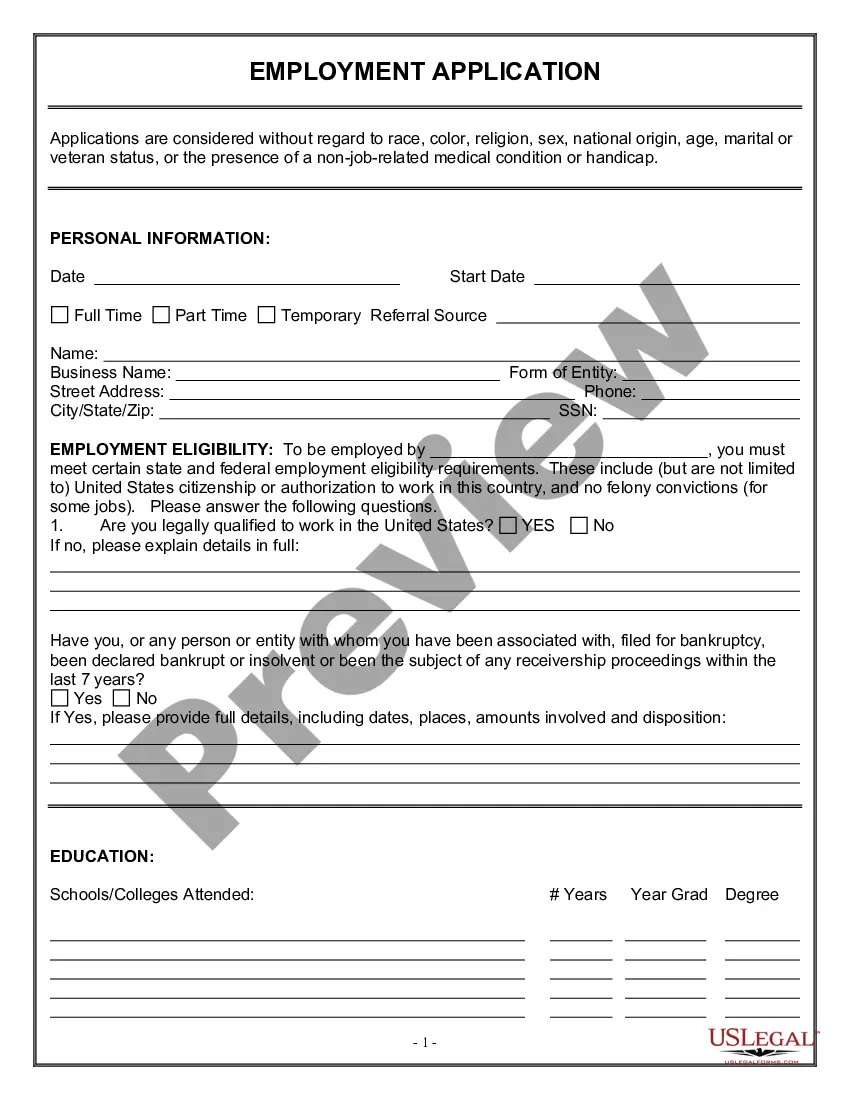

How to fill out Application For Military Leave Bank?

You can spend hours online searching for the legal document format that meets the state and federal criteria you need.

US Legal Forms offers a vast selection of legal templates that can be reviewed by professionals.

You can easily download or print the Hawaii Application for Military Leave Bank from the service.

To locate another version of the form, use the Search field to find the template that meets your needs and specifications.

- If you possess a US Legal Forms account, you can Log In and then click the Download button.

- Subsequently, you can fill out, modify, print, or sign the Hawaii Application for Military Leave Bank.

- Every legal document you obtain is yours permanently.

- To get another copy of the acquired form, navigate to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct format for your county or area of preference.

- Read the form description to confirm that you have chosen the right form.

Form popularity

FAQ

Finally, some states don't tax any income, including military benefits: Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington and Wyoming.

