Hawaii Sample Letter for Request for Payment - Credit Line Exceeded

Description

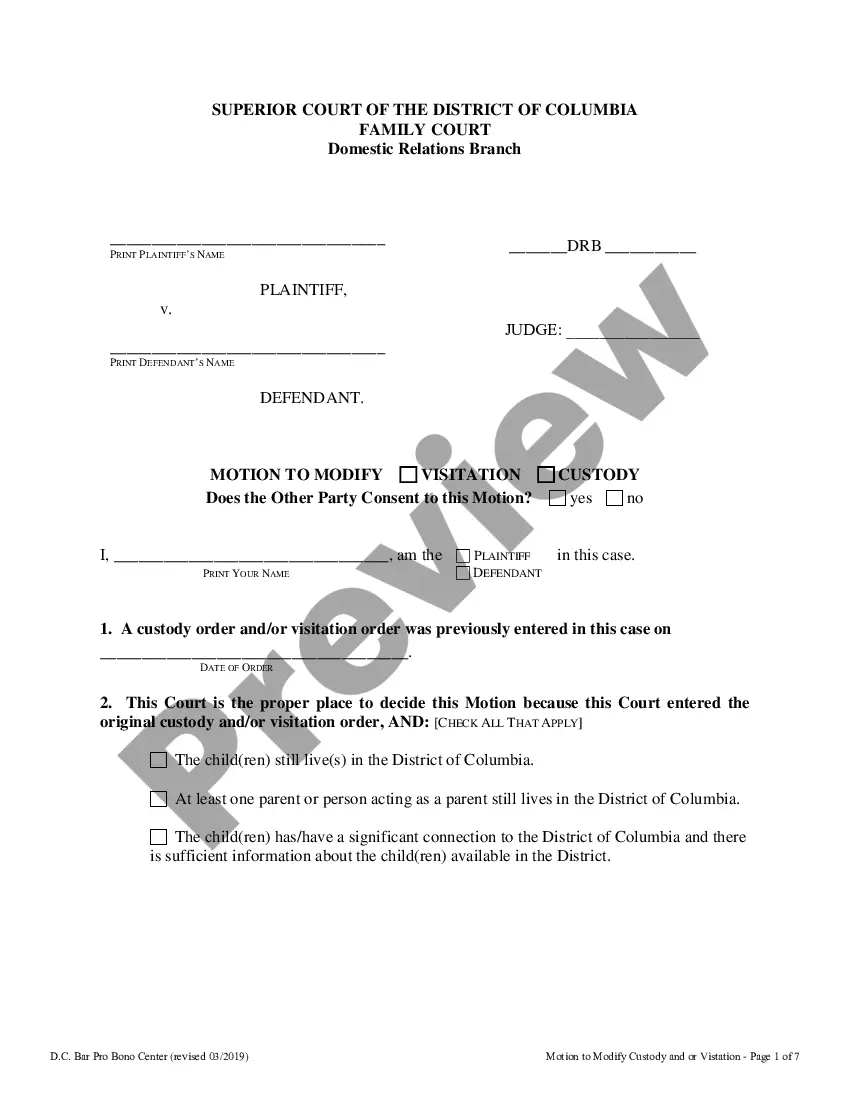

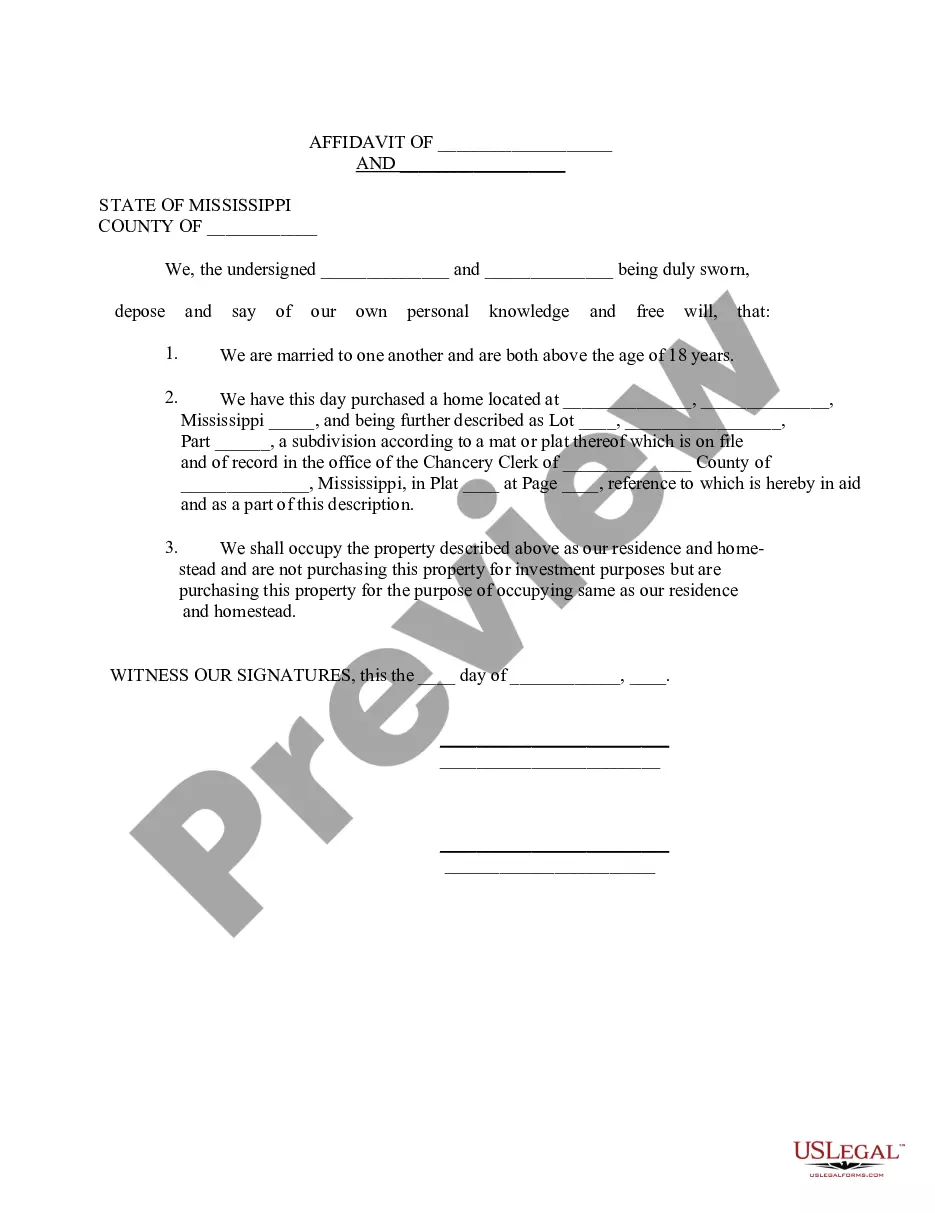

How to fill out Sample Letter For Request For Payment - Credit Line Exceeded?

If you need to finalize, download, or create legal document templates, utilize US Legal Forms, the largest compilation of legal forms, available online.

Take advantage of the site's straightforward and user-friendly search to find the documents you require.

Various templates for business and personal purposes are sorted by categories and requests, or keywords.

Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form format.

Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Employ US Legal Forms to obtain the Hawaii Sample Letter for Request for Payment - Credit Line Exceeded in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Acquire button to obtain the Hawaii Sample Letter for Request for Payment - Credit Line Exceeded.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have selected the form for your specific city/state.

- Step 2. Use the Review option to examine the form's content. Be sure to read the information.

Form popularity

FAQ

The phrase 'max credit limit exceeded' means that you have reached or surpassed the maximum amount of credit allowed on your account. This can affect your ability to make new purchases or take on additional debt. Addressing this situation promptly can help you avoid fees and ensure your financial health. Consider writing a letter based on the Hawaii Sample Letter for Request for Payment - Credit Line Exceeded to request an increase.

To request a credit limit increase, start by reviewing your current credit cards and checking your credit score. Once you understand your creditworthiness, you can use the Hawaii Sample Letter for Request for Payment - Credit Line Exceeded as a guide to formally submit your request to the credit card issuer. Be sure to clearly state your reasons for a credit increase, such as improved income or reduced debt, to strengthen your case.