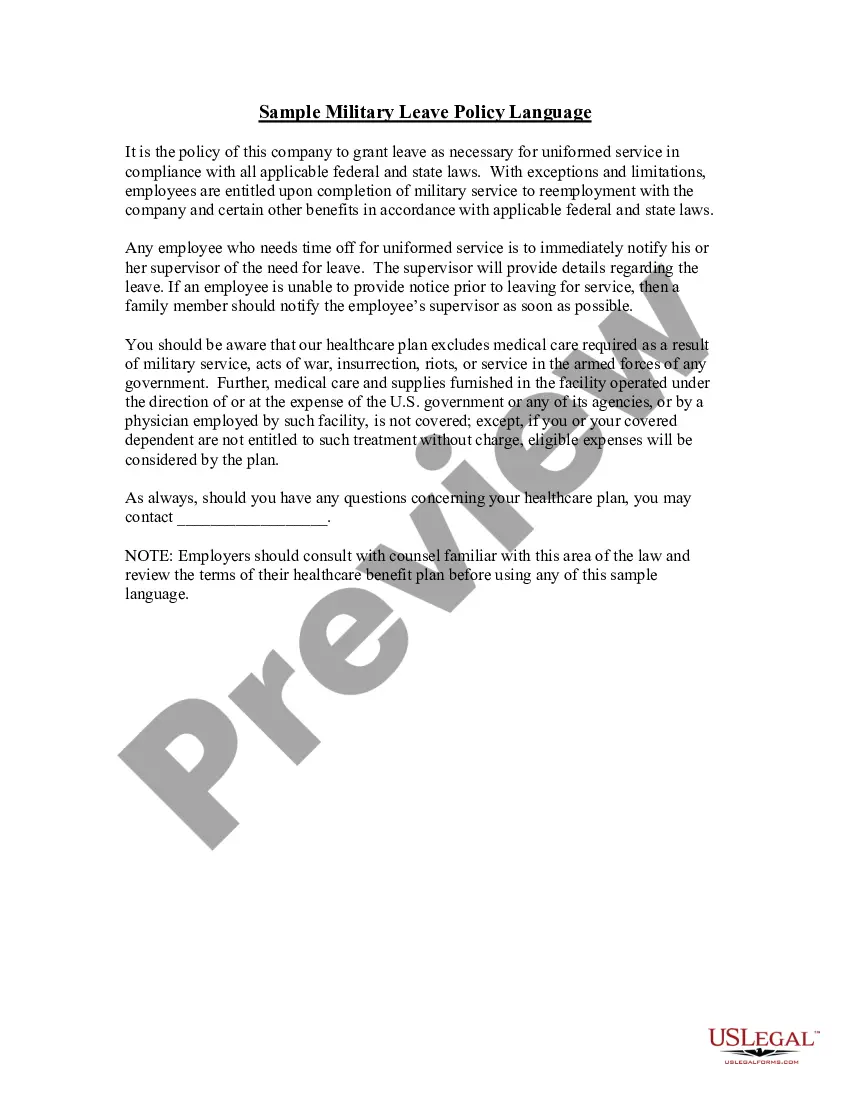

An eligible employee must be granted, upon request, military leave to which he or she is entitled for performance of active duty or active duty for training. With the exception of military leave granted under 5 U.S.C. 6323(b) and 5 U.S.C.

Charging Military Leave.The minimum charge is one hour. An employee is charged military leave only for hours that the employee would have worked and received pay.

If you are a member of the military who served in a combat zone, your income may not be taxed by the IRS. Tax-exempt military pay applies if: You're a member of the U.S. Armed Forces. You serve in a designated combat zone or were as hospitalized for wounds, disease, or injury in a designated combat zone.

One misconception about military leave is that employers never have to pay for this time off. But sometimes military leave does have to be paid, such as when it's comparable to other kinds of paid time off like sick leave or jury duty leave.

According to the Hawaii filing instructions, if you are a resident of Hawaii your income is taxable on the Hawaii resident return. If you are a nonresident of Hawaii stationed in Hawaii, you are not subject to Hawaii income tax on your active duty military pay.

To request a temporary or extended military leave of absence, the employee should generally obtain a request for leave of absence form from HR. Written notice is preferred, but not required under the law or this policy.

Submit your Military Leave of absence through HR/Pay »:Navigate to Self Service > Time Reporting > Report Time > Absence Request.Select Military Leave in the absence name field.Select either Training or Deployment in the reason name field.

In the military, the federal government generally only taxes base pay, and many states waive income taxes. Other military paythings like housing allowances, combat pay or cost-of-living adjustmentsisn't taxed.

No. As stated previously, an employer may not require documentation for notification prior to military duty. Further, an employer does not have a"right of refusal" for military leave of absence, so long as the employee has not exceeded the 5 years of cumulative service provided under USERRA.