To, (Name of the Vendor), (Address of the Vendor) Date: // (Date) Subject: Request for Issuance of credit note Dear Sir/Madam, With reference to the material supplied by your company against our purchase order no. , you are requested to provide us credit note for (Amount).

Respected Sir/Madam, I like to state that my name is (Name) and, I hold a (name of credit card) credit card with your bank having credit card number (credit card number). I am writing this letter to ask you to kindly increase the limit of my credit card.

The card which I am using has a limit that cannot exceed (Amount of money). It is pertinent to mention here that I have expanded my business and need to make a transaction of amount more than its defined limit. Therefore, you are requested to please increase the limit of my credit card from ($xyz to %abc).

Credit card issuers determine your credit limit by evaluating factors like your credit score, payment history, income, credit utilization and large expenses. By understanding what they're looking for, you can manage your credit responsibly and increase your odds of getting approved for a higher credit limit.

A best practice it to limit the credit offered to 10% of the customer's net worth. The result will be 10% of the customer's net worth and a good benchmark for setting their credit limit. You may also consider basing their limit on 10% of the customer's working capital or average monthly sales.

A letter of credit, or "credit letter," is a letter from a bank guaranteeing that a buyer's payment to a seller will be received on time and for the correct amount. In the event that the buyer is unable to make a payment on the purchase, the bank will be required to cover the full or remaining amount of the purchase.

Most companies check your credit reports and gross annual income level to determine your credit limit. Factors that issuers like to consider include your repayment history, the length of your credit history and the number of credit accounts on your report.

If you exceed your credit limit on a specific credit card, your card issuer could increase the interest rate you pay on that card. If you have multiple credit cards under your name, your other credit card issuers might notice the change in your credit score and raise their rates as well.